Life is unpredictable. One day you’re navigating the traffic on I-55, and the next, a fluke accident or a sudden health scare leaves you unable to speak for yourself. If that happens, who decides what happens to your house? Who tells the doctor whether to keep you on a ventilator? Most people think their spouse or kids can just "step in," but Illinois law doesn't work that way. Without a properly executed illinois power of attorney form, your family might end up in a mess of court dates and expensive guardianship hearings just to pay your electric bill.

Honestly, it's kinda scary how many people skip this. They think it's just for the elderly or the "super-rich" with estates in Lake Forest. It isn't. It’s for anyone over 18 who wants to stay in the driver’s seat, even when they aren't physically able to steer.

What Most People Get Wrong About the Illinois Power of Attorney Form

There's a massive misconception that you only need one form. Nope. In Illinois, we split things up. You generally need two distinct documents: one for your health and one for your money.

The Power of Attorney for Health Care deals with your body. We’re talking surgery, life support, and nursing home admissions. The Power of Attorney for Property deals with your "stuff"—your bank accounts, your mortgage, and even your taxes. If you only sign one, you’re only half protected.

Illinois updated its laws recently—specifically Public Act 103-0994, which kicked in at the start of 2025. It’s a big deal because it makes it harder for banks to reject your forms. In the past, a bank might look at your document and say, "We don't like this font, use our internal form instead." Now? They basically can't do that if your form is legally valid.

✨ Don't miss: Why the Siege of Vienna 1683 Still Echoes in European History Today

The Nitty-Gritty of the Health Care Form

The Illinois Statutory Short Form Power of Attorney for Health Care is the standard "go-to." It’s a powerful document. You’re naming a "health care agent." This person needs to be someone who won't crumble under pressure.

Think about it.

If a doctor asks whether to continue a specific treatment, your agent needs to know what you would want, not what they want for you. You can specify whether you want to be an organ donor or how you feel about life-sustaining treatment.

One thing that's super important: the witness rules. You can't just have your best friend sign it if they’re also your agent. In Illinois, your witness must be at least 18. They can't be your health care provider or even an employee of the facility where you're being treated. It’s all about preventing "funny business."

🔗 Read more: Why the Blue Jordan 13 Retro Still Dominates the Streets

Managing the Money: The Property Form

The property form is arguably more complex. When you sign an illinois power of attorney form for property, you’re giving someone the keys to your financial life. They can sell your car. They can withdraw money from your savings.

Because the power is so broad, the state requires a "Notice to the Individual Signing" at the very beginning. It’s a big, bold warning that basically says: "Hey, you are giving this person a lot of power. Be careful."

As of 2025 and 2026, there’s a new safeguard called the Agent’s Certification. If a bank is being prickly about accepting your POA, your agent can sign a certification under penalty of perjury. It’s a way to prove the document is still in effect and the principal (that's you) hasn't passed away or revoked it.

Why "Durable" Matters

You’ll hear the word "durable" a lot. In Illinois, a power of attorney is durable by default. This means it stays in effect even if you become "incapacitated" (meaning you can’t think or communicate clearly).

💡 You might also like: Sleeping With Your Neighbor: Why It Is More Complicated Than You Think

Some people want a "springing" power of attorney instead. This only "springs" into action once a doctor certifies you’re unfit. Sounds safer, right? Kinda. But it often causes massive delays. Your agent has to go find two doctors to sign off while your bills are sitting unpaid. Most experts suggest sticking with a durable power that starts immediately, provided you trust your agent completely.

The 2026 Reality: Signing and Notaries

Don't think you can just print this out, sign it at your kitchen table, and call it a day. Illinois is strict.

- Notary Public: For property POAs, you absolutely need a notary.

- The Witness: You need at least one witness.

- The "No-Double-Dipping" Rule: The notary cannot also be the witness. They have to be two different people.

- Electronic Signatures: Since the pandemic, Illinois has warmed up to electronic signatures, but the notary and witness usually still need to be "electronically present" via a real-time video link. It’s not just a "click and forget" thing.

Actionable Steps to Get This Done

Don't wait for a crisis. It's the worst time to try to find a notary.

- Download the Statutory Forms: The Illinois Department of Public Health and the Illinois Secretary of State websites have the "Short Form" versions. They are free.

- Pick Your People: Choose an agent and at least one "successor agent." If your first choice is in the same car accident as you, you’ll need a backup.

- Talk to Your Agent: This is the part everyone skips. Sit them down. Say, "If I'm in a coma, I want X, Y, and Z." Don't make them guess.

