Money is a strange thing. You think you've got a handle on it, and then the Bank of Japan decides to sneeze, and suddenly your vacation budget for Tokyo looks completely different. If you’ve been watching the INR into Japanese Yen rate lately, you know exactly what I mean. It’s been a wild ride.

The Indian Rupee and the Japanese Yen are basically the "odd couple" of the currency world. On one side, you’ve got India—a high-growth, high-inflation emerging market. On the other, you’ve got Japan—a mature, historically low-interest-rate economy that has spent decades trying to actually get some inflation. When you try to swap one for the other, you aren't just trading paper. You’re betting on two completely different economic philosophies.

Most people just want to know if their 100,000 Rupees will buy them a decent week in Osaka. It’s a fair question. But the answer depends on things like the "Carry Trade," something most travelers have never heard of, yet it dictates every single move of the Yen.

The Carry Trade Chaos and Your Rupee

So, what’s actually moving the needle for INR into Japanese Yen?

For years, the Yen was the world’s favorite "funding currency." Because interest rates in Japan were basically zero (or even negative), big-shot investors would borrow Yen for almost nothing. They’d then take that money and dump it into higher-yielding assets elsewhere—like Indian government bonds or the Nifty 50. This is the carry trade.

When people do this, they sell Yen and buy Rupees. This makes the Rupee stronger and the Yen weaker.

But things changed. In 2024 and heading into 2025, the Bank of Japan (BoJ) finally started nudging rates upward. It wasn't a massive jump, but in the world of finance, a tiny move is a tectonic shift. Suddenly, all those investors got nervous. They started buying back Yen to pay off their loans. When everyone rushes for the exit at once, the Yen spikes. If you were planning to convert your Indian money during one of these spikes, you probably felt the sting.

The Reserve Bank of India (RBI) plays a different game. Governor Shaktikanta Das has been pretty vocal about keeping the Rupee stable. They don't like volatility. While the Yen swings like a pendulum, the RBI uses its massive foreign exchange reserves—which hit record highs over $700 billion recently—to keep the Rupee from crashing or soaring too fast.

📖 Related: Marriott International Inc Share Price: What Most People Get Wrong About This Hospitality Giant

This means that when you look at the INR into Japanese Yen chart, a lot of the "drama" is actually coming from the Japanese side, not the Indian side.

Why 1 Rupee Doesn't Buy What It Used To (Or Does It?)

You might see a rate of 1.80 or 1.90 Yen per Rupee and think you're rich. You're not.

Japan is expensive, but maybe not in the way you think. While the exchange rate has favored the Rupee over the last couple of years compared to the early 2010s, Japanese inflation is finally waking up. A bowl of ramen in Shinjuku that cost 800 Yen five years ago might be 1,100 Yen now.

It’s a tug-of-war.

The Rupee has been remarkably resilient. India’s GDP growth remains the envy of the G20. When a country grows at 6% or 7%, global capital wants in. This demand for Rupees provides a floor for the currency. Even when the Yen gets strong because of BoJ policy shifts, the Rupee usually holds its ground better than other emerging market currencies like the Turkish Lira or the Brazilian Real.

Real World Math: Converting INR into Japanese Yen

Let’s get practical for a second. If you go to a bank in Mumbai to get Yen, you aren't getting the "interbank" rate you see on Google. You’re getting hit with a spread.

Suppose the market rate is 1.85. The bank might give you 1.78. Then there’s the GST on currency conversion. Then there's the fixed fee. Honestly, it’s a racket.

✨ Don't miss: USD to SAR: What the Fixed Exchange Rate Really Means for Your Wallet

- The Cash Trap: Carrying physical Yen is still weirdly necessary in Japan. Despite being a tech giant, many smaller ramen shops and temples in Kyoto are cash-only. But buying cash in India is the most expensive way to do it.

- Forex Cards: These are usually better. You lock in the INR into Japanese Yen rate on the day you load the card. If the Yen gets stronger while you’re mid-flight, you don't care. You’ve already locked your rate.

