You’ve probably noticed that your grocery bill is a horror show lately. Honestly, it’s exhausting. Everyone is talking about how the Federal Reserve is "fighting" something, but for most of us, it just feels like everything is getting more expensive while borrowing money becomes a total nightmare.

That’s the interest rate and inflation trap in a nutshell.

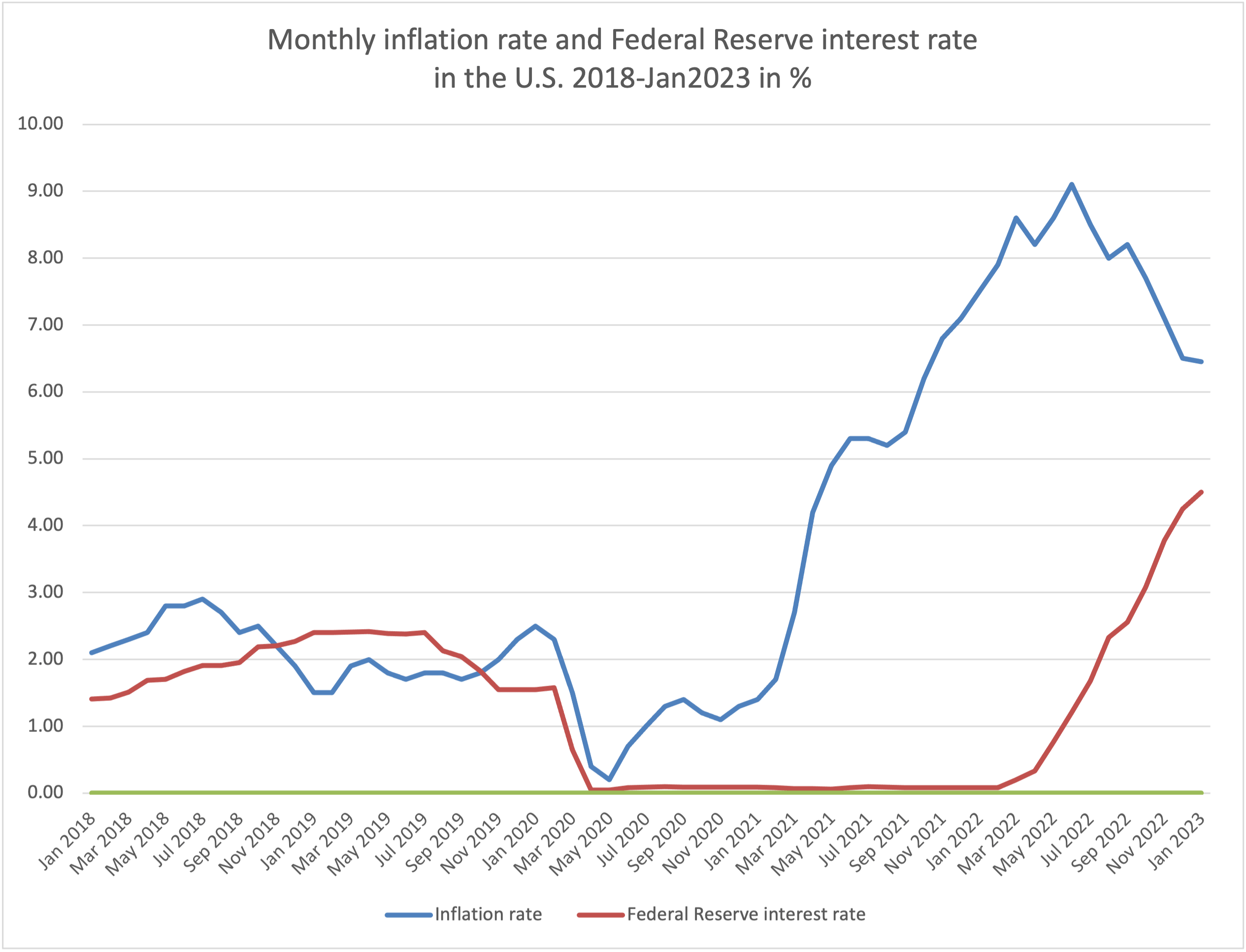

Basically, these two things are stuck in a toxic relationship. When one moves, the other reacts, and usually, the consumer is the one caught in the middle. We've seen this play out aggressively over the last few years. In early 2021, the narrative was that price hikes were "transitory." That turned out to be a massive miscalculation by the Fed. Jerome Powell eventually had to admit it. Since then, we’ve been living through a period of high-speed adjustments that have fundamentally changed how we buy houses, cars, and even eggs.

Why Interest Rate and Inflation Are Constantly Fighting

Think of the economy like a car engine. Inflation is the heat. A little heat is good; it means the car is moving. But if the needle hits the red zone, the engine explodes. To cool it down, the central bank uses interest rates as the coolant.

When the Federal Reserve raises the "fed funds rate," they aren't directly changing your credit card's APR, but they are making it more expensive for banks to borrow money from each other. Banks, being banks, pass those costs directly to you. Suddenly, that mortgage you were eyeing at 3% is now 7%.

Why do they do this? To make you stop spending.

