You’re standing at the DMV or a landlord’s office, and they won't take Zelle. They want paper. Specifically, they want a check. For a lot of us, this feels like being asked to operate a rotary phone. It’s an old-school financial ritual that feels weirdly high-stakes because if you mess up one line, the bank might reject it, or worse, someone could alter the amount and drain your account.

Learning how to fill out a check isn't just about avoiding a "void" scribble. It’s about security.

👉 See also: Americana Grill & Cafe: Why This Local Staple Actually Matters

Let's be real. Nobody uses these daily anymore. But when you do need one—for a security deposit, a tax payment, or a wedding gift—you want to look like you know exactly what you’re doing. Most people stumble on the decimal points or the legal line. Honestly, it’s simpler than it looks once you break down the six specific zones that matter.

The First Step: The Date and the Payee

Top right corner. That’s where the date goes. You might think it doesn't matter, but "post-dating" a check—putting a future date on it—is a common tactic people use when they don't have the funds yet. Here is the thing: banks don't actually have to honor that. According to the Uniform Commercial Code (UCC), a bank can often cash a check even if the date is in the future unless you’ve given the bank specific notice. Just use today’s date. It keeps things clean.

Then there is the "Pay to the Order of" line. This is the most important part for making sure your money goes where it's supposed to.

Write the name of the person or organization clearly. If you are paying a business, ask them exactly how their name should appear. Avoid abbreviations if you can. If you're paying "John Smith," write "John Smith," not just "John." Why? Because a blank or vague payee line is basically a gift to a thief. If you leave it blank, it’s legally a "bearer instrument," meaning anyone who holds it can cash it. That is terrifying.

Getting the Numbers Right (The Decimal Trap)

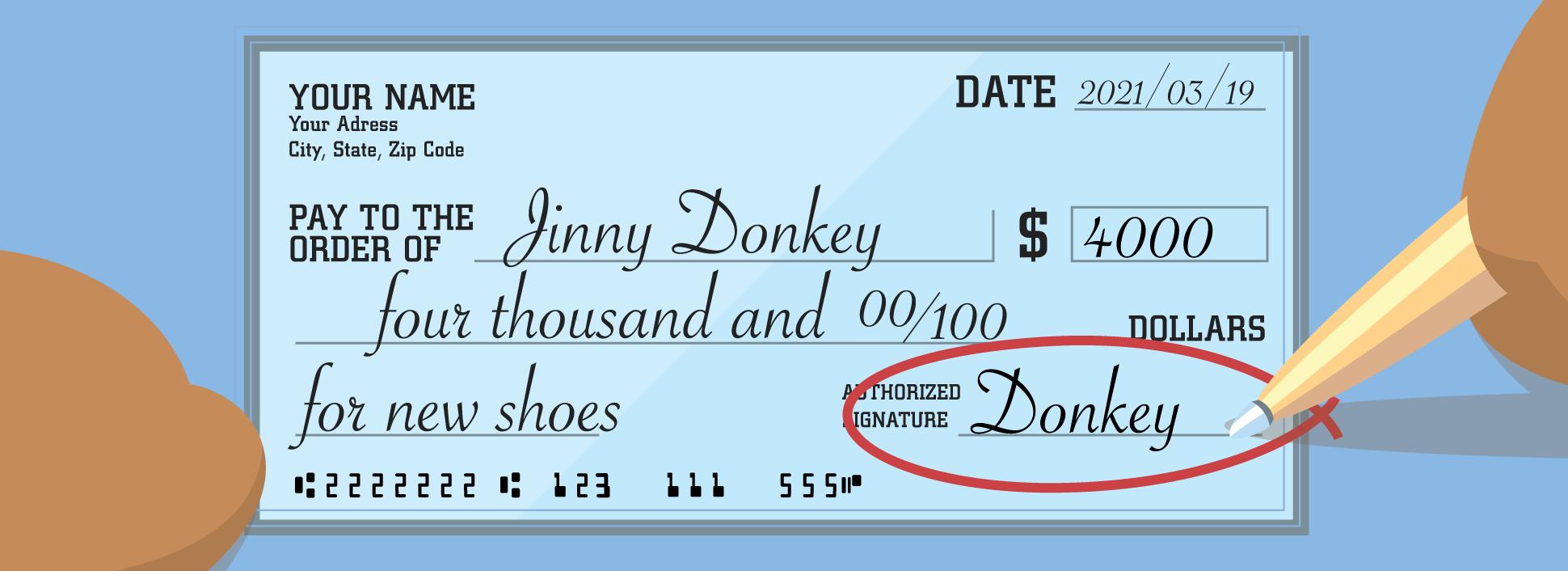

There are two places where you write the amount. There is the small box on the right, and then there is the long line underneath the payee's name.

