You’ve probably seen the headlines. There is a massive, ongoing brawl in Washington over a century-old trade rule that most people hadn't heard of until about three years ago. If you are a shopper hitting "buy" on Temu or a small business owner sourcing samples from overseas, the question is de minimis still in effect isn't just academic. It’s a matter of your bottom line.

Technically, yes. As of today, the de minimis exemption—specifically Section 321 of the Tariff Act of 1930—is still the law of the land in the United States. You can still bring in goods valued at $800 or less without paying formal duties or taxes. But saying "it's still here" is like saying a house is still standing while a wrecking ball is swinging inches from the front door. Things are changing fast.

The $800 Loophole Under Fire

Wait, why does everyone suddenly care about a 1930s customs rule? Because it’s being used at a scale the original authors could never have imagined. In 2016, Congress raised the threshold from $200 to $800. It was supposed to be a "paperwork reducer." It turned into a firehose.

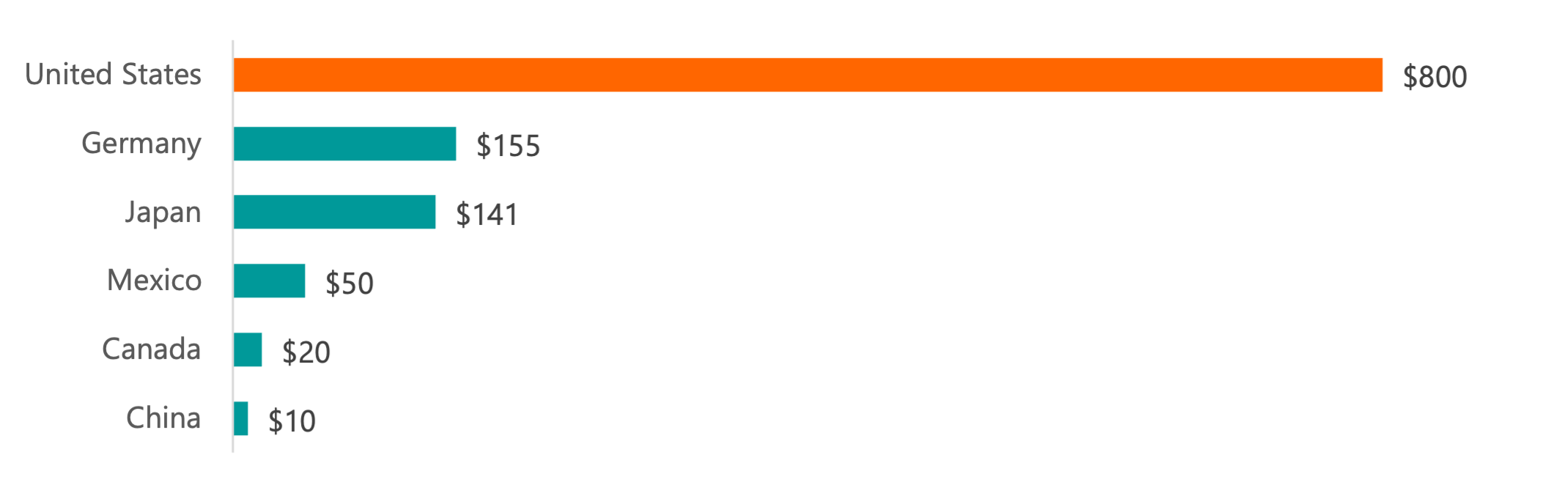

We are talking about over a billion packages a year entering the U.S. under this exemption. Customs and Border Protection (CBP) is overwhelmed. Critics, including many members of the House Select Committee on the Chinese Communist Party, argue that this "loophole" allows companies like Shein and Temu to undercut American retailers by avoiding the 25% Section 301 tariffs that apply to larger bulk shipments.

It’s not just about money, though. It's about safety. Lawmakers like Senator Sherrod Brown have been incredibly vocal about how fentanyl and counterfeit goods slip through because these small packages don't require the same rigorous data as a massive shipping container. When you ask is de minimis still in effect, you have to realize that while the answer is "yes," the enforcement has already shifted. CBP has started "suspending" several major customs brokers from the Type 86 program, which is the electronic filing system used for these low-value shipments. That's a massive warning shot.

✨ Don't miss: Les Wexner Net Worth: What the Billions Really Look Like in 2026

Recent Executive Action and the White House Move

In September 2024, the Biden-Harris administration threw a massive wrench into the works. They didn't "end" de minimis—they can't do that without Congress—but they announced a "Notice of Proposed Rulemaking."

