Honestly, most people treat the stock market like a giant casino. They see a "cheap" stock trading at $5 and think they’ve found a bargain. But if you've ever picked up William O'Neil's classic, you know that’s basically the fastest way to go broke. How to make money in stocks O'Neil style isn't about finding bargains; it's about finding the fastest horses in the race and riding them until they start to tire.

O'Neil wasn't just some guy with a lucky streak. He founded Investor's Business Daily (IBD) and essentially codified a system that looked at what every great winning stock had in common right before it exploded. He called it CAN SLIM. It sounds like a late-night diet infomercial, but it’s actually a rigorous, seven-point checklist that filters out the junk.

🔗 Read more: How Did Andrew Tate Get Rich: The Truth About the Hustle

The CAN SLIM Breakdown: No, It’s Not a Diet

Most traders get impatient. They want to buy everything. O'Neil’s system is meant to make you incredibly picky. If a stock doesn't check these boxes, you don't touch it. Simple.

C: Current Quarterly Earnings

The "C" stands for current quarterly earnings per share (EPS). You’re looking for a massive jump—at least 25% compared to the same quarter last year.

Why? Because big institutions don't buy a stock because it has a "cool logo." They buy it because the company is printing money. If you see a company like Nvidia or a smaller biotech firm report a 50% or 100% earnings increase, that’s your first clue.

A: Annual Earnings Increases

A lucky quarter is one thing. But "A" requires a track record. O'Neil wanted to see annual earnings growth of at least 25% over the last three to five years. You want a company that's consistently getting better at what it does. This eliminates the "one-hit wonders" that happen to have one good product cycle then disappear.

N: New Product, New Management, or New Highs

This is where most people get scared. O'Neil's "N" suggests buying stocks that are making new price highs.

It feels counterintuitive. Our brains want to buy low and sell high. But O'Neil proved that stocks hitting new highs often keep going. Think about it: a stock at an all-time high has zero "overhead supply." Nobody is waiting to sell just to break even because everyone who owns it is in the green.

S: Supply and Demand

Basically, you want a stock with a relatively small "float"—the number of shares available to trade. If a company has a billion shares out, it takes a monumental amount of buying to move the needle. But if a company has 20 million shares and a sudden surge in demand, the price can skyrocket.

L: Leader or Laggard

Don't buy the "sympathy play." If the semiconductor industry is booming, don't buy the fourth-best company because it's "cheaper" than the leader. Buy the leader. The leader has a Relative Strength Rating (RS Rating) of 80 or higher. It’s outperforming 80% of the market. Laggards are just anchors for your portfolio.

I: Institutional Sponsorship

You need the "Big Boys" on your side. Look for stocks owned by at least a few top-performing mutual funds. Without the institutions (the pension funds and hedge funds) buying millions of shares, a stock won't have the fuel for a 100% or 200% run.

