You’ve probably seen the headlines. The IAG group share price has been on a bit of a tear lately, and honestly, it’s making a lot of people nervous. Why? Because when an airline stock starts climbing like this, everyone waits for the other shoe to drop. But 2026 isn't 2020, and the math behind British Airways' parent company is starting to look weirdly solid.

Right now, IAG is sitting around 412p on the London Stock Exchange. It's been a wild ride from the 2022 lows when the stock was languishing under 90p. If you’d put money in back then, you’d be sitting on a gain of nearly 180%. That’s not just a "recovery"—it's a fundamental shift in how the market views the group.

The Transatlantic Fortress

The thing about IAG—which, reminder, owns British Airways, Iberia, Vueling, and Aer Lingus—is that it basically owns the "Atlantic Bridge." While other airlines struggle with regional competition in Europe from budget carriers, IAG has a death grip on the London-to-US routes.

Bernstein analyst Alex Irving recently pointed out that IAG is arguably the best-positioned European airline for 2026. The reason? Capacity tightness. There aren't enough planes or slots at Heathrow to meet the demand for premium seats to New York, Boston, and LA. When supply is low and demand is high, IAG can charge whatever it wants. That's why their operating profit hit €2.05 billion in the third quarter of 2025.

It’s easy to think of IAG as just a bunch of planes. It’s not. It’s a cash machine that happens to have wings.

Why the IAG Group Share Price is Suddenly Everyone’s Favorite Value Play

For years, nobody wanted to touch airline stocks. They were "uninvestable." But look at the Price-to-Earnings (P/E) ratio. IAG is currently trading at a normalized P/E of roughly 7.1.

Compare that to Ryanair at 13 or even Delta at 11.

Basically, you’re buying a company that is printing money at a significant discount compared to its peers. Is the market being fair? Kinda. There are always "ghosts of COVID" haunting these valuations. Investors are terrified of another pandemic or a sudden spike in oil prices. But IAG has been aggressive about fixing its balance sheet. Net debt is down to €6.0 billion, which is about 0.8x EBITDA. That is incredibly low for an airline group.

The TAP Portugal Factor

There is a huge catalyst looming in the background: TAP Air Portugal.

IAG has been very vocal about wanting a piece of the Portuguese carrier. Why? Because it would give them total dominance over routes to South America, specifically Brazil. If that deal gets the green light in 2026, it could be the fuel the share price needs to break past the 450p resistance level.

Of course, regulators are a pain. They might demand IAG give up some slots in Madrid or Lisbon, which would sour the deal's appeal. It’s a balancing act.

Revenue Isn’t Just Seats Anymore

A lot of people miss the "IAG Loyalty" segment. This is the Avios ecosystem. In Q3 2025, while passenger revenue was relatively flat at €9.3 billion, the loyalty and third-party maintenance divisions showed real growth. This is high-margin revenue. It’s "sticky." People will keep earning and spending Avios even if they skip one summer holiday because of inflation.

- British Airways still drives about 45% of the profit.

- Iberia is the growth engine for the Spanish-speaking market.

- Vueling handles the low-cost European leisure routes.

- Aer Lingus is the clever back-door into the US for Irish and European passengers.

This diversification is why the stock didn't crater when short-haul leisure demand softened slightly last summer.

What Could Actually Go Wrong?

Let’s be real for a second.

Investing in the IAG group share price is not a guaranteed win. The biggest threat right now isn't competition; it's the macro environment. If the US dollar weakens significantly, those lucrative transatlantic profits look smaller when converted back to Euros.

Also, fuel.

IAG is well-hedged for the next few months, but if geopolitical tensions in the Middle East send Brent crude back toward $100, those margins will evaporate. They also have a massive capital expenditure (CapEx) plan. They’re looking to spend €5.0 billion a year on new planes by 2028. That’s a lot of money leaving the building. If they don't get the returns they expect, shareholders will be the first to complain.

Management Shakeups

Just this month, we saw a transition in the C-suite. The CFO is stepping down, replaced by the BA finance chief. Markets usually hate uncertainty at the top. On January 12th, the stock took a 3% hit on the back of general market jitters and this leadership news. It has since stabilized, but it shows how sensitive the price is to even minor news.

