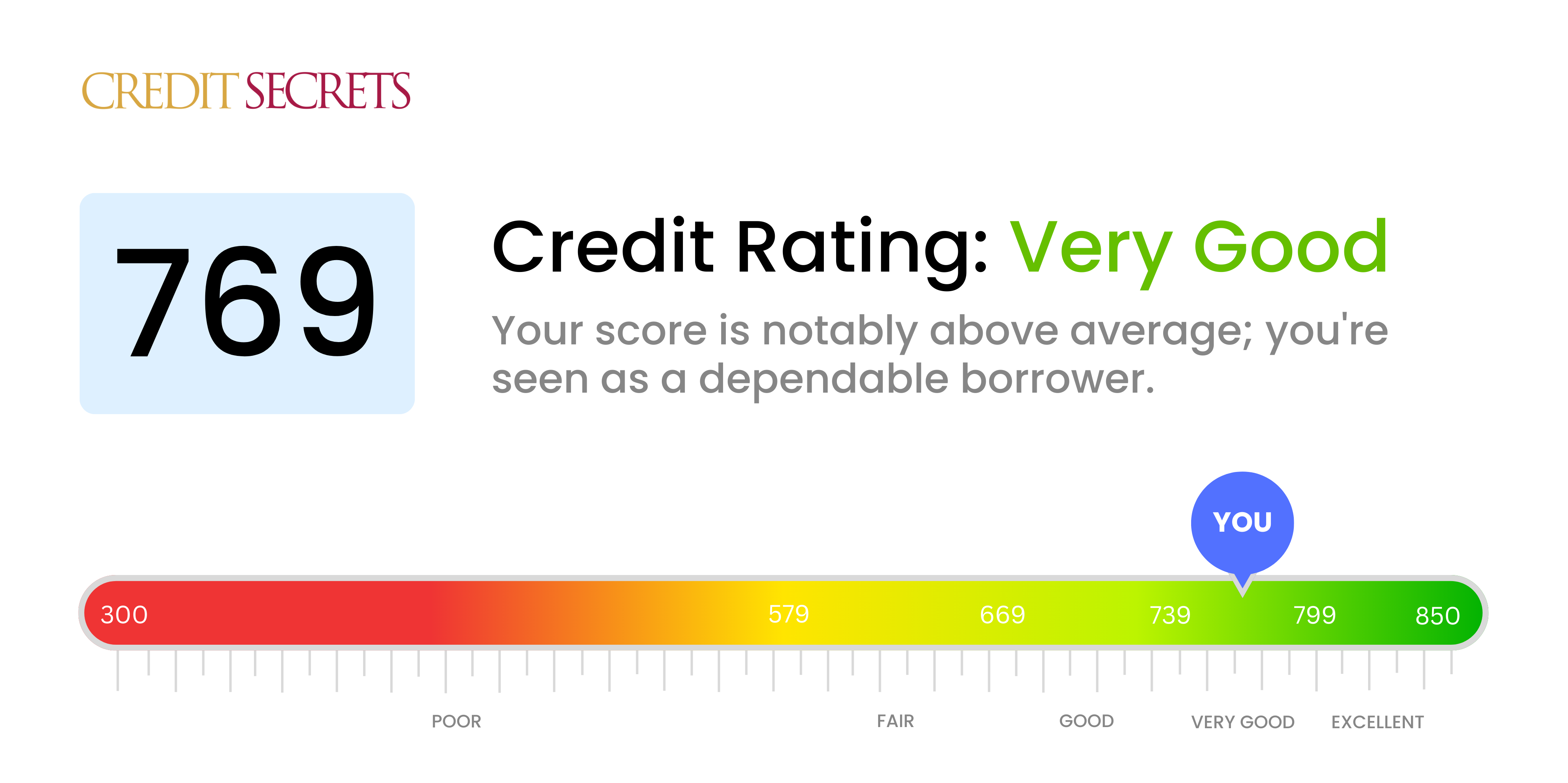

You just checked your banking app or a site like Credit Karma and saw it. The number 769. It looks high, right? It’s definitely not in the "danger zone" where you’re getting rejected for a basic store card, but it isn't a perfect 850 either. Honestly, if you’re sitting at a 769, you’ve basically won the credit game, even if you don't feel like a high roller yet.

