Markets are messy. You've probably seen those perfect, textbook diagrams of an inverse head and shoulders pattern where everything looks like a clean, symmetrical "W" with a deep middle. They make it look easy. They make it look like free money. But if you’ve spent any real time staring at a TradingView candle chart at 2 AM, you know the market rarely hands out gifts that wrapped up in a bow.

The truth? Most of these patterns fail because traders are too impatient or they're looking for symmetry that doesn't exist.

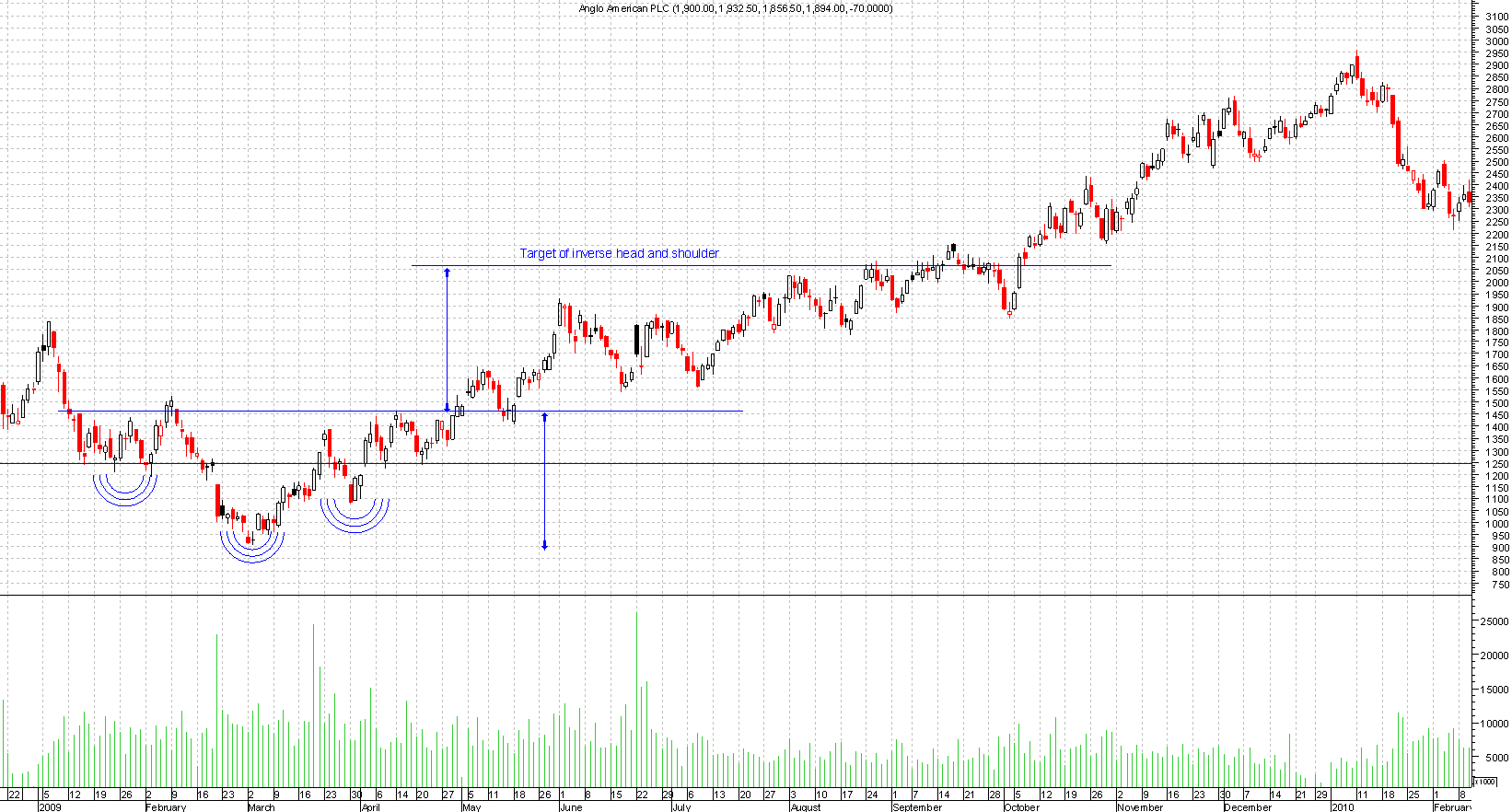

An inverse head and shoulders is basically a story of exhaustion. It’s the visual representation of bears losing their grip on a stock, crypto asset, or currency pair. It’s not just three dips in a row; it’s a psychological shift where the "smart money" starts absorbing sell orders before the retail crowd even realizes the downtrend is over. If you want to actually trade this without getting stopped out by a "fakeout," you have to look past the lines and understand the volume and the necklines that everyone else is misdrawing.

What's actually happening under the hood?

Think about a stock in a brutal downtrend. It’s making lower lows. Everyone is miserable. Then, suddenly, it hits a floor—the left shoulder. It bounces a bit because some people take profits, but then it crashes even harder to a new, terrifying low. That’s the head. This is the moment of maximum pessimism.

But then something weird happens.

Instead of staying down, the price rallies back up to that previous bounce point. This creates your "neckline." When the price drops a third time but fails to reach the depth of the head, you have your right shoulder. This is the "higher low." It’s the first signal that the sellers are out of gas.

Thomas Bulkowski, a legendary chart pattern researcher and author of Encyclopedia of Chart Patterns, has crunched the numbers on thousands of these. His data suggests that while the inverse head and shoulders is one of the best-performing bullish reversal patterns, its success is heavily dependent on volume. If that right shoulder doesn't have a specific kind of volume profile, it’s often just a "dead cat bounce" in disguise.

✨ Don't miss: Jeff Smith BlackRock Website: What Most People Get Wrong

The volume secret nobody mentions

