Tax season is honestly a fever dream for most of us. You spend months avoiding that pile of receipts in the kitchen drawer, only to suddenly care deeply about every cent once January rolls around. It's the same dance every year. You want to know what you’re getting back—or what you're going to owe—long before you actually hit the "submit" button. That is exactly where the H&R Block refund calculator enters the chat. It’s basically the digital equivalent of peering through a crystal ball, except instead of seeing your future spouse, you’re seeing whether you can afford that new couch or if you’ll be eating ramen for a month to pay the IRS.

But here is the thing.

Most people use these tools wrong. They treat them like a toy, punching in a few rough guesses and then getting mad when the actual tax return looks totally different. If you want a number that actually means something, you have to understand the logic behind the math.

Why the H&R Block Refund Calculator Isn't Just a Random Number Generator

Tax software companies don't just build these calculators for fun. They want you to use their paid services, obviously. But to get you there, they provide a free estimator that taps into the current year's tax brackets and standard deduction amounts. For the 2025-2026 cycle, those numbers have shifted again because of inflation adjustments. The H&R Block refund calculator uses these updated IRS parameters to give you a ballpark figure.

It’s not a legal document. It's a "what-if" machine.

When you start plugging in data, the tool is looking at two primary buckets: your total income and your total tax payments. If you paid in more than you owe based on your credits and deductions, you get a refund. If not? Well, you're writing a check. The nuances, however, are where people usually trip up. Are you filing as Head of Household or just Single? Did you remember that your side hustle income counts as "gross" and hasn't had taxes taken out yet?

The Standard Deduction vs. Itemizing Trap

Most Americans—somewhere around 90%, according to IRS Statistics of Income (SOI) data—take the standard deduction. For the current tax year, the standard deduction has climbed. If you’re a single filer, it’s a big chunk of change you don't have to pay taxes on. If you're married filing jointly, it's double.

The H&R Block refund calculator usually defaults to this because it's the safest bet for the average user. But if you own a home with a massive mortgage, or if you had astronomical medical bills that exceeded 7.5% of your adjusted gross income (AGI), the standard deduction might actually be the wrong choice.

🔗 Read more: United States President Salary History: What Most People Get Wrong

If you just breeze through the calculator without considering whether your itemized deductions beat the standard amount, your "estimate" is basically useless. It’s like trying to guess the weight of a suitcase without knowing if there are bricks inside.

What You Actually Need to Feed the Machine

Don't sit down to use the H&R Block refund calculator with just your vibes and a rough memory of your salary. You need the receipts. Literally.

You’ll need your W-2s, obviously. But what about that 1099-NEC from the three weeks you spent doing freelance consulting? Or the 1099-INT from your high-yield savings account that finally started actually yielding something? Every dollar counts.

- Wages and Salaries: This is the easy part. Grab your last pay stub if you don't have your W-2 yet. Look at the "Year to Date" (YTD) totals.

- Federal Tax Withheld: This is the most important number for a refund estimate. If you didn't have enough withheld throughout the year, no amount of "calculator magic" is going to conjure a refund out of thin air.

- The "Kiddie" Tax and Credits: If you have children under 17, the Child Tax Credit (CTC) is a heavy hitter. The H&R Block refund calculator will ask for the number of dependents, and you better get it right.

- Student Loan Interest: Even if you aren't itemizing, you can often deduct up to $2,500 in student loan interest as an "above-the-line" deduction.

Honestly, the tool is only as smart as the person typing. If you forget to mention that you sold some Bitcoin at a profit, the IRS won't forget later, even if the calculator didn't account for it now.

The Difference Between a Credit and a Deduction

This is where people get confused. I see it all the time.

A deduction lowers the amount of income you are taxed on. If you made $60,000 and have a $10,000 deduction, the IRS only looks at $50,000.

A credit is way better. It’s a dollar-for-dollar reduction in the actual tax you owe. If you owe $3,000 in taxes but have a $2,000 tax credit, you now only owe $1,000.

The H&R Block refund calculator is designed to sniff out these credits. It'll ask about your education expenses (The American Opportunity Tax Credit is a big one) or whether you spent money making your home more energy-efficient. These are the "hidden" gems that turn a "you owe money" result into a "here is your refund" result.

