Money feels fake sometimes. You go to the grocery store, pick up a carton of eggs and a loaf of bread, and suddenly you’re out twenty bucks. It’s frustrating. Naturally, we want someone to blame, and the person sitting in the Oval Office is the easiest target. We talk about the inflation rate by president like it’s a scorecard, a direct reflection of how well a leader manages the country’s checkbook.

But honestly? It’s way more complicated than just who’s behind the Resolute Desk.

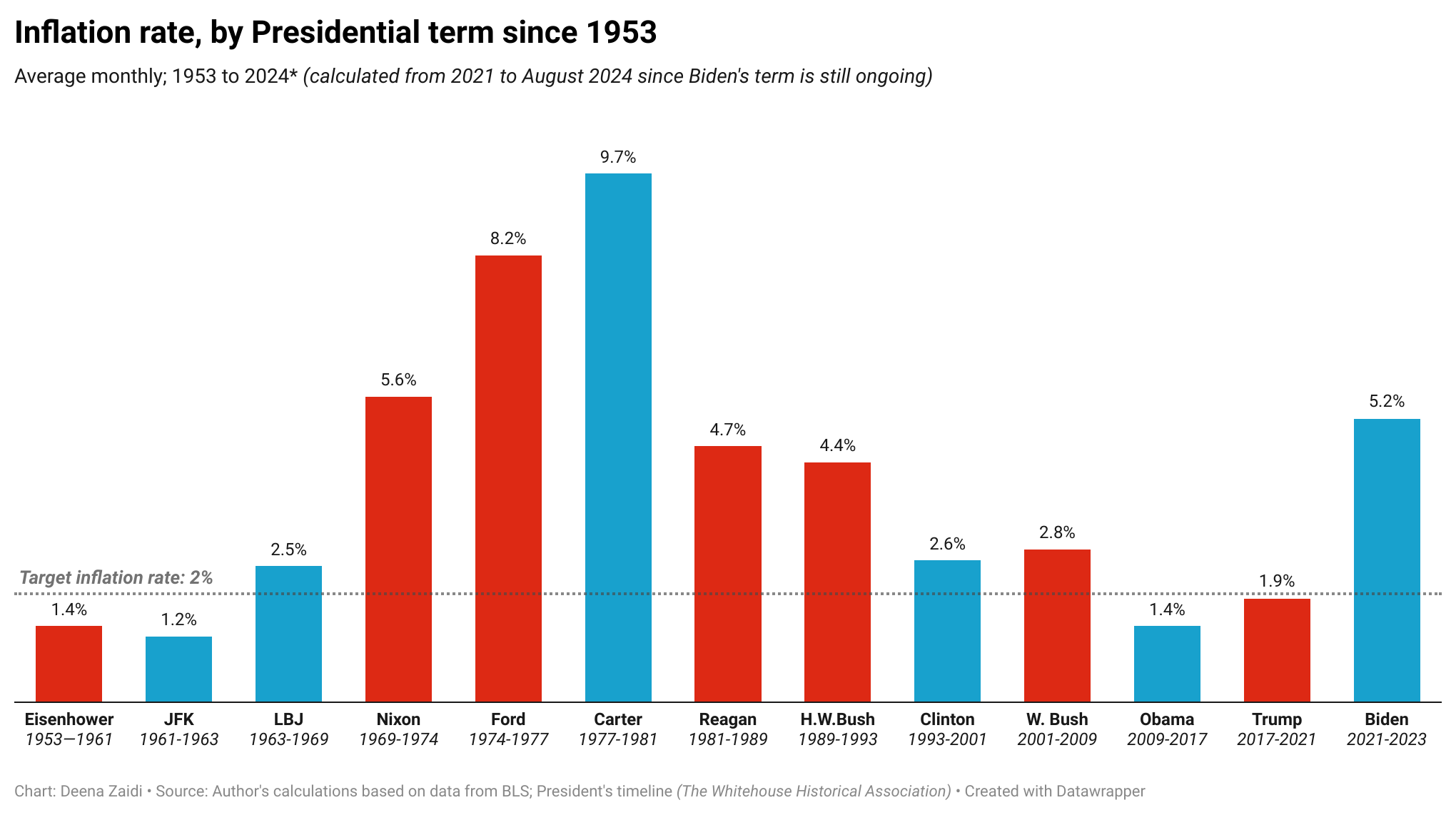

Presidents get way too much credit when things are cheap and way too much grief when prices skyrocket. If you look at the raw data, the numbers tell a wild story of oil shocks, world wars, and a group of people at the Federal Reserve who actually hold the steering wheel. Let's peel back the curtain on what really happened to your purchasing power over the last few decades.

The Great Inflation Rollercoaster

If you want to understand where we are, you’ve gotta see where we’ve been. Looking at the inflation rate by president since World War II is like looking at a heart monitor for a marathon runner. Some periods are calm; others are terrifying.

Jimmy Carter and the 1970s Chaos

Poor Jimmy Carter. He’s basically the poster child for bad inflation. During his term (1977–1981), the average year-over-year inflation rate was a staggering 9.85%. By the time he left, it had peaked at over 14%.