- UPI in Japan: This is the big news. NIPL (NPCI International Payments Limited) has been working to expand UPI acceptance in Japan. It’s not everywhere yet, but it’s coming. This would bypass a lot of the traditional "forex" headaches.

The "Cheap Japan" Narrative is Ending

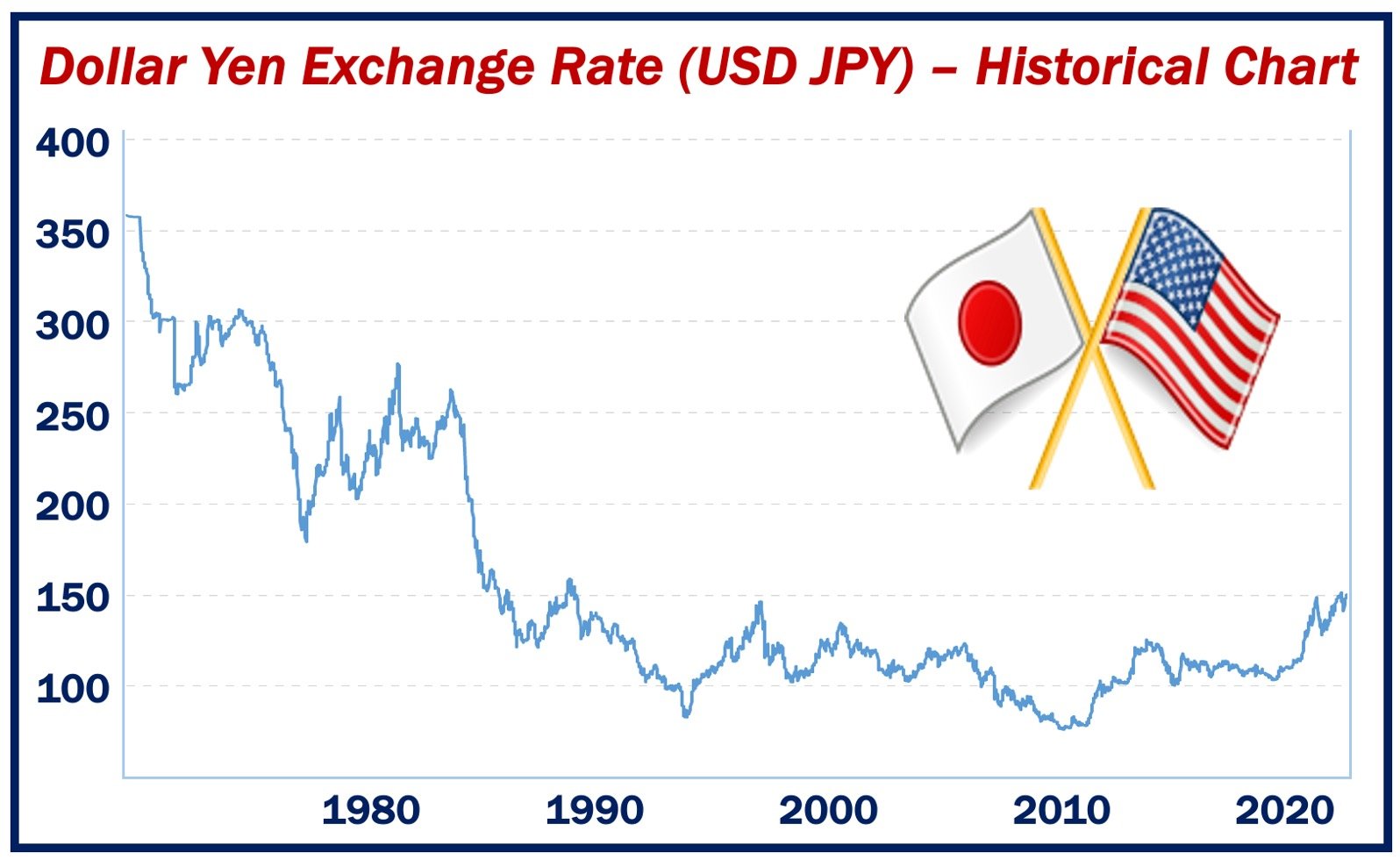

For a while, there was this buzz that Japan was "on sale" for Indians. The Yen hit multi-decade lows against the Dollar, and the Rupee rode those coattails. You could get nearly 2 Yen for 1 Rupee.