M: Market Direction

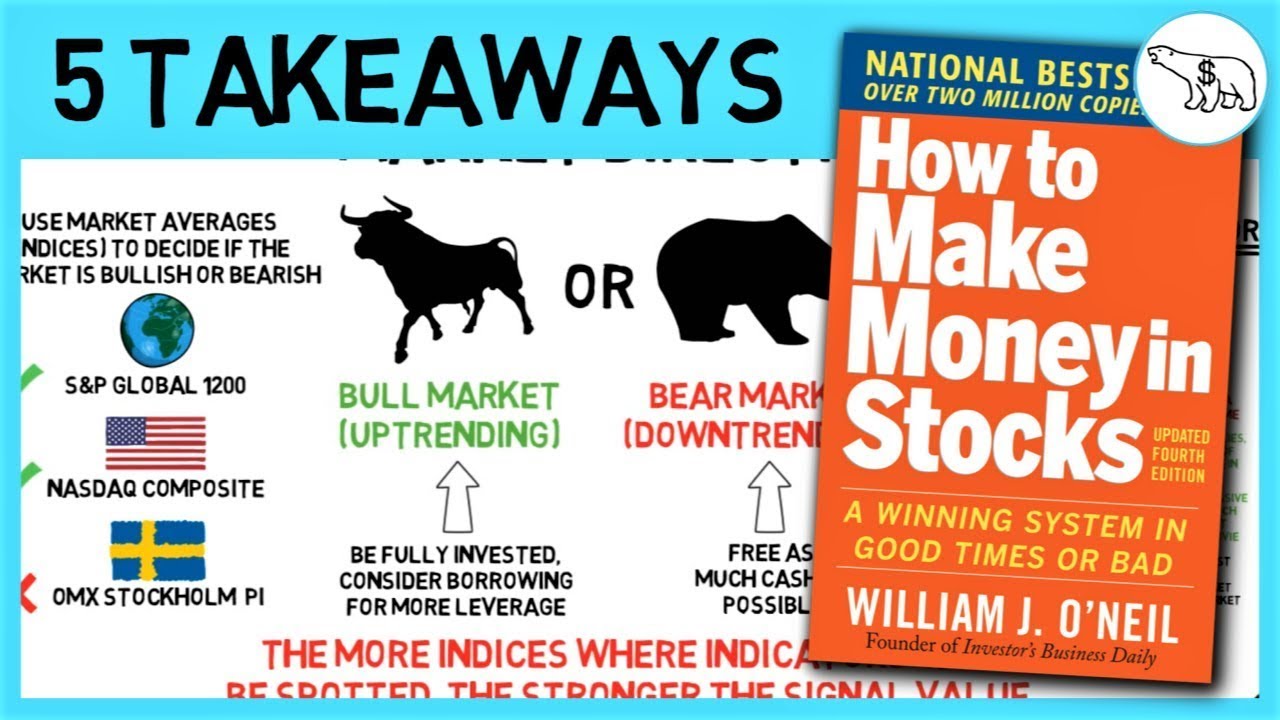

This is the most important part. You can have the perfect stock, but if the overall market is in a "Confirmed Downtrend" (a bear market), three out of four stocks will fall anyway. O'Neil famously used "distribution days"—days when the major indices closed down on higher volume—to spot a market top before it became a disaster.

🔗 Read more: Point Olema Capital Partners: What Most People Get Wrong About This High-Stakes Multi-Family Office

The Cup with Handle: The Only Chart You Really Need?

O'Neil loved the "Cup with Handle" pattern. It looks exactly like it sounds on a price chart.

The "cup" is a U-shaped recovery after a decline. It shows that the weak hands have been shaken out. The "handle" is a small, quiet drift downward or sideways on low volume. This is where the last few nervous sellers exit.

When the stock breaks out above the peak of the handle on massive volume (at least 40-50% above average), that's your cue.

"The whole secret to winning big in the stock market is not to be right all the time, but to lose the least amount possible when you're wrong." — William O'Neil

He wasn't kidding about the risk. One of his non-negotiable rules was the 8% stop-loss. If you buy a stock and it drops 8% below your purchase price, you sell. Period. No "hoping" it comes back. No "waiting for the next earnings report." You cut it and move on.

Why CAN SLIM is Harder Than It Looks

On paper, this sounds like a money-printing machine. In reality? It’s emotionally brutal.

You’ll find yourself buying a stock at $150 after it just jumped from $100. Your gut tells you it's "too high." Then, you have to sell it at $138 if it hits your stop-loss, only to watch it potentially go to $300 a month later.

It requires a level of discipline that most humans just aren't wired for. You’re essentially training yourself to ignore your "bargain-hunting" instincts.

Real-World Nuance: Does it Still Work in 2026?

The market has changed. High-frequency trading and AI-driven algos mean breakouts can be more volatile now than they were in the 90s.

Sometimes a stock will "undercut" its handle just to freak out the retail traders before it actually takes off. You’ve gotta be a bit more flexible with your entries, maybe buying a "pocket pivot" (an internal volume signature) rather than waiting for the classic breakout.

But the core of how to make money in stocks O'Neil advocated—earnings growth and institutional demand—is timeless. Whether it’s 1960 or 2026, money follows growth.

✨ Don't miss: How to Change Chase PIN Settings Without Getting Locked Out

Actionable Steps to Get Started:

- Get a Charting Tool: You can't do this without seeing volume. Use something like MarketSurge (formerly MarketSmith) or TradingView.

- Run a Screen: Filter for stocks with EPS growth > 25% and an RS Rating > 80.

- Watch the Market Pulse: Don't buy anything if the S&P 500 and Nasdaq are consistently closing lower on high volume.

- Start Small: Don't put your whole life savings into one breakout. Try a few small positions to get a feel for the "8% rule."

The goal isn't to be a genius. It's to be a disciplined follower of what the big money is doing. If you can stop looking for bargains and start looking for leaders, you're already ahead of 90% of the people in the market.