So, you’re holding a piece of paper that’s supposed to be as good as cash. Maybe you just sold a vintage camera on Facebook Marketplace, or perhaps a new tenant just handed you a deposit. It looks official. It has the Ben Franklin watermark. But something feels slightly off, or maybe you're just the cautious type who doesn't like losing money. Honestly, you’re right to be skeptical. In an era of instant digital transfers, the old-school paper trail is still a playground for scammers.

If you need to verify USPS postal money order validity, you aren't just looking for a thumbs-up from a website. You’re looking for peace of mind. The United States Postal Service processes millions of these every year because they are arguably the most secure form of paper payment in the country. But "most secure" isn't "invincible."

Let's get into the weeds of how you actually check these things without getting scammed.

📖 Related: Exchange Rate Euro to Czech Crown: Why 2026 is Throwing Everyone for a Loop

The Quick Way: Using the Official Verification System

The most direct route is the USPS Money Order Inquiry System. It’s a bit clunky—standard government tech—but it works. You’ll need three specific pieces of information from the slip in your hand: the serial number, the post office number, and the exact dollar amount.

Don't just Google "verify money order" and click the first ad you see. Scammers actually pay for ads to lead you to fake verification sites that "confirm" their own forged documents. Always go directly to tools.usps.com.

Once you’re there, you enter the digits. If the system says "Match Not Found," don't panic immediately. It can take a few days for a newly issued money order to show up in the digital database. However, if the person who gave it to you seems rushed or aggressive about you cashing it right now, that "Match Not Found" is a massive red flag.

Why the Phone Number is Often Better

Sometimes the website hangs. Or maybe you're standing in a parking lot and the mobile site is acting up. You can call the USPS Money Order Verification System at 1-866-459-7822.

It’s an automated system. It’s boring. You’ll listen to a lot of prompts. But it’s the most definitive way to know if that specific serial number was actually issued by a post office. If the automated system can't find it, you can eventually get through to a human, though honestly, bring a snack because the wait times can be brutal.

Physical Red Flags: How to Spot a Forgery in 10 Seconds

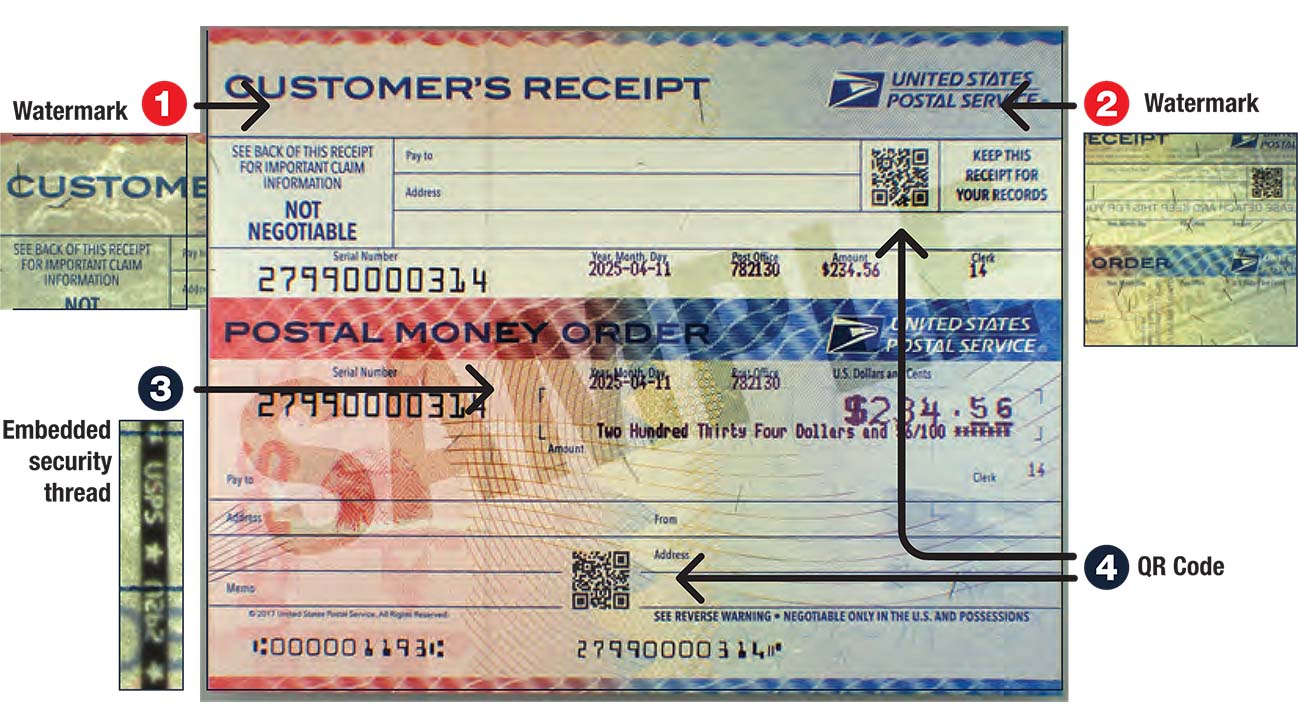

You don't always need a computer to verify USPS postal money order authenticity. The USPS builds in "covert and overt" security features that are incredibly hard for a guy with a high-end printer to replicate.

