Tax season is basically the only time of year when everyone suddenly becomes an amateur accountant. You’re sitting there, staring at a stack of W-2s or 1099s, wondering if you can finally afford that trip to Japan or if you’re going to be eating ramen for the next six months to pay off the IRS. That’s where the H&R Block tax estimator comes in. It’s a free tool, and honestly, it’s one of the better ones out there because it doesn't make you create an account just to see a rough number.

But here’s the thing.

Most people use these calculators wrong. They treat the number that pops up on the screen like it’s a legal guarantee. It isn't. It’s a math model based on the data you feed it, and if your data is "sorta" right, your estimate will be "sorta" wrong.

How the H&R Block Tax Estimator Actually Works

The tool is essentially a simplified version of the IRS tax code. It asks about your filing status—single, married filing jointly, head of household—and then starts layering in your income. It’s looking for your Gross Adjusted Income (AGI).

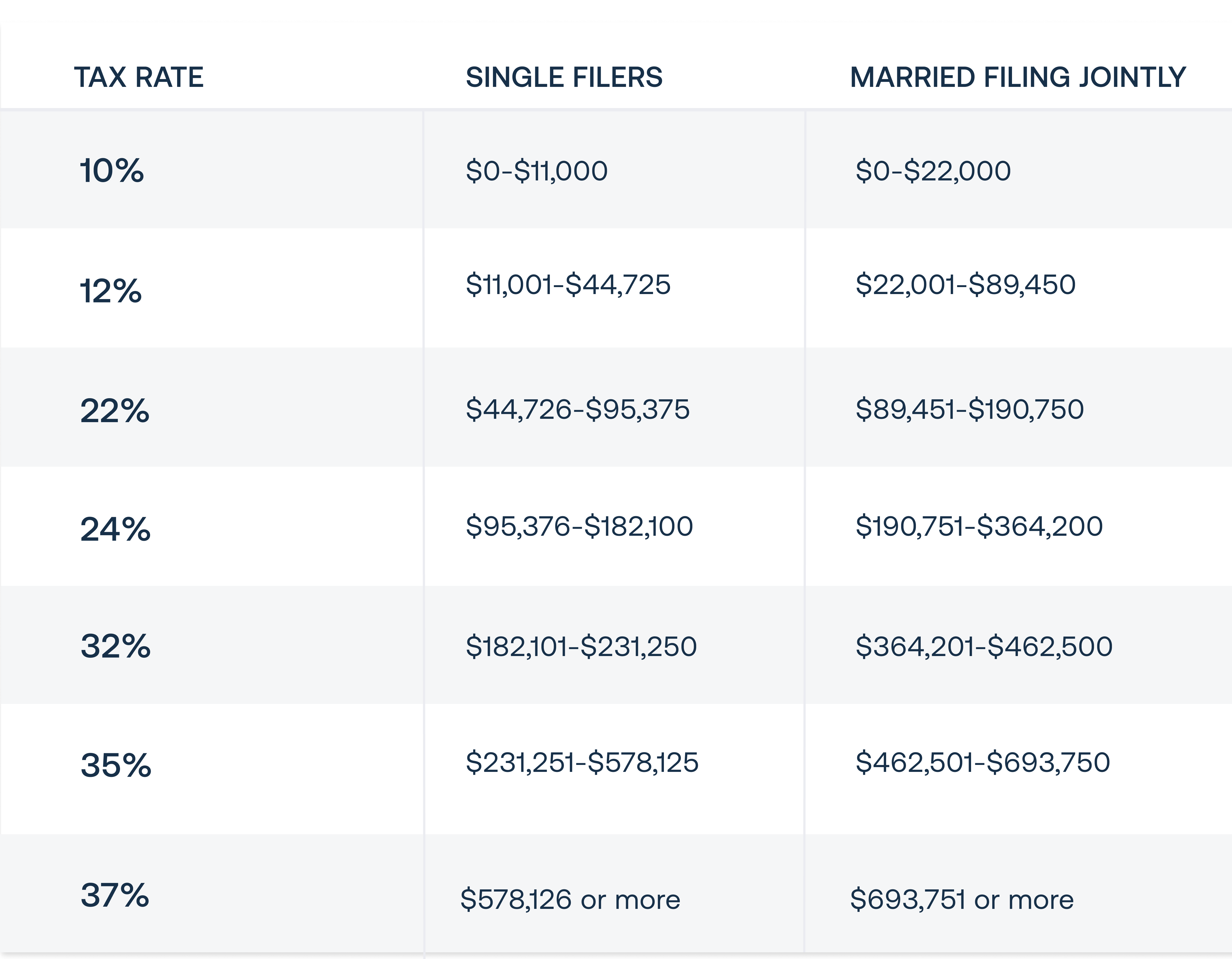

The logic is pretty straightforward. It takes your total earnings, subtracts the standard deduction—which for the 2025 tax year (the ones you're likely filing in early 2026) has been adjusted for inflation—and then applies the current tax brackets. It’s a funnel. Money goes in the top, the IRS takes its cuts at different percentages, and whatever is left over from your withholdings is your refund. Or, if you didn't pay enough throughout the year, it’s what you owe.

The H&R Block tax estimator is particularly good at handling the "standard" stuff. If you have a 9-to-5, one house, and no kids, the number it gives you will be scarily accurate. However, the moment you add a side hustle or a complicated investment portfolio, things get murky.

