Tax season always feels like that uninvited guest who shows up right when you’re starting to enjoy your paycheck. Honestly, keeping track of the changes in income tax slabs for fy 2025-26 is becoming a bit of a full-time job. You've probably heard the buzz from the Union Budget announcements, but translating that "finance-speak" into actual cash-in-hand is where most people get tripped up. It’s not just about the percentages; it’s about where the government is nudging you to put your money.

Let’s be real. The "Old Regime" is basically on life support. The Ministry of Finance, led by Nirmala Sitharaman, has made it crystal clear: the New Tax Regime is the default, the favorite child, and the path they want everyone to take. If you’re still clinging to your LIC receipts and HRA slips like a security blanket, you might be leaving money on the table this year. Or, you might be the rare outlier who actually benefits from the old ways. It’s complicated.

What’s Actually Happening with Income Tax Slabs for FY 2025-26?

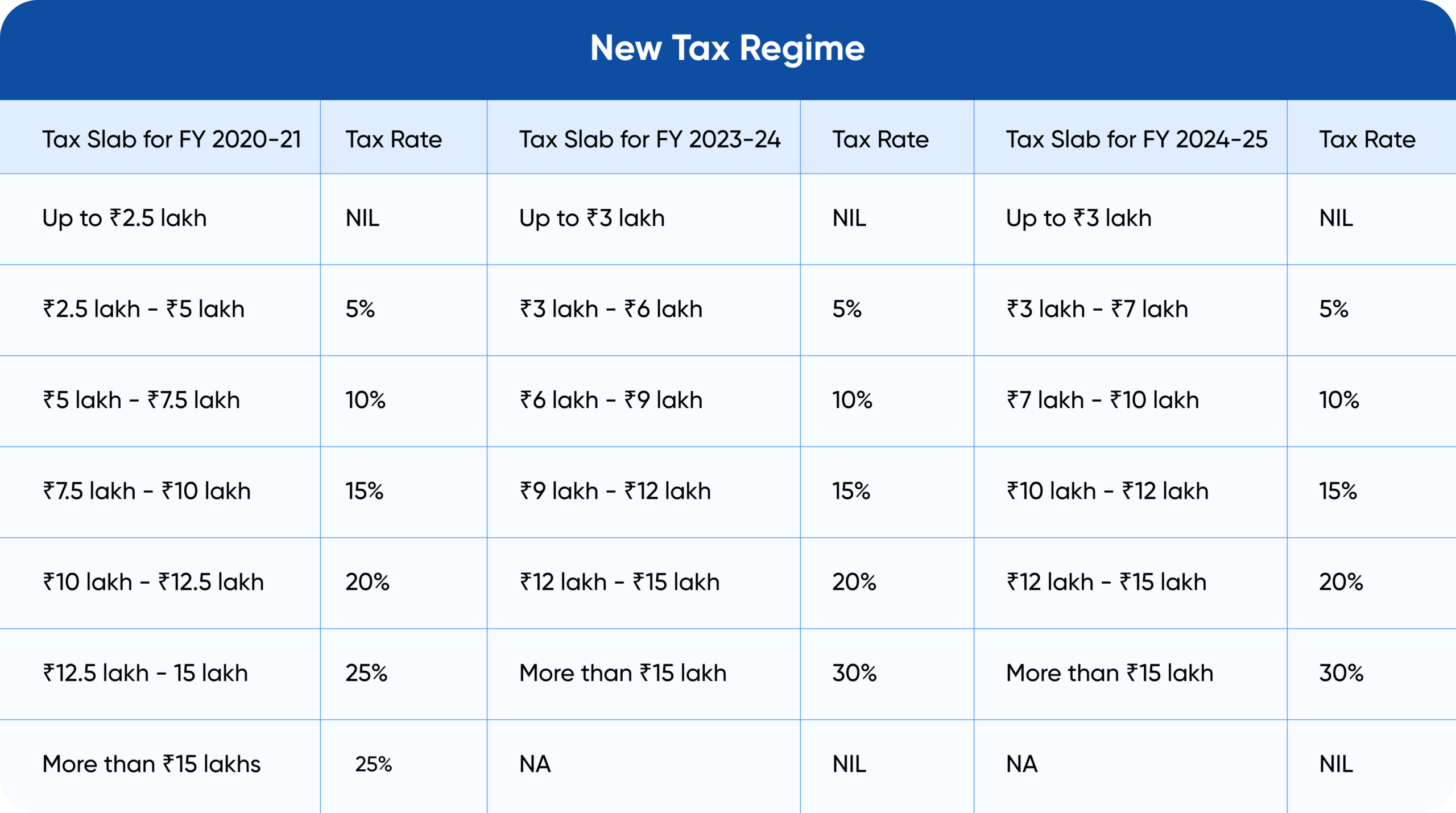

The structure for the current financial year (which covers the assessment year 2026-27) has been tweaked to give the middle class a bit more breathing room. Or at least, that’s the pitch. The biggest shift is the widening of the tax brackets under the New Regime. Basically, you can earn more now before you hit those higher percentage tiers.

If you're looking at the New Tax Regime—which most of us are now forced into by default—the slabs are pretty straightforward. You don't pay a single rupee in tax if your total income stays below a certain threshold thanks to the Section 87A rebate. For FY 2025-26, the standard deduction has also been a major talking point. It’s been bumped up to ₹75,000 for salaried individuals and pensioners under the New Regime. That’s a free pass on seventy-five grand before the taxman even looks at your ledger.

Here is how the math breaks down for the New Regime slabs. From zero to ₹3,00,000, you're in the clear—0% tax. Then, from ₹3,00,001 to ₹7,00,000, it’s a 5% hit. Moving up, the ₹7,00,001 to ₹10,00,000 bracket attracts a 10% rate. If you’re doing well and making between ₹10,00,001 and ₹12,00,000, you’re looking at 15%. The next jump is to 20% for income between ₹12,00,001 and ₹15,00,000. Anything over ₹15,00,000? That’s the big 30%.

The Section 87A Catch

