Let’s be real. Taxes suck. There’s no way around it. Every year, you’re staring at a screen, clicking through questions about whether you bought a horse for business purposes or if your side hustle qualifies as a "hobby." Then comes the moment of truth: the checkout screen.

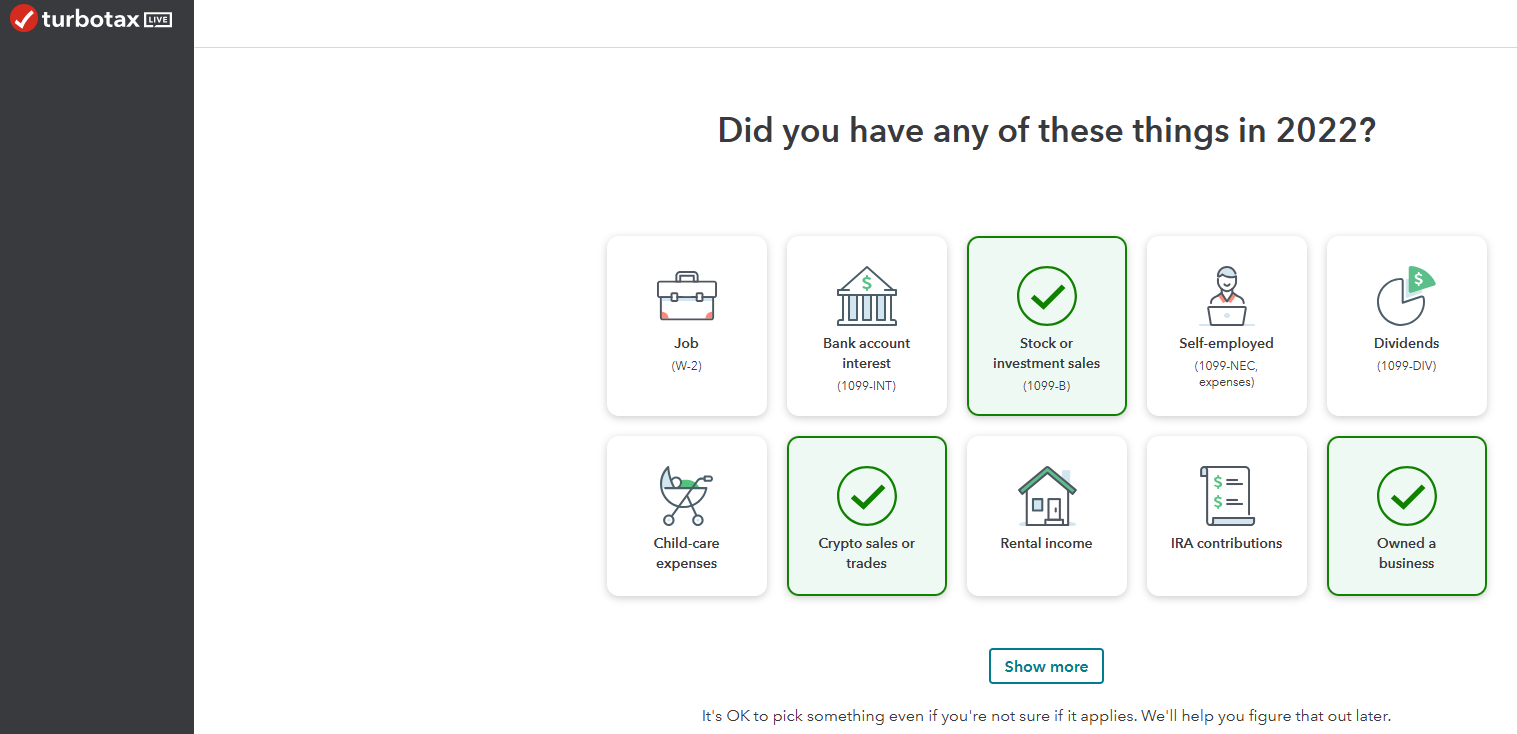

You’ve probably seen the ads. TurboTax is everywhere. It’s the shiny, user-friendly giant that promises to hold your hand through the whole messy process. But then you see the price tag. $100? $200? Suddenly, that "free" version you started with has disappeared because you dared to have a 1099 or an HSA.

That’s usually when people start asking: is FreeTaxUSA better than TurboTax?