Most people obsess over hitting that mythical 800 mark. They think that extra 31 points will suddenly open doors to secret vaults. It won't. In the eyes of a mortgage lender or an auto finance officer, a 769 is usually treated with the same respect as an 800. You are firmly in the "Very Good" to "Exceptional" range depending on which model—FICO or VantageScore—the lender is pulling.

The short answer: Is 769 a good credit score for real-world stuff?

Yes. It’s better than good. It’s great.

According to data from FICO, the average credit score in the United States has been hovering around 715 to 718 lately. At 769, you are nearly 50 points above the national average. You’re the student who got an A- while everyone else was struggling for a C+.

What does this actually get you? Let’s talk brass tacks. When you walk into a dealership, you aren’t just getting "approved." You’re getting the promotional 0% or 1.9% APR offers that they reserve for their top-tier applicants. When you apply for a mortgage, you’re getting the lowest possible interest rates available in the current market. A few points higher might save you a microscopic amount on a jumbo loan, but for 99% of people, 769 is the finish line.

FICO vs. VantageScore: Does the 769 change?

Banks usually look at FICO. It’s the old-school heavyweight. FICO 8 is the version most commonly used for credit cards. In this system, 769 is "Very Good." It’s just one tier below "Exceptional" (which starts at 800).

VantageScore is the one you see on free apps. It’s more sensitive to recent changes. On a VantageScore 3.0 or 4.0 scale, 769 is often labeled as "Excellent."

Does the label matter? Not really. What matters is the risk. Lenders look at a 769 and see a person who pays their bills on time, keeps their balances low, and hasn't gone on a wild spree of opening twenty new accounts in a month. You’re a safe bet. You're the person they want to lend money to because they’re almost certain you’ll pay it back.

Breaking down the 769: What’s under the hood?

To understand why you’re at 769 and not 820, we have to look at the ingredients. FICO doesn't just pull numbers out of a hat.

✨ Don't miss: Funny Team Work Images: Why Your Office Slack Channel Is Obsessed With Them

Payment history is the big one. It accounts for 35% of the score. If you have a 769, you almost certainly have a clean record. One single 30-day late payment can tank a score by 60 to 100 points. If you’re at 769, you’ve been diligent. Nice work.

Credit Utilization is the second heavy hitter at 30%. This is the "balance-to-limit" ratio. Even if you pay your bill in full every month, if your statement closes with a $4,000 balance on a $5,000 limit, your score will dip. People with a 769 usually keep their utilization under 10%. They might have $50,000 in total available credit but only show $2,000 in use.

Then there is length of credit history. This is often the only thing keeping a 769 from being an 800. If your oldest account is only five years old, you simply haven't had enough time to prove your reliability over a decade or two. You can’t rush time. You just have to wait.

The "760 Threshold" myth and reality

In the mortgage world, there’s a legendary "760 rule."

For a long time, 760 was the magic number where you peaked in terms of interest rate benefits. Once you hit 760, you got the "best" rate. Anything higher was just ego.

Recently, some changes in LLPA (Loan Level Price Adjustments) from Fannie Mae and Freddie Mac have shifted the tiers slightly. Nowadays, having a score above 780 can occasionally net you a slightly better price on mortgage insurance or a tiny fraction of a percent on the rate. But we are talking about the difference between a 6.5% rate and a 6.45% rate. It’s not life-changing.

If you have a 769, you are already past that 760 benchmark. You’re in the room. You’re at the table.

Why your 769 might suddenly drop (and why you shouldn't panic)

Credit scores breathe. They go up and down like a heartbeat.

🔗 Read more: Mississippi Taxpayer Access Point: How to Use TAP Without the Headache

Maybe you bought a new couch on credit. Or perhaps you applied for a new travel card to get those sweet 60,000 bonus miles. Your score might drop to 755.

