You’re staring at your banking app. The balance is high—maybe higher than you’d like to admit. You see that "Minimum Payment Due" button. It looks so tempting. It’s small. It’s manageable. But honestly? It's a trap. If you only pay that minimum, you’re basically donating your future wealth to a multi-billion dollar bank. Using a credit card calculator monthly payment strategy is the only way to see the math for what it actually is: a math problem, not a character flaw.

Most people treat their credit card bill like a suggestion. It’s not. It’s a high-interest loan that compounds daily. If you have a $5,000 balance at a 24% APR—which is pretty standard these days—and you only pay the minimum, you’ll be paying that off for decades. Literally. You’ll pay back double or triple what you originally spent. That’s why you need to play with the numbers yourself.

Why Your Minimum Payment Is Designed to Keep You Broke

Banks aren't your friends. They’re businesses. Their goal is to keep you in debt for as long as possible because that's how they make interest. When you look at a credit card statement, the "minimum payment" is usually just 1% to 2% of your total balance plus the interest for that month. It covers the cost of the debt but barely touches the principal.

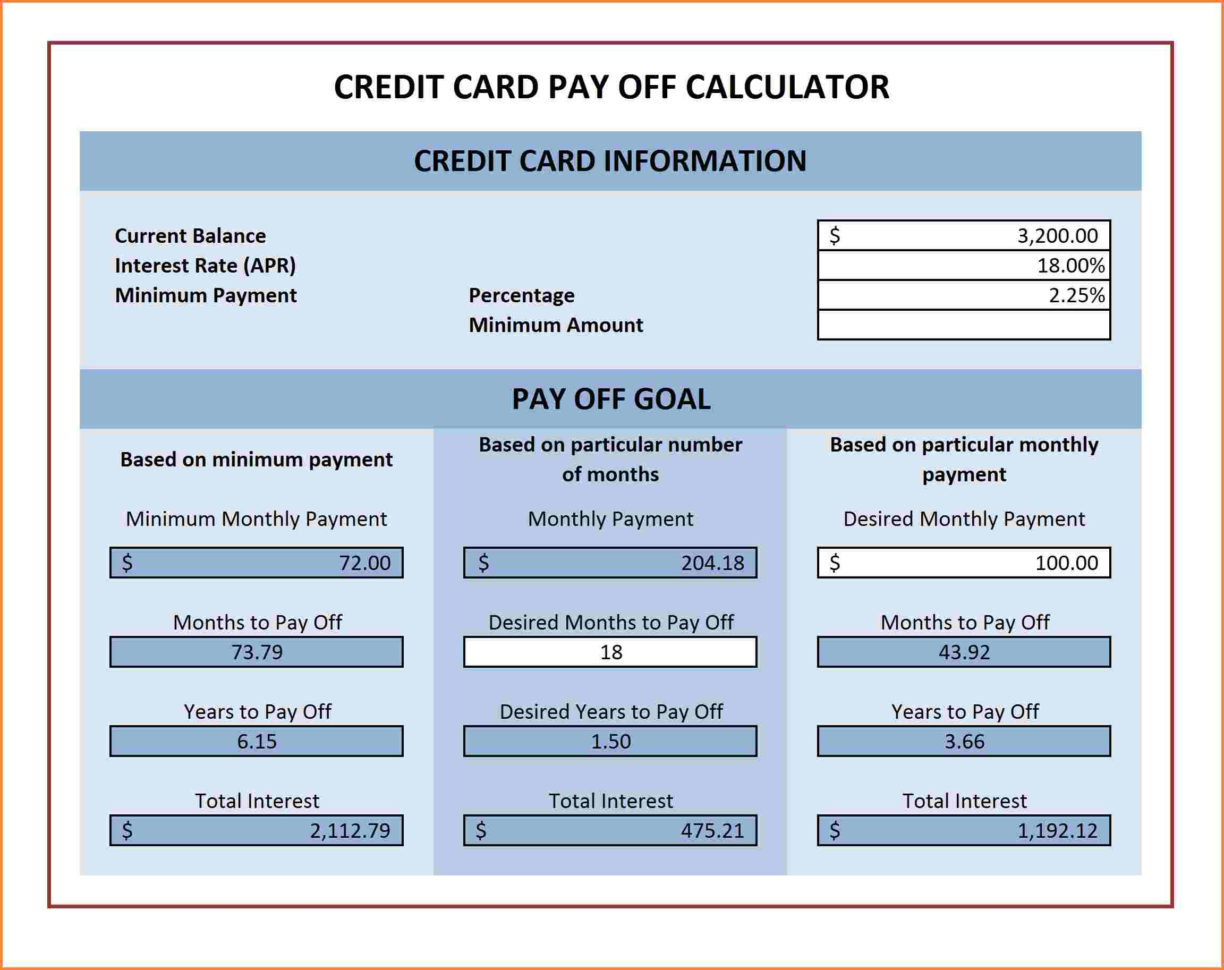

Think about it this way. If you owe $10,000 and your interest rate is 29%, your interest charge for the month is roughly $240. If your minimum payment is $250, you only actually "paid down" $10 of your debt. The rest just vanished into the bank's pocket. It’s a treadmill. You’re running fast, but you aren't going anywhere. This is exactly where a credit card calculator monthly payment tool becomes a wake-up call. It shows you the "years to pay off" and the "total interest paid" in stark, unyielding numbers.

The Psychology of the "Anchor"

There is this thing in behavioral economics called anchoring. The bank "anchors" your brain to that small minimum number. You see $85 and think, "I can do that!" even if you could actually afford $400. Once your brain sees that lower number, it feels like a win. It’s a lie. You have to break the anchor. You have to decide your monthly payment based on your goals, not the bank’s requirements.

How the Math Actually Works (The Boring but Crucial Part)

Let’s get into the weeds for a second. Credit card interest is usually calculated using something called the Average Daily Balance. Every day, the bank looks at what you owe, multiplies it by a daily periodic rate (your APR divided by 365), and adds that to a running tally. At the end of the billing cycle, they slap that total onto your balance.

