Let’s be real. Most of us haven't stepped foot inside a physical bank branch in years. We do everything on our phones while sitting on the couch. But then, life happens. You’re applying for a mortgage, trying to get a visa for a trip to Italy, or maybe you’re dealing with a high-stakes business audit. Suddenly, a standard PDF download from your mobile app isn't enough. You need the "holy grail" of banking documents: a bank statement or letter signed by a bank official at Chase.

It sounds simple. It’s just a signature, right? Wrong.

If you walk into a Chase branch unprepared, you might be met with a blank stare or told that "we don't do that here." Banking regulations and internal security protocols have made getting a manual signature on a document surprisingly complicated. Chase, like most "Big Four" banks, has moved toward automation. They want you to use their digital portals. However, when a third party—like the IRS or a foreign consulate—demands a "wet ink" signature or a specific verification letter, you have to know how to navigate the Chase hierarchy to get it done.

Why a Standard Download Often Fails

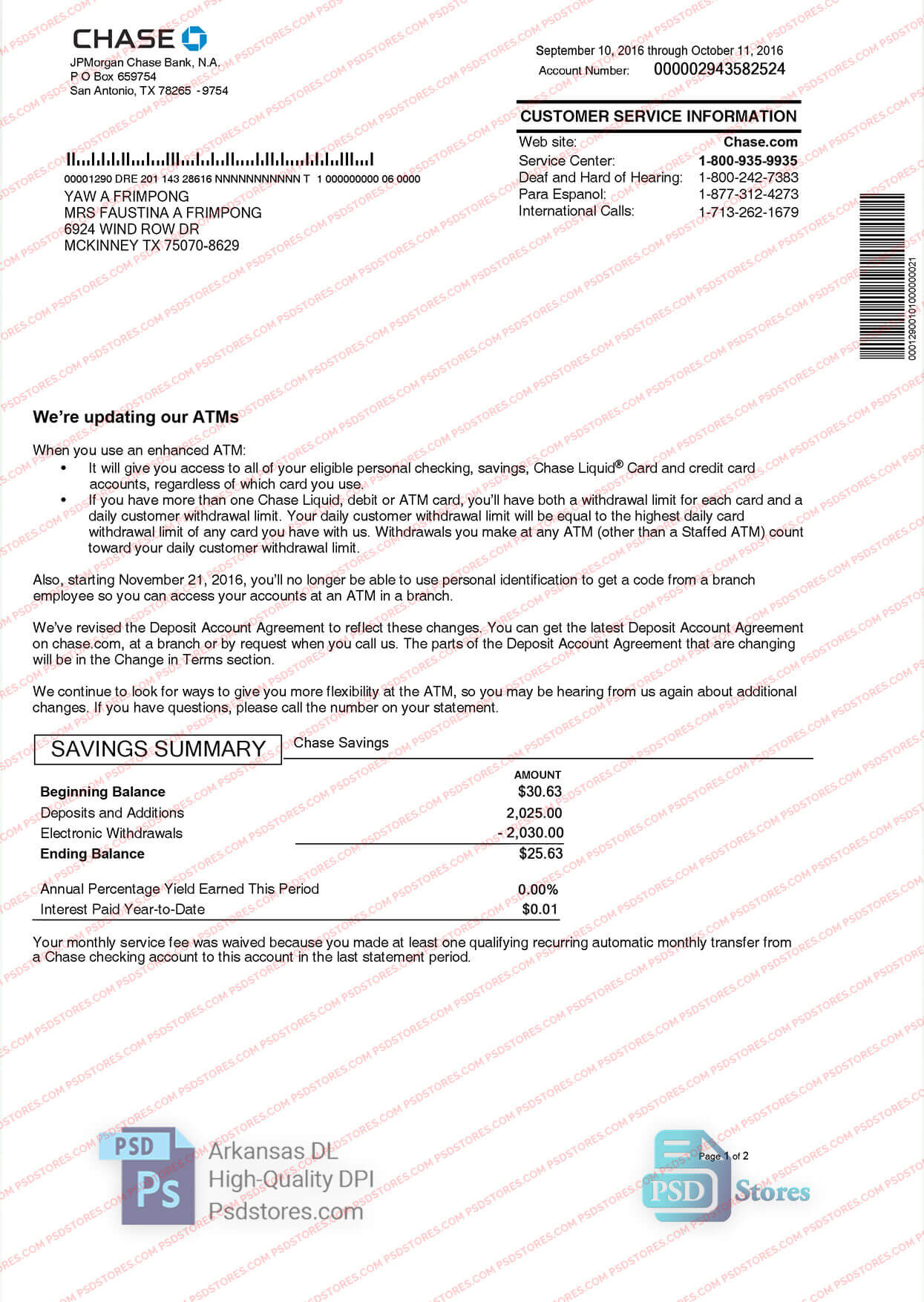

Most people think a bank statement is a bank statement. Honestly, it usually is. But the "official" part changes the game. A standard electronic statement is just data printed on a template. It lacks a human validator.

When you're dealing with a Proof of Funds (POF) requirement for a real estate closing, the title company or the seller’s attorney might be skeptical of a printed PDF that anyone with a basic knowledge of "Inspect Element" could have faked. They want a letter on bank letterhead, signed by a Chase officer, confirming the balance is real and the account is in good standing. This isn't just about the money; it’s about the liability. A signature puts the bank’s reputation on the line.

Getting a Bank Statement or Letter Signed by a Bank Official at Chase: The Reality

Chase officials, particularly tellers, are often restricted from signing documents that they didn't personally generate through their internal system. If you bring in a document you wrote yourself and ask them to sign it, they will say no. Every time. It’s a massive liability risk for them.