You’ve got to watch out for the "cliff." Under the New Regime, if your taxable income (after the standard deduction) is ₹7,00,000 or less, you get a rebate that makes your tax liability zero. But if you earn just one rupee over that limit, the tax is calculated from the original slabs. It’s a weird quirk of the Indian tax system that can lead to some "marginal relief" calculations that make most people's heads spin. Tax experts often point out that this creates a "poverty trap" for those just crossing the threshold, where a small raise could theoretically lead to a higher tax bill than the raise itself.

👉 See also: Why Toys R Us is Actually Making a Massive Comeback Right Now

The Old Regime: Is It Still Relevant?

Most people think the Old Regime is dead. It’s not. But it’s definitely tucked away in a corner. The income tax slabs for fy 2025-26 under the Old Regime haven't really changed, which is the government's subtle way of saying "please leave."

Under this system, you still have the ₹2.5 lakh basic exemption limit. It goes up to ₹3 lakh for senior citizens and ₹5 lakh for super senior citizens. The rates are familiar: 5% up to ₹5 lakh, 20% up to ₹10 lakh, and 30% beyond that. The only reason—and I mean the only reason—to stay here is if you have massive deductions. We’re talking a big home loan (Section 24b), heavy investments in 80C (PPF, ELSS, LIC), and maybe a high HRA component if you live in a Tier-1 city like Mumbai or Bengaluru.

If your deductions don't total more than roughly ₹3.75 lakh to ₹4 lakh, the New Regime is almost certainly going to win on math alone.

The Standard Deduction Shift

One of the most significant moves for this fiscal year was the increase in the Standard Deduction. It went from ₹50,000 to ₹75,000 for those opting for the New Regime. Salaried folks get this automatically. You don't need to show bills. You don't need to prove you spent it on "work expenses." It’s a flat deduction.

Interestingly, the Old Regime keeps the standard deduction at ₹50,000. This is a deliberate "nudge" by the Finance Ministry. They are making the New Regime more attractive by increasing the "untaxed" portion of your salary. When you combine this ₹75,000 deduction with the ₹7 lakh rebate, a salaried individual effectively pays zero tax on an annual income of up to ₹7.75 lakh under the New Tax Regime. That’s a pretty decent chunk of change for the average Indian professional.