Basically, the administration wants to exclude any goods that are subject to Section 301, 201, or 232 trade enforcement actions from using the de minimis exemption. Since about 70% of Chinese textile and apparel imports fall under Section 301, this would effectively kill the $800 tax-free ride for most fast-fashion shipments coming out of China.

It’s a clever move. By targeting the eligibility of the goods rather than the dollar amount, they can bypass some of the gridlock in the House. But for the average person wondering is de minimis still in effect, this creates a "lame duck" period of high uncertainty. You can still import, but the paperwork requirements are getting tighter, and the threat of a sudden 25% price hike is looming over every shipment.

What This Actually Means for Your Wallet

Let's get real. If you’re a consumer, you’ve enjoyed years of dirt-cheap prices. That $12 hoodie or $5 kitchen gadget is cheap because the seller didn't pay a dime in import taxes. If de minimis is significantly gutted or eliminated, those prices go up. Period.

🔗 Read more: Left House LLC Austin: Why This Design-Forward Firm Keeps Popping Up

- Small Businesses: Many "Amazon FBA" sellers or independent boutique owners rely on Section 321 to bring in inventory. If you're importing $700 worth of jewelry, you pay $0 in duty today. If the rule changes, you might pay 20-30% in duties plus brokerage fees. That eats your margin instantly.

- The Big Guys: Companies like UPS, FedEx, and DHL are caught in the middle. They love the volume, but they hate the liability. They are spending millions on lobbyists to ensure any new rules don't make them legally responsible for every single pill or fake Nike shoe in a 50,000-package shipment.

- Logistics Hubs: Look at places like Cincinnati or Louisville. These air hubs live and breathe on the speed of de minimis. Any slowdown in clearing these packages creates a bottleneck that ripples through the entire U.S. economy.

Honestly, the debate is split. On one side, you have the National Council of Textile Organizations (NCTO) saying the exemption is killing American manufacturing. On the other, the National Foreign Trade Council argues that removing it would be a "tax on the poor" and a logistical nightmare that would break the postal system.

The Uncertainty of 2025 and 2026

The political landscape is the biggest factor in whether the answer to is de minimis still in effect changes next month or next year. We have the "De Minimis Reciprocity Act" and the "Import Security and Fairness Act" floating around. Both have bipartisan support, which is rare these days.

Most experts expect a "sliding scale" or a "product-specific" ban rather than a total repeal. For example, they might lower the threshold back to $200 or simply say "no clothes allowed under de minimis."

The "Type 86" crackdown is the real-world metric you should watch. In early 2024, CBP suspended several brokers, leading to massive delays at airports. If you are an importer, you’ve likely already noticed that "clearance" takes longer than it did in 2022. That’s because "in effect" doesn't mean "easy."

💡 You might also like: Joann Fabrics New Hartford: What Most People Get Wrong

Actionable Steps for Importers and Sellers

Stop assuming the $800 limit will be there forever. It’s a risky way to run a business right now. You need a "Plan B" that doesn't rely on tax-free individual shipments.

Diversify Your Sourcing Immediately

If 100% of your product is coming from China via Section 321, you are a sitting duck. Look at Mexico or Vietnam. While the US-Mexico-Canada Agreement (USMCA) has its own complexities, it offers more long-term stability than the volatile de minimis loophole.

Audit Your HTS Codes

Know exactly what Harmonized Tariff Schedule (HTS) code your products fall under. If the White House moves forward with excluding Section 301 goods, you need to know if your specific product is on that "hit list." If it is, your landed cost is about to jump.

Talk to a Licensed Customs Broker

Don't rely on the "shipping guy" at a factory in Shenzhen. Get a U.S.-based broker who understands the "Entry Type 86" changes. They can tell you if your current shipping method is likely to get flagged or delayed in the coming months.

Calculate Your "Post-De Minimis" Margins

Run the numbers. If you had to pay a 25% duty on your last ten shipments, would you still be profitable? If the answer is no, you need to raise prices now or find a cheaper way to manufacture. Waiting for the law to change before you react is a recipe for bankruptcy.

The era of the "free ride" for small-value imports is closing. Whether the law is officially repealed or just regulated into oblivion, the friction is increasing. Stay nimble, keep your data clean, and watch the CBP bulletins like a hawk. The "de minimis" you knew two years ago is already gone; what's left is a more scrutinized, more expensive version of it.