You’ve probably seen the late-night commercials or the frantic social media threads. They all say the same thing: buy gold before the world ends. But honestly, most of those people are talking about burying bars in the backyard. That’s not what we’re doing here. When we talk about gold on the stock market, we are talking about liquidity, leverage, and avoiding the literal weight of a metal bar in your basement. It's a different game.

Gold is weird. It doesn’t pay dividends. It doesn’t produce earnings like Apple or Microsoft. It just sits there. Yet, for thousands of years, humans have decided this soft, yellow metal is the ultimate "get out of jail free" card for the global economy.

The GLD Phenomenon and the Paper Gold Reality

In the old days—basically anytime before 2004—if you wanted gold, you had to call a dealer. Then the SPDR Gold Shares (GLD) launched. It changed everything. Suddenly, you could trade gold just like a share of Tesla. One click and you're in.

But there is a catch. You don't actually own the gold. You own a share of a trust that holds the gold. For most people, that’s fine. If you’re day trading or just hedging a portfolio for a few months, it’s perfect. But the "gold bugs"—the hardcore enthusiasts—will tell you that if you can't touch it, you don't own it. They worry about "counterparty risk." If the entire financial system melts down, will that digital share of GLD actually be redeemable for anything? It's a valid question, though a bit doomsday-heavy for most casual investors.

Why Miners Aren't Just "Gold with Extra Steps"

This is where people get burned. They think buying a gold mining stock, like Newmont (NEM) or Barrick Gold (GOLD), is the same as buying gold. It isn’t. Not even close.

👉 See also: Disney Stock: What the Numbers Really Mean for Your Portfolio

Mining stocks are businesses. They have CEOs who might make bad decisions. They have labor strikes in South Africa. They have diesel costs that eat into their profits. If the price of gold goes up 10%, a mining stock might go up 30% because of "operational leverage." But if gold stays flat and the company's mine floods, that stock is going to zero. You’re trading a commodity's price for a company's management ability.

I've seen people pour money into junior miners—the tiny companies looking for gold—thinking they've found the next big strike. Most of those companies are just "a hole in the ground with a liar standing next to it," as the old Mark Twain quote (often attributed to him, anyway) goes. Stick to the majors if you want to sleep at night.

The Real Driver: Real Interest Rates

Forget what you heard about inflation. Gold doesn't always go up when inflation goes up. What actually matters is the real interest rate.

Basically, it’s a math problem. Take the 10-year Treasury yield and subtract the inflation rate. If that number is negative, gold usually screams higher. Why? Because if a bank account pays you 2% but inflation is 5%, you’re losing 3% of your purchasing power every year. In that world, gold—which pays 0%—suddenly looks like a high-yield investment.

✨ Don't miss: 1 US Dollar to 1 Canadian: Why Parity is a Rare Beast in the Currency Markets

But when the Fed cranks up interest rates and you can get a "safe" 5% return on cash while inflation is only 2%, gold becomes a "pet rock." Why hold a heavy metal that does nothing when you can get paid 3% in real terms to hold dollars? This is why gold struggled in the mid-2020s despite global chaos; the yields on bonds were just too juicy to ignore.

Central Banks: The "Whales" in the Room

While you’re trying to decide whether to buy two shares of an ETF, central banks are buying tons. Literally.

China, Russia, and India have been on a massive buying spree lately. They want to diversify away from the US Dollar. This creates a "floor" for the price. Even if retail investors get bored and move to Bitcoin, the big institutions are often there to soak up the supply.

How to Actually Play Gold on the Stock Market

If you're looking to jump in, don't just throw darts at a board. You need a strategy.

🔗 Read more: Will the US ever pay off its debt? The blunt reality of a 34 trillion dollar problem

- The "Safety First" Approach: Use ETFs like IAU or GLDM. These have lower expense ratios than the big GLD. If you're holding for years, those 0.10% differences in fees add up to a lot of money.

- The "Income" Play: Look at royalty and streaming companies like Franco-Nevada (FNV) or Wheaton Precious Metals (WPM). They don't dig the holes. They just give the miners cash upfront in exchange for a percentage of the gold produced. It's a much cleaner business model with higher margins and less risk than actual mining.

- The "Speculator" Route: This is for the gamblers. GDXJ is an ETF that tracks junior miners. It’s volatile. It’s scary. It can drop 50% in a few months. Only touch this if you have a high pain tolerance.

