You’re standing in line at a grocery store, or maybe you're just sitting on your couch staring at a "Payment Due" text message that feels slightly accusatory. We’ve all been there. Managing a modern wireless account isn't exactly a hobby most people enjoy. But when it comes time to pay T-Mobile phone bill, the "Un-carrier" actually gives you a surprising number of ways to get it done, though some are definitely better than others. Honestly, some methods are just plain annoying if you’re trying to save five bucks or avoid a "support fee."

Let’s get real for a second. The way we handle mobile payments has shifted. Gone are the days of mailing a check and crossing your fingers that the USPS doesn't lose it in a sorting facility in Nebraska. Now, it’s all about apps, automated clearing houses, and avoiding that dreaded $5 in-store payment fee. Yes, T-Mobile charges you to pay them in person. It’s a bit of a quirk, but that’s the reality of the current telecom landscape.

The AutoPay Discount Dilemma

If you want the best price on your Magenta or Go5G plan, AutoPay is basically mandatory. T-Mobile offers a $5 per line discount (up to 8 lines) if you set up automatic payments. However, there was a massive shift in 2023 that still trips people up. To get that discount now, you have to link a debit card or a bank account.

📖 Related: How to Sync Beats Earbuds Without Losing Your Mind

Using a credit card? You’ll likely lose the discount. This was a move to reduce processing fees for the company, but it annoyed a lot of customers who liked stacking credit card rewards or relied on the cell phone protection insurance offered by cards like the Amex Platinum or Wells Fargo Autograph. If you value that $5 to $40 monthly savings, you’ve gotta hand over the debit info. It’s a trade-off.

Some people are nervous about linking a bank account directly. That makes sense. Security breaches happen—T-Mobile has had its fair share over the last decade. A smart workaround is setting up a secondary "bills only" checking account at a digital bank like Ally or Chime. You transfer only what you owe for the month, keep the AutoPay discount, and keep your main savings account isolated from the billing system.

Using the T-Life App (Formerly T-Mobile Tuesdays)

The app situation is a little confusing right now. T-Mobile rebranded their primary "perks" app to T-Life. It’s supposed to be the "everything" app where you manage your home internet, your phone plan, and your free MLB.TV subscriptions.

Open the app. Hit the "Payments" tab. It’s usually right there at the bottom. The interface is clean, but it can be laggy on older iPhones. You can make a one-time payment here using Apple Pay or Google Pay, which is incredibly convenient if you don't want to type in your 16-digit card number while sitting on the bus.

One thing people often overlook is the "Split Payment" feature. If you’re on a family plan and your brother is late with his share of the bill, you don't have to pay the whole thing yourself. You can pay a specific amount and leave the balance for later. Just be careful; if the full balance isn't settled by the due date, the primary account holder is the one who takes the credit hit.

Guest Pay: The "I Forgot My Password" Lifesaver

We’ve all forgotten a password. It’s a universal human experience. T-Mobile’s Guest Pay feature is the unsung hero for people who are locked out of their My T-Mobile account or just don't feel like dealing with two-factor authentication.

You go to the T-Mobile website, click on "Pay as Guest," and enter the phone number. That’s it. You don't need the PIN. You don't need the password. You just need a valid payment method. This is also how parents often pay for their kids' lines if they aren't on a shared family plan. It’s fast. It’s dirty. It works.

Why Guest Pay is Risky

- You don't get a detailed PDF of your bill.

- You can't see if there are weird third-party charges.

- There's no way to dispute a specific line item during the process.

