If you’d walked into a brokerage in October 1971 and dropped a few hundred bucks on a brand-new company called Intel, you’d be sitting on a fortune today. But honestly, it wouldn't have been a smooth ride. Not even close. People talk about "blue chip" stocks like they’re these steady, boring climbs, but the Intel historical stock price is more like a psychological thriller than a bank statement.

It started at $23.50 a share. Adjusted for the thirteen times they’ve split the stock since then? That’s about two cents. Think about that for a second. Two pennies.

The Wild West of the 80s and 90s

Back in the early days, Intel wasn't even the CPU giant we know. They were a "memory" company. When the Japanese started crushing them in the DRAM market in the mid-80s, the stock felt the heat. It hit a low around $0.28 (adjusted) in 1986. That was the "bet the company" moment. Andy Grove, who was basically a legend in a lab coat, decided to dump memory and go all-in on microprocessors.

It worked. Boy, did it work.

The 1990s were the "Wintel" era. If you had a PC, you had Intel inside. Simple as that. The stock price reflected this total domination, exploding from under a dollar in 1990 to the dizzying heights of the dot-com bubble. By August 2000, Intel was trading at a split-adjusted peak of around $75. People thought it was going to the moon.

📖 Related: 53 Scott Ave Brooklyn NY: What It Actually Costs to Build a Creative Empire in East Williamsburg

Then the bubble popped. Hard.

By September 2002, the stock had tumbled below $15. It was a bloodbath. Investors who bought at the top didn't see those prices again for nearly two decades. That’s the thing about historical charts—they hide the pain of the people who lived through the "lost years."

The Long Sideways Grind and the Modern Era

For a long time, Intel was just... there. While companies like Nvidia were quietly building the future of AI and AMD was clawing its way back from the brink of bankruptcy, Intel was stuck in a rut.

Between 2002 and 2017, the stock mostly hung out between $15 and $35. It paid a nice dividend, sure. But the growth was gone. People started calling it a "value trap." You've probably heard that term—it's a stock that looks cheap but never actually goes up.

👉 See also: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

Things got weird in 2021. The stock hit an all-time closing high of $62.09 in April of that year. There was this brief moment of optimism during the pandemic as PC sales skyrocketed. But it didn't last. Manufacturing delays and the rise of Apple Silicon (Apple dumping Intel chips for their own) sent the stock into another tailspin.

What Really Happened in 2024 and 2025?

Most recently, the Intel historical stock price went through what I call the "Valuation Reset." In 2024, the stock took a massive hit, dropping nearly 60% as the company poured billions into its "IDM 2.0" strategy. Basically, they're trying to become the world's foundry—making chips for everyone else, not just themselves.

It was a gut-punch for shareholders. The stock dipped as low as $17.66 in late 2024.

But here is where it gets interesting. 2025 turned out to be a massive recovery year. As of early 2026, we’re seeing the stock trade back in the $44 to $48 range. Why the sudden love? Honestly, it’s a mix of government support (the CHIPS Act) and the fact that Intel's new 18A manufacturing process is actually starting to work. Even Nvidia—their biggest rival in the AI space—took a $5 billion stake in Intel recently. That’s like your biggest enemy suddenly buying you a drink.

