You've probably heard it at a family dinner or from that one friend who thinks they’ve "hacked" the banking system. They lean in and tell you that if you want a perfect credit score, you need to leave a little bit of money on your card every month. Just a few bucks, they say. It shows the banks you’re using the credit.

Honestly? It's nonsense.

It is a persistent, annoying myth that keeps people handing over their hard-earned cash to billion-dollar banks in the form of interest payments. When people ask is it better to pay credit card in full, the answer isn't just a "yes"—it's a "yes, and if you don't, you're essentially volunteering to be taxed for no reason."

Let's get into the weeds of why this happens and how the math actually shakes out for your wallet.

The math of the "Full Payment" advantage

When you pay your statement balance in full by the due date, something magical happens. It’s called a grace period. Most credit card issuers—think Chase, Amex, or Citibank—won't charge you a single penny in interest on new purchases if you paid off the previous month's balance completely.

But the moment you leave even $5 on that card? That grace period vanishes.

Suddenly, the bank starts calculating interest on your average daily balance. They don't just charge you interest on that leftover $5. They often start charging interest on every new bag of groceries or gas station trip the moment you swipe the card. It's expensive. It’s also totally avoidable.

According to data from the Federal Reserve, the average credit card interest rate has climbed significantly over the last two years, often hovering well above 20%. If you're carrying a balance, you are likely losing more money in interest than you are gaining in any "cash back" or "points" programs. You're basically buying a dollar for $1.20. That’s a bad trade.

Is it better to pay credit card in full for your credit score?

This is where the confusion usually starts. People mix up "activity" with "debt."

📖 Related: The Betta Fish in Vase with Plant Setup: Why Your Fish Is Probably Miserable

The credit bureaus—Experian, Equifax, and TransUnion—want to see that you use your cards. They like seeing a transaction here and there. However, "using" a card is tracked via your statement balance, not your remaining debt after the due date.

Your credit score is heavily influenced by something called credit utilization. This is the ratio of how much credit you’re using compared to your total limits. FICO, the company that creates the most widely used credit scores, says that utilization accounts for about 30% of your total score.

Lower is almost always better.

If you have a $1,000 limit and you spend $300, your statement will show 30% utilization. If you pay that $300 off in full, the credit bureau sees that you were responsible enough to settle the debt. If you leave $100 on the card, your utilization stays higher for the next month, which can actually drag your score down, not push it up. There is no "bonus" for paying interest.

FICO experts like Tom Quinn have gone on record multiple times stating that you do not need to carry a balance to have a high score. In fact, people with the highest scores—the "800 club"—typically have utilization rates in the low single digits. They pay in full. Every single time.

Why the "carry a balance" myth is so sticky

Why do people still believe this? It’s probably a misunderstanding of how credit reports "snapshot" your life.

Every month, your bank sends a report to the bureaus. This usually happens on your "statement closing date," which is different from your "due date." If you pay your card off the very second you buy something, your statement might show a $0 balance. To a credit bureau, a $0 balance looks like the card is sitting in a drawer gathering dust.

This is the only tiny grain of truth in the myth.

👉 See also: Why the Siege of Vienna 1683 Still Echoes in European History Today

If the bureau thinks you aren't using the card at all, your score might stay stagnant. But there is a massive difference between "showing a balance on your statement" and "carrying a balance past the due date."

The smart move? Let the statement generate with a balance, then pay it off entirely before the due date. You get the credit for "using" the card, but you pay $0 in interest. It’s the closest thing to a free lunch in the financial world.

Real world consequences of trailing interest

Here is something most people don't realize until they try to fix their habits.

If you've been carrying a balance and finally decide to pay it all off, you might still see an interest charge on your next statement. This is called "trailing interest" or "residual interest." Because interest is calculated daily, you owe the interest that accrued between the time your last statement was printed and the day your payment actually landed.

It’s frustrating. You think you're debt-free, then a bill for $12.43 shows up. This is why it’s better to pay credit card in full consistently; once you get off the interest merry-go-round, you want to stay off it for good.

When it's actually okay to not pay in full

I’m not going to be a robot about this. Life happens.

If you have a medical emergency or your car's transmission decides to explode on a Tuesday, you might not be able to pay the full balance. That’s what credit is for—it's a safety net. If you have to carry a balance for a month or two, you aren't a failure. Your credit score isn't going to spontaneously combust.

The goal is to avoid making it a habit.

✨ Don't miss: Why the Blue Jordan 13 Retro Still Dominates the Streets

There is also the 0% APR intro offer. If you just got a new card that has a 15-month window of zero interest, then the math changes. In that specific scenario, you aren't being penalized for carrying a balance. You can keep that cash in a high-yield savings account earning 4% or 5% while the bank charges you 0%. Just make sure that balance is gone the second that intro period ends, or the interest will hit you like a freight train.