The Standard Deduction Trap

Most Americans—about 90%, according to IRS Statistics of Income data—take the standard deduction. For 2025, those numbers jumped again. If you're single, it’s $15,000. If you’re married filing jointly, it’s $30,000.

A lot of people think they should "itemize" because they heard their neighbor saved money doing it. They go into the estimator and start plugging in mortgage interest and charitable donations. But if those things don't add up to more than $15,000 for an individual, the H&R Block tax estimator is just going to default you back to the standard deduction anyway. It’s designed to give you the biggest break possible, but it can be frustrating if you spent hours digging up receipts for Goodwill donations that ended up not mattering at all.

👉 See also: Average Gas Price USA Today: Why Your Local Pump Still Feels Like a Rip-off

Why Your Side Hustle Changes Everything

If you’re driving for Uber, selling vintage clothes on Depop, or doing freelance graphic design, the estimator gets a lot more complicated. This is where "Schedule C" income comes into play.

Self-employed people often forget about the Self-Employment Tax. It’s 15.3%. That’s on top of your regular income tax. When you use the H&R Block tax estimator, you have to be honest about your business expenses. If you just put in "I made $50,000 freelancing," the tool might show you owe a massive chunk of change. But if you didn't subtract your home office, your internet bill, and your equipment costs, that estimate is uselessly high.

Honestly, the "Quick" version of most estimators skips the nuance of business deductions. To get a real number, you have to do the legwork of calculating your net profit first.

Credits vs. Deductions: The Math People Get Wrong

There’s a massive difference between a credit and a deduction. The H&R Block tax estimator handles both, but you need to know which is which to understand the results.

A deduction lowers the amount of income you are taxed on. If you make $60,000 and have a $10,000 deduction, you are taxed as if you made $50,000.

A credit is way better. It’s a dollar-for-dollar reduction in the tax you actually owe. The Child Tax Credit (CTC) is the big one here. For the 2025 tax year, the credit remains a vital lifeline for families, but there are phase-outs. If you make too much money, the credit starts to disappear. The H&R Block tool is pretty savvy at calculating these phase-outs automatically, which is a huge plus compared to some of the "bare bones" calculators found on random financial blogs.

The "Secret" Inflation Adjustments

Every year, the IRS adjusts the tax brackets to prevent "bracket creep." This is when inflation raises your salary, but your actual purchasing power stays the same, yet you end up in a higher tax bracket.

For the 2025/2026 cycle, the brackets have shifted upward. This means you can earn more money before hitting the 22% or 24% rates. When you use an updated H&R Block tax estimator, it’s using these new 2025 thresholds. If you’re using an old spreadsheet you saved on your desktop from three years ago, your math is going to be wrong. Use the current web-based tools. They update the back-end code the moment the IRS releases the new Rev. Proc. documents.

Common Mistakes That Ruin Your Estimate

- Forgetting Interest Income: Did you have money in a High-Yield Savings Account? In 2025, interest rates stayed relatively high for a while. That 1099-INT you’ll get from your bank counts as taxable income.

- The "Head of Household" Error: People often claim this because it sounds cool or they are the "head" of their home. But if you aren't unmarried and paying more than half the cost of keeping up a home for a qualifying person, the IRS will reject this. The estimator will give you a much bigger refund for HoH than for Single filing, so don't trick yourself into a false sense of security.

- Withholding Confusion: Your refund is just the IRS giving you back your own money that you overpaid. If you changed your W-4 at work halfway through the year, your H&R Block tax estimator results might look wildly different than last year.

What to Do Before You File

First, grab your last pay stub of the year. Don't guess. Look at the "Year to Date" (YTD) gross pay and the "Federal Tax Withheld" boxes. Those are the two most important numbers you'll put into the H&R Block tax estimator.

Second, check your filing status. If you got married on December 31st, the IRS considers you married for the entire year. That changes everything.

👉 See also: Why the old Toys R Us logo still hits so hard

Third, look at your capital gains. If you sold stocks or crypto in 2025, you need to know if you held them for more than a year (Long Term) or less (Short Term). The tax rates are completely different. Short-term gains are taxed like regular income; long-term gains have their own, much lower, brackets (0%, 15%, or 20%).

Actionable Steps for a Better Tax Outcome

- Gather the 1099s early: Even if you haven't received the physical mail, most banks and brokerages have digital versions ready by mid-January.

- Run the numbers twice: Do one estimate with the standard deduction and another where you attempt to itemize. If the difference is less than $100, just take the standard. It’s not worth the audit risk or the headache.

- Adjust your withholdings now: If the H&R Block tax estimator shows you owe $3,000, don't just panic. Go to your HR portal at work today and adjust your W-4 for the coming year so you don't end up in the same hole next January.

- Check for state taxes: Remember that the federal estimator usually doesn't account for state income tax. If you live in California or New York, you need to run a separate calculation for your state obligations, as those can take another 5-10% of your income.

- Verify your dependents: Make sure you have social security numbers ready for everyone you’re claiming. The estimator doesn't need them, but the actual tax software will, and any typo there will trigger an immediate "mismatch" error from the IRS e-file system.

By the time you actually sit down to file, the estimate should just be a confirmation of what you already know. Use the tool as a roadmap, not a final destination.