You're standing at a car dealership, or maybe you're finally setting up that high-yield savings account you promised yourself you'd open months ago. Then it hits you. You need that string of digits—the account number. Not the one on the front of your sapphire-blue debit card. That's just the card number. I’m talking about the actual internal identifier for your Chase checking or savings account.

Finding it should be easy, right?

Well, it is, but only if you know exactly where the "Settings" button is hiding this week or which corner of a PDF statement holds the golden ticket. Honestly, banks don't always make this intuitive. They bury these numbers behind layers of encryption and "security features" that, while great for stopping hackers, are kind of a pain when you're just trying to finish a wire transfer before the 4:00 PM cutoff.

If you need to get Chase account number details quickly, there are about four reliable ways to do it. Some are instant. One involves digging through your junk drawer for a checkbook you haven't touched since 2019.

The Mobile App Is Usually Your Best Bet

Most people have the Chase Mobile app glued to their thumb. It’s the fastest way. Once you log in—hopefully with FaceID because typing passwords is a relic of the past—you’ll see your accounts listed right there on the home screen. Tap the specific account you're curious about. You might think the number would just appear, but Chase masks it. You'll see something like "Checking (...1234)."

To see the whole thing, you have to tap "Show details" or "Account details." It’s usually tucked right under the "Present Balance" header. One more tap on the eye icon or the "See full account number" link, and there it is.

Quick tip: don't screenshot this. Chase actually blocks screenshots on Android for security reasons, and on iPhone, it’s just a bad habit to keep unmasked bank numbers in your photo gallery. Use the "Copy" button if it's there, or just write it down on a physical scrap of paper and then shred it.

What If the App Is Glitching?

Apps fail. Servers go down. If the app is spinning its wheels, jump over to the browser.

The desktop experience is actually a bit more robust for finding "boring" administrative data. Log in to Chase.com. On the main dashboard, click on the account name. Look for the "Account services" tab or just the "Show details" arrow near the top of the page. It’s the same logic as the app but usually loads faster if your cell signal is weak.

Paper Statements: The Old School Method

If you aren't enrolled in paperless billing, you probably have a stack of mail on your kitchen counter. Every single Chase statement—whether it's for a Total Checking account, a Premier Plus account, or a basic savings—has the full account number printed on it.

✨ Don't miss: 16000 won to usd: Why This Specific Amount Matters Right Now

Usually, you’ll find it in the top right-hand corner of the first page. It's often grouped with the "Statement Period" and the "Customer Service" phone number.

But what if you are paperless?

You can still access these PDFs. In the app or online, look for "Statements & Documents." Download the most recent month. Open the PDF. Boom. The full number is there, unmasked. This is actually the most "official" way to verify the number if you’re providing it to an employer for direct deposit, as they sometimes want to see a voided check or a statement header to prove the account belongs to you.

