Look, the days of just clicking a "Buy" button and hoping for a moonshot are mostly behind us. If you're trying to figure out how to make money on Coinbase in 2026, you've probably noticed that the platform looks nothing like it did a few years ago. It's moved way beyond a simple exchange.

Honestly? Most people leave money on the table because they treat it like a digital vending machine. They buy some Bitcoin, watch the charts until they get a headache, and eventually sell when things get boring or scary. But if you're actually looking for a strategy, you have to dig into the ecosystem features that pay you just for existing in the space.

It's not just about price action anymore. It's about yield.

Staking is the New Savings Account (Sorta)

The biggest shift in how to make money on Coinbase is the normalization of staking. Back in the day, staking felt like some weird, technical wizardry you had to do in a terminal window. Now? It’s two taps on your phone.

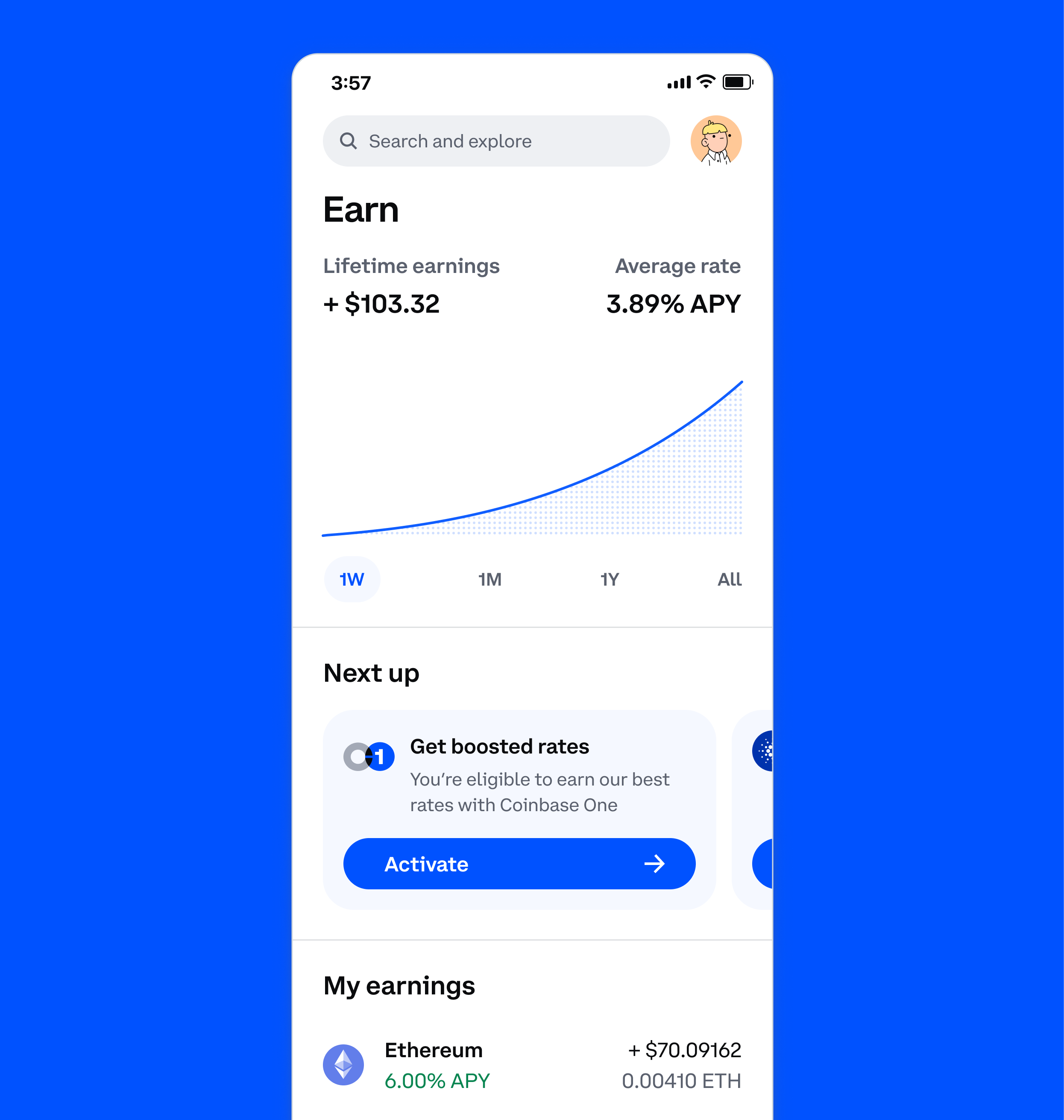

When you stake assets like Ethereum (ETH), Solana (SOL), or Cardano (ADA), you’re basically helping the network verify transactions. In exchange, the network pays you. Currently, the rates fluctuate based on how many other people are staking, but you’ll often see yields between 3% and 10% APY.