Most beginners just look at the shapes. "Hey, it looks like a person standing on their head!"

Don't do that.

You need to see volume dropping off as the head forms and then—this is the vital part—an absolute explosion of volume when the price finally pierces the neckline. Without that surge, the "breakout" is usually a trap. I’ve seen countless traders buy the breakout on thin volume only to see the price plummet back through the neckline two days later. It’s painful. It’s avoidable.

Why symmetry is a total lie

Stop looking for perfect shoulders. Seriously.

In the real world, the left shoulder might be a sharp V-shape while the right shoulder is a long, rounded saucer that takes three weeks to form. One shoulder might be significantly higher than the other. The neckline? It’s almost never a perfectly horizontal line. Usually, it’s slanted.

A downward-sloping neckline is actually more bullish once it breaks. Why? Because it shows the resistance is getting lower and lower, making the eventual vertical "pop" much more violent. Conversely, if the neckline is sloping upward, the "breakout" has less room to run because the price has already been climbing for a while.

Context matters. If you find an inverse head and shoulders at the end of a six-month bear market, it’s a powerhouse. If you find one in the middle of a sideways chop, it’s probably just noise. You have to be discerning.

Spotting the "fake" right shoulder

Sometimes the market likes to mess with you. It starts forming what looks like a right shoulder, and you get excited. You enter early. Then, the price just keeps drifting sideways or makes a "lower high" instead of a "higher low."

A true right shoulder needs to show conviction. If the price is just wobbling around, it’s not a reversal; it’s a consolidation. Wait for the candle to close above the neckline. Just because the price "touched" the line doesn't mean it "broke" the line. Patience is literally the only thing that separates a profitable trader from someone who’s just gambling on shapes.

Real world example: Bitcoin and the 2023 pivot

If you look back at the Bitcoin charts from early 2023, you can see a classic (though messy) inverse head and shoulders forming after the FTX collapse. The "head" was that soul-crushing dip toward $15,500. The right shoulder formed around $18,000.