Your Checkbook Isn't Just for Rent

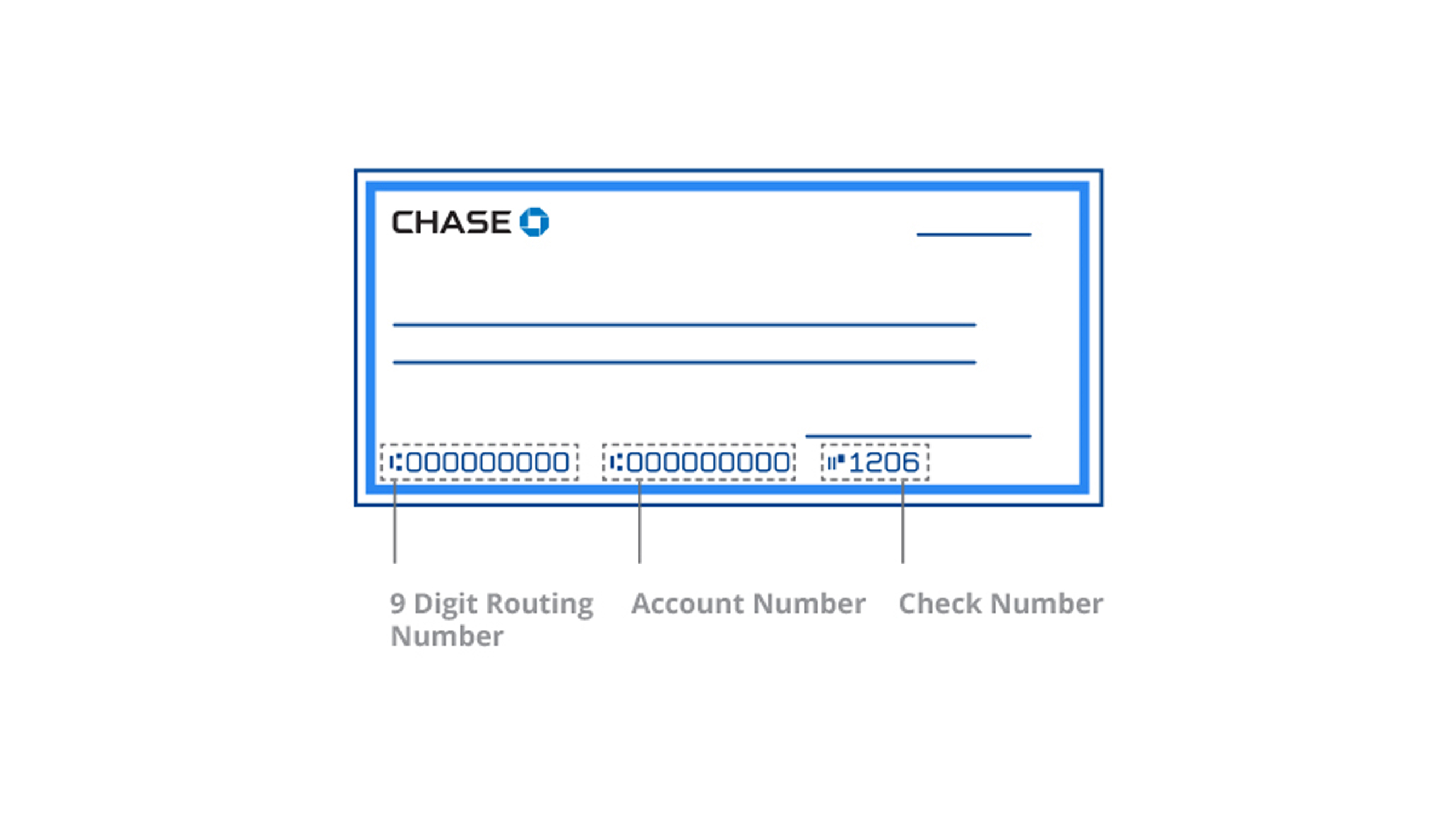

People forget that checks are literally maps to their bank accounts. If you have a Chase checkbook, look at the very bottom of any check. You’ll see three sets of numbers printed in that weird, blocky magnetic ink (it's called MICR font, by the way).

- The first nine digits are your Routing Number. For Chase, this varies by the state where you opened the account.

- The second string of numbers is your Chase account number.

- The third number is usually just the specific check number.

It’s worth noting that your routing number for electronic "ACH" transfers (like getting paid) might be different from the routing number for "Wire" transfers. Chase is a massive institution. They have different routing numbers for different regions. If you use the number from your check for a domestic wire, it might bounce. Always double-check the "Wire Instructions" section on the Chase website if you’re moving large sums of money.

Why You Can't Just Use Your Debit Card

I see people try this all the time at retail kiosks. They look at their debit card and think that 16-digit number is the account number.

It isn't.

That card is just a "key" that grants access to the account. If you lose your card and Chase sends you a new one, that 16-digit number changes. But your get Chase account number mission stays the same because the underlying account doesn't change. If you try to set up a direct deposit using your debit card number, the transaction will fail 100% of the time.

Calling Customer Service (The Last Resort)

Sometimes technology hates us. If you can't log in and you don't have a checkbook, you can call 1-800-935-9935.

Be prepared. They are going to grill you. They'll ask for your Social Security number, your mother's maiden name, and maybe the amount of your last three transactions. They might not even give you the full number over the phone for security reasons—often, they’ll offer to mail a letter or tell you to visit a branch with your ID.

If you live near a branch, just walking in with your driver's license is honestly less stressful than navigating a phone tree for twenty minutes. A teller can print out an "Account Verification Letter" in about sixty seconds.

Actionable Steps to Secure Your Info

Once you actually have the number, don't just leave it sitting in your "Notes" app. That's a security nightmare.

📖 Related: Where Did the Dow Jones Finish Today: The Long Weekend Stall Explained

- Use a Password Manager: Put the account and routing numbers in a "Secure Note" section of something like Bitwarden or 1Password. These are encrypted. Your phone's default notes are often not.

- Verify the Routing Number: Before you send money, go to the Chase "Routing Number" search tool. You enter the state where you opened the account, and it tells you which of their numbers to use. It’s better to spend two minutes checking than two weeks trying to claw back a misdirected transfer.

- Update Your Direct Deposit: If you’re finding this number because you got a new job, make sure you also specify if the account is "Checking" or "Savings" on your HR portal. If you give the right number but the wrong account type, the banking system sometimes gets confused and kicks it back.

- Label Your Accounts: If you have multiple Chase accounts, give them nicknames in the app (like "Emergency Fund" or "Rainy Day"). This prevents you from accidentally grabbing the account number for your savings when you meant to use your checking.

Finding these digits is a minor hurdle, but once you have them saved securely, you won't have to go hunting through your PDF statements ever again.