You've probably seen that thick, navy blue book sitting on the shelf of every serious trader you know. It’s been around for decades. Yet, most people who crack open How to Make Money in Stocks by William O'Neil end up losing money anyway. Why? Because they treat it like a rigid textbook instead of a volatile, living philosophy.

O’Neil wasn't just some guy with a theory. He founded Investor’s Business Daily. He bought a seat on the NYSE at age 30. He was obsessed with data long before "big data" was a buzzword. His core realization was simple: the biggest winners in stock market history all shared specific, measurable traits before they went on massive runs. He called this the CAN SLIM system.

But here is the kicker. Most people get the "CAN" part right and completely ignore the "SLIM" part, or they buy at the exact moment O'Neil would tell them to run for the hills.

The CAN SLIM Blueprint is Not a Suggestion

If you're looking for "value" stocks—those dusty, unloved companies trading at a discount—you're reading the wrong book. O'Neil hated value investing. He thought buying a stock because it was "cheap" was a great way to stay broke. He wanted the Ferraris, not the used sedans.

The C stands for Current Quarterly Earnings. We aren't looking for "okay" growth here. We are looking for explosions. O’Neil insisted on seeing earnings per share (EPS) up at least 18% to 20%, though 50% or 100% is better. If a company isn't accelerating its profit, it isn't an O'Neil stock. Period.

Then there is A, or Annual Earnings Increases. You want to see a three-year track record of growth. It’s about consistency. Then N—the New factor. This is the one people miss. It’s a new product, a new management team, or a new high in the stock price. Most retail investors are terrified of buying a stock at an all-time high. O’Neil argued that’s exactly when you should buy. It’s a sign of strength, not a sign that it’s "too expensive."

✨ Don't miss: Funny Team Work Images: Why Your Office Slack Channel Is Obsessed With Them

The Secret Sauce of Supply and Institutional Support

The middle of the acronym is where things get technical. S is for Supply and Demand. O’Neil preferred stocks with a smaller "float"—fewer shares available—because it takes less buying pressure to send the price to the moon.

L stands for Leader or Laggard. Honestly, this is where your ego gets in the way. People love an underdog. They want to buy the stock that’s down 40% hoping for a "bounce." O’Neil would tell you that’s a loser’s game. You buy the leaders. You buy the stock that is outperforming 80% or 90% of the rest of the market. Use the Relative Strength (RS) Rating. If it’s below 80, don’t touch it.

Then comes I, for Institutional Sponsorship. You want the "big boys" on your side. Mutual funds, banks, and pension funds move markets. You’re looking for stocks that have an increasing number of institutional owners. But you don't want too many owners. If everyone already owns it, who is left to buy?

