Honestly, trying to figure out exactly how the stock market will do tomorrow is a bit like trying to predict where a toddler is going to run next in a room full of puppies. It's chaotic. It’s loud. And just when you think you’ve got the pattern down, someone drops a bowl of cereal.

As we stare down Friday, January 16, 2026, the vibe on Wall Street is... well, it’s complicated. If you’ve been watching the tickers lately, you know the S&P 500 has been flirting with that psychological 7,000 level like it’s a high school crush. But tomorrow isn't just another Friday. It's a day caught between a massive power struggle at the Federal Reserve and a "stock pickers' market" that is finally rewarding companies that aren't named Nvidia.

The Elephant in the Room: The Trump-Powell Showdown

You can't talk about tomorrow without talking about the drama. It’s been wild. We’ve seen the Department of Justice essentially subpoena Fed Chair Jerome Powell over a $2.5 billion building restoration, which many analysts—and Powell himself—see as a political move to force more aggressive rate cuts before his term ends in May.

Whenever the independence of the Fed is questioned, the market gets the jitters. Why? Because investors hate uncertainty more than they hate a 10% interest rate cap on credit cards. Speaking of which, that proposed cap for January 20 has already been dragging down the big banks. Citigroup and JPMorgan took a beating earlier this week, and tomorrow is likely to see more "defensive" positioning as traders weigh the reality of these policy shifts.

Breaking Down the Indices for Tomorrow

If you're looking for a simple "up or down," you're probably going to be disappointed. The market has become incredibly bifurcated.

- The S&P 500: It’s been trading in a tight range. Technical analysts like Fiona Cincotta have pointed out that 6,920 is a key support level. If we dip below that tomorrow, things could get ugly fast. But if the bulls can push it toward 7,000? That’s a whole different story.

- The Nasdaq: Tech is in a weird spot. We’re seeing a "winner-takes-all" dynamic where companies that actually show AI revenue (think Intel or AMD lately) are soaring, while others are being left in the dust. Salesforce recently got smacked because of a Slackbot update, showing just how twitchy tech investors are right now.

