Waiting on a tax refund feels like staring at a pot of water, hoping it’ll boil. Except the pot is in Springfield, and you’re pretty sure someone forgot to turn the burner on. If you’ve been searching for how to illinois track tax return status lately, you’ve likely realized that "Where's My Refund?" isn't always as instant as we'd like.

Honestly, the Illinois Department of Revenue (IDOR) has gotten a lot stricter over the last couple of years. It’s not just you. In 2026, the state is leaning hard into fraud prevention, which is great for security but kind of a pain for your bank account.

The Reality of the Illinois Refund Timeline

Forget the "21 days" rule you hear for federal returns. Illinois is its own beast.

If you e-filed, the official line is that you should see something within about four weeks. But that’s a "best-case scenario" vibe. If you were old-school and mailed a paper return? You’re looking at eight weeks, maybe more. I’ve seen some paper returns take up to 15 weeks if there’s a single smudge on a number.

📖 Related: Where Did MoviePass Go? What Really Happened With the App That Broke Cinema

Basically, the IDOR goes through a multi-stage review process. First, they make sure you are who you say you are. Then they check the math. Finally, they send the "okay" to the Illinois Comptroller’s office. The Comptroller is the one who actually writes the check or hits the "send" button on the direct deposit.

How to Actually Use the Illinois Track Tax Return Tools

You have two main digital hubs for this.