Hold the paper up to a light. Do it right in front of the person who gave it to you. If they get nervous, you have your answer.

- The Watermark: Look for the Benjamin Franklin watermark on the left side. It should be embedded in the paper, not printed on top. If it looks blurry or sits on the surface, it's a fake.

- The Security Thread: To the right of the Franklin watermark, there’s a vertical thread. If you hold it to the light, you’ll see "USPS" repeating backward and forward along the strip.

- The Dollar Amount: This is where most amateurs mess up. On a real USPS money order, the dollar amount shouldn't have any gaps. If it says "$ 500.00" with weird spacing between the dollar sign and the number, someone likely "washed" a $5.00 money order and reprinted a higher value over it. This is a common tactic. They buy a legit $1.00 order and turn it into $1,000.00.

- Color Bleeding: Genuine money orders use high-quality ink that doesn't run. If the colors look muddy or the edges of the text are fuzzy, it’s a counterfeit.

The "Overpayment" Scam: A Real-World Warning

You’ve probably heard of this, but people still fall for it every single day. A buyer sends you a USPS money order for $1,500 for an item you’re selling for $1,000. They tell you, "Oops, my assistant made a mistake! Just cash it, keep an extra $100 for your trouble, and send the remaining $400 back to me via Zelle or Apple Pay."

It feels like a win for you. You get a $100 bonus!

But here’s the kicker: You go to your bank, deposit the money order, and the bank "clears" it the next day. You think you’re safe. You send the $400. Three days later, the bank realizes the money order was a sophisticated fake. They reverse the entire $1,500 from your account. You’re out the $400 you sent, the item you sold, and you might even face a "distributing counterfeit instruments" investigation from your bank’s fraud department.

Your bank "clearing" a deposit is not the same as the USPS verifying the funds. Banks are required by law to make funds available quickly, often before they’ve actually finished the inter-bank verification process.

Where to Actually Cash It

If you want to be 100% safe, take the money order to a Post Office.

✨ Don't miss: Precio del dólar hoy Banco Azteca: Por qué cambia tanto y cómo ganarle al tipo de cambio

Banks will take them, sure. But if you take it to a USPS counter, they will verify USPS postal money order status instantly because they are the ones who issued it. If they hand you the cash, the transaction is over. You're safe. If the Post Office teller looks at it and says they can't cash it, you haven't lost any of your own money yet—you've just avoided a scam.

Keep in mind that post offices don't always keep thousands of dollars in the drawer. If you show up with five $1,000 money orders at 9:00 AM, they might tell you to come back later or go to a larger branch.

Limits and Rules You Should Know

You can't just buy a $50,000 money order. The USPS has a daily limit of $1,000 per individual money order. If someone hands you a single USPS money order for $2,500, it is 100% a fake. No exceptions.

If you are buying them, you’ll need to show a photo ID if you’re purchasing $3,000 or more in a single day. This is part of federal anti-money laundering (AML) laws. The USPS is required to fill out a Form 8105-A if you hit that threshold.

Domestic vs. International

There’s a big difference between the green domestic money orders and the pinkish international ones. International money orders (especially for countries like Japan) have different verification hurdles. If you receive an international one, don't even try to guess. Take it to a main post office branch.

What to Do if You Find a Fake

Don't just throw it away. And definitely don't try to "pass it on" to someone else—that’s a federal felony.

If you realize you’ve been handed a counterfeit, you need to contact the U.S. Postal Inspection Service. These guys are the "silent service" of federal law enforcement, and they take mail fraud incredibly seriously. You can report it online at uspis.gov or call their tip line.

You should also keep the envelope it came in. The postmark is a piece of forensic evidence that helps investigators track where the scam originated.

Summary of Actionable Steps

If you are currently holding a money order and feeling unsure, do these four things in this exact order:

- Check the Limit: If the amount is over $1,000 on a single slip, stop. It’s fake.

- The Light Test: Hold it up to a window. Look for Ben Franklin and the vertical "USPS" strip. If you don't see both, it's a fake.

- The Digital Check: Use the USPS website or call 1-866-459-7822. If the serial number doesn't exist in their system, don't accept it.

- Cash at Source: Take it to a physical Post Office location to cash it rather than depositing it at your bank. This eliminates the "chargeback" risk if the document is fraudulent.

Postal money orders are great tools for those who don't want to use banks or need a guaranteed payment method. They’ve been around since the Civil War for a reason. But they only work if you know the rules of the game. If a deal feels too good to be true, or if the "buyer" is pressuring you to skip the verification steps, walk away. Your bank account will thank you.