You're probably tired of seeing your self-employment tax bill every April. It hurts. Honestly, watching a massive chunk of your hard-earned revenue vanish into the Social Security and Medicare coffers feels like a punch in the gut. That is exactly why the llc to s corp form—specifically IRS Form 2553—is the holy grail for small business owners who finally hit that "sweet spot" of profitability.

But here is the thing.

Most people treat this form like a "set it and forget it" checkbox. It isn't. If you mess up the timing or the way you pay yourself afterward, the IRS won't just wag a finger; they’ll dismantle your tax savings and hit you with penalties that make your original tax bill look like pocket change.

What is Form 2553 and Why Does it Exist?

Basically, an LLC is a bit of a shapeshifter. By default, if you're a single-member LLC, the IRS looks at you as a "disregarded entity." You and the business are one and the same for tax purposes. You pay self-employment tax on every single dollar you profit.

The llc to s corp form, or Form 2553, tells the IRS: "Hey, I want to be treated as a corporation for tax reasons, but I want to keep the flow-through benefits of an LLC."

It’s a specific election. You aren't changing your legal structure at the state level—you're still an LLC in the eyes of your Secretary of State—but you’re wearing a "S Corp" hat when you talk to the feds.

Why bother? Because of the split.

✨ Don't miss: DeKalb GA Business License: What Most People Get Wrong

In an S Corp, you become an employee of your own company. You pay yourself a "reasonable salary" (we will get to that nightmare in a second) and take the rest as a distribution. You only pay payroll taxes on the salary. The distribution? That’s free from the 15.3% self-employment tax. If you're making $100,000 in profit, that can save you thousands. Literally thousands.

The Deadline is Not a Suggestion

If you want to be an S Corp for the current tax year, you have a very narrow window. You have to file the llc to s corp form no later than two months and 15 days after the beginning of the tax year. For most of us on a calendar year, that means March 15th.

Miss it? You’re stuck as a regular LLC for the rest of the year.

Usually.

There is a "Late Election Relief" provision under Revenue Procedure 2013-30. If you can prove you intended to be an S Corp, acted like one, and just had "reasonable cause" for being late, you can sometimes sneak it in. But banking on IRS mercy is like banking on a blizzard in Miami. It might happen, but you shouldn't plan your life around it.

The "Reasonable Salary" Trap

This is where the IRS gets its teeth into you. Once you file that llc to s corp form, you can't just take all the money as a distribution to avoid taxes. That’s tax evasion, plain and simple.

The IRS requires S Corp owners to pay themselves "reasonable compensation."

What’s reasonable?

Well, it’s subjective. If you’re a specialized software engineer in San Francisco making $200k in profit and you try to tell the IRS your "salary" is $30,000, you are going to get audited. They look at what someone else would get paid to do your job.

Expert tax pros like those at Gusto or Bench often suggest a 60/40 split as a rule of thumb, but that isn't law. It's a guess. A safer bet is looking at Bureau of Labor Statistics data for your role and your zip code. If you lowball it too much, the IRS can reclassify your distributions as wages, hit you with back taxes, and add interest that compounds faster than you can say "audit."

Real-World Nuance: The Basis Problem

There’s a technicality called "basis" that ruins people’s lives. In a regular LLC, you can often deduct losses regardless of how much cash you’ve personally put in. In an S Corp, your ability to deduct business losses is strictly limited to your "basis"—essentially the money you’ve put into the company plus any profit you’ve left in the bank.

If you take out more money than you have basis, that distribution is taxed as a capital gain.

Suddenly, your clever tax-saving move just created a brand new tax bill.

How to Actually Fill Out the LLC to S Corp Form

Don't let the four pages of Form 2553 scare you. Most of it is straightforward, but the signature page is the "gotcha" moment. Every single member of the LLC—even if they have 1% ownership—must sign that form. If you have a silent partner who is on vacation in Bali and they don't sign by the deadline, your election is dead on arrival.

- Part I: This is your basic info. Employer Identification Number (EIN), legal name, and the date you incorporated.

- The Election Date: You have to specify when the S Corp status should start. Usually, it's January 1st of the current year.

- Shareholder Consents: This is where everyone signs.

- Part II: This deals with the fiscal year. Most small businesses just use the calendar year (ending Dec 31). Unless you have a very weird seasonal business, don't try to get fancy here.

Common Mistakes That Get You Rejected

- Wrong EIN: People often use their personal Social Security Number by mistake.

- Missing Signatures: Again, every member must sign.

- Entity Eligibility: S Corps can't have more than 100 shareholders, and they can't have "ineligible" shareholders like corporations or certain non-resident aliens. If your LLC is owned by another company, you can’t file the llc to s corp form. Period.

The Administrative Headache Nobody Tells You About

Being an S Corp is "high maintenance."

You have to run payroll. You can't just Zelle yourself money from the business account anymore. You need a payroll provider (like Gusto or ADP) to withhold federal and state taxes, pay into unemployment insurance, and issue you a W-2 at the end of the year.

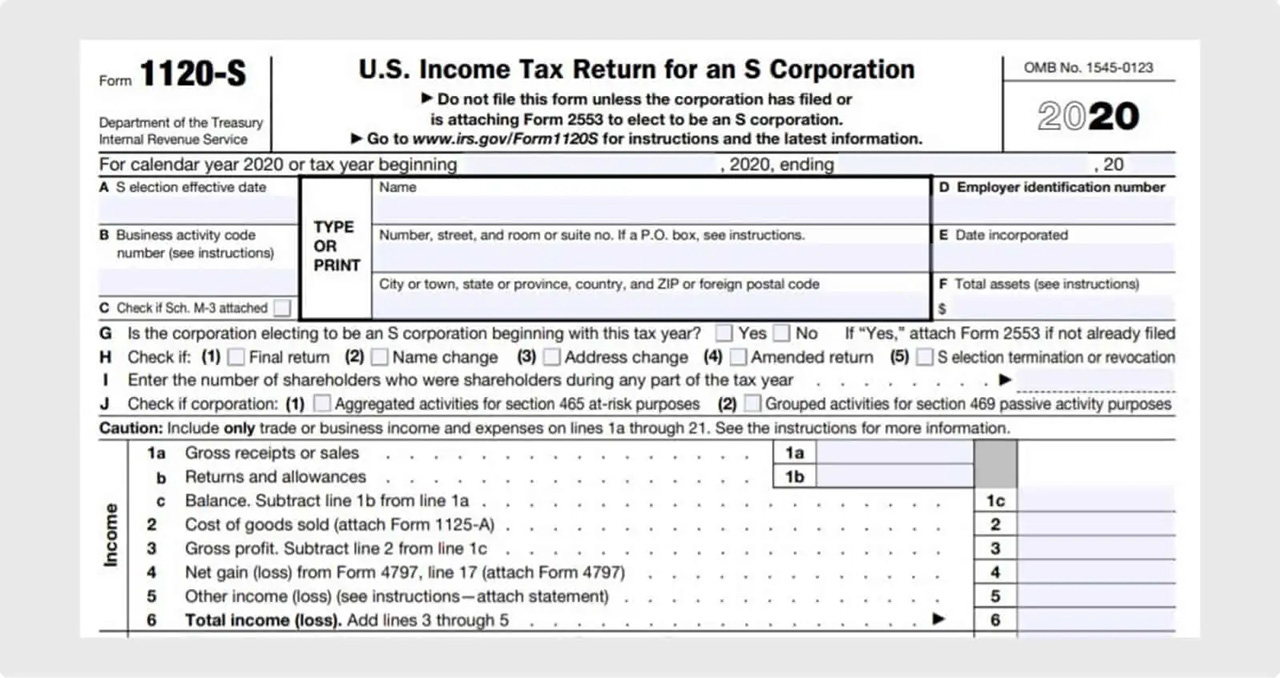

Then there’s the Form 1120-S. This is the corporate tax return. It’s significantly more complex than a standard Schedule C. Your accountant is going to charge you more. Probably a lot more.

📖 Related: Samsung Electronics Share Price: Why the Sleeping Giant is Finally Waking Up

You need to ask yourself: "Is my tax savings greater than the cost of the extra accounting and payroll fees?"

If you're only profiting $40,000 a year, the answer is probably no. The $2,000 you save in taxes might be eaten up by $2,500 in new administrative costs. Most experts suggest waiting until you're consistently clearing $60,000 to $75,000 in net profit before pulling the trigger.

Actionable Next Steps

Don't just download the form and mail it because you read a blog post. Tax law changes, and 2026 might have specific adjustments to the QBI (Qualified Business Income) deduction that change the math for you.

- Run a Break-Even Analysis: Calculate your projected profit. Subtract a "reasonable salary" based on local job listings. Multiply the remainder by 15.3%. If that number is significantly higher than $3,000, the S Corp election starts to make sense.

- Check Your Operating Agreement: Ensure your LLC operating agreement allows for S Corp election. Some older agreements have "partnership" language that conflicts with S Corp rules.

- Consult a CPA: Specifically, ask them about "Stock Basis" and "QBI Deduction impact." If they can't explain those two things clearly, find a different CPA.

- Obtain Form 2553: Download it directly from IRS.gov. Do not use third-party "form filler" sites that charge you for a free government document.

- Set Up Payroll First: Do not file the form until you have a plan for payroll. You must begin paying yourself a salary the moment the election becomes effective.

The llc to s corp form is a powerful tool, but it's a double-edged sword. It demands discipline. If you’re the type of person who forgets to track expenses or hates paperwork, an S Corp might be a nightmare you don't want. But if you're ready to treat your business like a real corporation, it’s the single best way to keep more of your money where it belongs: in your pocket.