In the box, use numbers. $125.50. Make sure the numbers are shoved right up against the dollar sign so nobody can squeeze an extra digit in there. If you leave a gap, a $100 check can become a $900 check with one quick flick of a pen.

Then comes the "Legal Line." This is the line where you write out the amount in words.

💡 You might also like: What year were you born if your 18 in 2024: The Math and the Milestones

Did you know that if the numbers in the box and the words on the line don't match, the bank is legally required to go by the words? It’s true. The words are considered the "legal amount."

To do this properly, write the dollar amount in words and the cents as a fraction over 100. For example: One hundred twenty-five and 50/100.

Draw a thick line through any remaining empty space on that line. This prevents anyone from adding "and zero cents" or changing "One hundred" to "One hundred thousand." People actually do this. Check washing—a process where criminals use chemicals to erase ink—is a rising concern according to the U.S. Postal Inspection Service. Using a gel pen, specifically one with pigmented ink like a Uniball 207, makes it much harder for someone to "wash" your check.

The Memo Line and the Signature

Bottom left is the memo. It’s optional.

You don't have to write anything there, but your future self will thank you. If you’re paying rent, write "February 2026 Rent." If it’s for a utility bill, write your account number. This is your paper trail. If the company claims you never paid, that memo line is your evidence in a dispute.

Finally, the signature. Bottom right.

This is the "on" switch for the whole document. Without your signature, the check is just a piece of paper with scribbles on it. Use the signature that the bank has on file for you. If you’ve changed your name or your signature has evolved from a legible name to a chaotic loop over the last decade, it might be worth updating your signature card at your local branch.

What Most People Get Wrong About Security

Security isn't just about how you write; it's about what you use.

Pencils are a hard no. Any erasable pen is a disaster waiting to happen. You want permanent ink. Most experts recommend black or blue ink because it shows up clearly on bank scanners.

The "Void" Rule

If you mess up, don't try to fix it. Don't write over a number. Don't use white-out. Banks are trained to look for "alterations." If they see a messy correction, they will likely reject the check to protect you from fraud.

Just write VOID in huge letters across the front of the check and start over.

Recording the Transaction

Once the check is gone, it’s out of your sight but not out of your bank account. Use the check register—that little paper booklet that came with your checkbook—to write down the check number, the date, and the amount. It feels tedious. Do it anyway. In an era of instant digital banking, a paper check can take days or even weeks to clear. If you forget you wrote it, you might spend that money elsewhere and end up with a bounced check and a $35 overdraft fee.

Dealing with Mobile Deposits

In 2026, most people receiving your check will probably use their phone to deposit it. This doesn't change how you fill out the front, but it changes what happens on the back.

👉 See also: Why the Ryobi Mini Leaf Blower Is Actually the Most Useful Tool in Your Garage

When you receive a check and want to deposit it via an app, you must endorse the back. Most banks now require you to write "For Mobile Deposit Only at [Bank Name]" under your signature. If you don't do this, the deposit might be rejected. It's a security measure to ensure the same check isn't deposited twice—once via the app and once at an ATM.

Practical Steps to Stay Safe

If you are mailing a check, don't just drop it in a standard blue USPS collection box late at night. The Postal Inspection Service has warned about "fishing" where thieves use sticky strings to pull mail out of these boxes. Take it inside the post office.

- Use Gel Pens: As mentioned, they bind to the paper fibers.

- Fill the Lines: Leave no gaps for extra words or numbers.

- Check Your Statement: Look at the digital image of the cleared check in your banking app to ensure the amount matches what you wrote.

- Destroy Old Checks: If you close an account, shred the remaining checks. Never just throw them in the trash.

Writing a check feels like a relic of the past, but it remains a fundamental part of the global financial system. When you do it right, you ensure your money goes exactly where you intended, with no room for error or "creative" interpretation by anyone else.

Keep your checkbook in a secure location, use a consistent signature, and always double-check your "legal line" words against your "box" numbers. This tiny bit of friction in our fast-paced digital world is actually what makes the paper check a surprisingly resilient tool for large, important payments.

Actionable Next Steps:

- Locate your checkbook and verify you have a "fraud-proof" gel pen (black ink is best).

- Review your bank's mobile deposit requirements so you know how to endorse checks you receive.

- If you haven't written a check in over a year, do a "practice" voided check to get the muscle memory back for the word-based legal line.

- Update your check register immediately after signing any new check to avoid overdraft surprises.