If you bought your first home nearly two decades ago, the last thing you’re probably thinking about today is your 2008 tax return. It feels like ancient history. But for a specific group of homeowners, IRS Form 5405 is the ghost that keeps haunting their mailboxes every spring.

It’s a weirdly specific tax situation.

Most people hear "tax credit" and think of free money from the government. Usually, that’s exactly what it is. You get a credit, your tax bill goes down, and you move on with your life. But the 2008 version of the First-Time Homebuyer Credit was different. It wasn’t a gift; it was essentially an interest-free loan. If you took that money to help with a down payment back then, the IRS expects it back. Slowly. Over fifteen years.

What is IRS Form 5405 anyway?

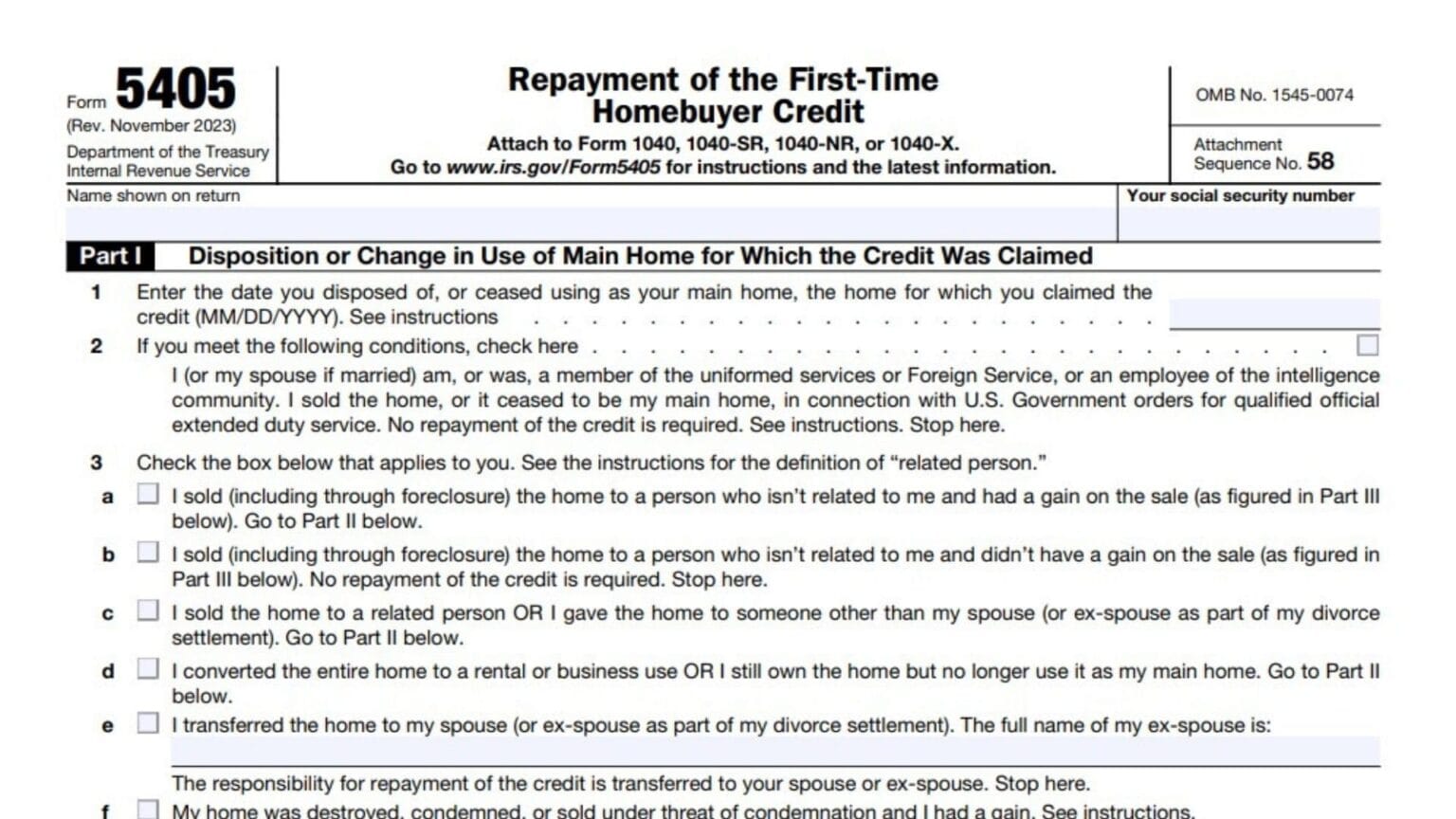

Basically, you use this form to tell the IRS how much of that old credit you’re paying back this year. Or, in some cases, why you’re paying the whole thing back at once because you sold the house.

Back during the Great Recession, the housing market was a mess. To get people buying homes again, Congress passed the Housing and Economic Recovery Act of 2008. They offered a credit of up to $7,500. It worked! People bought houses. But the "catch" was buried in the fine print: the money had to be repaid starting two years after the purchase.

If you bought in 2008, your repayment period started in 2010. Since it's a 15-year repayment schedule, many people are just now reaching the final stretch of those payments. It’s a long game.

