Honestly, if you’re living in Illinois, you’ve probably heard the same tax debate circling like a vulture every couple of years. People talk about "fair taxes" and "graduated scales" until they’re blue in the face. But here’s the reality for 2026: nothing has changed. We are still a flat tax state.

Whether you’re a barista in Carbondale or a C-suite exec in a Chicago high-rise, the Illinois income tax rates sit at a steady 4.95%.

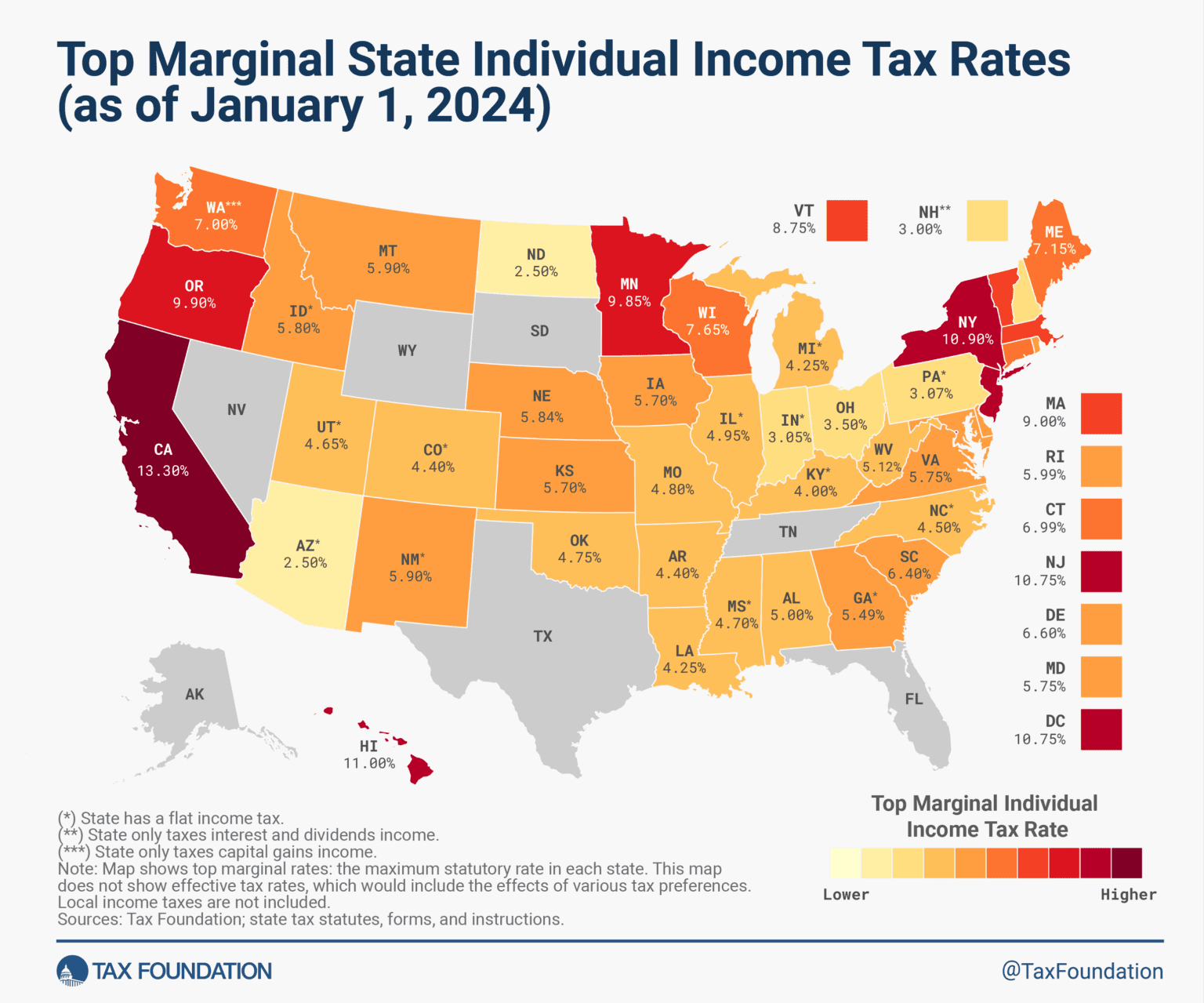

It’s simple, sure. But "simple" doesn't always mean "cheap." While 4.95% sounds low compared to California’s double-digit brackets, Illinois makes up for it in other ways—mostly through property taxes that feel like a second mortgage.

The 4.95% reality in 2026

So, why are we still at 4.95%? Basically, it’s written into the state constitution. Back in 2020, there was a massive push to change this. Governor J.B. Pritzker really wanted a graduated system where higher earners paid more. Voters said "no thanks."

Fast forward to today, and even with a $2.2 billion budget gap looming, the flat tax remains the law of the land. It’s a bit of a political third rail.