To get a bank statement or letter signed by a bank official at Chase, you basically have two paths. You can try the "Letter of Verification" or the "Certified Statement" route.

✨ Don't miss: Rough Tax Return Calculator: How to Estimate Your Refund Without Losing Your Mind

The Letter of Verification (Form 1442)

Chase has a specific internal process for what they call a "Standard Bank Confirmation." In many cases, if you need a letter for a visa or a mortgage, the banker will pull up a standardized template. It’s clean, it’s professional, and it includes the Chase logo. This is much easier for them to sign because the system populates the data. They aren't "guessing" your balance; the software is telling them what to write.

The "Certified" Statement Stamp

If you specifically need an existing monthly statement to be "official," you’re looking for a certification. A banker can print your statement from their terminal, and then use a physical stamp—often a round or rectangular teller stamp—and sign across it. This "certifies" that the document is a true and correct copy of the bank’s records.

Don't expect them to sign a statement you printed at home. They can’t verify that you didn't change the numbers in Photoshop before you walked in. They have to be the ones to hit "Print."

The "Notary" Misconception

Here is where a lot of people get tripped up. You might think, "I'll just get the bank statement notarized."

Chase branches usually have a Notary Public on staff. But here’s the kicker: A notary does not verify the content of the document. They only verify the identity of the person signing it. If you ask a Chase notary to notarize your bank statement, they will likely refuse. Why? Because the bank (the entity) is the one "issuing" the statement, and a notary cannot notarize a document where they have a conflict of interest or where the bank itself is the party of interest.

Instead, what you actually want is a sworn affidavit or a Letter of Identity, but honestly, just stick to the bank official's signature. It carries more weight in financial circles than a random notary seal.

🔗 Read more: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

Dealing with the "I Can't Sign That" Response

If you run into a banker who is hesitant, don't get frustrated. They are trained to be risk-averse. Banks are terrified of fraud.

Ask for a Personal Banker or a Branch Manager. Tellers have the least amount of authority when it comes to signing non-standard documents. A Branch Manager has more leeway. If you're a Private Client member, use that leverage. Chase Private Client customers have dedicated bankers who are much more willing to go the extra mile to produce a custom letter.

Specific details to ask for in your letter:

- Account opening date.

- The current balance (obviously).

- The average balance over the last 6 or 12 months (this is huge for mortgage lenders).

- The status of the account (e.g., "Active and in good standing").

- The banker's printed name and direct office phone number.

Without that phone number, the person receiving the letter can't verify it. And if they can't verify it, the signature is basically useless ink.

Is There a Fee?

Sometimes. Chase is a business, after all. While a standard monthly statement download is free online, asking a banker to spend 20 minutes drafting a custom letter or certifying five years of records might trigger a research fee. Usually, it's around $25 to $35, but it varies by the complexity of the request and your account tier.

Honestly, if you have a Premier Plus or Sapphire Checking account, they’ll often waive it as a courtesy. Just ask nicely.

💡 You might also like: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

The Timeline Problem

Do not wait until the day before your flight or your closing. Getting a bank statement or letter signed by a bank official at Chase can sometimes take 24 to 48 hours if the Branch Manager is out or if they need to send the request to a centralized "back office" for verification.

While most branches can print and sign a "Verification of Deposit" (VOD) on the spot, more complex letters—like those required for international business transitions or EB-5 investor visas—might require a "Corporate Seal." That is a whole different level of bureaucracy that a local branch might not be able to handle instantly.

Real-World Example: The Visa Application

I once saw a guy trying to get a Spanish Digital Nomad visa. The consulate was incredibly picky. They didn't just want a Chase statement; they wanted it signed by a "manager-level official" and they wanted it translated.

He went to three different Chase branches in Manhattan before he found a manager who understood the assignment. The first two told him it was "against policy" to sign anything. The third manager realized that the "Standard Bank Letter" template in their system met all the consulate's requirements. It just took finding someone who knew how to navigate their own software.

The lesson? If one branch says no, try the one three blocks away. Policies are the same, but the interpretation of those policies varies wildly from person to person.

Essential Action Steps

If you need this document today, here is your game plan:

- Identify the exact requirements. Ask the person requesting the document if they need a "Verification of Deposit" (VOD), a certified statement, or a custom letter on letterhead.

- Make an appointment. Don't just walk in during the lunch rush. Use the Chase mobile app to schedule a meeting with a "Personal Banker." This ensures you have their undivided attention.

- Bring your ID and account details. Sounds obvious, but you’d be surprised.

- Request a "Letter of Verification." Use that specific terminology. It’s what is in their system.

- Check for the "wet signature." Ensure they sign it with a blue or black pen. Some institutions reject digital or stamped signatures.

- Get a business card. Staple the banker’s business card to the letter. It adds an extra layer of legitimacy for whoever is reviewing your paperwork.

Following these steps won't guarantee a "yes" every time, but it significantly lowers the friction. Most of the time, the "no" you get at a bank is just a result of a communication gap. Speak their language, understand their constraints, and you'll get your signature.

Key Takeaway: Banks are moving away from manual signatures, so you must be specific about needing a "Certified Statement" or a "Letter of Verification" (Form 1442) rather than just a "signed paper." Always work with a Personal Banker or Branch Manager for the best results. High-tier account holders (Private Client/Sapphire) usually have an easier time bypassing the "standard policy" hurdles. Ensure any letter includes the banker's contact info for third-party verification.