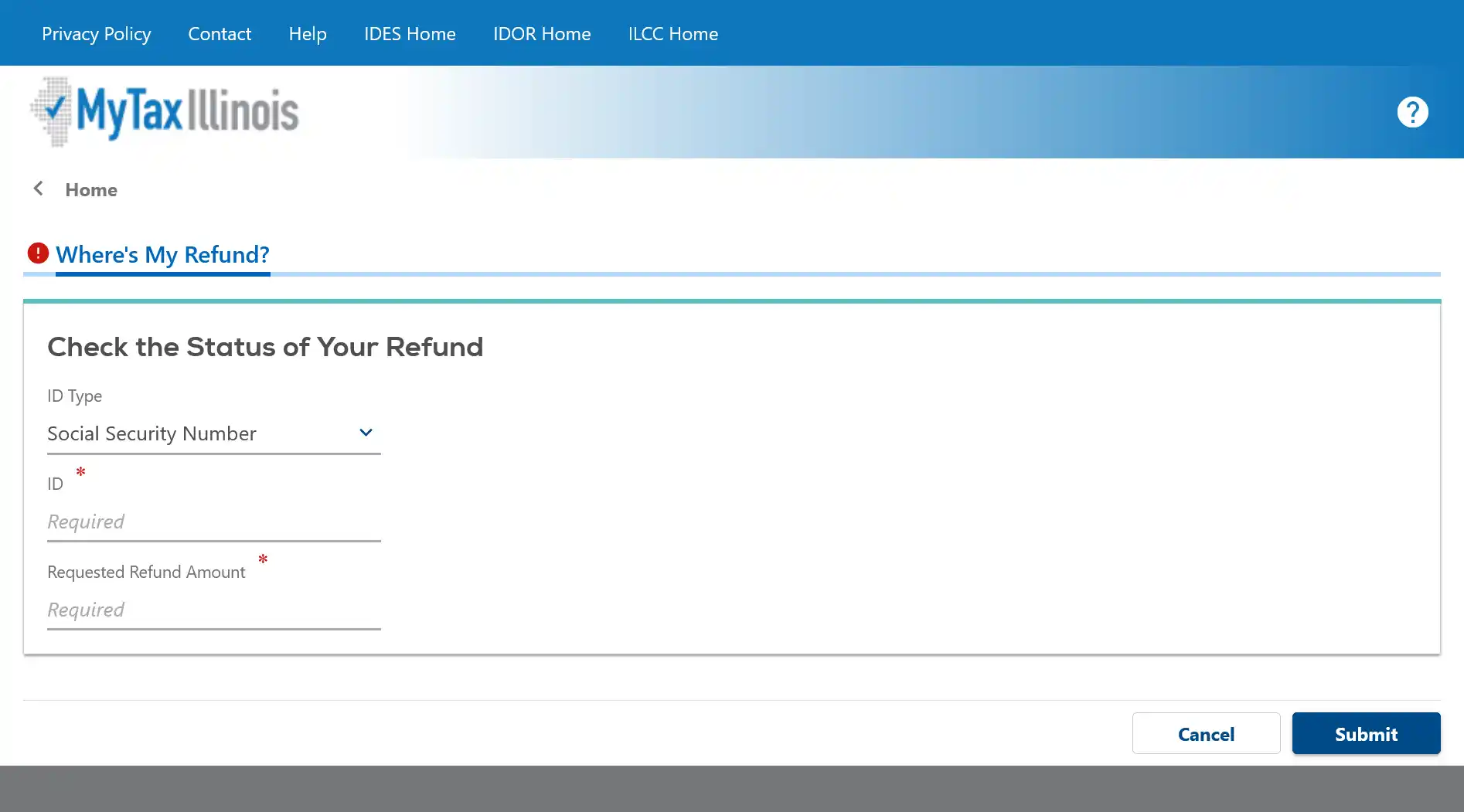

The first is MyTax Illinois. You don't actually need an account to check your refund, which is a relief because setting up a full account requires a "Letter ID" that takes 10 days to arrive by mail. For a quick check, you just need:

- Your Social Security Number (SSN) or ITIN.

- Your exact refund amount (down to the cent).

- Your first and last name.

The second tool is the Illinois Comptroller’s "Find Your Illinois Tax Refund" system.

Think of it this way: IDOR is the kitchen where the meal is cooked, and the Comptroller is the delivery driver. Once IDOR finishes processing, the status on their site might say "sent to Comptroller." That’s when you switch over to the Comptroller’s site to see exactly when that money is hitting your account.

Why Your Status Might Be Stuck

It’s frustrating when the bar doesn’t move for three weeks. Usually, it’s one of these:

💡 You might also like: Dow Jones Industrial Average Explained (Simply): Why the Index Slipped Before the Holiday

- Identity Verification: Illinois is aggressive about this. They might send you a letter asking you to "take a quiz" or send in a copy of your ID. Until you do, that return is sitting in a digital pile.

- The EITC or Child Tax Credit: For 2026, the Child Tax Credit calculation updated to 40%. If you claimed this, or the Earned Income Credit, expect an extra layer of manual review.

- Math Errors: Even a $1 discrepancy between your W-2 and what you typed can trigger a manual hold.

Beyond the Screen: Calling for Help

If it's been over 10 weeks and you’re still seeing "Processing," it might be time to pick up the phone.

The Taxpayer Assistance Hotline is 1-800-732-8866. Just a heads up—calling won't actually "speed up" the return. The people on the phone aren't the ones processing the forms. But they can tell you if a notice was mailed to you that you might have missed.

2026 Changes to Keep in Mind

The personal exemption for the 2026 tax year (which you'll deal with next year) is bumping up to $2,925. But for the 2025 returns we're filing right now, remember that the exemption amount was $2,850. If you used the wrong year's forms or numbers, that's a surefire way to get your return flagged.

Also, if you're a high earner—making over $500,000 for married couples—you aren't getting the Property Tax Credit or the K-12 Education Expense Credit anymore. Trying to claim those when you're over the limit is a common reason for "reduced" refunds.

🔗 Read more: HEB Warehouse San Marcos: What Most People Get Wrong

What to Do Next

- Check both sites: Don't just rely on MyTax Illinois; check the Comptroller’s site if the first one says "processed."

- Watch your mail: IDOR communicates almost exclusively via physical letters when there’s a problem. Don't toss anything that looks like official state mail.

- Verify your bank info: If your direct deposit fails because of a typo, the state will automatically default to a paper check, which adds another 10 to 14 days to your wait time.

If you’ve checked the illinois track tax return portal and see a "Refund Sent" status but no money after 5 business days, call the Comptroller’s Office at 1-800-877-8078. They handle the "lost check" or "failed deposit" side of things.