The 2008 vs. 2009 Confusion

This is where things get messy and where most people get frustrated.

If you bought your home in 2009 or early 2010, you likely don't need IRS Form 5405 anymore. Why? Because the law changed. Congress realized that asking for the money back wasn’t as "stimulative" as they hoped. So, for homes purchased in 2009 and the first part of 2010, the credit became a true gift. No repayment required—unless you sold the house within three years.

But if you were the "early adopter" who bought in 2008? You’re stuck with the old rules. It feels unfair to a lot of people. You bought a house to help the economy, and you're the only group that has to pay the money back.

💡 You might also like: Virgo Love Horoscope for Today and Tomorrow: Why You Need to Stop Fixing People

When do you actually have to file this form?

You don't need to file Form 5405 every single year if you're just doing the standard annual repayment. Usually, you just enter the amount on Schedule 2 of your 1040. However, there are big "trigger events" that make the form mandatory.

Selling your home is the big one.

If you sell the house that you bought with the 2008 credit, the entire remaining balance becomes due immediately. The IRS wants their cut of the proceeds. There are some nuances here, though. If you sell the house to a non-relative and you don't actually make a profit on the sale, the IRS might limit the repayment amount. They aren't going to make you pay back more than the "gain" you made on the home.

Honestly, that’s a small silver lining if you’re selling in a down market.

Another trigger is if the house stops being your main home. Maybe you turned it into a rental property. Or maybe it’s a vacation home now. The moment it isn't your primary residence, the IRS considers the "loan" due in full.

Real World Example: The $500 Annual Headache

Let's look at an illustrative example. Imagine Sarah bought a condo in 2008 and claimed the full $7,500 credit. Her repayment schedule is $500 a year for 15 years.

Sarah has been paying this since 2010. By 2024, she’s paid back $7,000. She only owes $500 left. If she keeps living there, she’ll just pay that last bit on her next tax return. But if Sarah decides to sell that condo tomorrow to move into a bigger house, she has to file IRS Form 5405 to settle that final $500 balance from the sale proceeds.

It sounds simple, but people forget.

📖 Related: Lo que nadie te dice sobre la moda verano 2025 mujer y por qué tu armario va a cambiar por completo

If you forget to account for this during a home sale, you might end up with a surprising bill from the IRS a year later, plus interest. Nobody wants that.

Exceptions to the Repayment Rule

Tax law is rarely black and white. There are always "ifs" and "buts."

- Death: If the person who claimed the credit passes away, the remaining repayment is usually waived. The IRS doesn't chase the estate for the balance.

- Divorce: This gets tricky. If the home is transferred to a spouse as part of a divorce settlement, the person who keeps the house also keeps the responsibility for the future repayments.

- Involuntary Conversion: If your house is destroyed in a natural disaster or seized by the government (eminent domain), you might get a reprieve. You typically have two years to buy a new primary residence before the full repayment kicks in.

How to check what you still owe

Most people have no idea what their remaining balance is. Who keeps tax records from 2008?

The easiest way is to use the First-Time Homebuyer Credit Account Look-up tool on the official IRS website. You’ll need your Social Security number, date of birth, and the address of the home you bought. It will tell you exactly how much you’ve paid and how much is left on the "loan."

It’s worth checking even if you think you’re done.

Common Mistakes People Make with Form 5405

One of the biggest errors is thinking the credit "expires" after a certain number of years regardless of whether you sell. It doesn't. That 15-year clock is rigid.

Another mistake is failing to file the form when a spouse passes away. If you filed a joint return in 2008, each spouse is usually responsible for half the credit. If one spouse dies, their half of the remaining debt is generally canceled, but the surviving spouse still owes their half. You have to file the form to "clear" the deceased person's portion, or the IRS computer will keep looking for the full amount.

Why does this still matter in 2026?

We are at the tail end of the repayment cycle. For many, 2024 or 2025 will be the final year of that $500 payment.

👉 See also: Free Women Looking for Older Men: What Most People Get Wrong About Age-Gap Dating

But because the housing market has been so volatile lately, more people are selling those 2008-era "starter homes" to downsize or relocate. When you sell, the "acceleration" rule kicks in. You can't just keep paying $500 a year if you don't own the house anymore.

Actionable Steps for Homeowners

If you think you might be one of the 2008 homebuyer credit recipients, don't wait for a nasty letter.

First, go to the IRS "First-Time Homebuyer Credit Account Look-up" tool. See where you stand. Knowledge is power, or at least it’s a way to avoid a surprise $1,500 tax bill.

Second, check your previous two years of tax returns. Look for "First-Time Homebuyer Credit Repayment" on your Form 1040. If it’s there, you’re still in the loop.

Third, if you are planning to sell your home this year, tell your CPA or tax preparer immediately. They need to know so they can prepare IRS Form 5405 and calculate if you owe the full balance from your capital gains.

Finally, keep a copy of your 2008 closing statement. It sounds ridiculous to keep a paper that old, but if the IRS ever disputes the purchase date or the amount of the credit, that piece of paper is your only shield.

The 2008 credit was a unique moment in financial history—a weird hybrid of a gift and a loan. Dealing with Form 5405 is just the final chore of that era. Once that last payment is made, or the final form is filed after a sale, you can finally close the book on 2008 for good.