You’re staring at a "Notice of Intent to Levy" or maybe just a confusing form that feels like it was written in a lost ancient language. You think, "I'll just drive over to the IRS office in Glendale Arizona and sort this out face-to-face."

Stop.

If you just show up at the door, you’re likely going to leave frustrated. Honestly, the biggest mistake people make is assuming this place works like a DMV or a bank where you can just pull a ticket and wait. It doesn't.

The IRS Taxpayer Assistance Center (TAC) in Glendale is a high-security, appointment-only operation. You can’t just walk in, and you definitely can't just "drop by" to ask a quick question.

👉 See also: 1 American Dollar to Mexican Pesos: What Most People Get Wrong

Where Exactly Is the IRS Office in Glendale Arizona?

First off, let’s get the location straight. You’ll find the office tucked away at 7350 W. Camino San Xavier, Glendale, AZ 85308.

It’s right near the Arrowhead Towne Center area, which is actually kinda convenient if you want to grab a coffee or hit a shop after dealing with tax stress. But don't let the suburban vibe fool you. Security is tight. You’ll go through a metal detector. Your bags will be searched. It feels a bit like the airport, just without the Cinnabon.

The Appointment Rule (No Exceptions)

You absolutely must call 844-545-5640 to schedule your visit.

They used to have walk-in Wednesdays or special hours, but those are basically relics of the past. If you show up without an appointment, the security guards—who are usually just doing their jobs—will likely turn you away.

What They Can (and Can't) Do for You

There is a huge misconception that the people at the Glendale office are there to do your taxes. They aren't. Don't expect them to sit down and fill out your Form 1040 while you wait.

Here’s what they actually help with:

- Identity Verification: This is a big one. If the IRS flagged your return for potential fraud, you might have to show up in person with two forms of ID to prove you are who you say you are.

- Tax Law Questions: They can answer basic questions, but they won't give you "tax planning" advice or tell you how to dodge a bill.

- Payments: You can pay your taxes here, but honestly, it’s a hassle. They prefer you do it online. If you must pay in person, they only take checks or money orders—no cash.

- Alien Birth Certification: Useful for those dealing with international tax status issues.

- ITIN Applications: If you don't have a Social Security number and need a taxpayer ID, this is where you bring your original documents so they can verify them without you having to mail your passport away.

What they won't touch:

They don't provide "Free File" services here. If you need help actually preparing your return, you’re better off looking for a VITA (Volunteer Income Tax Assistance) site in Glendale or Peoria. The IRS employees at the Camino San Xavier office are there for administrative hurdles and account issues, not math homework.

Surviving Your Appointment

So, you’ve called the 844 number. You’ve sat on hold for forty minutes. You finally have a time slot. Now what?

You need to bring everything.

💡 You might also like: Finding a Verbal Alternative to a Tap on the Shoulder for Better Focus

And I mean everything.

If you are going for identity verification, bring your passport and a driver's license. If it’s about a notice you received, bring the original notice. The IRS moves on paper. If you don't have the paper, they often can't "see" the problem in their system as quickly as you’d like.

Expect to be there for a while. Even with an appointment, things run behind. It’s just the nature of the beast.

Parking and Access

Parking at the 7350 W. Camino San Xavier location is generally fine. It’s a standard lot. You won’t have to pay for a garage like you might at the Phoenix office on Central Avenue. That’s a small win, at least.

Better Alternatives to the Glendale Office

Sometimes, the IRS office in Glendale Arizona isn't actually your best bet.

