Wait, let's clear something up immediately. If you’re looking for the il inheritance tax rate, you’re actually looking for something that doesn't technically exist.

No, really.

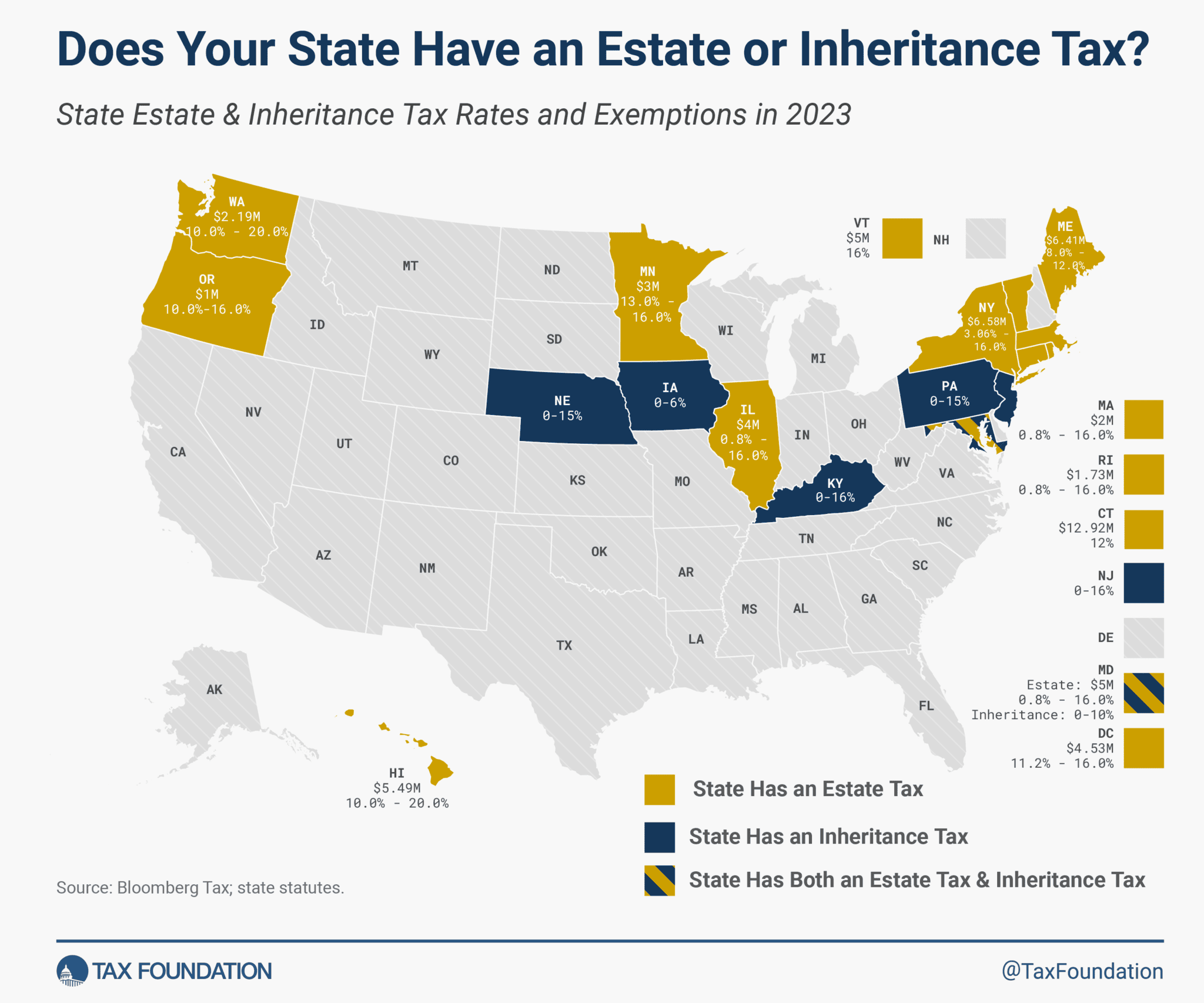

Illinois does not have an inheritance tax. If your Aunt June leaves you a vintage Mustang and $50,000 in cash, the State of Illinois isn't going to send you—the person receiving the gift—a tax bill for it. You don't pay a dime just for being an heir.

But—and this is a "but" the size of Lake Michigan—Illinois has a very aggressive estate tax.

While you don't pay for receiving the money, the "estate" (the pile of stuff left behind) has to pay the state before you ever touch a cent. It’s a subtle distinction, but for your wallet, the result is the same: the government takes a cut. And in 2026, the rules are weirder than ever.

Why the Illinois Estate Tax is basically a "Cliff"

Most people think taxes work like a staircase. You pay a little on the first chunk, a bit more on the next, and so on.

👉 See also: USD to SLR: Why the Exchange Rate is Doing That Right Now

Illinois isn't like that.