A Quick Word on the Earned Income Tax Credit (EITC)

The EITC is one of the most complex but valuable credits for low-to-moderate-income working individuals and couples. It’s "refundable," which means even if your tax bill is zero, the government will still send you the remaining balance of the credit.

When you use the H&R Block refund calculator, pay very close attention to the income thresholds for the EITC. If you're right on the edge, a few dollars of income can be the difference between a $500 refund and a $5,000 one. It’s that sensitive.

Why Your Result Might Change When You File

So, you ran the numbers. The screen says you're getting $2,450. You're already picking out a new TV.

Stop.

There are about a dozen reasons why that number might shift when you actually sit down with a pro or finish the full software flow.

- State Taxes: Most free calculators focus on federal taxes. Your state might have totally different rules, higher rates, or credits that don't exist at the federal level.

- Self-Employment Tax: If you're a gig worker, you're responsible for the employer's share of Social Security and Medicare. This is roughly 15.3%. A lot of people forget this and are shocked when their "refund" vanishes into the void of self-employment tax.

- Accuracy of Withholding: If your W-2 hasn't arrived and you're guessing based on paychecks, you might be missing pre-tax contributions to a 401(k) or a Health Savings Account (HSA). Those contributions lower your taxable income, which is good! But if you didn't account for them, your estimate will be off.

The "Hidden" Adjustments

Life happens. Maybe you got married in October. Or you had a baby in December. The IRS treats you as if you were in that status for the entire year. The H&R Block refund calculator accounts for this, but you have to be honest about your status as of December 31st.

Navigating the H&R Block Interface

The tool itself is pretty slick. It's built to be "mobile-first," meaning you can do it on your phone while you're waiting for your coffee. It usually starts with the basics: age, filing status, and how many kids you have.

Then it moves into the "Money In" section. This is where you list your salary, tips, and business income.

Finally, it hits the "Deductions" section. This is the part where you should spend the most time. Don't just click "No" to everything. Read the prompts. Did you donate clothes to Goodwill? Did you pay for a classroom as a teacher? These small things add up.

💡 You might also like: Hawaiian Electric Industries Inc: What Most People Get Wrong About Its Future

Real-World Nuance: The Reality of Tax Law

Tax law is essentially a 7,000-page monster that changes every time Congress feels like it. While H&R Block keeps their calculator updated with the latest major legislation, it can't capture every weird edge case.

For instance, if you have foreign bank accounts (FBAR requirements) or complex K-1 forms from a partnership, a simple online calculator is going to struggle. It’s built for the "standard" American taxpayer. If your life is "non-standard"—maybe you live in one state but work in another—you should treat the calculator result as a very loose suggestion rather than a bankable fact.

Comparing Tools

Is the H&R Block refund calculator better than TurboTax's version? Or the one on the IRS website?

Honestly, they all use the same math. The IRS publishes the tax tables. The "difference" is mostly in the user interface and how they phrase the questions. Some people find H&R Block's "interview style" easier to navigate because it feels less like a math test and more like a conversation.

Actionable Steps to Get the Most Accurate Estimate

If you're ready to see where you stand, don't just jump in headfirst. Follow this workflow to make sure the number you see is actually grounded in reality.

Gather your documents first. Don't guess. If you don't have your W-2 yet, log into your payroll provider (like ADP or Gusto) and download your final 2025 pay stub. This will have your total earnings and total federal tax withheld.

Double-check your filing status. This is the biggest mistake people make. If you’re divorced, who is claiming the kids? You can't both do it. If you claim a child that your ex-spouse also claims, the IRS will flag both of you, and your refund will be frozen for months. Sort that out before you run the calculator.

Input your "Adjustments to Income." Don't forget about things like IRA contributions or HSA contributions you made with post-tax dollars. These "above-the-line" deductions are powerful because they lower your AGI regardless of whether you take the standard deduction.

Run the numbers twice. Try it once with the standard deduction. Then, if you have significant expenses, try it again with itemized estimates. See which one yields a better result.

