Tax season in Idaho used to be a headache of math and multiple percentages. Honestly, it was a mess. You’d look at a list of seven different rates and try to figure out which slice of your paycheck belonged to which bracket.

But things changed fast.

If you are looking for a complex chart of idaho income tax brackets, I have some news for you. Most of those brackets are gone. Gone! The state has been on a tear lately, slashing rates and simplifying the code until there’s basically nothing left of the old system.

As of right now, Idaho has officially moved to a flat tax system.

The Death of the Old Idaho Income Tax Brackets

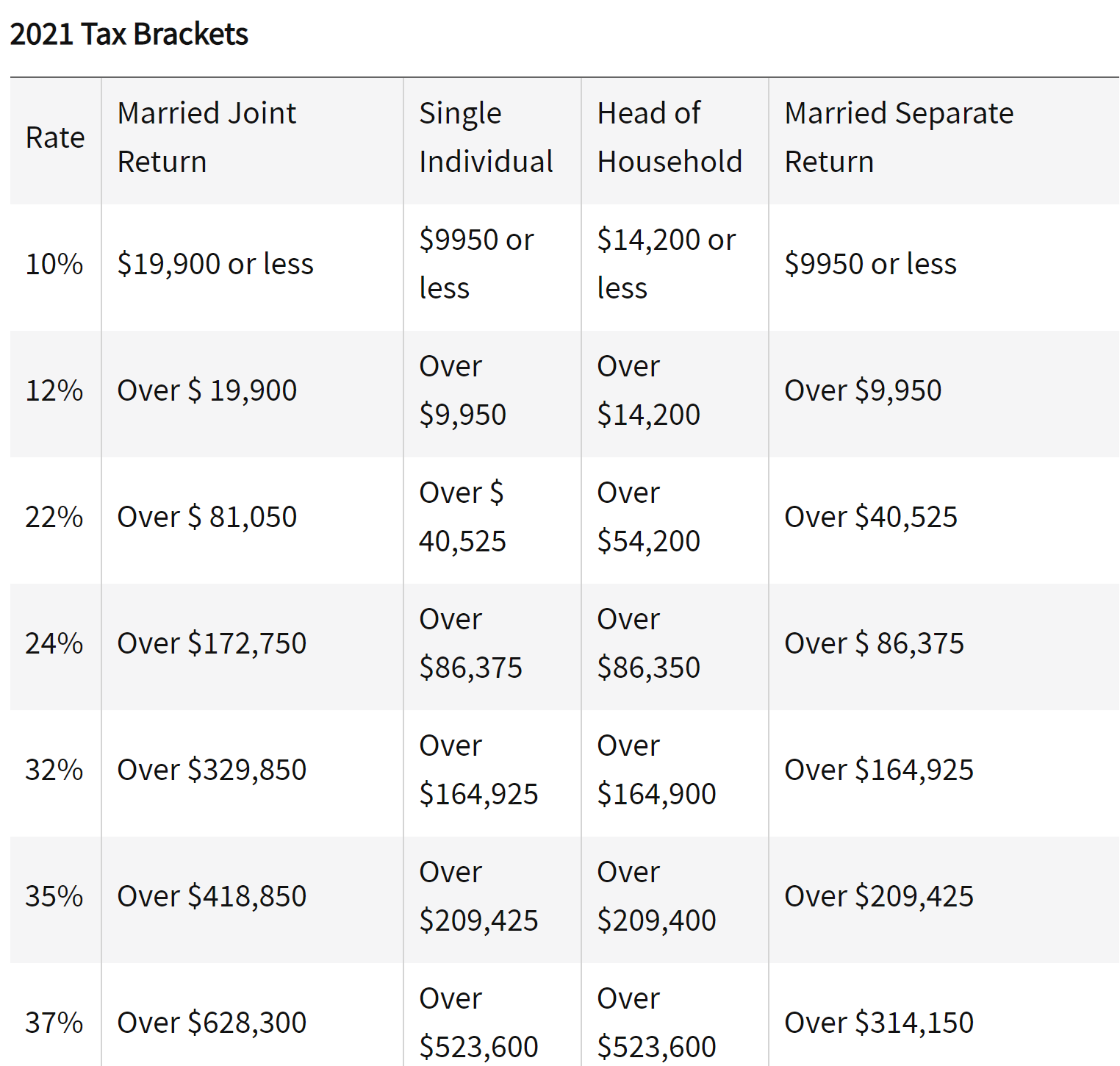

For years, Idaho operated like the federal government. It had a "progressive" system. That means the more you made, the higher the percentage you paid on those top dollars. In 2021, we had seven brackets. By 2022, that dropped to five. In 2023, the legislature took a sledgehammer to the whole thing and collapsed it into a single flat rate.