- Sign It Right: Get a notary. Find a witness who isn't related to you or your agent.

- Distribute Copies: Your doctor needs the health care one. Your bank might want a copy of the property one. Keep the originals in a safe, fireproof spot—but make sure someone knows the code to the safe!

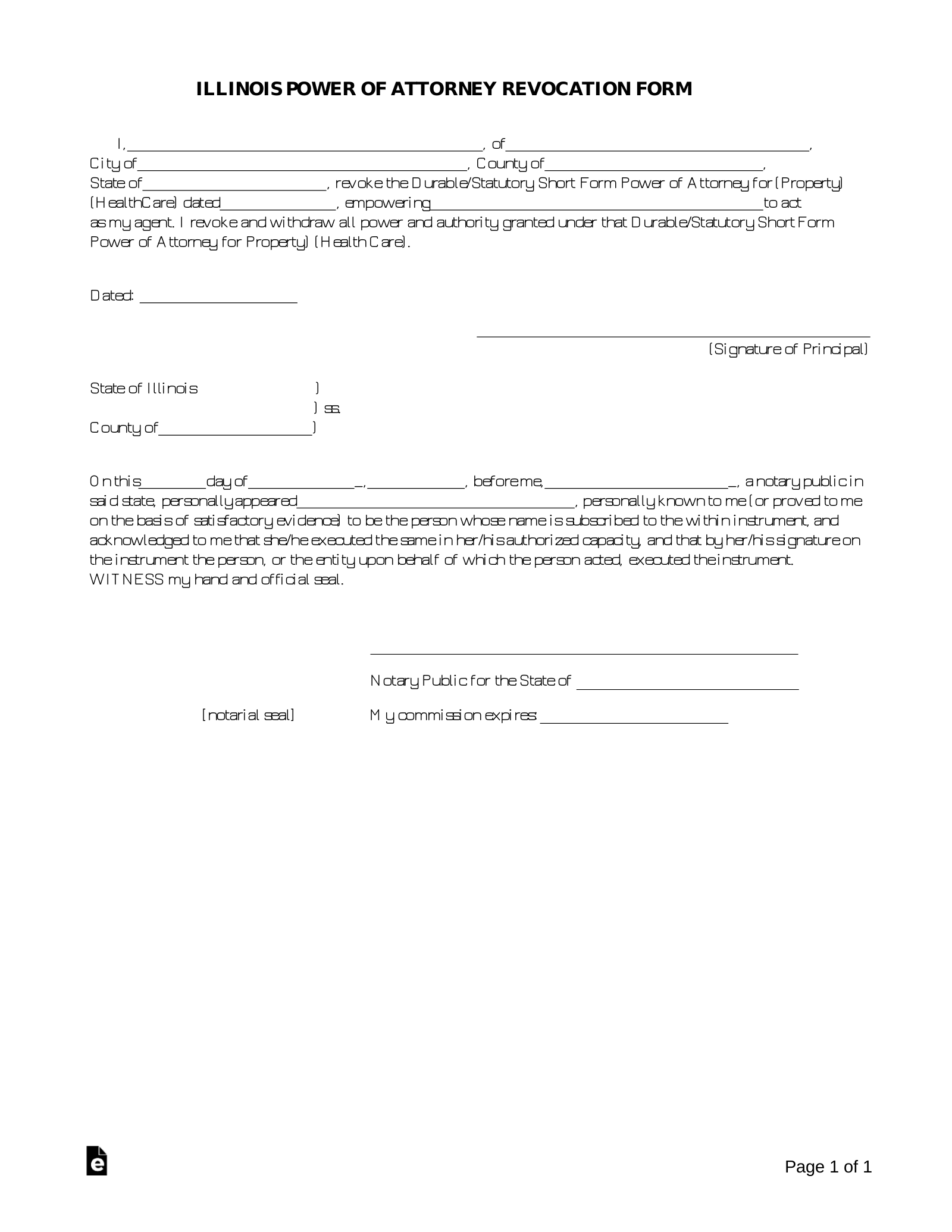

If you change your mind later, you can revoke the form. Just tear up the old one and write a new one, or sign a formal "Revocation of Power of Attorney." Just make sure you tell your agent that they’re fired, or they might keep acting on your behalf legally.

Getting your illinois power of attorney form sorted isn't about planning for death. It's about making sure your life stays yours, no matter what happens tomorrow. It’s one of those things you do once and hopefully never have to think about again.

Check your current documents today. If they were signed before the 2025/2026 law changes, they’re likely still valid, but having the updated versions with the new certification language can save your family a mountain of stress at the bank.