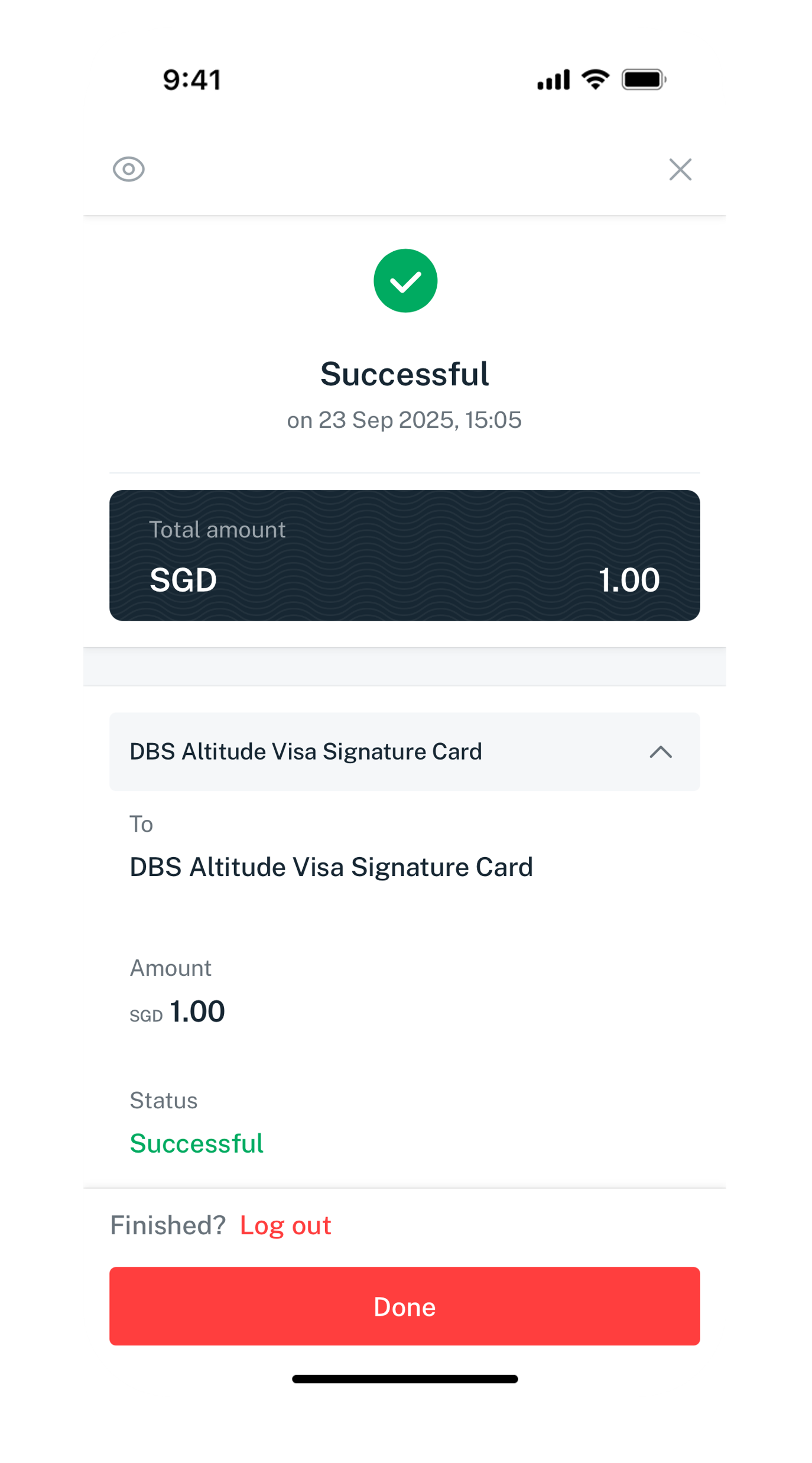

Nuance: The "Statement Balance" vs. "Current Balance" trap

When you log into your banking app, you'll see two numbers. They’re usually different. It’s confusing.

- Statement Balance: This is what you owed when the last billing cycle ended. This is the number you must pay to avoid interest.

- Current Balance: This is everything you owe right now, including stuff you bought this morning.

To win the game, you only need to pay the Statement Balance. You don't have to pay the current balance to avoid interest. Some people prefer to pay the current balance just to keep their utilization as low as possible, which is a great move if you’re about to apply for a mortgage or a car loan and need your score to be at its absolute peak.

Actionable steps to stop paying interest

If you're currently stuck in the cycle of carrying a balance, here is how you break out.

First, stop the bleeding. If you can't pay the full balance this month, try to pay as much as possible—even $20 over the minimum makes a difference.

Second, set up Autopay. But don't set it to the "minimum payment." Set it to the "Statement Balance." If you're worried about overdrawing your checking account, set up a "Balance Alert" on your credit card. Most apps will text you when your balance hits a certain amount, like $500, so you can keep your spending in check.

Third, look at your "Statement Closing Date" versus your "Due Date." Mark them on a calendar. Knowing when the "snapshot" is taken helps you understand why your credit score moves the way it does.

Fourth, if you are buried under high-interest debt, consider a balance transfer card. Move that 24% interest debt to a 0% card for 12 months. This gives you a breathing room to pay the principal without the bank skimming off the top every month.

The bottom line is simple: Banks make billions because people think it's okay to carry a balance. It isn't. Pay it off. Keep your money. Use the bank's money for 30 days for free, then give it back before they can charge you for the privilege. That is how you actually win at credit cards.

Final checklist for your wallet

- Verify your card's APR so you know exactly how much "carrying a balance" is costing you.

- Shift your Autopay settings to "Statement Balance" if your cash flow allows.

- Check your credit utilization via a free tool like Chase Journey or Capital One Eno; aim to keep it under 10%.

- If you have 0% interest promo, set a "kill date" reminder three weeks before the promo ends to ensure the balance is $0.