Why does this matter to you?

Well, if you're looking at old tax forms or blog posts from three years ago, you're going to see rates like 6.5% or 6.925%. Ignore those. They are relics. For the 2025 tax year (the returns you'll likely be thinking about right now), the rate has been cut even further. Governor Brad Little signed HB 40 into law, which dropped the flat rate from 5.695% down to a clean 5.3%.

That 5.3% applies to everyone. Whether you’re a barista in Boise or a tech exec in Coeur d'Alene, the percentage is the same.

✨ Don't miss: 40 Quid to Dollars: Why You Always Get Less Than the Google Rate

What the 5.3% Flat Rate Actually Looks Like

Let's talk real numbers.

Because Idaho starts its tax calculation based on your Federal Adjusted Gross Income (AGI), you don't actually pay 5.3% on every single dollar you earn. You still get the benefit of the standard deduction. For 2025, the filing thresholds—the amount you have to earn before you even owe the state a dime—look like this:

- Single filers under 65: $15,000

- Married filing jointly (both under 65): $30,000

- Head of household: $22,500

If you earn $50,000 as a single person, you aren't paying 5.3% on $50,000. You subtract that $15,000 threshold first. That leaves you with $35,000 in "Idaho Taxable Income." You multiply that by .053.

The result? About $1,855 in state tax.

It's simple. Sorta refreshing, actually. You don't have to worry about "climbing" into a higher bracket and suddenly losing a bigger chunk of your bonus to the state.

The Grocery Credit: Idaho’s Secret Weapon

You can't talk about idaho income tax brackets without mentioning the Grocery Tax Credit. Since Idaho is one of the few states that still charges sales tax on groceries, they give you a "refund" on your income tax return to make up for it.

This is a big deal.

🔗 Read more: 25 Pounds in USD: What You’re Actually Paying After the Hidden Fees

For 2025, that credit increased to $155 per person. If you’re a family of four, that’s $620 straight off your tax bill. If your total tax owed was $1,855 (like in our example above), you now only owe $1,235. For many lower-income families, this credit actually wipes out their entire state tax liability and results in a refund check.

Surprising Details Most People Miss

One thing that catches people off guard is how Idaho handles retirement.

If you are a retired member of the U.S. military or a widow/widower of one, Idaho is incredibly friendly. Under the new 2025 rules, you can subtract those federal retirement benefits from your taxable income. There’s no longer an age or disability requirement for this. It’s just... off the books.

Also, watch out for the "Social Security" trap. Idaho is one of the states that does not tax Social Security benefits. If it's included in your federal AGI, you get to subtract it on your Idaho return.

Is the Flat Tax "Fair"?

There's a lot of debate about this in the statehouse.

Groups like the Idaho Center for Fiscal Policy argue that flattening the idaho income tax brackets actually makes the system "regressive." Their logic is that since everyone pays 5.3%, but lower-income people spend a higher percentage of their money on sales tax and gas tax, the overall burden is heavier on the working class.

On the flip side, proponents argue it makes Idaho more competitive. They want to attract businesses from high-tax states like California or Oregon. By keeping a simple, low flat rate, they make the "Gem State" look like a haven for investment.

💡 You might also like: 156 Canadian to US Dollars: Why the Rate is Shifting Right Now

Whichever side you're on, the reality for your checkbook is that the rate is lower than it’s been in decades.

Actionable Steps for Your Idaho Taxes

Don't just wait until April 15. The state is move-fast-and-break-things right now with tax law.

First, check your withholding. Since the rate dropped to 5.3% retroactively for 2025, your employer might be taking out too much. You can use the Idaho Form ID W-4 to adjust this. Why give the state an interest-free loan?

Second, track your medical expenses. Idaho allows a deduction for medical expenses that exceed a certain percentage of your income. If you had a rough year with health bills, this can significantly lower that "taxable income" number before the 5.3% is applied.

Third, look into the new Parental Choice Tax Credit. This is a brand-new program (started around 2025/2026) that provides nearly $50 million in funds for families. If you have kids in school, you need to see if you qualify. It’s a refundable credit, meaning even if you owe zero tax, they might send you a check.

Finally, keep an eye on the Idaho State Tax Commission website. They’ve been moving toward mandatory online filing through the Taxpayer Access Point (TAP) for many businesses and individuals.

The days of complicated idaho income tax brackets are in the rearview mirror. It's 5.3% now. Calculate your AGI, subtract your deductions, and keep your grocery receipts.

Log into your payroll portal today. See what percentage they are actually taking out. If it’s still based on the old 5.695% or 5.8% rates, you’re overpaying every month. Fix that W-4 and put that money back in your pocket where it belongs.