Common Misconceptions That Will Cost You

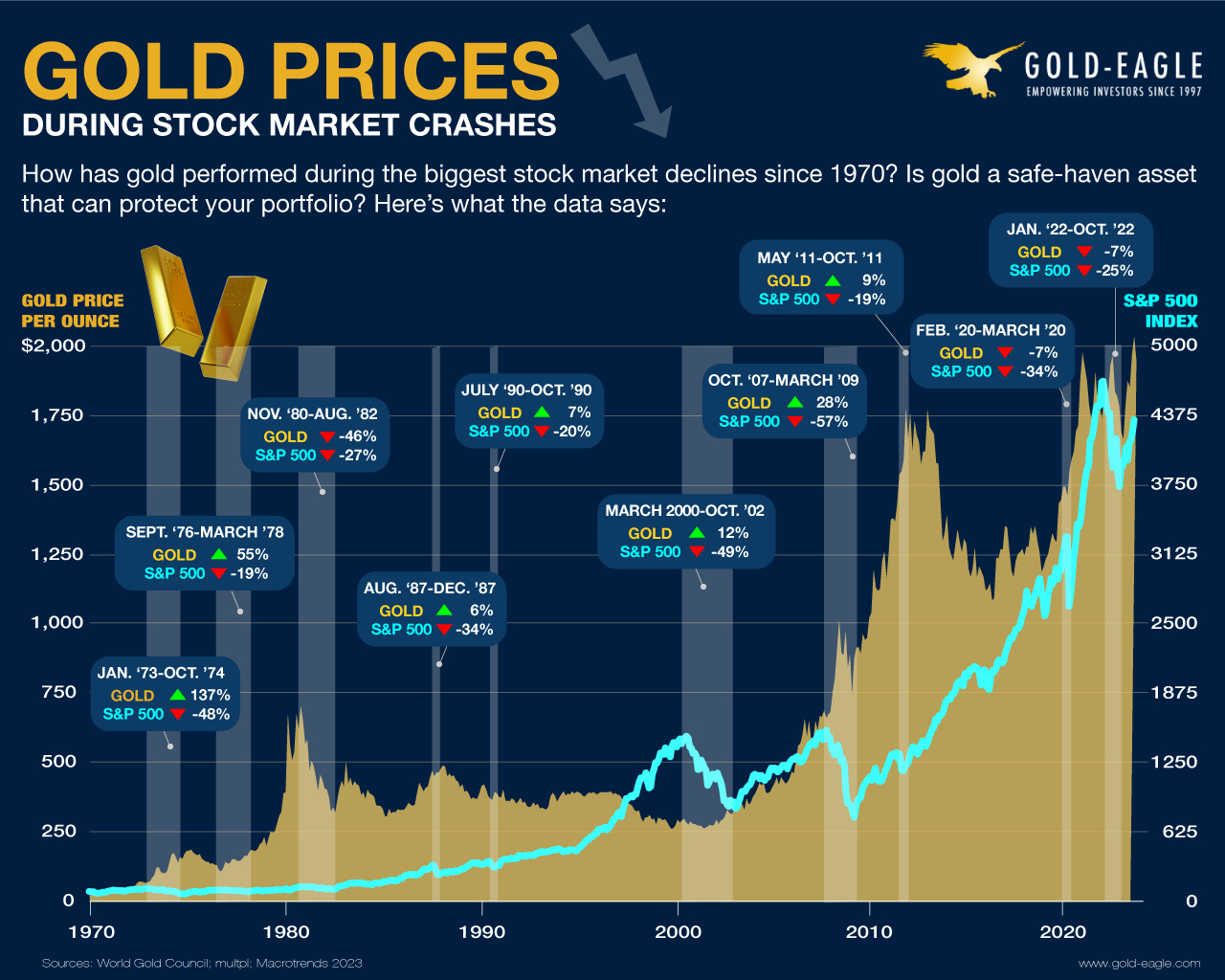

- "Gold is a hedge against a bad stock market." Not always. In a true liquidity crunch—like March 2020—everything gets sold. People sell their gold to cover their losses in other stocks. Gold often crashes with the market initially, then recovers first.

- "Digital gold is the same as physical." It’s not. If you buy "digital gold" through a fintech app, read the fine print. Who holds the vault key? Is it insured?

- "Gold is a get-rich-quick scheme." Absolutely not. Gold is a "stay rich" scheme. It's meant to preserve the value of your labor over decades, not to turn $1,000 into $100,000 by next Tuesday.

Is It Too Late to Buy?

The "all-time high" is a scary phrase. But you have to look at gold in inflation-adjusted terms. Gold at $2,500 today isn't the same as gold at $800 in 1980. We are still nowhere near the real peak of the early 80s when adjusted for how much the dollar has devalued.

Geopolitical tension isn't going away. Debt isn't going away. As long as governments keep printing money to solve problems, gold will have a seat at the table.

Actionable Next Steps

- Check your allocation. Most financial advisors suggest 5% to 10% in "alternatives." If you're 100% in tech stocks, you're not diversified.

- Audit your fees. If you own GLD, check the expense ratio. Switching to a lower-cost version like GLDM can save you thousands over a decade.

- Watch the DXY (Dollar Index). If the dollar is crashing, gold is usually your best friend. If the dollar is rallying, maybe wait for a pullback in gold before buying.

- Don't ignore the miners. If you want growth, look at the royalty companies first. They provide the best balance of safety and upside without the headaches of environmental lawsuits or cave-ins.

Stop looking at gold as a "doomsday" insurance policy and start seeing it as a currency that no government can print. Once you make that mental shift, the volatility becomes much easier to handle.