✨ Don't miss: Jerry Jones 19.2 Billion Net Worth: Why Everyone is Getting the Math Wrong

When you use a credit card calculator monthly payment tool, you’re usually inputting three things:

- Your current balance.

- Your APR (Annual Percentage Rate).

- Your desired monthly payment or your goal payoff date.

If you plug in a $3,000 balance at 21% APR and tell the calculator you want to be done in 12 months, it’ll tell you that you need to pay roughly $280 a month. But here is the kicker: if you just pay the minimum, it might take you 11 years. Eleven years for a $3,000 purchase. That’s a car's lifespan. That's a whole childhood.

Variation in Interest Rates

Not all cards are created equal. A "low interest" card might be 15%, while a retail store card (like that one you got at the mall for 10% off your shoes) could be 32%. The difference in your credit card calculator monthly payment results for those two rates is staggering. On a $2,000 balance, the 32% card will cost you thousands more in interest over time if you don't aggressively pay it down.

Real World Example: The "Latte Factor" vs. The Interest Factor

We’ve all heard the annoying advice about skipping lattes to get rich. It’s mostly nonsense. However, skipping a $300 interest payment by being aggressive with your monthly payment? That’s real money.

Let's look at an illustrative example. Imagine Sarah. Sarah has $7,000 in debt across two cards.

🔗 Read more: Missouri Paycheck Tax Calculator: What Most People Get Wrong

- Card A: $3,000 at 18%

- Card B: $4,000 at 26%

If Sarah uses a credit card calculator monthly payment to set a fixed goal of $500 a month total, she can use the "Avalanche Method." She pays the minimum on Card A and throws every extra cent at Card B because it has the higher interest. Once Card B is gone, she moves all that money to Card A. This isn't just about math; it's about momentum. She saves months, maybe years, of payments and thousands in interest.

The Stealth Killers: Fees and Penalties

Calculators often miss the "hidden" stuff. If you miss a payment by one day, your APR might jump to a "penalty rate" of 29.99%. Suddenly, the monthly payment you calculated is useless because the interest is eating your progress even faster. And don’t get me started on annual fees. If you’re paying $95 a year for a "rewards" card but carrying a balance, those rewards are costing you a fortune. You're trading dollars for pennies.