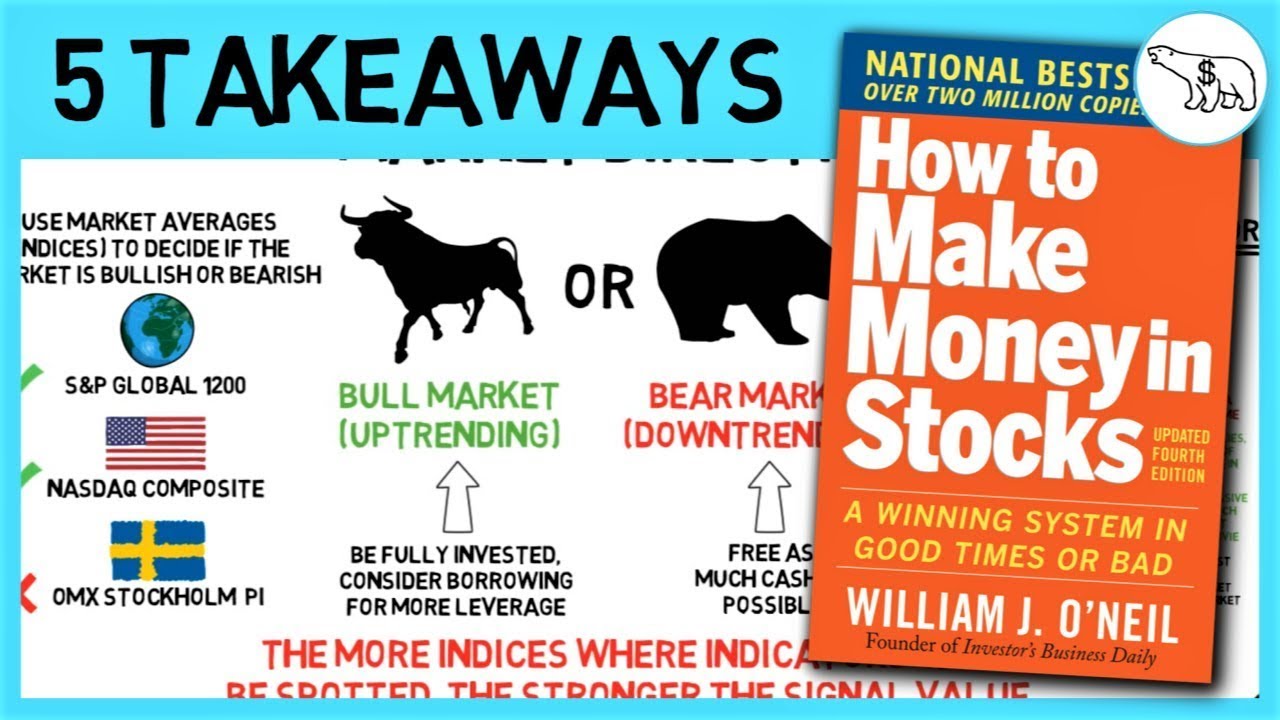

Finally, M. The Market Direction. This is the most important letter. You can have a perfect CAN SLIM stock, but if the overall market is in a downtrend, three out of four stocks will fall with it. O'Neil didn't use a crystal ball. He looked at the daily charts of the S&P 500 and Nasdaq to identify "distribution days"—days where the volume is higher than the day before but the price closes lower. Too many of those? Pack your bags. The party is over.

Charts: The Language of the Market

If you think technical analysis is astrology for men, William O'Neil would disagree. Loudly. He spent his life studying "cup with handle" patterns.

🔗 Read more: Mississippi Taxpayer Access Point: How to Use TAP Without the Headache

It sounds silly. A cup? With a handle? But it represents a very specific human psychology. The "cup" is a period of consolidation where weak-handed investors get bored and sell. The "handle" is a final shakeout on low volume. When the stock breaks out above the rim of that handle on massive volume, that is the "pivot point."

That is your entry. Not a penny before.

He was incredibly disciplined about this. If you buy early, you’re gambling. If you buy more than 5% above the pivot point, you’re "extended" and likely to get caught in a natural pullback. It’s a game of inches.

Why You Will Probably Fail (And How Not To)

Most people fail with How to Make Money in Stocks by William O'Neil because they lack the stomach for his sell rules. O'Neil had one absolute, non-negotiable commandment: Cut every single loss at 7% or 8%. No exceptions.

No "giving it room to breathe."

No "waiting for it to come back."

He viewed his portfolio like a garden. You pull the weeds and water the flowers. Most investors do the opposite. They sell their winners to "lock in a profit" and hold their losers "until they break even." O'Neil called this financial suicide.

💡 You might also like: 60 Pounds to USD: Why the Rate You See Isn't Always the Rate You Get

He also advocated for "pyramiding." This means you add to your winners as they go up. It feels counterintuitive to buy more of something at a higher price, but O’Neil’s data showed that winners tend to keep winning. You start with a "pilot" position. If it goes up 2%, you add a bit more. If it hits that 7% loss mark, you kill it. You keep your losses tiny and your wins massive.

The Modern Reality of O'Neil's Strategy

Is this still relevant in 2026? Yes and no. High-frequency trading and AI algorithms have made breakouts "choppier" than they were in the 1990s. Sometimes handles are deeper. Sometimes the market "undercuts" a low just to scare you out before the real move happens.

But the core of the book—identifying high-growth companies supported by big institutions during a bull market—is timeless. You can see it in the runs of companies like Nvidia or Tesla. They followed the CAN SLIM script almost perfectly before their historic surges.

One thing to watch out for: The "M" (Market Direction) is harder to read now because of the influence of the Fed and massive passive index flows. You have to be even more sensitive to volume than O'Neil was.

Actionable Steps to Execute the O'Neil Method

To actually use these insights, you need a workflow. It isn't enough to just read the book and feel inspired.

- Get a screening tool. You can use MarketSurge (formerly MarketSmith, which O’Neil’s company created) or TradingView. Set up a screen for stocks with an RS Rating above 80 and EPS growth above 25%.

- Stop bottom fishing. Delete the stocks from your watchlist that are trading below their 200-day moving average. O'Neil never bought a stock in a downtrend.

- Master the Cup with Handle. Study historical charts. Look at the "Greatest Stock Market Winners" section in the back of the book. Look at how the volume dries up in the handle and explodes on the breakout.

- The 8% Rule. Next time you buy a stock, immediately set a stop-loss at 7% or 8% below your purchase price. If it hits, sell it without thinking. Treat it like an insurance premium you paid to stay in the game.

- Wait for the Follow-Through Day. Don't try to time the exact bottom of a market crash. Wait for a "Follow-Through Day" (FTD)—a big gain on huge volume usually occurring between day 4 and day 10 of a new rally attempt. This is the signal that the "M" is turning back to your favor.

The beauty of How to Make Money in Stocks by William O'Neil isn't that it's easy. It’s that it’s a system. It removes the "hope" and replaces it with math. Most people can't handle the discipline it requires, which is exactly why the rewards for those who can are so significant. Success here isn't about being right 100% of the time. It’s about being spectacularly right 20% of the time and admitting you’re wrong the other 80% before it ruins you.