But don’t let that single number fool you into thinking your math is done. You don’t just take your salary, multiply by .0495, and call it a day. The state gives you a few "discounts" first, and if you miss them, you’re just handing over free money.

📖 Related: Oil Market News Today: Why Prices Are Crashing Despite Middle East Chaos

The Personal Exemption (Your first win)

Every taxpayer gets a little bit of "free" income that isn't taxed. For the 2025 tax year (the ones you're likely filing now), that amount is $2,850. If you’re looking ahead to your 2026 income, it bumps up slightly to $2,925 because of inflation adjustments.

Here is how that works in the real world:

If you’re single and earn $50,000, you don’t pay tax on the full $50k. You subtract that $2,925 first. You're only taxed on $47,075. It’s not a fortune, but it’s a few extra tanks of gas.

The "Senior Bonus"

If you’re 65 or older, there is a new win for you. Recent legislation (SB1645) actually doubled the additional exemption for seniors. Starting in 2025, if you’ve hit that 65-year milestone, you get an extra $2,000 off your taxable income instead of the old $1,000. If you’re married and both over 65, that’s $4,000 extra you get to keep.

The "Rich Person" Phase-out

Illinois has a bit of a "gotcha" for high earners. If your federal Adjusted Gross Income (AGI) is over $250,000 (or $500,000 for married couples), you lose the personal exemption entirely. You also lose the Property Tax Credit and the K-12 Education Credit.

Basically, the state decides that if you’re making a quarter-million, you don’t need the $140 tax break from the exemption. It’s their subtle way of making the flat tax act a tiny bit like a graduated one.

👉 See also: Cuanto son 100 dolares en quetzales: Why the Bank Rate Isn't What You Actually Get

Credits that actually move the needle

If you want to lower what you owe, you have to look at credits. A deduction lowers your taxable income, but a credit lowers your actual tax bill dollar-for-dollar.

The Property Tax Credit

This is the big one. If you own your home in Illinois, you can claim a credit equal to 5% of the property taxes you paid. Since Illinois has some of the highest property taxes in the country, this usually wipes out a decent chunk of your state income tax.

The Illinois EITC and the New Child Tax Credit

The Earned Income Tax Credit (EITC) is huge for working families. In 2026, it’s worth 20% of whatever you got from the federal government's EITC.

But here’s the kicker: If you qualify for the Illinois EITC and have a kid under 12, you now qualify for the Illinois Child Tax Credit. This is calculated as 40% of your Illinois EITC.

Let's say your Illinois EITC is $1,000. You’d get an extra $400 just for having a kid under 12.

✨ Don't miss: Dealing With the IRS San Diego CA Office Without Losing Your Mind

The Business Side: Corporate Rates

If you’re running a business, the math changes. The corporate income tax rate is 7%. But wait, there’s more. Most businesses also have to pay a "Personal Property Replacement Tax," which adds another 2.5% for corporations (or 1.5% for partnerships and S-corps).

So, effectively, most corporations are looking at a 9.5% rate. It’s one of the reasons you hear business owners complaining at Chamber of Commerce meetings.

What most people get wrong about Illinois taxes

People often compare Illinois to Florida or Texas because those states have zero income tax. But they forget that those states often have higher sales taxes or fewer services.

On the flip side, people compare us to Wisconsin or Iowa, thinking a flat tax is "fairer." Honestly, it depends on who you ask. Advocates like the Center for Tax and Budget Accountability argue that a flat tax is regressive—meaning lower-income people feel the 4.95% "hit" way harder than a billionaire does.

Meanwhile, groups like the Illinois Policy Institute argue that the flat tax is the only thing keeping the state from spending even more money. They fear that a graduated tax would just give politicians a "blank check" to raise rates on everyone eventually.

Actionable steps for your 2026 taxes

Don't just wait for April to roll around. Tax season is a lot less painful if you do a few things right now.

- Check your withholding: If you got a big refund last year, you’re basically giving the state an interest-free loan. If you owed a lot, you might get hit with an "underpayment penalty." Adjust your IL-W-4 with your employer to get closer to zero.

- Save your K-12 receipts: You can claim 25% of qualified education expenses (tuition, book fees) over $250, up to a $750 credit. This applies to public and private school parents.

- Contribute to a 529 plan: Illinois allows you to deduct contributions to "Bright Start" or "Bright Directions" college savings plans. You can deduct up to $10,000 (single) or $20,000 (married) from your taxable income.

- Look into the "Gives" Credit: A new credit called "Illinois Gives" is now in effect for 2026, designed to incentivize certain charitable donations. Check with your CPA to see if your favorite local non-profit qualifies.

The 4.95% rate is likely here to stay for the foreseeable future. The political appetite for another constitutional amendment is pretty much non-existent right now. Your best bet is to stop worrying about the rate and start focusing on the credits that can actually bring that effective rate down.