When it finally broke the neckline near $20,000, the volume was massive.

That wasn't just a technical pattern; it was a fundamental shift in sentiment. The "weak hands" had been shaken out at the head, and the buyers were finally back in control. Those who waited for the confirmed break of the neckline saw a move that eventually carried the market much higher. Those who tried to "guess" the bottom at the head got chopped up by volatility for weeks.

Stop placing your stops in the wrong place

Here is where most people get liquidated. They find the pattern, they buy the breakout, and they put their stop loss exactly at the neckline.

Market makers know this.

📖 Related: Illinois Tool Stock Price: Why This "Boring" Giant is Winning 2026

They will often push the price back down just below the neckline to "hunt" those stops before the real move starts. This is called a "throwback." It’s incredibly common. According to Bulkowski’s research, throwbacks happen about 60% of the time with this pattern.

If you want to survive, your stop loss should generally be below the low of the right shoulder, not the neckline. Yes, it means a smaller position size because your risk is wider, but it also means you aren't getting kicked out of a winning trade by a 30-minute stop-run.

Calculating your target (The boring math bit)

There’s a standard way to figure out how high the price will go. It’s not a guarantee, but it’s a solid "rule of thumb."

- Measure the distance from the bottom of the head to the neckline (in dollars or points).

- Add that exact amount to the breakout point on the neckline.

- That’s your target.

So, if the head is at $50 and the neckline is at $60, your target is $70. Simple. But keep an eye on previous resistance levels. If there’s a massive "supply zone" at $68, don't be a hero and wait for $70. Take your profits where the market is likely to stall.

The psychology of the reversal

Why does this pattern even work? It’s not magic. It’s the visual footprint of a "short squeeze" meeting "value buying."

At the head, short sellers are piling in, thinking the stock is going to zero. When the price fails to stay down and starts forming that right shoulder, those short sellers start getting nervous. Their buy-to-cover orders add fuel to the fire. Combine that with long-term investors who think the asset is cheap, and you get a massive imbalance of buy orders.

The inverse head and shoulders is just a map of that panic turning into greed.

Common pitfalls to avoid right now

- Trading on tiny timeframes: An inverse head and shoulders on a 1-minute chart is basically useless. It’s just random noise. Stick to the 4-hour or Daily charts if you want the pattern to actually have some "weight" behind it.

- Ignoring the trend: If the overall market (like the S&P 500) is crashing, your individual stock’s bullish reversal pattern is probably going to fail. Don't fight the tide.

- The "Double Head" Trap: Sometimes you’ll see two heads or three shoulders. It’s called a complex head and shoulders. These are actually very strong, but they take forever to play out. Don't lose your mind if the pattern doesn't look like the one in your textbook.

Actionable steps for your next trade

If you think you've found an inverse head and shoulders, don't just market-buy. Follow this checklist to stay sane.

First, confirm the downtrend. The pattern is meaningless if the stock has already been going up for months. It must be a reversal of a previous downward move.

Second, check the volume on the head versus the right shoulder. You want to see less selling pressure on that final dip. This proves the bears are tired.

Third, draw your neckline. If it's a slanted line, make sure you're using the candle closes, not just the wicks, to get a more conservative entry.

Fourth, wait for a daily candle to close above that neckline. This is the hardest part. The FOMO will be screaming at you to jump in early. Don't. Wait for the confirmation.

Fifth, set your take-profit targets based on the "measured move" but adjust them for major historical resistance levels. Always take some profit at the first sign of trouble. You can always leave a "runner" with a break-even stop if you think the move has more legs.

The inverse head and shoulders is a powerful tool, but it's only one piece of the puzzle. Use it alongside other indicators like the RSI (look for bullish divergence at the head) or the 200-day moving average to increase your odds. Trading is about probabilities, not certainties. Treat every pattern as a "maybe" until the volume and the price action prove it's a "yes."