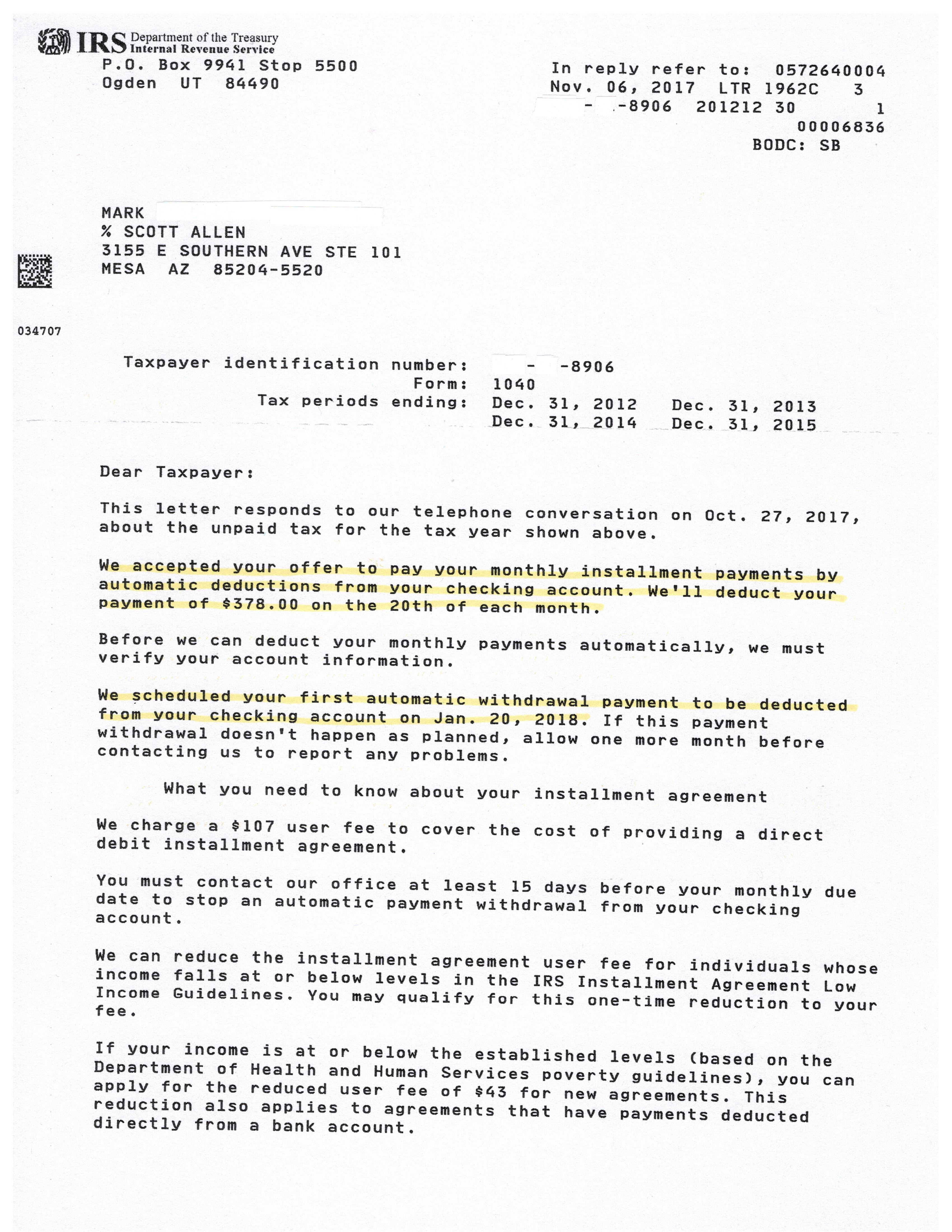

If your problem is that you owe money you can't pay, you don't necessarily need an appointment. You can often set up an "Installment Agreement" online in about ten minutes. It’s much faster than driving to the office and waiting in a sterile room.

If you’re dealing with a legitimate financial hardship—like the IRS is about to garnish your wages and you won’t be able to pay rent—contact the Taxpayer Advocate Service (TAS) instead. They are an independent organization within the IRS that helps people when the system breaks down. They have a Phoenix office, but they handle cases from Glendale residents all the time.

Actionable Next Steps

- Check the Website First: Go to IRS.gov and use the "Interactive Tax Assistant." It sounds robotic, but it solves about 80% of the questions people usually take to the local office.

- Call the Appointment Line: If you truly need to go in, dial 844-545-5640. Do not call the local Glendale office number for appointments; they usually won't pick up or will just redirect you to the main line.

- Gather Two Forms of ID: Even if you aren't there for identity theft, bring a state ID and a Social Security card or passport. You can't get past security without a photo ID.

- Print Your Notices: If the IRS sent you a letter, have it in your hand. Digging through your phone to find a PDF is a great way to make the clerk lose patience.

The Glendale office is a tool, but it's a blunt one. Use it for the complex stuff that requires a human to look at your physical documents, and handle the rest through the portal to save your sanity.