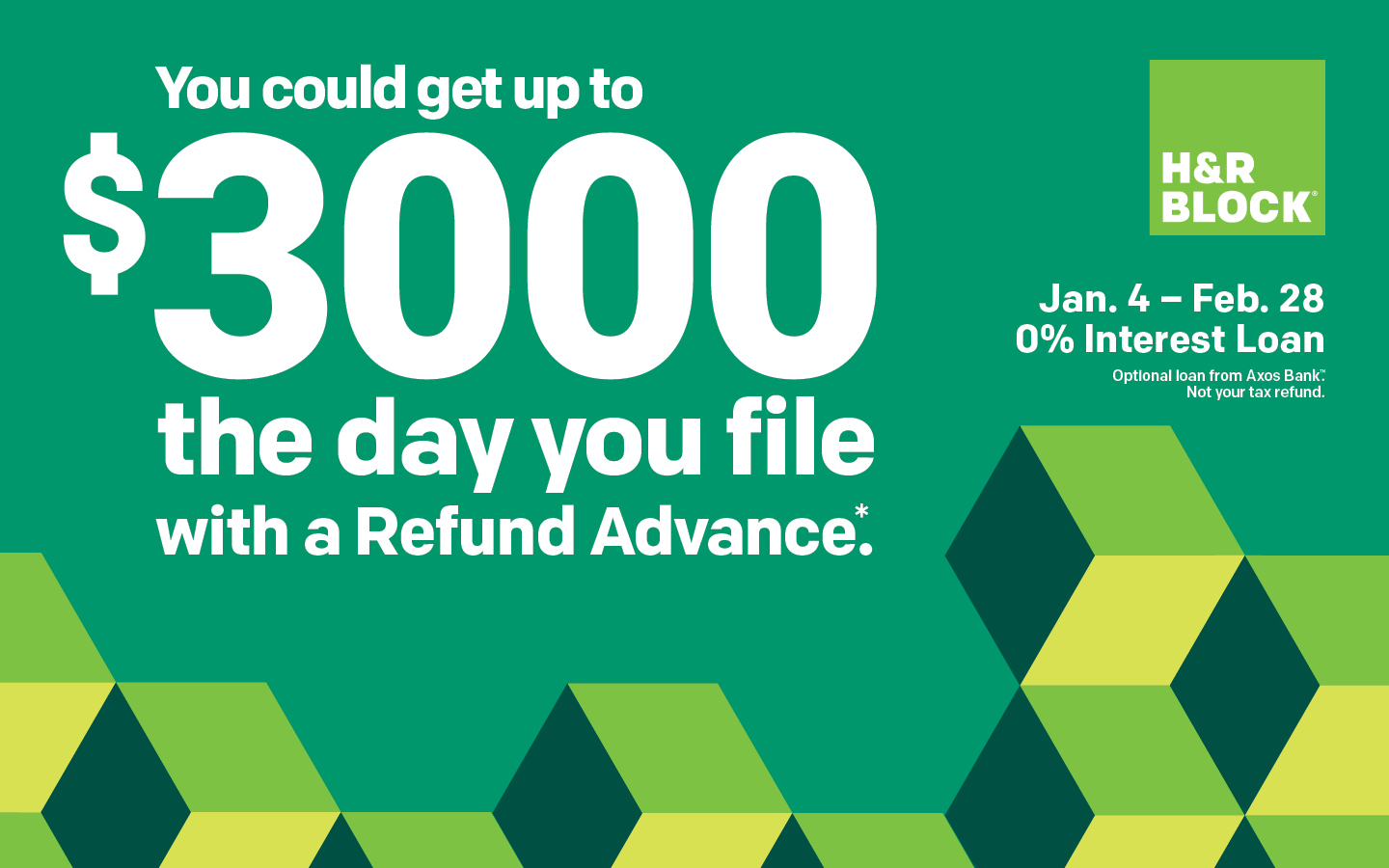

Watch for the "Refund Advance" fine print. Often, once you finish using the H&R Block refund calculator, you’ll see offers for a "Refund Advance." This is essentially a loan. It can be helpful if you’re in a pinch, but remember that it's based on your estimated refund. If your actual refund comes back lower, you still owe that money back.

The goal isn't just to see a big number on a screen. The goal is to plan your financial life. If the calculator shows you owe $2,000, you have a few months to save up before the April 15th deadline. If it shows a $3,000 refund, maybe you should adjust your W-4 at work so you get more money in each paycheck throughout the year instead of giving the government an interest-free loan.

Tax planning is a year-round sport. The calculator is just the scoreboard. Use it wisely, be honest with the inputs, and always keep a copy of your results to compare against your final return. That’s how you actually win at the tax game.

Check your numbers. Update your info. Get your money back. It's really that simple when you stop treating taxes like a mystery and start treating them like a math problem you can actually solve.