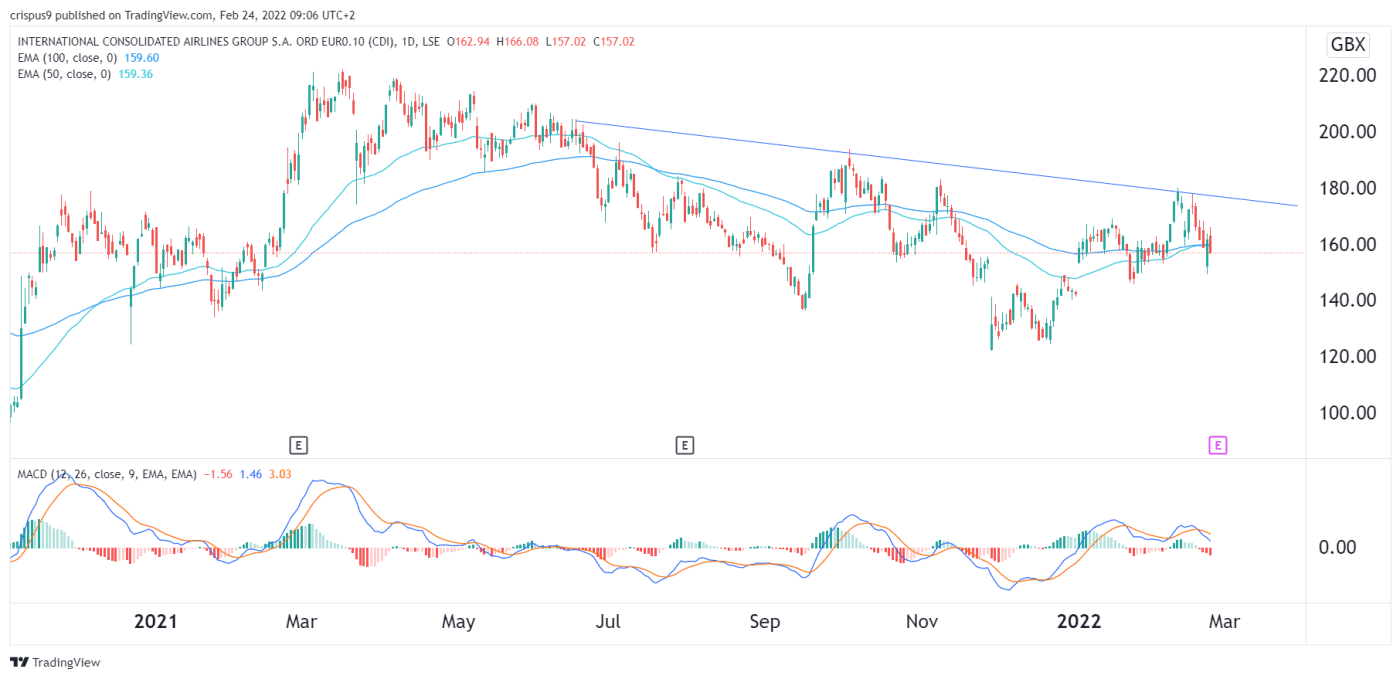

Technical Analysis: The "Cup and Handle"

If you’re into charts, the weekly view of IAG is looking interesting. It has formed what traders call a "cup and handle" pattern. The stock hit 430p (the rim of the cup), pulled back slightly (the handle), and is now looking for a breakout.

If it clears 438p—its post-pandemic high—some analysts think 500p is the next logical stop.

But if it falls below 360p, the bullish story is effectively over. That 360p level is the "line in the sand." As long as the price stays above that, the trend is your friend.

Dividends and Buybacks

IAG is finally being generous again. They’ve nearly finished a €1 billion share buyback. In November 2025, they increased the interim dividend to €0.048. It’s not a massive yield—roughly 2.3% to 2.7% depending on when you buy—but it’s a signal. It says, "We are healthy enough to give you your money back."

💡 You might also like: Unicorn Companies: What the Definition Actually Means for Business Today

For a long-term investor, that’s often more important than the daily price movement.

Actionable Insights for Investors

If you are looking at the IAG group share price today, you have to decide if you believe in the "Goldilocks" scenario: steady travel demand, manageable fuel costs, and successful consolidation.

- Watch the February 27th results: This is when they’ll give 2026 unit cost guidance. This will be the make-or-break moment for the spring rally.

- Keep an eye on the TAP acquisition news: Any progress here is a massive tailwind. Any regulatory blocking is a headwind.

- Check the US Dollar/Euro exchange rate: A strong dollar is generally good for IAG’s revenue but can make their dollar-denominated debt more expensive to service.

- Look at the "Fair Value" gap: Most models, including those from InvestingPro, suggest the fair value of IAG is closer to €4.50 (around 380p-400p), meaning it’s currently trading right around its intrinsic value. There isn't a massive "margin of safety" here, but the momentum is undeniable.

The IAG of 2026 is a leaner, meaner version of the company that went into the pandemic. It has less debt, better routes, and a dominant position in the most profitable flight corridor in the world. Whether that’s enough to push the share price to new highs depends on whether the global economy plays ball.

To get the most out of an IAG position, you should set a firm stop-loss around the 360p mark to protect against a sudden sector downturn. Monitor the upcoming February 2026 full-year results specifically for news on a second share buyback program, as management has already hinted that further returns of excess cash are on the table.