The Realities of the Lock-up

You’ve got to be careful here. Staking isn't "free" money without strings. When you stake your ETH, it’s often locked. You can’t just sell it the second the market crashes. Coinbase has introduced liquid staking options (like cbETH) which helps, but you need to understand that liquidity—the ability to turn your crypto back into cash instantly—is something you’re trading for that interest rate.

The USDC Reward Loop

If you're too nervous to hold volatile assets like Bitcoin, there’s the stablecoin route. Holding USDC on Coinbase is one of the lowest-effort ways to earn. As of early 2026, Coinbase offers around 3.5% to 5.1% APY just for holding USDC in your account.

👉 See also: Gold Per Gram Price Today in India: Why the Market is Spiking

It’s crazy because that’s higher than what most traditional banks offer for a "high-yield" savings account.

- No lock-ups: You can spend it or move it whenever.

- Monthly payouts: You see the "Rewards" tab tick up in real-time.

- Predictability: $1 always equals $1.

If you have a Coinbase One subscription (which costs about $30 a month), that USDC rate often gets a "boost." For some, the extra 1% or 2% in rewards pays for the subscription itself.

Turning Expenses Into Bitcoin

The Coinbase Card is probably the most underrated tool in the shed. It’s a Visa debit card. You spend your USD or USDC at the grocery store or for gas, and you get a percentage back in crypto.

In the past, they offered rotating rewards like 4% back in XLM or 1% in BTC. In 2026, the structure has shifted toward "Bitcoin-back" tiers. If you hold more assets on the platform, your reward percentage climbs.

Expert Note: If you’re a high-balance user (holding $50k+ on the platform), you can snag up to 4% back in Bitcoin. If you spend $2,000 a month on regular life stuff, that’s $80 in free Bitcoin every month. Over a year, that’s nearly $1,000 of "found" money.

Coinbase Wallet Quests: The Successor to Learn and Earn

You might remember the old "Learn and Earn" videos where you’d watch a 2-minute clip about a random token and get $3. Well, Coinbase officially retired that specific program in May 2025.

But it didn't really go away; it just evolved.

Now, the money is in Coinbase Wallet Quests. These are "on-chain" tasks. Instead of just watching a video, the app might ask you to "Swap $5 of ETH for Base" or "Mint an NFT on the Base network." Because Coinbase owns the Base network (a Layer 2 scaling solution), they are highly incentivized to pay you to use it.

These quests often pay out $5, $10, or even $20 in tokens like OP, AERO, or USDC. It requires a bit more technical comfort since you're moving assets into a self-custody wallet, but the rewards are significantly higher than the old quiz model.

📖 Related: The 4 Hour Work Week: Why Tim Ferriss’s Blueprint is Still Breaking Brains Two Decades Later

Advanced Trading: Cutting the "Convenience Tax"

If you're still using the "Simple" trade interface, you're losing money. Period.

The simple "Buy" button on the home screen carries a massive spread and a high flat fee. To make money, you have to keep your costs low. Switching to Coinbase Advanced (which is free for everyone) moves you into a "Maker/Taker" fee model.

- Simple Trade Fee: Can be as high as 3-4% for small amounts.

- Advanced Maker Fee: Usually around 0.40% or lower.

If you buy $1,000 worth of Bitcoin, the simple interface might charge you $30 or $40. The Advanced interface will charge you $4. That $36 difference is money that stays in your pocket (and in your investment).

Actionable Next Steps for 2026

If you want to stop clicking buttons and start a real strategy, here is exactly how to set it up:

💡 You might also like: The Enormous Problem With Giant Logistics: Why Bigger Isn't Always Better

- Audit your idle cash: If you have money sitting in a zero-interest checking account, move the "emergency fund" portion to USDC on Coinbase to capture the 3.5%+ yield.

- Toggle on Staking: Go to your settings and ensure staking is enabled for ETH and SOL. Even if you only have a few hundred dollars, the compounding effect over twelve months is real.

- Move to Advanced: Never use the "Simple" buy/sell UI again. Use limit orders to set the price you want and pay the lowest possible fees.

- Check Quests Weekly: Open the Coinbase Wallet app (the separate one, not the main exchange app) and look for Base network quests. These are basically the only "free" money left in the ecosystem.

The goal isn't to get lucky on a random "meme coin." The goal is to use the platform's own mechanics to build a balance that grows while you're asleep. Focus on the yield, minimize the fees, and use the card for your daily coffee. It adds up faster than you think.