Let’s be honest. Nobody actually wakes up excited to deal with the Pennsylvania Department of Revenue. It's just one of those things you've got to grind through so you can get back to your real life. But if you need to file PA state income tax, there is some good news. Pennsylvania is one of the few places left with a flat tax rate. It’s $3.07%$. That’s it. No complicated brackets like the federal side where you're trying to figure out if that last overtime shift pushed you into a higher percentage. It's a straight line.

But don't let the simplicity of the rate fool you. The PA-40 form is a finicky beast.

If you’re a W-2 employee living in Scranton or Philly, your life is probably easy. Your employer likely took out exactly what they should have. But for the freelancers, the "side-hustle" crowd, or people moving across state lines, Pennsylvania tax season is basically a scavenger hunt for receipts and specific schedules. You've got to know where the traps are.

The PA-40 vs. The World

Most people assume that because they finished their federal return, the state part is just a "copy-paste" job. Wrong. Pennsylvania doesn't follow federal rules for business expenses or even some retirement contributions. It's weirdly specific. For instance, Pennsylvania is one of the only states that doesn't allow a deduction for traditional IRA contributions on the state level. You’re paying tax on that money now, even if you deferred it on your 1040.

Then there is the issue of "compensation."

In the eyes of Harrisburg, almost everything is compensation. Did you get a move-in bonus? Taxed. Did your boss give you a prize? Taxed. You've basically got to account for every dime. However, the state is surprisingly chill about some things. Social Security benefits? Not taxed. Pensions for people who meet the full retirement age? Generally not taxed. It’s a bit of a give-and-take.

Where to Actually File

You have options. You don't have to pay a big software company $50 just to hit "submit" on a state return.

- myPATH: This is the state's official portal. It’s free. It’s also... a government website. It works, but it isn’t going to hold your hand like a paid professional would. If your taxes are simple, just use myPATH.

- Third-Party Software: If you’re already using something for your federal return, it usually imports your data. It’s faster but costs money.

- Paper Filing: Please don't do this unless you absolutely have to. It takes forever. The mail is slow. The processing is slower. Just don't.

Common Mistakes When You File PA State Income Tax

The biggest headache for Pennsylvanians is usually the local earned income tax (EIT). People forget that the state and the municipality are two different things. You might file PA state income tax perfectly, but if you forget to file your local return with Keystone Collections Group or Berkheimer, you're going to get a nasty letter in two years with a bunch of interest tacked on.

💡 You might also like: Finding the Bank of America Marysville MI Location: What You Actually Need to Know

Check your PSD codes. Every township has a six-digit code. If you use the wrong one, your money goes to the wrong town. It’s a mess to fix.

Another trap? Unreimbursed business expenses.

Pennsylvania is actually more generous than the federal government here. Since the 2017 Tax Cuts and Jobs Act, you can't really deduct work expenses on your federal return. But in PA? You still can. If you had to buy your own uniform, your own small tools, or paid for your own professional dues, you can use Schedule UE. Just make sure you have the receipts. The Department of Revenue loves to ask for proof three years later.

The Residency Headache

Did you move? If you spent part of the year in New Jersey or Delaware but worked in PA, you're looking at a part-year resident return. Pennsylvania has "reciprocity" with several states—Indiana, Maryland, New Jersey, Ohio, Virginia, and West Virginia. This basically means if you live in one and work in the other, you only pay tax to your home state.

Except for Philadelphia.

Philly is its own planet when it comes to taxes. The Wage Tax is a whole different animal, and if you work in the city, they’re getting their cut regardless of where you sleep at night.

✨ Don't miss: Is the Dow Today Live Telling the Whole Story? What Traders Are Seeing Now

Dealing with the "No Tax" Reality: Tax Forgiveness

If you didn't make a lot of money this year, you might not owe anything at all. Pennsylvania has a program called Tax Forgiveness (Schedule SP). For a family of four, the income limit is surprisingly high. You could potentially get every cent of your state withholding back.

A lot of people skip this because the form looks intimidating. It’s not. It’s basically just proving how many people live in your house and how much you made. If you’re eligible, it’s the easiest money you’ll ever make.

