Let’s be real. The first time you realize you have to pay the IRS every three months instead of once a year, it feels like a personal attack. You finally start making decent money as a freelancer, a small business owner, or a side-hustler, and then—bam. The "pay-as-you-go" system kicks in. Most people think they can just wait until April, but if you’re pulling in more than a grand in tax liability, the IRS wants their cut in real-time. Knowing how to determine quarterly taxes isn't just about math; it’s about avoiding those annoying underpayment penalties that eat your profits.

It’s confusing. I know.

The IRS website, while technically helpful, reads like a toaster manual translated into three different languages before landing back in English. But here is the gist: if you expect to owe $1,000 or more when you file your return, you’re likely on the hook for estimated payments. This applies to S-corp shareholders, sole proprietors, partners, and even some W-2 employees who have significant outside income from dividends or rental properties.

Why the IRS Demands a Cut Every 90 Days

The United States tax system is essentially a giant subscription service. When you work a standard job, your boss handles the "subscription" by taking money out of every paycheck. When you’re the boss, you have to do the heavy lifting yourself.

The government uses these funds to keep the lights on throughout the year. If everyone waited until April 15th to pay, the Treasury would basically be broke for eleven months. To prevent this, they’ve set up four specific deadlines. They aren't actually "quarterly" in the sense of being every three months on the dot—because why would the government make things easy?

- April 15 (Covering Jan 1 – March 31)

- June 15 (Covering April 1 – May 31) — Yes, that’s only two months.

- September 15 (Covering June 1 – Aug 31)

- January 15 (Covering Sept 1 – Dec 31)

If you miss these, you’re not just late; you’re potentially accruing interest on the money you "borrowed" from the government by keeping it in your own savings account.

The Safe Harbor Rule: Your Best Friend

If you’re stressed about getting the math perfect, stop. You don't actually have to be a psychic to figure out how to determine quarterly taxes. The IRS provides a "Safe Harbor" provision.

Basically, if you pay 100% of the tax shown on your prior year’s return (or 110% if your adjusted gross income was over $150,000), you won't be penalized for underpayment. This is huge. It means even if your business explodes and you make $500k this year after making $50k last year, you can just pay based on that $50k and settle the massive difference in April without a penalty.

🔗 Read more: US Stock Futures Now: Why the Market is Ignoring the Noise

It’s the easiest way to sleep at night.

Method 1: The Prior Year Approach

Take your total tax from last year’s Form 1040 (look at the "total tax" line, not what you paid in April). Divide that by four. Pay that amount every quarter. Simple. Done. This works best for people with steady income or those who expect to make more this year than last year.

Method 2: The Estimated Tax Worksheet (Form 1040-ES)

For the overachievers, there’s Form 1040-ES. This is the "official" way. You’ll estimate your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year. It’s a lot of guesswork. Honestly, if your income swings wildly—like a Realtor or a seasonal contractor—this can be a nightmare. You might end up overpaying and giving the government an interest-free loan, or underpaying and getting hit with a fee.

How to Determine Quarterly Taxes When Your Income is a Rollercoaster

What if you have a massive Q1 but a dead Q2?

This is where the Annualized Income Installment Method comes into play. It’s the most complex way to calculate your payments, but it’s the fairest for people with fluctuating income. Instead of paying four equal chunks, you pay based on what you actually earned in each specific period.

If you made $0 from January to March, you pay $0 in April. If you made $100k in July, you’re going to have a massive payment in September. To do this correctly, you’ll need to fill out Form 2210, Schedule AI. It is tedious. It requires keeping pristine books. But it prevents you from having to pay taxes on money you haven't even earned yet.

Don't Forget the "Other" Tax

When you're an employee, you pay 7.65% for Social Security and Medicare, and your employer matches it. When you’re self-employed, you are both the employee and the employer.

💡 You might also like: TCPA Shadow Creek Ranch: What Homeowners and Marketers Keep Missing

Surprise: you owe 15.3%.

This is called the Self-Employment Tax. When you are looking at how to determine quarterly taxes, many people only look at the income tax brackets (the 10%, 12%, 22%, etc.). They forget that 15.3% "off the top." You can deduct half of that tax on your 1040, but you still have to account for it in your quarterly cash flow.

A good rule of thumb? Set aside 25% to 30% of every dollar you bring in. It sounds like a lot. It is a lot. But it covers the federal income tax, the self-employment tax, and usually your state taxes too.

Real-World Example: Sarah the Freelance Designer

Sarah made $80,000 in profit last year. Her total tax liability was $12,000.

This year, she thinks she’ll make $100,000.

If Sarah uses the Safe Harbor method, she just pays $3,000 every quarter ($12,000 / 4). Even though she’s making more money this year, the IRS is happy because she paid 100% of her previous year’s tax.

If Sarah had a terrible year and only makes $40,000, she should probably use the actual estimation method so she doesn't overpay the IRS $6,000 that she could use for her rent.

Common Pitfalls and Misconceptions

People think the "standard deduction" doesn't apply to them if they’re self-employed. It does. You still get that $15,000ish (depending on filing status) cushion before you owe income tax.

📖 Related: Starting Pay for Target: What Most People Get Wrong

Another big one: State taxes.