✨ Don't miss: Price of Tesla Stock Today: Why Everyone is Watching January 28

Why the "Default" Status Matters

When you start a new job or the new financial year kicks off at your current company, your HR department will likely assume you are on the New Tax Regime. This is the law now. If you want to use the Old Regime to claim your home loan interest or your kids' tuition fees, you have to proactively tell them.

You can switch once a year if you’re salaried. But if you have "business income"—say you’re a freelancer or a consultant—once you switch out of the New Regime, you might only get one chance in your lifetime to switch back under certain conditions. It’s a bit of a "Hotel California" situation for business owners.

Beyond the Slabs: Surcharge and Cess

Don't forget the hidden extras. The tax rates we talk about aren't the final price you pay. There is always the 4% Health and Education Cess applied on top of your tax amount.

Then there’s the surcharge for the high earners. If you’re making over ₹50 lakh, the government adds a surcharge. However, in a move to make India more attractive for HNWIs (High Net Worth Individuals), the maximum surcharge rate was previously capped at 25% instead of the old 37% for those in the New Regime. This brings the effective maximum marginal tax rate down from about 42.7% to roughly 39%. Still high, but better than it was.

Real World Example: The ₹12 Lakh Earner

Let’s look at "Aditya," a software engineer in Pune making ₹12,00,000 a year.

🔗 Read more: GA 30084 from Georgia Ports Authority: The Truth Behind the Zip Code

In the New Regime for FY 2025-26:

First, he takes the ₹75,000 standard deduction. His taxable income is now ₹11,25,000.

- 0 to 3L: Nil

- 3L to 7L: ₹20,000 (5% of 4L)

- 7L to 10L: ₹30,000 (10% of 3L)

- 10L to 11.25L: ₹18,750 (15% of 1.25L)

Total Tax: ₹68,750 + 4% Cess.

If Aditya chose the Old Regime, he’d need to have at least ₹3 lakh in deductions (like 80C and HRA) just to get close to that number. For most people without a home loan, the New Regime is a no-brainer.

Common Misconceptions About 2025-26 Taxes

A lot of people think that if they earn ₹7.1 lakh, they only pay tax on that extra ₹10,000. Nope. That's not how it works. If you cross the rebate threshold, you pay tax on everything above the basic exemption of ₹3 lakh. This is why tax planning near the threshold is so vital.

Another myth? That you can't claim any deductions in the New Regime. While it’s true you lose 80C, 80D (mediclaim), and HRA, you do get to keep a few things. The standard deduction is there. Employer contributions to your NPS (Section 80CCD(2)) are still deductible. Family pension deductions are also allowed. It's not a total scorched-earth policy on deductions, just most of them.

Actionable Steps for Your Tax Planning

- Run the Numbers Early: Don't wait until March 2026. Use a basic tax calculator to compare your liability under both regimes based on your projected 2025-26 income.

- Review Your Investments: If you choose the New Regime, you don't need to lock your money in a 5-year tax-saver FD or an ELSS just for tax reasons. This frees up your cash to invest in higher-yield or more liquid assets.

- Declare to HR: Ensure your payroll department knows your choice. If you don't declare, they’ll deduct TDS based on the New Regime, which might lead to a lower take-home pay if you actually intended to use the Old Regime deductions.

- Max Out NPS: Since employer contributions to NPS are deductible in the New Regime, check if your company offers this benefit. It’s one of the few ways to lower your taxable income in the new system.

- Track Your Standard Deduction: Ensure your Form 16 reflects the updated ₹75,000 amount. Mistakes happen in payroll software transitions.

The shift toward a simplified, lower-rate, deduction-free system is clearly the long-term goal for the Indian tax authorities. While it removes the "forced savings" aspect of 80C, it gives more control back to the taxpayer. Understanding where you fall in the income tax slabs for fy 2025-26 is the first step in making sure that control actually results in more money in your bank account at the end of the month.