Important Deadlines and Penalties

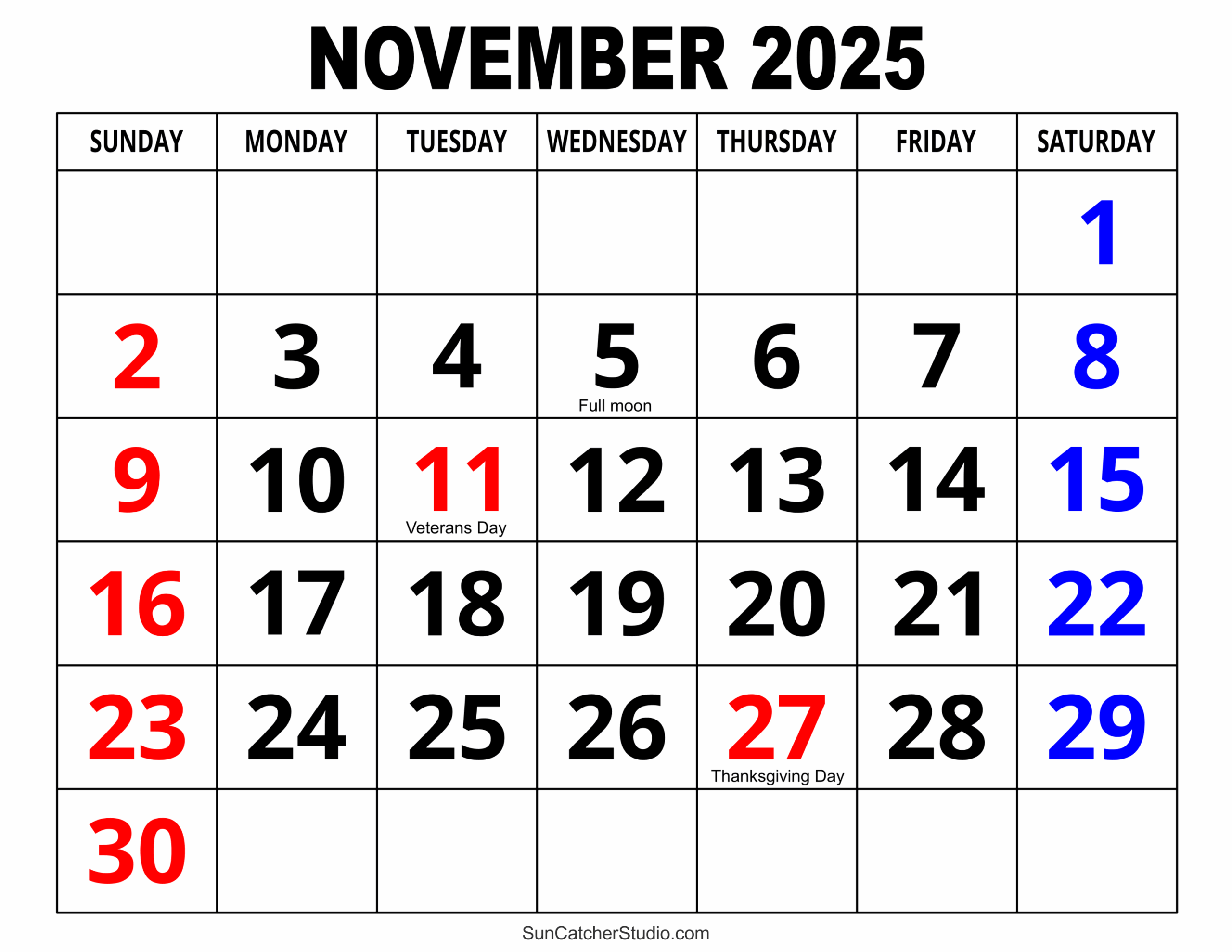

April 15th is the big day. Usually. If it falls on a weekend or a holiday (like Emancipation Day in D.C.), it might push to the 16th or 17th.

If you can't pay, file anyway.

Seriously. The penalty for "failure to file" is much steeper than the penalty for "failure to pay." If you file your PA-40 on time, you can usually work out a payment plan through myPATH. The state is actually pretty reasonable if you reach out first. If you wait for them to find you? Not so much.

What Documents Do You Need?

Don't start until you have these:

- W-2s from every job you held.

- 1099-NEC or 1099-MISC if you did any gig work.

- 1099-G if you collected unemployment (Yes, PA taxes unemployment, unlike some other states).

- Your local tax info.

- Records of any estimated payments you made throughout the year.

If you’re self-employed, you really need to be paying quarterly. If you wait until April to pay the full year's worth of state tax, you're going to get hit with an underpayment penalty. It’s a percentage of what you should have paid throughout the year. It adds up.

Final Steps for a Clean Return

Double-check your social security number. It sounds stupid, but it’s the number one reason returns get rejected. Make sure your address is current. If the state sends you a check and it goes to your old apartment, you're in for a three-month headache trying to get it reissued.

Once you hit submit, keep your records for at least seven years. While three years is the standard for many things, Pennsylvania can go back further in certain cases of "substantial underreporting."

💡 You might also like: Walt's Ad This Week: Why You Can’t Find the Circular Anymore

Practical Action Plan

- Check your eligibility for Tax Forgiveness. Even if you think you made too much, look at the Schedule SP income limits. It might surprise you.

- Gather your 1099-G. If you were between jobs, that unemployment income must be reported.

- Locate your PSD code. Use the "Find Your District" tool on the PA Department of Community and Economic Development website to ensure your local taxes are routed correctly.

- Use myPATH for free filing. Skip the commercial software fees if you have a straightforward W-2 or simple 1099.

- Verify Reciprocity. If you live in a neighboring state, ensure your employer didn't accidentally withhold PA tax if they weren't supposed to. If they did, you'll need to file to get that refund back.

- Pay via Electronic Funds Transfer. It’s the fastest way to prove you paid on time and avoids the risk of checks getting lost in the mail.

Filing doesn't have to be a nightmare. It's just a process of checking boxes and being honest about the numbers. Get it done early, avoid the April rush, and keep your receipts in a folder where you won't lose them.