That window is closing.

Economists at firms like Nomura and Goldman Sachs have been pointing out that the Yen is fundamentally undervalued. Real Effective Exchange Rates (REER) suggest the Yen should be much stronger. If the BoJ continues to hike and the US Federal Reserve starts cutting, the Yen will roar back.

If you're sitting on a pile of Rupees and planning a trip to Tokyo for the cherry blossom season, waiting might be a gamble. The INR into Japanese Yen rate is currently in a "sweet spot" that historically doesn't last forever.

What to Watch for Tomorrow

Keep an eye on the crude oil prices. India imports over 80% of its oil. When oil prices spike, the Rupee hurts. Japan also imports its energy. However, because the Rupee is more sensitive to trade deficits, a global energy crisis usually hurts the INR more than the JPY.

Also, watch the tech sector. Japan is reinvesting heavily in its semiconductor industry (look at the Rapidus project). If Japan starts attracting massive Foreign Direct Investment (FDI) again, the Yen will become much harder to buy with your Rupees.

Strategic Moves for Your Money

Don't just watch the numbers on a screen. If you have a business obligation or a trip coming up, you need a plan that isn't just "hoping for the best."

Stop using airport counters. It sounds obvious, but people still do it. You lose 5-10% of your value instantly. Use a neo-bank or a specialized forex service that offers "interbank" rates with a transparent markup.

Layer your purchases. If you need to convert a large amount of INR into Japanese Yen, do it in three chunks over a month. This is called "cost averaging." If the Yen drops next week, you win. If it spikes, you’ve already protected a portion of your money at the lower rate.

Check the "Big Mac Index" logic. Sometimes the exchange rate looks bad, but the local purchasing power is high. Right now, Japan is actually relatively affordable for Indians compared to Europe or the US, even if the Yen has recovered slightly from its rock-bottom lows.

✨ Don't miss: Is Overtime Still Being Taxed? The Harsh Reality Your Paycheck Won’t Hide

The reality of the INR into Japanese Yen relationship is that it’s no longer a one-way street of Yen weakness. We are entering a period of "normalization." Japan wants a stronger currency to fight the rising cost of imported food and fuel. India wants a stable currency to keep investors happy.

If you are looking for the best time to exchange, look for days when the US Dollar is exceptionally strong. Usually, a "risk-off" environment in the global markets causes investors to flock to the Dollar, sometimes dragging the Yen down with it, providing a temporary window for Rupee holders to strike.

Monitor the Bank of Japan's monthly policy statements. They are the true driver here. Even a slight change in the wording about "yield curve control" can shift the exchange rate by 2% in an hour. In the world of currency, that's a lifetime.

Stick to digital platforms for conversion, keep an eye on the BoJ, and stop waiting for the Yen to hit 2.0 again—that ship might have already sailed.

Actions to take now:

- Compare the Spread: Check your bank’s rate against a mid-market tracker like XE or Reuters. If the difference is more than 1%, find a new provider.

- Lock-in Rates: Use a multi-currency forex card if you have a fixed expense in Japan coming up in the next 90 days.

- Monitor the RBI: If the Indian central bank starts aggressive interventions to support the Rupee, that is usually your signal that the Rupee is at a temporary local bottom.

- Local Payment Apps: Before traveling, check if your Indian banking app or UPI provider has activated its international "UPI Global" feature for Japanese merchants.