✨ Don't miss: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

Why the Context of "Adjusted" Prices Matters

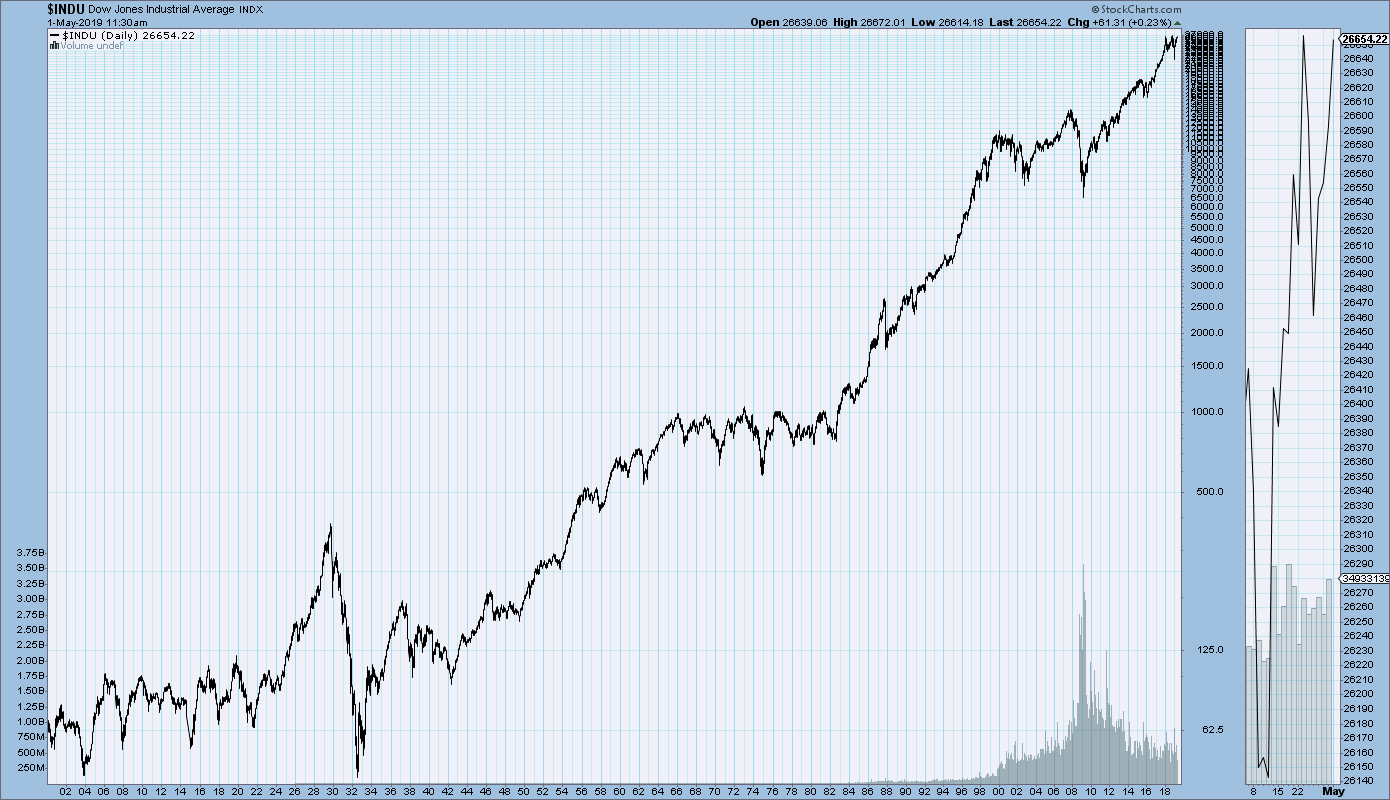

When you look at a chart of Intel's price from 1980 to now, it looks like a series of jagged mountains. But you have to be careful with the numbers.

- Stock Splits: Intel has split 13 times. If you don't use "split-adjusted" data, the chart makes no sense.

- Dividends: Intel has been a dividend machine for decades. If you reinvested those checks, your actual return is much higher than just the price change.

- Market Cap: In 2000, Intel was one of the most valuable companies on Earth. Today, it's a fraction of Nvidia's size, even though its stock price is "recovering."

Actionable Insights for Investors

If you're looking at Intel's history to decide what to do next, don't just stare at the line on the graph. The "old" Intel (the one that dominated the 90s) is dead. The "new" Intel is essentially a massive infrastructure play.

- Watch the Foundry Wins: The stock moves more on news about who Intel is making chips for (like Microsoft or Apple) than on how many i7 processors they sell.

- The "Turnaround Discount": Intel currently trades at a lower P/E ratio than AMD or Nvidia. This is because the market still isn't 100% sure they can pull off this manufacturing pivot. If they do, that "discount" disappears and the stock could pop.

- Geopolitical Hedge: Intel is one of the few companies building massive chip factories on U.S. soil. In a world where Taiwan (TSMC) is a geopolitical question mark, Intel’s historical value might start to include a "security premium."

Start by checking the current "Price-to-Book" ratio. Historically, when Intel trades near its book value (like it did in late 2024), it has been a generational buying opportunity. As we head further into 2026, keep a close eye on the 18A node yields; those technical specs will dictate the stock price more than any earnings report ever could.