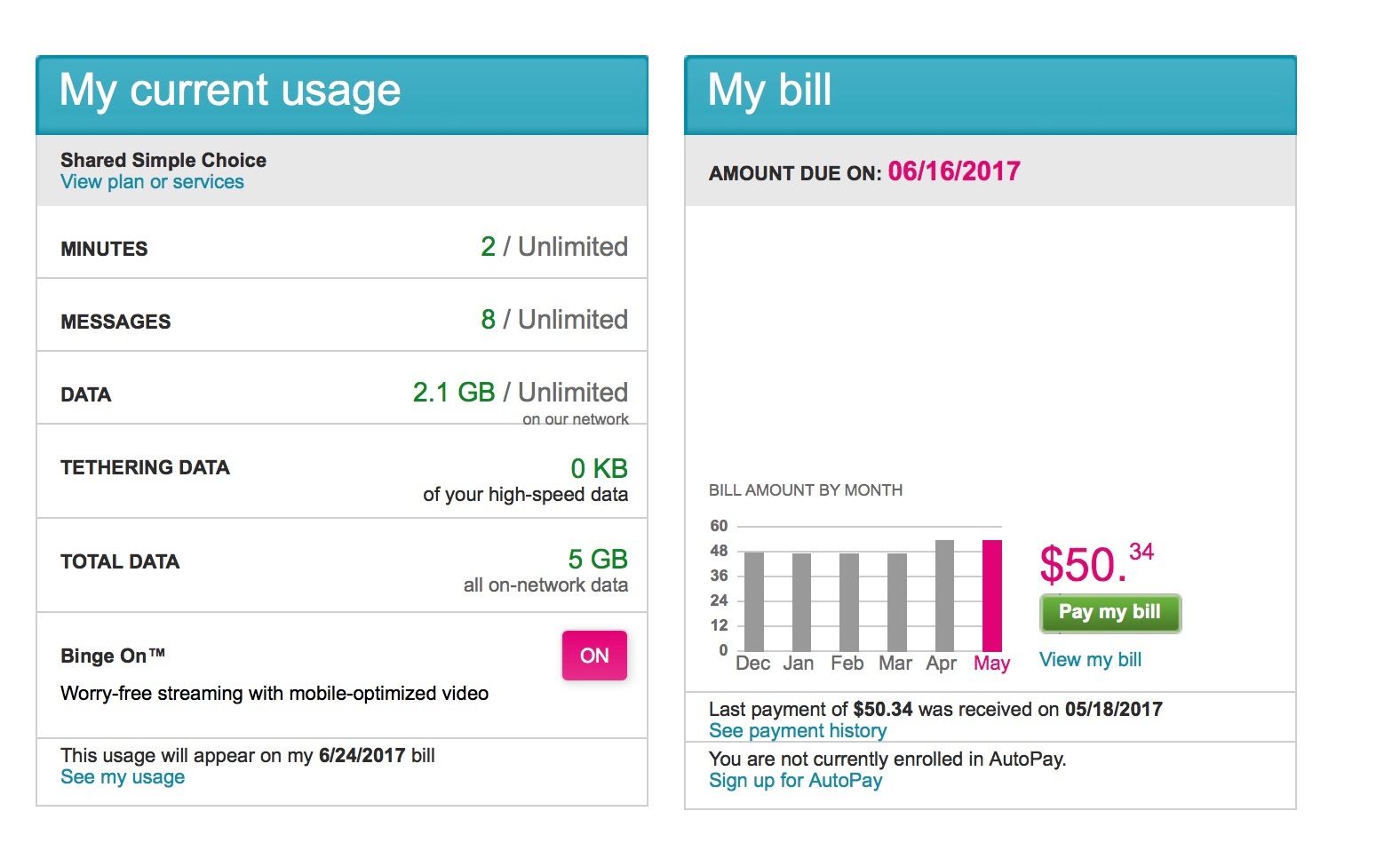

If your bill is suddenly $20 higher than usual, don't use Guest Pay. Log in. Look at the "Usage" and "Equipment" sections. Sometimes a promotional credit drops off, or a "free" line suddenly starts charging you because of a system glitch. You won't see that in the guest portal.

Dealing with the In-Store "Support Fee"

If you walk into a T-Mobile retail store to pay your bill, be prepared. They will charge you a Payment Support Fee, which is currently $5. It feels like a "convenience fee" for the company, not for you. The only real reason to pay in-store is if you are paying with cash.

Maybe you’re a gig worker and you’ve got a stack of twenties from tips. Fine. But if you have a card in your pocket, just pull out your phone and do it through the app while standing in the store. You’ll save enough for a cheap latte.

If you absolutely must pay in person, try to find a T-Mobile Authorized Retailer versus a Corporate Store. Sometimes the rules vary slightly, but generally, that $5 fee is a company-wide mandate to push people toward digital self-service.

What Happens if You're Late?

Life happens. Maybe the paycheck didn't hit on Friday like it was supposed to. T-Mobile is generally more "chill" than some of the older carriers, but they aren't a charity.

Usually, there is a grace period of a few days, but after that, you’ll see a late fee. This is typically $5 or 1.5% of the balance, whichever is greater. If you’re really struggling, the best move is to set up a Payment Arrangement.

You do this through the app or website before the due date. You can split your bill into two smaller payments spread out over two weeks. This keeps your service active. If your service gets suspended, you’ll have to pay a Restoral Fee, which is roughly $20 per line. That adds up fast on a family plan. If you have four lines, a simple missed payment could cost you an extra $80 just to get your data turned back on. That’s a nightmare.

Dialing #PAY from Your Phone

This is the "old school" way that actually still works. Dialing #PAY (#729) from your T-Mobile handset connects you to an automated system. It’s voice-activated or keypad-driven. It’s free. It’s surprisingly robust. If you're in an area with terrible data coverage but enough signal to make a call, this is your best bet to pay T-Mobile phone bill without needing a 5G connection to load a heavy website.

👉 See also: AP Physics 1 Sample Test: Why Your Score is Probably Lying to You

International Payments and Third-Party Scams

A word of caution: if you are traveling abroad and trying to pay your bill, use a VPN or the official app. There are tons of "Bill Pay" websites that look vaguely like T-Mobile but are actually third-party processors. They charge a "service fee" and sometimes take 3-5 days to actually send the money to T-Mobile. Stick to the official channels.

Also, T-Mobile will never call you and demand payment via a gift card. If someone calls saying your service will be cut off unless you read them the numbers on the back of a Target gift card, hang up. It sounds obvious, but these scams are sophisticated and often target elderly users or those who are stressed about their bills.

Actionable Steps for a Better Billing Experience

To make this whole process less of a headache, follow this checklist:

- Audit your AutoPay: Check if you are using a debit card. If you're using a credit card, you are likely overpaying by $5 per line every single month.

- Set up a "Bill" Account: Open a separate, no-fee checking account specifically for your phone and utility bills to protect your main stash of cash.

- Download the T-Life App: Even if you hate extra apps, it's the fastest way to check for "phantom charges" before you click pay.

- Use #PAY in a Pinch: Bookmark the shortcode in your contacts. It’s the fastest way to pay if your data is throttled or the website is down for maintenance.

- Check for Employer Discounts: Many companies, especially in healthcare, education, and government, have "Workplace Discounts" that can be applied to your account. This doesn't change how you pay, but it definitely changes how much you pay.

Managing your wireless account doesn't have to be a chore. By picking the right method and avoiding those annoying retail fees, you can keep your service running and your bank account a little bit fuller. Just remember to check that itemized bill at least once a quarter; those little "protection 360" add-ons have a habit of appearing when you least expect them.