Most states want their quarterly payments too. If you live in California or New York, those payments are significant. Don't send everything to the IRS and forget about your state's Department of Revenue. They are often less "forgiving" than the IRS when it comes to late fees.

Tracking Your Numbers

You cannot calculate these taxes on a napkin at 11 PM the night before the deadline. Well, you can, but your accountant will hate you.

Use software. Whether it’s QuickBooks, FreshBooks, or just a really clean Excel sheet, you need to know your net profit, not just your gross revenue. You only pay taxes on the profit. If you made $10,000 but spent $4,000 on software, advertising, and a new laptop, you only owe taxes on $6,000.

Keep your receipts. Digital ones are fine. The IRS accepts scans and photos. Just don't lose them.

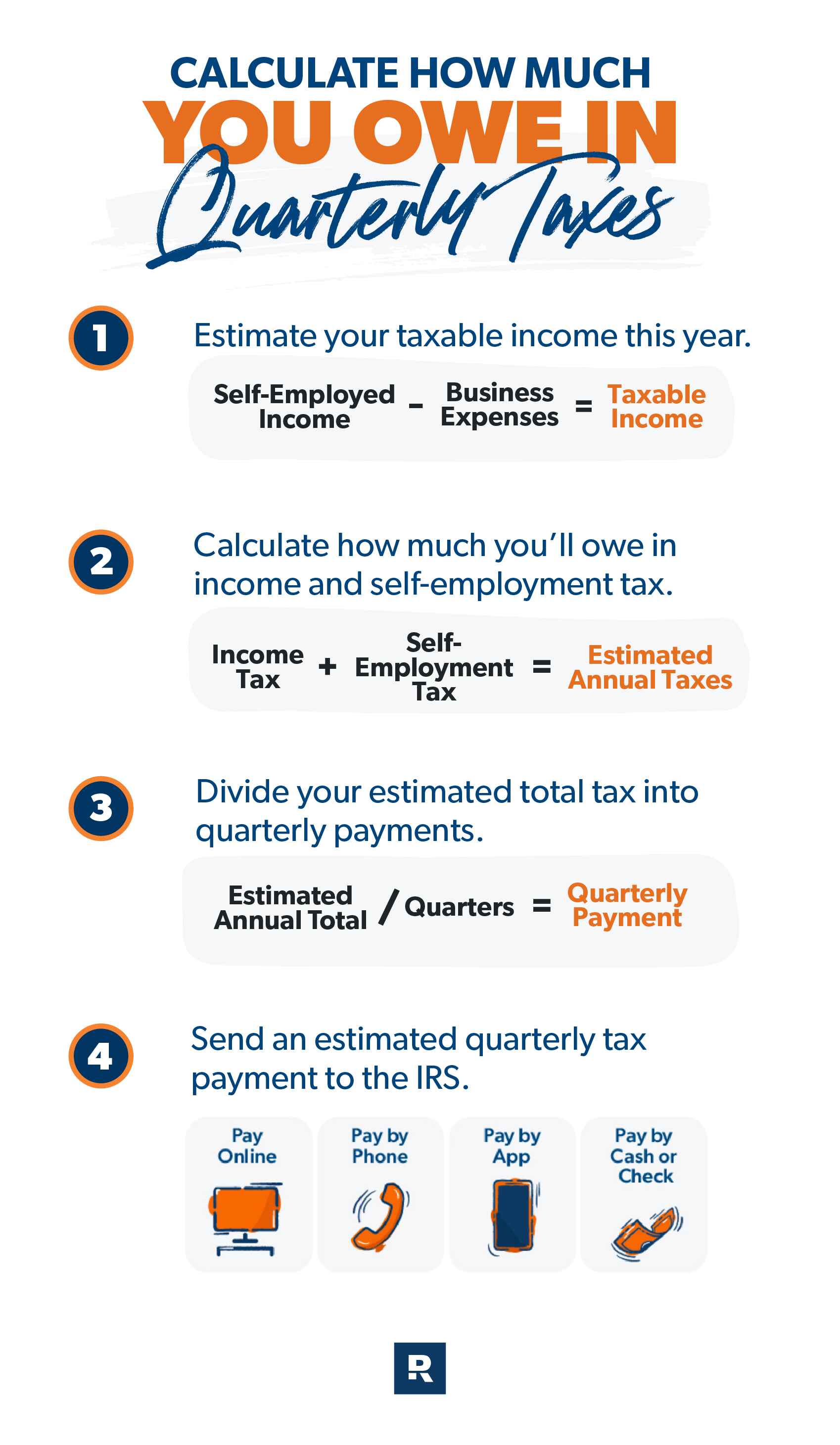

Actionable Next Steps

- Find your 2024 (or most recent) tax return. Look at the line that says "Total Tax."

- Divide that number by four. This is your "Safe Harbor" number.

- Mark the deadlines. April 15, June 15, Sept 15, Jan 15. Set calendar alerts two weeks prior.

- Open a separate bank account. Label it "Tax Savings." Every time a client pays you, move 30% into that account immediately. Do not touch it. It is not your money. It belongs to Uncle Sam.

- Pay online. