You've probably heard that iron condor options trading is basically a "free money" machine. The pitch is simple: the market usually stays within a range, so you just sell volatility and collect rent. Sounds easy. But honestly, most people who jump into this get absolutely smoked the first time the S&P 500 decides to go on a random 3% tear in a single afternoon.

It’s frustrating.

The strategy is a four-legged animal. You’re essentially selling a credit spread on the call side and another one on the put side. You want the stock to sit perfectly still, like a bored teenager at a Sunday dinner. If it stays between your short strikes, you keep the premium. If it moves? Well, that’s where things get messy.

The mechanics of the iron condor options trading strategy

Let’s look at a real-world scenario. Imagine the SPDR S&P 500 ETF (SPY) is trading at $580. You think it's going nowhere over the next 30 days. You decide to open an iron condor. You might sell a $595 call and buy a $600 call (the bear call spread side). Simultaneously, you sell a $565 put and buy a $560 put (the bull put spread side).

You just created a "tent."

If SPY stays between $565 and $595, you win. The math behind this is driven by Theta, or time decay. Every day that passes without a massive market move puts money in your pocket. It's the ultimate "theta gang" play. But here is the kicker: you are "short vega." This means if volatility spikes—maybe because of a surprise Fed announcement or some geopolitical chaos—the value of your spreads goes up, which is bad for you because you sold them. You want them to go to zero.

The total risk is the width of the wings minus the credit received. If you collected $1.50 on a $5 wide spread, your max loss is $3.50. You're risking $350 to make $150. Does that sound like a good deal? Most professional traders, like those following the methodologies of Tom Sosnoff at Tastytrade, suggest that the "probability of profit" (POP) is high enough to justify that lopsided risk-reward ratio. But you have to be right often. Like, really often.

Why the "Set it and Forget it" mantra is a lie

People love to say you can just put these trades on and walk away. That’s total nonsense.

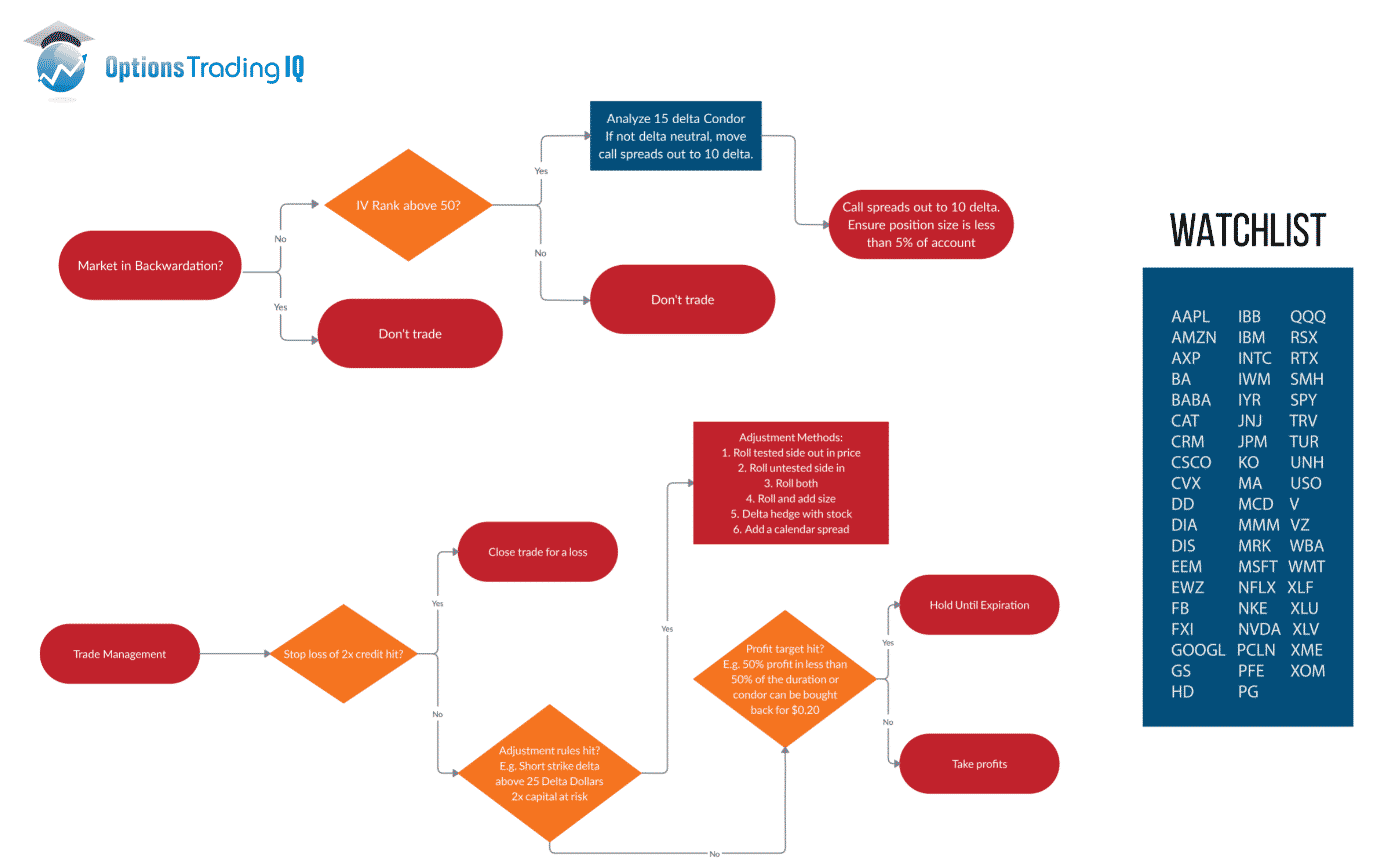

The market isn't a static thing. It’s a vibrating, chaotic mess of human emotion and algorithmic high-frequency trading. If you aren't managing your delta, you're just gambling. Delta measures how much your option price moves for every $1 move in the underlying stock. In a perfect iron condor, you start delta-neutral. But as the stock moves toward your $595 call, that side of the trade becomes "delta heavy." Your losses start accelerating.

🔗 Read more: Why 444 West Lake Chicago Actually Changed the Riverfront Skyline

I've seen traders watch their "safe" income trade turn into a nightmare because they refused to adjust.

Managing the tested side

What do you do when the market attacks your strikes? You have a few options.

- Roll the untested side: If the stock is skyrocketing toward your calls, your puts are now worthless. You can buy them back for pennies and sell a new put spread closer to the current price. This collects more credit and reduces your overall "delta" risk.

- Close the whole thing: Sometimes, the best trade is the one you exit. If you've hit 50% of your max loss, maybe it's time to go home.

- The "Iron Butterfly" pivot: Some aggressive traders will roll the untested side all the way up until the short strikes meet. Now you're in a butterfly. It's a high-stress move, but it can save a losing trade.

The Greeks aren't just for math nerds

If you want to survive iron condor options trading, you have to respect the Greeks. Specifically Gamma. Gamma is the rate of change of Delta. In the final week before expiration, Gamma is a monster. It makes your position values swing wildly with even tiny moves in the stock. This is why many pros exit their condors 21 days before expiration (DTE).

Why 21 days?

Because research from groups like Tastytrade suggests that the "gamma risk" in that final stretch isn't worth the extra few bucks of theta decay. You get the meat of the move between 45 DTE and 21 DTE. After that, you're just picking up nickels in front of a steamroller.

Vera is the other one. Most beginners trade condors when volatility is low because they feel "safe." That is exactly backwards. You want to sell an iron condor when the Implied Volatility (IV) Rank is high. Why? Because when IV is high, the premiums are fat. When the market eventually calms down—which it usually does—the "volatility crush" makes the price of your spreads drop, allowing you to buy them back and book a profit much faster than waiting for time decay alone.

Realities of the "Defined Risk" trap

The term "defined risk" gives traders a false sense of security. Yes, you know exactly how much you can lose. But "defined risk" often means "high probability of a small win, low probability of a catastrophic loss."

If you lose $500 on one trade, you might need four or five winning trades just to get back to even. This is the "tail risk" problem. In a black swan event—think March 2020—the market moves so fast that your "defined" stop losses might not even trigger where you want them to because of slippage and wide bid-ask spreads.

💡 You might also like: Panamanian Balboa to US Dollar Explained: Why Panama Doesn’t Use Its Own Paper Money

You have to be disciplined.

I remember a guy who traded condors on Roku. He thought he was a genius for six months. Then Roku had an earnings gap that blew past his long strikes by $20. He didn't just lose his "defined risk"; the liquidity was so bad at the open that he took an even bigger hit than the theoretical max. It happens.

Choosing the right underlyings

Don't trade iron condors on low-volume penny stocks. You'll get eaten alive by the spread. Stick to the big boys.

- SPY or VOO: High liquidity, tight spreads, moves predictably (mostly).

- IWM: The Russell 2000 is great for range-bound trading, though it's more volatile than the S&P.

- QQQ: This is the tech-heavy Nasdaq. It's great for premium, but man, it can move. You need wider wings here.

- Blue Chips: Stocks like Apple (AAPL) or Microsoft (MSFT) are favorites, but watch out for earnings dates. Never hold a condor through earnings unless you're looking for a heart attack.

Liquidity is your best friend. If the bid-ask spread on your options is more than a few cents, you're losing money the second you click "send." You want to see thousands of contracts in "open interest." If you can't get in and out of the trade instantly, you're trading a ghost.

The psychology of the "losing" winner

The hardest part of iron condor options trading isn't the math. It's the psychology. You will spend 90% of the time "underwater" on the trade. Because of how the pricing models work, the trade often looks like a loser for the first two weeks even if the stock hasn't moved.

New traders panic. They see a -$100 P/L and they close the trade. Then they watch as, two weeks later, the trade would have been a full profit. You need a "stomach for the red."

You also need to know when you're beat. There’s a fine line between "staying the course" and "being a stubborn idiot." If the fundamental reason you took the trade has changed—say, a surprise inflation print changes the market's entire trajectory—the "range-bound" thesis is dead. Kill the trade. Live to fight another day.

Actionable steps for your next trade

If you're going to pull the trigger on an iron condor tomorrow, follow this checklist. It won't guarantee a win, but it'll keep you from doing something stupid.

📖 Related: Walmart Distribution Red Bluff CA: What It’s Actually Like Working There Right Now

Check the IV Rank. If it's below 30, maybe wait or look for a different stock. You want to sell expensive insurance, not cheap insurance. Look at the expected move. Most trading platforms (like Thinkorswim or Interactive Brokers) show you the "expected move" for an expiration cycle based on option pricing. If you sell your strikes outside that expected move, you're playing the probabilities correctly.

Set your profit target at 50%. Don't be greedy. If you sold the condor for $2.00, put in a "buy to close" order at $1.00 immediately. This automates your success. Often, a stock will flash into your profit zone for ten minutes while you're at lunch. If your order isn't resting on the exchange, you miss it.

Stop-losses are tricky with spreads, but have a "mental" point of no return. Usually, if the premium of the total spread doubles, it's time to re-evaluate.

Watch the calendar. Check for dividends and earnings. An upcoming dividend can cause early assignment on your short calls if they are in the money. An earnings report will spike volatility and blow your wings off.

Sizing is everything

The biggest mistake? Trading too large. If you have a $10,000 account, don't put $5,000 into a single iron condor. One bad move in the market and you've nuked half your portfolio. Use 1-2% of your capital per trade. It feels slow. It feels boring. But boring is how you stay in the game long enough to actually get rich.

Iron condors are a tool, not a magic trick. Use them when the market is overreacting and volatility is pumped up. Use them on liquid indices. And for heaven's sake, don't hold them through the final week. Take your 50% profit and go buy a steak.

The goal isn't to be right about where the market is going. The goal is to be right about where the market isn't going. Once you realize that, the whole game changes. Stick to the high-probability zones, manage your deltas, and respect the power of a trending market to ruin your day. Do that, and you might actually make this "income" thing work.