The state has a $4 million exclusion threshold. If the total value of everything you own—house, 401(k), life insurance payouts (yes, those count!), and even that old farm in Dekalb—is $3,999,999, you owe the state exactly zero dollars.

But if you hit $4,000,001? You just fell off the cliff.

The tax isn't just on that extra dollar. The way the math works, the state looks back and calculates tax on a huge chunk of the total. It’s brutal. This "cliff effect" means a tiny increase in your net worth can trigger a tax bill of $250,000 or more overnight. Honestly, it's one of the most punitive setups in the country.

Breaking Down the 2026 Rates

So, what is the actual il inheritance tax rate (or rather, the estate tax rate) you'll be facing?

It’s graduated. It starts at about 0.8% and climbs all the way up to 16%.

For 2026, the federal government actually raised its exemption to roughly $15 million thanks to new legislation (the "One Big Beautiful Bill Act" or OBBBA). That’s great for the super-rich who don't want to pay Uncle Sam. But Illinois? Illinois didn't move. They kept their $4 million threshold.

This creates a massive gap. You could be "poor" in the eyes of the IRS (meaning you owe $0 in federal estate tax) but still be "rich" enough for Illinois to demand a massive check.

A quick look at the math (Illustrative Examples)

- Estate of $4 Million: $0 tax.

- Estate of $5 Million: Approximately $285,714 goes to the state.

- Estate of $10 Million: You're looking at a bill of roughly $903,800.

Think about that $5 million example. To the state, you are wealthy. But if that $5 million is mostly tied up in a family farm or a small business, the heirs might have to sell the land just to pay the tax. This happens to Illinois farmers more than almost anyone else.

The 3-Year "Shadow" Rule

Here’s a detail that catches people off guard.

You might think, "Fine, I'll just give my money away before I die."

Nice try. Illinois has a three-year look-back rule. If you make significant taxable gifts within three years of passing away, the state "drags" those gifts back into your estate for tax purposes. You can't just hand out checks on your deathbed to avoid the il inheritance tax rate.

However, there is a loophole. Illinois does not have a standalone gift tax. If you give away money and then live for at least three years and one day, that money is officially out of the state's reach.

Portability: The Missing Feature

In the federal system, there’s a thing called "portability." If a husband dies and doesn't use his $15 million exemption, the wife gets to keep it. She now has a $30 million shield.

Illinois says "No thanks."

The $4 million Illinois exemption is not portable. If a couple doesn't do specific legal planning (usually involving a "Bypass Trust" or an "IL QTIP" trust), they might lose the first spouse’s exemption entirely.

If they just leave everything to each other, when the second spouse dies, the kids only get one $4 million shield instead of two. That mistake can cost a family over $300,000 in unnecessary taxes. It's basically a "paperwork penalty" for not having a sophisticated lawyer.

What about Non-Residents?

Maybe you moved to Florida to escape the winters (and the taxes), but you still kept a condo in Chicago or some rental property in Peoria.

You aren't safe.

Illinois taxes "real and tangible property" located within its borders, even if you live in a mansion in Miami. They use a ratio. They calculate what the tax would be on your entire worldwide estate, and then they make you pay the percentage that corresponds to your Illinois assets.

If 20% of your stuff is in Illinois, you pay 20% of that calculated tax. They always get their cut.

Strategies to Lower the Bill

Since we're stuck with these rates, what do people actually do?

- Gifting Early: As mentioned, if you're healthy, start moving assets now. The 2026 annual gift exclusion is $19,000 per person. You can give that much to every kid and grandkid every year without even reporting it.

- The IL QTIP Election: This is a specialized trust move that lets you delay the state tax until the second spouse dies, which buys time for the assets to grow (or for you to spend them!).

- Life Insurance Trusts (ILITs): If you have a $2 million life insurance policy, that $2 million is added to your estate value. By putting the policy in an ILIT, you keep that payout "outside" the tax net.

- Charitable Lead Trusts: If you’re feeling generous, giving to a 501(c)(3) can wipe out a huge chunk of the taxable value.

Actionable Next Steps

If you think your total net worth—including your home equity and all insurance policies—is approaching the $4 million mark, you need to move.

First, tally your "Gross Estate." Don't just look at your bank account. Look at the death benefit of your life insurance. Look at the fair market value of your home, not what you paid for it in 1994.

Second, check your titles. Are your assets held in "Joint Tenancy"? That might be ruining your ability to use two exemptions.

Third, consult a specialist. This isn't a DIY project. A standard "Will" from a website won't fix the Illinois estate tax cliff. You need a trust-heavy strategy that specifically addresses the 16% il inheritance tax rate and the lack of state portability.

💡 You might also like: Zappos customer service number: Why people still call when they could just click

Waiting until 2027 or 2028 might be too late if the 3-year look-back rule catches you. The state is counting on you being disorganized; don't give them the satisfaction.