You finally found it. That sleek, midnight-blue SUV is sitting in your driveway, and it looks perfect. But then you open the first envelope from your insurance company. Suddenly, that "affordable" monthly payment feels like a trap. Honestly, most of us look at the sticker price and the gas mileage, maybe even the cupholders, but we rarely think about the hidden tax of owning certain vehicles.

Insurance rates by car model aren't just random numbers pulled out of a hat. They are the result of cold, hard actuarial math. Insurers look at how often a specific model gets stolen, how much it costs to replace those fancy LED headlights, and whether the people who drive it tend to have a heavy foot.

Buying a car in 2026 is different than it was even two years ago. The "shock" rate hikes of 2023 and 2024 have slowed down a bit, but the baseline is higher than ever. Nationally, you’re looking at an average of about $208 a month for full coverage. But that number is a ghost—it doesn't exist for most people because the car you choose can swing that bill by hundreds of dollars.

What Most People Get Wrong About Vehicle Premiums

A common myth is that "safe" cars are always the cheapest to insure. It makes sense, right? If a car has high safety ratings, it should cost less. Well, sort of. While a 5-star crash rating helps, insurers are often more concerned with the cost of the claim than the safety of the occupants.

Take the modern bumper. Ten years ago, a fender bender was a $500 fix. Today, that same bumper is packed with ultrasonic sensors and cameras for lane-departure warnings. If you’re driving a car known for expensive proprietary tech—think high-end trim levels of the Tesla Model Y or the Audi RS7—a minor tap in a parking lot can easily turn into a $5,000 repair bill.

Insurers know this. They track every "average repair cost" by make and model. If a vehicle requires specialized technicians or parts that have to be shipped from overseas, you’re going to pay for that privilege every single month in your premium.

📖 Related: Bates Nut Farm Woods Valley Road Valley Center CA: Why Everyone Still Goes After 100 Years

The Winners: Cheapest Cars to Insure Right Now

If your goal is to keep your monthly overhead as low as possible, you’re looking for "boring" but reliable. The data from 2026 is pretty clear on who the winners are. Small to midsize SUVs and crossovers are currently the darlings of the insurance world.

The Honda CR-V and the Toyota RAV4 continue to dominate the "cheap to insure" lists. For a CR-V, you might see rates around $161 to $178 per month for full coverage. Why? Because they are everywhere. Parts are plentiful, any mechanic can fix them, and the people who buy them aren't usually trying to drag race at stoplights.

Interestingly, the Ford Bronco has emerged as a surprisingly affordable option in some markets, with some quotes dipping as low as $76 a month for certain profiles. On the sedan side, the Subaru Legacy and the Honda Civic remain solid bets, though they typically cost a bit more to insure than their SUV counterparts because sedans are statistically involved in more accidents.

The High Cost of Performance and Luxury

On the flip side, if you’re eyeing a Maserati Quattroporte, I hope you’ve got a healthy savings account. You could be looking at an annual insurance bill of over $7,000. It's not just the price of the car; it’s the scarcity. When a Maserati gets hit, the parts aren't sitting in a warehouse in Ohio.

Then there’s the "performance" tax. The Nissan GT-R is a legend on the track, but it’s a nightmare for your insurance agent. Owners of these cars tend to drive them exactly how they were meant to be driven—fast. That translates to higher risk and premiums that often hover around $400 a month.

👉 See also: Why T. Pepin’s Hospitality Centre Still Dominates the Tampa Event Scene

Even "affordable" performance cars like the Dodge Charger carry a heavy premium. They have some of the highest theft rates in the country, and that risk is baked directly into the insurance rates by car model for every single owner, regardless of how safe their personal neighborhood is.

The EV Gap is Closing (Slowly)

Electric vehicles (EVs) are a weird middle ground right now. For a long time, they were vastly more expensive to insure because of the battery. If the battery casing gets even a tiny crack in an accident, most insurers will total the whole car. It's just too risky to repair.

However, in 2026, we’re seeing that gap shrink. An electric Ford F-150 Lightning now costs only about 4% more to insure than the gas-powered F-150. That’s a huge change from a few years ago. More mechanics are trained on EVs now, and the "mystery" of repair costs is starting to fade. Still, the Tesla Model Y remains one of the more expensive "mainstream" cars to cover, often costing around $290 a month—nearly 18% more than a comparable gas SUV.

