Ever get that feeling at the grocery store where you stare at a carton of eggs and wonder if you’re being pranked? You aren’t. Prices have been a rollercoaster. Everyone loves to point fingers at whoever is sitting in the Oval Office when the bill comes due. But honestly, the relationship between inflation rates by president and who actually has their feet on the Resolute Desk is way messier than a campaign ad makes it out to look.

Presidents get too much credit when things are cheap and way too much blame when a gallon of milk costs as much as a small toy.

The Hall of Fame (and Shame) for Price Hikes

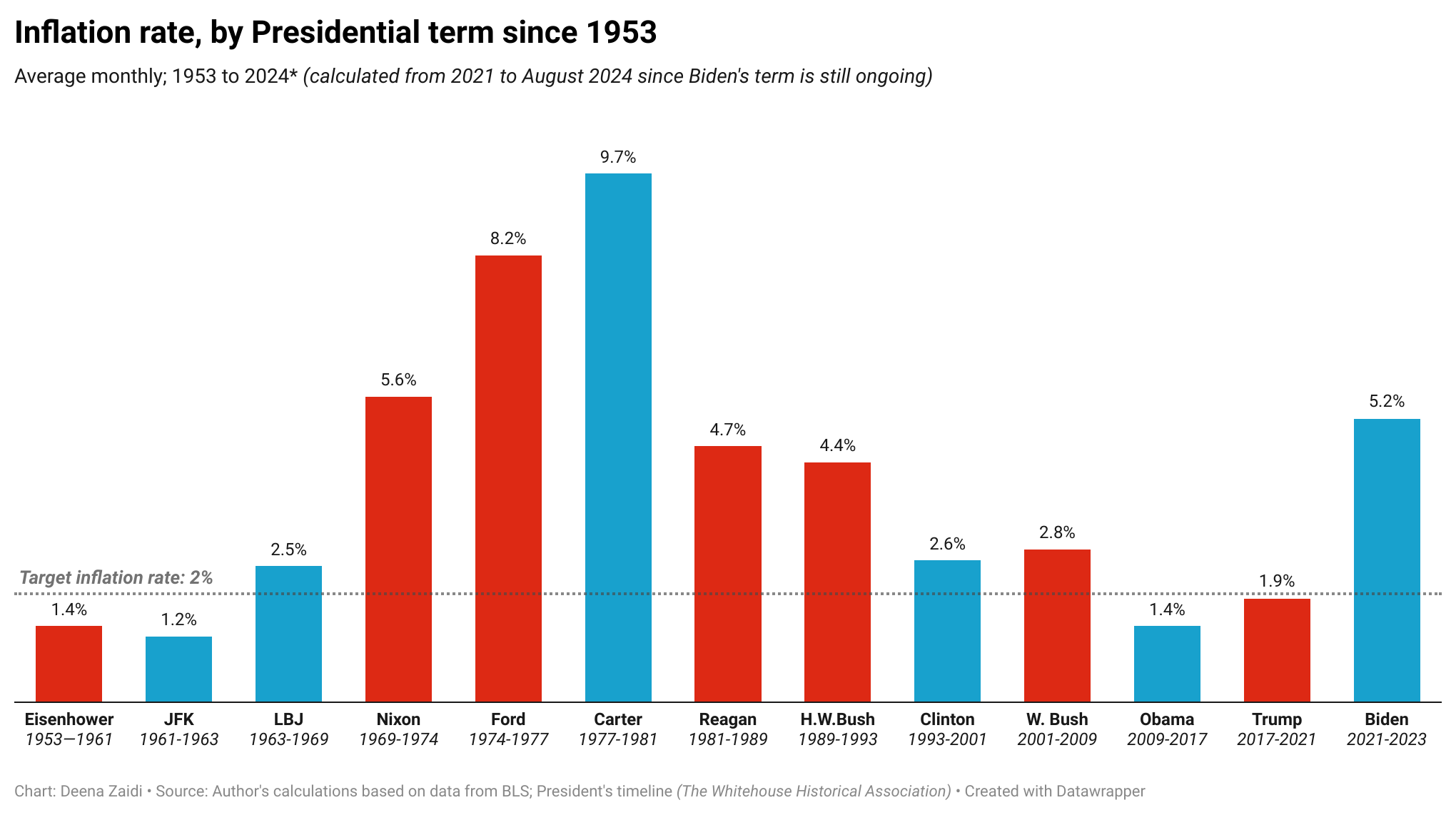

If we're looking at the raw numbers since World War II, some names jump out immediately. You've got Jimmy Carter sitting at the top of a mountain nobody wants to climb. During his four years (1977–1981), the average year-over-year inflation rate was a staggering 9.85%. Imagine almost 10% of your purchasing power just evaporating every single year. It was brutal.

On the flip side, you have guys like Dwight D. Eisenhower. The 1950s were basically the "Golden Age" of boring prices. Under Ike, inflation averaged a tiny 1.33%.

But wait.

Does that mean Eisenhower was an economic wizard and Carter was just bad at math? Not really. Ike inherited a post-war boom and a world where the U.S. was the only factory still standing. Carter inherited the "Great Inflation" that started under LBJ and Nixon, plus two massive oil shocks that he had zero control over.