It feels like a gut punch. You worked hard for that 769!

But honestly? It doesn't matter. A 755 still qualifies you for almost everything a 769 does. The obsession with a specific three-digit number can become a bit of a mental trap. Credit is a tool, not a trophy. If you aren't using the tool to get better rates or better rewards, the number is just pixels on a screen.

The trap of closing old accounts

One thing that kills a 769 faster than almost anything is closing an old credit card because you "don't use it anymore."

Don't do that.

When you close a card, you lose that account's credit limit. This makes your utilization look higher. You also eventually lose the "age" of that account. If that was your first card from college, closing it is like chopping the roots off a tree. Keep it open. Buy a pack of gum once every six months to keep it active. Let it sit in a drawer.

Real-world impact: Cars, Houses, and Insurance

Let's look at what a 769 actually saves you.

Imagine you’re buying a $40,000 car.

💡 You might also like: 60 Pounds to USD: Why the Rate You See Isn't Always the Rate You Get

- Person A (620 score): Might get a 12% APR. Over five years, they pay $13,000 in interest.

- Person B (769 score): Gets a 4.5% APR. Over five years, they pay about $4,700 in interest.

That 769 score just put $8,300 back in your pocket. That’s a Mediterranean cruise. That’s a massive head start on an emergency fund.

It’s not just loans, either. In most states, insurance companies use a "credit-based insurance score." They’ve found that people with higher credit scores tend to file fewer claims. So, your 769 might actually be making your car insurance $400 cheaper per year than your neighbor who has a 640.

How to nudge a 769 toward the 800s

If you’re a perfectionist and you really want that 800, here is how you do it.

- Micromanage your statement dates. Most banks report your balance to the bureaus on your "statement closing date," not your "due date." If you pay your bill on the due date, the high balance has already been reported. Try paying your bill three days before the statement closes. This forces the reported balance to be $0 or close to it.

- Request limit increases. Call your current card issuers. Ask for an extra $5,000 or $10,000 on your limit. If they can do it without a "hard pull" on your credit, do it. This lowers your utilization instantly.

- Check for "thin" files. Do you only have credit cards? Sometimes adding a "mix" of credit—like a small personal loan or an auto loan—can bump your score. But don't take out debt just for a score bump. That's paying interest for a number. It's a bad trade.

The psychological side of the 760s

There is a weird anxiety that comes with a "Very Good" score. You feel like you're on the precipice. One mistake and you're back in the 600s.

Relax.

At 769, you have built a "buffer." Your credit history is likely robust enough to handle a few inquiries or a small balance increase without a total collapse. You’ve moved past the "credit repair" phase and into the "wealth building" phase.

The biggest mistake people make at this level is getting complacent about identity theft. Since your credit is so good, you’re a prime target for someone wanting to open a fraudulent account. Check your reports at AnnualCreditReport.com. It's free. It's boring. It's necessary.

Moving forward with your 769

You don't need to do much. If you keep doing exactly what you've been doing—paying on time and not overspending—your score will naturally drift higher as your accounts age.

Actionable steps for the 769 club:

- Audit your rewards. With a 769, you qualify for the heavy-hitter cards. If you’re still using a basic 1% cashback card from ten years ago, you’re leaving money on the table. Look into cards like the Chase Sapphire Preferred or the Amex Gold. You’ve earned the right to the big sign-up bonuses.

- Freeze your credit. Unless you are applying for a loan in the next 30 days, freeze your files at Equifax, Experian, and TransUnion. It takes five minutes. It prevents anyone from opening accounts in your name. It doesn't hurt your score.

- Check for errors. Sometimes a random medical bill from three years ago that you never even saw can end up in collections. Even with a 769, a tiny error could be holding you back from a 790.

- Negotiate. Use your score as leverage. If you're calling your internet provider or a lender, remind them you have excellent credit. It doesn't always work, but it's a powerful card to play.

Stop stressing about the "missing" 81 points. You have achieved financial "escape velocity." You can get the house, the car, and the credit cards you want. The 769 is your green light. Go live your life.