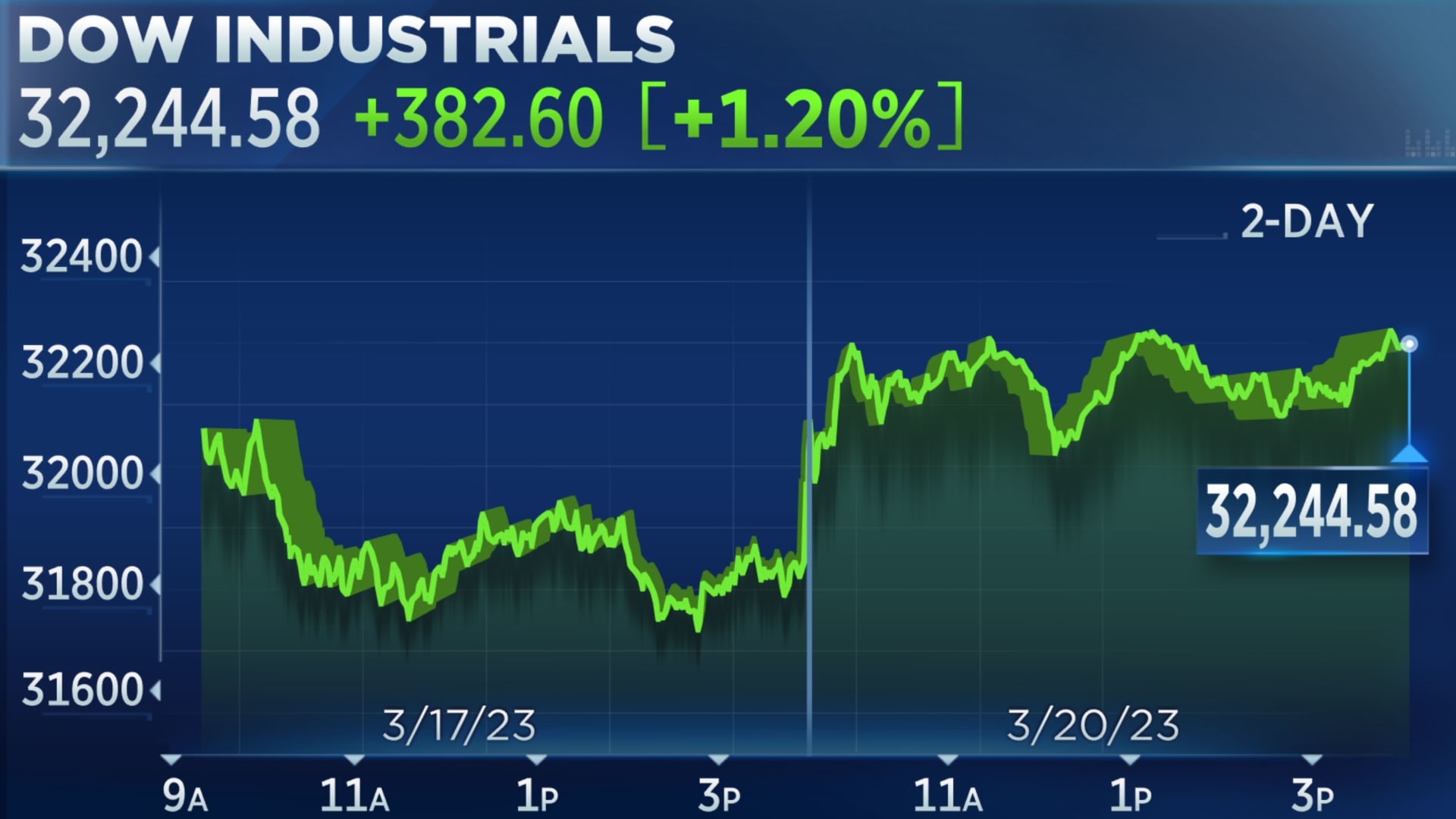

- The Dow: This is where the "Trump trade" is hitting hardest. With the proposed interest rate caps on credit cards, the blue-chips are feeling the squeeze.

Inflation is the "Sticky" Guest That Won't Leave

We just got the December CPI data, and it wasn't the "all-clear" signal people wanted. 2.7%. It’s fine, sure, but it’s "sticky." It’s the kind of number that makes the Fed hesitate. Tomorrow, the market will still be digesting what this means for the January 28 FOMC meeting. Currently, the odds of a rate cut are sitting at a measly 5%. Most big players, including Goldman Sachs, are betting the Fed stays on hold until March.

High interest rates are like a heavy backpack for the economy. Some companies—the big ones with mountains of cash—can carry it just fine. But the smaller guys in the Russell 2000? They're starting to sweat. Ironically, though, the Russell 2000 has been outperforming lately as investors look for "value" outside of the mega-cap tech bubble.

What Could Surprise Us Tomorrow?

Earnings season is starting to ramp up, and that’s the real wildcard. We’ve seen Lululemon raise its guidance because of strong holiday demand, while Delta Air Lines basically told everyone that flying is going to get more expensive because "the math has to work."

📖 Related: Dennis Collins Net Worth: What Most People Get Wrong About the Jeep King

Tomorrow is often about "repositioning" before the weekend. In 2026, the market has a habit of "Friday Fade" or "Friday Fever." If there’s more news about the geopolitical tensions in Venezuela or the potential "deal" involving Cuba and Greenland, expect a flight to safety. Gold is already sitting near record highs around $4,600 an ounce. When people buy gold, they aren't exactly feeling bullish about tomorrow's stock prices.

The "Stock Picker" Era is Actually Here

For years, you could just throw money at an index fund and wake up richer. That's not tomorrow's market. 2026 is shaping up to be a year where what you own matters way more than if you own. J.P. Morgan research suggests that while the AI supercycle is still a thing, the "Magnificent 7" are no longer the only game in town. In fact, earnings for the "other 493" companies in the S&P 500 are expected to grow by over 12% this year.

This broadening of the market is actually a healthy sign. It means the bull market isn't just leaning on one or two giant tech pillars that could crumble.

Actionable Steps for Tomorrow

Look, nobody has a crystal ball. But you can be smart about how you handle the open.

- Watch the 10-Year Treasury Yield: If it creeps back above 4.20%, expect tech stocks to face immediate pressure. It’s like an inverse relationship that rarely fails.

- Check the "Fear Index" (VIX): If the VIX starts climbing early in the morning, it’s a sign that the big institutional players are hedging for a rough day.

- Don't Panic on the Open: In 2026, we've seen a lot of "fake-out" opens where the market starts red and finishes green (or vice versa) as the algos fight it out.

- Keep an eye on the Dollar: A strengthening dollar is usually bad news for multinational companies because it makes their overseas earnings look smaller.

Tomorrow will likely be a day of consolidation. We're all waiting to see if the Fed-Trump drama escalates or if corporate earnings can provide enough of a "shield" to keep the rally alive. Stay diversified, keep some cash on the sidelines, and don't let a single day's movement dictate your entire investment strategy.

The best move for tomorrow? Watch the 6,920 level on the S&P 500. If it holds, the bull run likely has more legs. If it breaks, it might be time to look at those "haven" assets again.

Watch for the 10:00 AM ET "reversal window" tomorrow; it's been a consistent trend this month where the initial morning momentum completely flips as institutional orders settle in.