🔗 Read more: Shangri-La Asia Interim Report 2024 PDF: What Most People Get Wrong

Why the 70s were a total nightmare

The 1970s are the ultimate case study in why presidents struggle with prices. Richard Nixon tried "price controls"—basically telling companies they weren't allowed to raise prices. It failed miserably. It led to shortages. Then Gerald Ford tried the "Whip Inflation Now" (WIN) buttons. People wore them, but the prices didn't care about the buttons. By the time Carter took over, the "wage-price spiral" was a runaway train.

The Modern Era: From Trump to Biden and Back

Lately, the conversation about inflation rates by president has turned into a total shouting match between the Trump and Biden camps. Let’s look at the actual data without the noise.

Donald Trump's first term saw incredibly low inflation, averaging about 1.9% to 2.46% depending on how you calculate the tail end of 1920. It was a period of relative stability—until the pandemic hit. Then, the world broke. Supply chains snapped. The government (under both Trump and Biden) flooded the economy with stimulus cash to prevent a total depression.

When Joe Biden took over in 2021, that "coiled spring" of consumer demand exploded just as factories in China were still locking down.

- Biden's Peak: In June 2022, inflation hit 9.1%, the highest since the early 80s.

- The Average: Over his full term, it averaged out to roughly 4.9% to 5.5%.

- The Context: It wasn't just a "U.S. thing." Inflation spiked in the UK, Germany, and basically everywhere else because of global energy costs and the war in Ukraine.

As of early 2026, we’re seeing a weirdly fast cool-down. With Trump back in office for his second term, the most recent data from late 2025 and early 2026 shows core inflation dropping back toward that "sweet spot" of 2.7%. Is it because of new policy? Or is it just the delayed effect of the Federal Reserve's massive interest rate hikes from two years ago finally hitting the system? Honestly, it's usually a bit of both.

💡 You might also like: Private Credit News Today: Why the Golden Age is Getting a Reality Check

Who actually pulls the levers?

If a president tells you they "fixed" inflation, they're probably selling you something. The real power mostly sits with the Federal Reserve. They’re the ones who raise interest rates to make borrowing expensive, which cools down spending.

Think of the economy like a party. The President provides the snacks and the music (fiscal policy/spending). The Fed is the guy who shows up and takes away the punch bowl right when things are getting fun (monetary policy).

Factors a President can't control:

- Oil Prices: OPEC decides this more than Washington does.

- Global Pandemics: Clearly.

- The Fed: They are technically independent, though every president from LBJ to Trump has tried to lean on them at some point.

- Technology: The internet and automation have done more to keep prices low over the last 30 years than almost any law passed in D.C.

A Quick Look at the Numbers (Average YOY Inflation)

Let's just look at the averages for the "modern" era. These aren't perfect because some terms are longer than others, but it gives you the gist:

- Ronald Reagan (1981-1989): 4.68% (He "broke" the 70s inflation but it took a massive recession to do it).

- Bill Clinton (1993-2001): 2.61% (The tech boom helped keep things cheap).

- George W. Bush (2001-2009): 2.48% (Stable until the 2008 crash).

- Barack Obama (2009-2017): 1.46% (Very low, but growth was also kinda slow).

- Donald Trump (2017-2021): 2.46% (Pre-pandemic stability).

- Joe Biden (2021-2025): ~4.95% (The post-COVID spike).

What this means for your wallet right now

Looking at inflation rates by president is a great way to win an argument at Thanksgiving, but it doesn't help you pay for gas tomorrow. The reality is that we are moving into a "higher for longer" era. Even if the rate of inflation goes down to 2%, that doesn't mean prices go back to what they were in 2019. It just means they stop rising as fast.

If you’re trying to navigate this, you've gotta stop waiting for a politician to "fix" the price of eggs.

📖 Related: Syrian Dinar to Dollar: Why Everyone Gets the Name (and the Rate) Wrong

First, look at your debt. If interest rates stay high to fight inflation, that credit card balance is going to eat you alive. Second, watch the labor market. Historically, the only way we’ve truly killed high inflation is through a "soft landing" or a straight-up recession. We’re currently teetering on that edge.

Actionable Insights for the Savvy Voter:

- Don't get fooled by "Headline" numbers. Look at "Core" inflation, which strips out food and energy. That tells you if the whole economy is overheating or if it's just a temporary spike in gas prices.

- Watch the Fed's dot plot. This tells you where the experts think interest rates are going. If they stay high, your savings account might actually earn some interest for once, but your mortgage will be more expensive.

- Diversify. If you’re worried about long-term inflation under any president, look into assets that historically hold value, like TIPS (Treasury Inflation-Protected Securities) or even certain commodities, though those are way riskier.

Presidents are more like surfers than the ocean itself. They can ride the wave well or they can wipe out, but they didn't create the tide. Understanding that distinction is the difference between being a smart investor and just being an angry voter.

Keep a close eye on the Consumer Price Index (CPI) releases every month. It’s the closest thing we have to a real-time scoreboard for the economy, regardless of who's living in the White House.