Honestly, if you have a balance, stop using the card. Just stop. Every new purchase you make starts accruing interest immediately because you’ve lost your grace period. Most people don't realize this. Usually, if you pay your full balance every month, you get a 21-25 day "grace period" where interest doesn't charge. But the moment you carry even $1 over to the next month, that grace period vanishes. Every pack of gum or gallon of gas you buy starts ticking with 25% interest the second you swipe.

Why "Discover" and "Google" Searchers Get This Wrong

People often search for a credit card calculator monthly payment when they are already in over their heads. They’re looking for a magic wand. But the calculator is a mirror, not a wand. It shows you the reality of your situation.

The biggest mistake? Only looking at the monthly amount. You need to look at the Total Cost of Credit. That’s the real number. If you buy a $1,200 laptop and end up paying $2,100 for it over three years, that laptop didn't cost $1,200. It was a $2,100 laptop. Once you frame it that way, your motivation to increase that monthly payment usually skyrockets.

💡 You might also like: Why Amazon Stock is Down Today: What Most People Get Wrong

Strategic Moves to Lower That Payment

If the calculator tells you that you need to pay $600 a month to hit your goal but you only have $400, you have options. They aren't fun, but they work.

- Balance Transfer: Moving your debt to a 0% APR card for 12-18 months. This stops the bleeding. Every penny of your credit card calculator monthly payment goes toward the actual debt. Just watch out for the 3-5% transfer fee.

- Debt Consolidation Loan: Usually, a personal loan has a lower rate than a credit card. If you can get a loan at 12% to pay off a 28% card, do it. Your monthly payment becomes fixed and predictable.

- Hardship Programs: Believe it or not, you can call the bank. Tell them you’re struggling. Sometimes—not always—they’ll lower your rate temporarily if it means they actually get paid.

The Nuance of Credit Scores

Does a high monthly payment help your score? Yes and no. Your credit score cares about "Utilization." That’s the ratio of what you owe to your total limit. If you have a $5,000 limit and owe $4,500, your score is tanking. By using a credit card calculator monthly payment to aggressively target that balance, your utilization drops, and your score usually jumps.

But wait. Don't close the card once it’s paid off. The "age of credit" matters too. Just pay it off, put it in a drawer, and maybe use it once every six months for a small coffee just to keep the account active.

Moving Toward Action

Stop guessing. Most people fail because they "pay what they can" at the end of the month. That’s a losing strategy. By then, the money is gone. You’ve spent it on takeout or a new shirt. You have to treat your credit card payment like a non-negotiable bill, like rent or electricity.

Step-by-Step Execution Plan

- Audit Your Rates: Open every app. Write down the exact APR for every card you own. Don't guess.

- Find Your Total: Add up all the balances. It might be scary. Do it anyway.

- Run the Numbers: Use a credit card calculator monthly payment to find out what it takes to be debt-free in 24 months.

- Automate: Set up an auto-pay for that amount the day after you get paid. If you wait until the end of the month, you’ve already lost the battle against your own spending habits.

- The "Plus Ten" Rule: If you can't afford a massive increase, just add $10. Then next month, add another $10. It sounds small, but over time, it compounds in your favor instead of the bank’s.

Debt is a weight. It’s a monthly tax on your future self. Using a calculator isn't just about math; it's about taking back control. It’s about deciding that you’re done paying for the past so you can start paying for your future. The numbers don't lie, even when we try to lie to ourselves.

Check your statements tonight. Run the calculator. Pick a date. Stick to it. The peace of mind that comes with a zero balance is worth more than anything you can buy with that plastic card.

Actionable Insights for Today:

Gather your statements and identify the card with the highest APR. Use a calculator to determine the exact amount needed to pay it off in 12 months. Set your autopay to that specific number today, even if it requires cutting a small subscription or dining out less this week. Moving from a variable "what I can afford" payment to a fixed "what I must pay" amount is the single most effective way to eliminate credit card debt permanently.