Why was it so bad? Well, he inherited a mess from Nixon and Ford, including an energy crisis that made gas prices go vertical. When the cost of moving goods goes up, everything goes up. Carter tried to fix it with voluntary wage and price controls, but they worked about as well as a screen door on a submarine.

The Reagan "Recovery"

Ronald Reagan gets a lot of love for "beating" inflation. Under his watch, the average dropped to 4.68%. But here’s the kicker: Reagan didn't actually do the heavy lifting. Paul Volcker, the Fed Chair (who was actually appointed by Carter), jacked up interest rates to nearly 20%. It crushed the economy and caused a massive recession, but it finally broke inflation’s back. Reagan just had the political stomach to let Volcker keep the screws tightened.

Comparing the Modern Era: Clinton to Trump to Biden

The last thirty years have been relatively quiet until, well, they weren't. We got used to 2% inflation. It felt like a law of nature.

- Bill Clinton (1993–2001): Averaged about 2.61%. This was the "Goldilocks" era. Not too hot, not too cold. The tech boom was moving, and globalization kept prices for consumer goods low.

- George W. Bush (2001–2009): Came in at 2.48%. Even with the 2008 crash, inflation stayed pretty anchored because demand just evaporated when the housing bubble popped.

- Barack Obama (2009–2017): The low-water mark. Inflation averaged just 1.46%. The economy was recovering so slowly that there wasn't enough "heat" to push prices up.

- Donald Trump (2017–2021): His first term saw an average of roughly 2.46%. Prices were stable until the very end when the pandemic threw a wrench in everything.

The Biden-Trump Shift

Then came the 2021–2025 period. Joe Biden saw inflation hit a 40-year high of 9.1% in June 2022. Critics called it "Bidenflation," blaming the American Rescue Plan's stimulus checks. Supporters pointed to broken supply chains and the war in Ukraine.

By the time the 2024 election rolled around, the Fed had hiked rates again, and the rate started cooling. Entering 2026, the data shows that the second Trump administration inherited a cooling trend, with 2025 seeing the inflation rate by president metric stabilize around 2.7% as supply chains finally smoothed out and the post-pandemic "revenge spending" died down.

Does the President Actually Control Prices?

Kinda. But mostly no.

Presidents influence the fiscal policy—how much the government spends and taxes. If a president signs a bill that dumps $2 trillion into the economy while everyone is stuck at home, that’s going to drive up demand. More money chasing fewer goods equals higher prices. Simple math.

However, the real power sits with the Federal Reserve. They control monetary policy.

- They set interest rates.

- They control the money supply.

- They operate independently (theoretically) from the White House.

If the Fed decides to keep rates at zero for too long, they’re essentially pouring gasoline on the inflation fire. A president can scream for lower rates to make the economy look good for an election, but if the Fed Chair says "no," there isn't much the President can do besides complain on social media.

Why Some Presidents Get Lucky (and Others Don't)

Sometimes, a president is just in the wrong place at the wrong time.

Think about Richard Nixon. He dealt with the 1973 oil embargo. It didn't matter what his tax policy was; when the world’s oil supply gets cut, the price of everything from plastic to bread is going to rise.

Conversely, Bill Clinton presided over the rise of the internet and the massive expansion of trade with China. These were "deflationary" forces. They made things cheaper regardless of who was in the White House.

Expert economists like Janet Yellen or Larry Summers often debate how much "blame" belongs to policy versus luck. Summers famously warned in early 2021 that too much stimulus would trigger inflation. He was right. But he also acknowledges that global energy markets play a role that no single leader can fully dictate.

The Hidden Tax of Inflation

The reason we care so much about the inflation rate by president is that inflation is a hidden tax. If your grocery bill goes up 10% but your boss only gives you a 3% raise, you just took a 7% pay cut.

It feels personal. Because it is.

👉 See also: USD to VND current rate: Why it’s hitting 26,200 and what happens next

Actionable Steps to Protect Your Wallet

Since you can't control who the Fed Chair is or what the President spends, you have to play defense.

Watch the "Core" CPI, not just the headlines.

The "headline" inflation includes food and gas, which are crazy volatile. "Core" inflation tells you if the underlying economy is actually cooling off. If Core is high, expect interest rates to stay high.

Audit your "Lifestyle Inflation."

Sometimes we blame the president for our bills when we've actually just upgraded our lifestyle. Look at your recurring subscriptions and "convenience" spending. That $15 delivery fee is a bigger hit to your budget than a 0.5% spike in the CPI.

Hedge with Assets.

Inflation devalues cash. Historically, real estate and certain stocks have acted as a hedge. If you're just sitting on a pile of cash in a 0.01% savings account, you're losing money every single day.

Refinance when the window opens.

We saw a massive spike in mortgage rates in 2023 and 2024. As we move through 2026, keep a close eye on the Fed’s signals. If they signal a pivot to lower rates, be ready to refi.

Understanding the inflation rate by president is great for winning bar bets or arguing on the internet, but understanding how to pivot your own finances is what actually keeps your head above water. Numbers on a government spreadsheet matter less than the numbers in your own bank account.

Keep an eye on the 10-year Treasury yield—it's often a better predictor of your future costs than any campaign speech you'll hear this year.