Honestly, the answer isn’t a simple yes or no. It depends on how much you value your time versus your money. If you’re tired of the "bait and switch" pricing, FreeTaxUSA is basically a godsend. But if the thought of looking at a tax form makes you want to hide under your bed, you might actually prefer the expensive hand-holding Intuit provides.

The Massive Price Gap Nobody Likes to Talk About

The biggest reason anyone even considers making the jump is the cost. TurboTax is expensive. Like, "why am I paying this much to give the government money" expensive.

If you have anything beyond a very basic W-2—say, you sold some stock, have a little freelance income, or own a home—TurboTax is going to nudge you toward their Deluxe, Premier, or Self-Employed tiers. For the 2026 tax season, those federal filings can easily hit $60 to $120, and that doesn’t even include the $50 state filing fee.

💡 You might also like: Big Lots in Potsdam NY: What Really Happened to Our Store

Compare that to FreeTaxUSA.

Federal is $0. For everyone.

It doesn't matter if you have a complicated Schedule C for your TikTok shop or a messy list of crypto trades from 2025. The federal filing stays free. They make their money on state returns, which cost $15.99 this year. That’s it. You could walk away paying less than twenty bucks for a return that would cost you $150+ on TurboTax.

Is FreeTaxUSA Better Than TurboTax for Self-Employed Folks?

Here is where things get interesting. Most tax software companies treat "Self-Employed" like a premium luxury. They gatekeep the forms you need to deduct your home office or your equipment.

TurboTax does this aggressively.

📖 Related: Why 425 Market Street San Francisco California 94105 Stays Relevant in a Remote World

FreeTaxUSA, however, gives you all those forms for free. If you’re a freelancer, the "better" choice is almost always the cheaper one here because the logic of the tax code doesn't change based on how much you pay for software. A deduction is a deduction.

The interface in FreeTaxUSA is definitely more "bare bones." It looks like software from ten years ago. It’s fast, though. No flashy animations or pop-ups asking if you want to talk to a "Live Expert" for an extra $80. For some people, that’s a relief. For others, it’s intimidating.

What You Give Up for the Lower Price

There’s a catch. There’s always a catch.

- No Fancy Data Imports: TurboTax can pull data from almost any bank or brokerage. You sign in, and poof, your 1099-B with 500 trades is there. FreeTaxUSA has improved its 1099 uploads for 2026, but it’s still not as seamless as the Intuit ecosystem.

- The Help Factor: TurboTax’s "Live" feature is actually pretty great if you’re terrified of an audit. You can literally share your screen with a CPA. FreeTaxUSA offers "Pro Support" for about $44.99, which gives you access to an expert, but it feels less integrated into the experience.

- Mobile Experience: TurboTax has a polished app. FreeTaxUSA doesn't even have a dedicated app in the App Store—you just use their mobile-optimized website. It works, but it’s not "slick."

The "Tax-Prep Tax" and Why It Matters

We’ve reached a point where people are paying a premium just to avoid feeling confused. This is the "tax-prep tax."

TurboTax is designed to make you feel like you're having a conversation. It’s friendly. It uses plain English. FreeTaxUSA uses more "tax-speak." It’ll ask you about specific forms by name.

👉 See also: Is Today a Holiday for the Stock Market? What You Need to Know Before the Opening Bell

If you know what a W-2 is and you can find your way around a PDF, you probably don't need the $100 conversation. Honestly, many users find that once they switch, they realize they were paying for a lot of fluff they didn't actually need.

The Final Verdict for 2026

So, is FreeTaxUSA better than TurboTax?

If you are a "DIY" person who doesn't mind reading a few extra help blurbs to save $150, then yes, FreeTaxUSA is significantly better. It’s honest. It doesn't upcharge you at every corner.

However, if you have a massive portfolio of rental properties, 20,000 crypto transactions, or you just have "tax anxiety" and want the most polished safety net possible, you might find the TurboTax premium worth it.

What to do next:

- Check your 2025 documents. If you have more than one state return or a massive list of stock sales, see if your brokerage offers a discount for TurboTax first.

- Try the "Side-by-Side" trick. If you're nervous, start your return in both. You don't have to pay until you file. See if the numbers match.

- Look at the Deluxe add-on. If you go with FreeTaxUSA, the $7.99 Deluxe upgrade is actually a great value for priority support and amended returns.

At the end of the day, both programs send the same data to the IRS. The only real difference is how much of your refund stays in your own pocket.