Real Numbers: What People Are Actually Paying

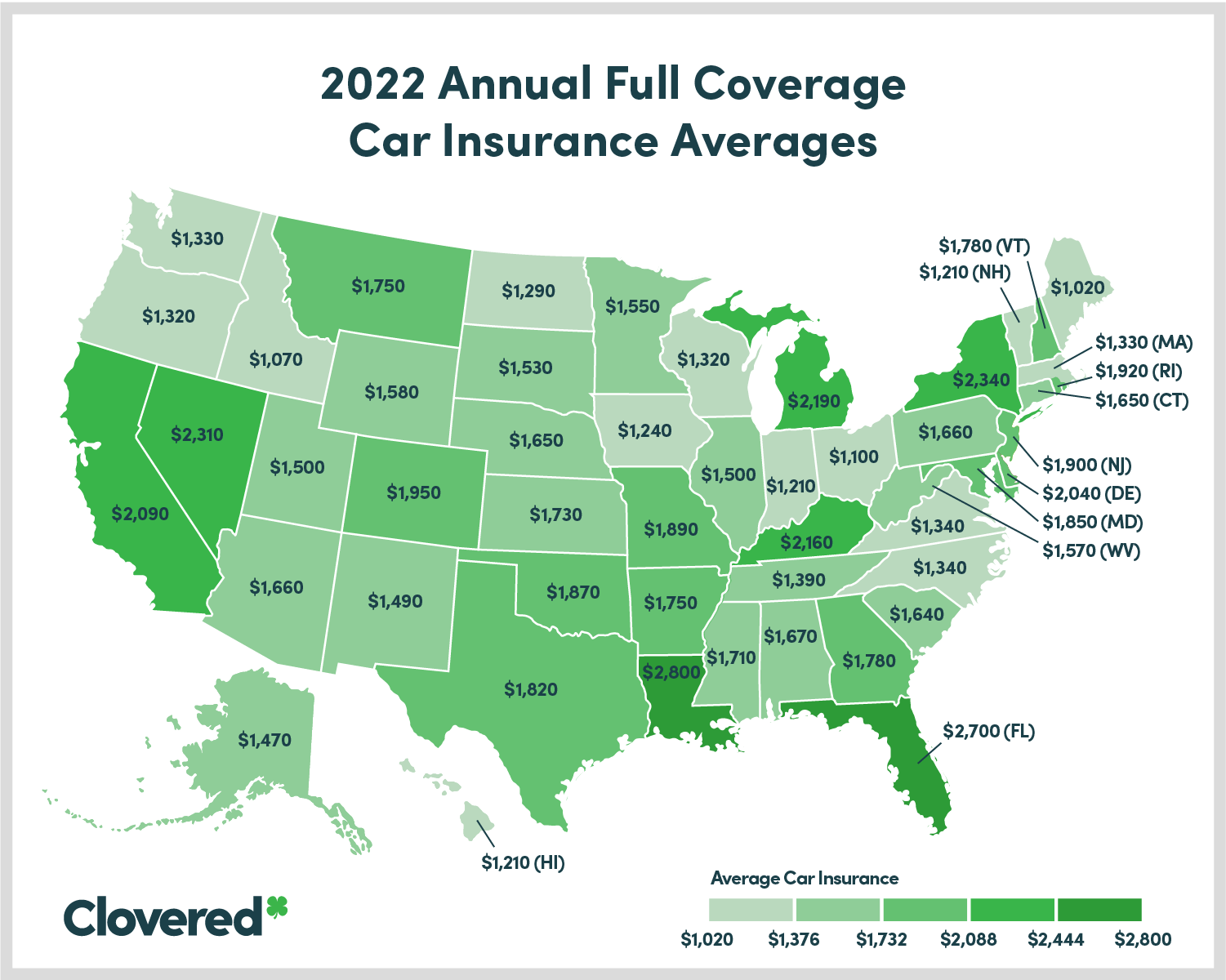

Insurance is local. If you live in Vermont, you’re probably laughing at these numbers because your rates are likely 40% below the national average. If you’re in Florida or Louisiana, you’re probably crying because you’re likely paying 5% of your total income just to keep your car legal.

- Toyota RAV4: ~$214/month

- Ford F-150: ~$258/month

- Tesla Model Y: ~$294/month

- Chevrolet Equinox: ~$229/month

These are just averages. A 20-year-old in a New York City zip code driving a Ford F-150 is going to pay vastly more than a 50-year-old in rural Maine driving the exact same truck.

✨ Don't miss: Human DNA Found in Hot Dogs: What Really Happened and Why You Shouldn’t Panic

How to Win the Insurance Game

You aren't stuck with the first quote you get. Since 2025, more people are "shopping their rate" than ever before. About 57% of drivers switched or looked for new coverage last year.

One thing that’s really changing the game is Telematics. You know those "track your driving" apps? If you’re a genuinely safe driver—meaning you don't slam on your brakes and you stay off your phone—these programs can shave 10% to 15% off your bill. It’s not for everyone (privacy is a real concern), but if you’re driving an expensive-to-insure model like a Tesla or a BMW, it might be the only way to make the monthly payment bearable.

Actionable Steps to Lower Your Rate

- Check the VIN before you buy. Before you sign the papers at the dealership, call your agent with the VIN. Don't guess.

- Bundle like crazy. Putting your renters or homeowners insurance with your auto policy is still the single most effective way to drop the price.

- Adjust your deductible. If you have $1,000 in an emergency fund, move your deductible from $500 to $1,000. It can drop your premium by nearly 15% in some cases.

- Look for safety tech discounts. Make sure your insurer knows if your car has automatic emergency braking or an anti-theft system. Sometimes they miss these details on newer models.

Choosing a car based on insurance rates by car model might feel like the "uncool" way to shop. But when you realize that choosing a Honda over a Tesla could save you $1,500 a year in premiums alone, that "boring" SUV starts looking a whole lot better. You're basically giving yourself a raise just by picking the right VIN.

Stop looking at the monthly car payment as the total cost. It’s the car payment plus the insurance plus the maintenance. When you look at it that way, the math usually points you toward the models that insurers trust the most.

Next Steps:

Go find your current insurance "Declarations Page." Look for the specific "Comprehensive" and "Collision" costs for your vehicle. If those two numbers combined are more than $800 every six months, it’s time to run a comparison quote with at least three different carriers to see if your specific car model is being overcharged in your current zip code.