👉 See also: Secretary of Labor Explained: What Most People Get Wrong

It sounds cruel because it is. If it’s too expensive to buy a new truck or expand a business, demand drops. When demand drops, companies (theoretically) stop raising prices. That’s the "soft landing" everyone hopes for, but it’s incredibly hard to stick the landing without causing a recession.

The Consumer Price Index (CPI) is the yardstick we use to track this. It measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. When CPI is high, the Fed gets aggressive. We saw this in the 1980s under Paul Volcker. He pushed rates to nearly 20% to break the back of runaway prices. It worked, but it was a brutal time for the American worker.

The Real Reason Your Rent Is Still High

One of the weirdest things about the current interest rate and inflation cycle is housing. Usually, when rates go up, home prices should drop because fewer people can afford the monthly payments.

But we’re in a supply drought.

Many homeowners are "locked in" to 2.5% or 3% mortgages from 2020. They aren't moving. Why would they? Selling their house and buying a new one would double their interest expense. This has created a "golden handcuff" effect. Because nobody is selling, inventory stays low, which keeps prices high even though the rates are painful.

And then there's the rent.

Rent is a "sticky" component of inflation. Unlike gas prices, which can jump 50 cents and drop 40 cents in a week, rent usually only moves in one direction. Landlords point to their own rising costs—property taxes, maintenance, and higher interest on their own commercial loans—to justify the hikes. This is why even when the headline inflation number looks better, your bank account still feels empty at the end of the month.

The Psychological War of Inflation Expectations

Economists like Ben Bernanke have often talked about "anchoring" expectations. This is a fancy way of saying that if you believe prices will go up 10% next year, you’ll demand a 10% raise today. Your boss then raises the price of your company's products to pay for your raise.

Boom. A wage-price spiral.

The Fed uses interest rates as a psychological signal. By hiking rates, they are telling the market: "We are willing to break things to stop inflation." If the public believes the Fed is serious, they might stop expecting prices to skyrocket, which actually helps cool the market down without the Fed having to do quite as much heavy lifting.

But it’s a gamble. If the Fed pivots too early—meaning they cut rates because they're scared of a recession—inflation could come roaring back. This happened in the 1970s. Arthur Burns, the Fed Chair at the time, let off the gas too soon, and the U.S. ended up with a decade of "stagflation" (stagnant growth plus high inflation). It was a disaster.

What This Means for Your Savings and Debt

It's not all bad news, though it feels like it.

If you have a pile of cash in a high-yield savings account, you’re finally actually making money. For a decade, interest rates were near zero. You got nothing for saving. Now, you can find accounts paying 4% or 5% easily.

On the flip side, credit card debt is a literal trap right now.

Most credit cards have variable rates tied to the prime rate. If the Fed hikes, your card’s interest rate usually follows within one or two billing cycles. If you’re carrying a balance, you aren't just paying for the stuff you bought; you’re paying a massive "inflation tax" in the form of interest.

Specific Impacts on Different Asset Classes

- Bonds: These have an inverse relationship with rates. When rates go up, the value of existing bonds goes down. It’s been a rough ride for bondholders lately.

- Stocks: High rates hurt tech companies specifically. These firms rely on "future" earnings. When interest rates are high, the value of that future money is worth less today.

- Gold: Usually seen as an inflation hedge, but it struggles when interest rates are high because gold doesn't pay a dividend or interest. If you can get 5% from a government bond, why hold a heavy bar of metal that just sits there?

- Crypto: Bitcoin and others were supposed to be an inflation hedge. The reality? They've mostly traded like high-risk tech stocks. When the Fed tightens the money supply, people pull their money out of "risky" stuff first.

Moving Forward: Actionable Steps for a High-Rate World

Waiting for the "old" prices or "old" rates to come back might be a losing strategy. The "Zero Interest Rate Policy" (ZIRP) era that defined the 2010s was actually the historical anomaly, not the current environment.

Here is how you actually handle the interest rate and inflation mess right now.

First, audit your debt. If you have high-interest credit card debt, look for a 0% APR balance transfer offer. They still exist, but they are getting harder to find as banks tighten their lending standards. Every dollar you pay in 22% interest is a dollar inflation has stolen from your future.

Second, rethink your "emergency fund." If your money is sitting in a standard big-bank savings account earning 0.01%, you are losing purchasing power every single second. Move it to a High-Yield Savings Account (HYSA) or a Money Market Fund. This is the only way to let the high-interest environment work for you instead of against you.

Third, don't time the housing market. If you need a place to live and you find something you can afford, the old saying "marry the house, date the rate" sort of applies. You can always refinance if rates drop in two years, but you can't easily negotiate a lower purchase price once rates drop and everyone else floods back into the market.

Finally, watch the "Core" inflation numbers. The headline number includes gas and food, which are volatile. The Fed looks at "Core PCE" (Personal Consumption Expenditures) which strips those out to see the underlying trend. If Core PCE stays high, expect rates to stay "higher for longer." Adjust your 2026 and 2027 financial goals based on the reality that cheap money isn't coming back through that door anytime soon.

Be defensive. Keep your overhead low. Avoid new variable-rate debt like the plague. The economy is currently in a tug-of-war, and your best bet is to make sure you aren't the rope.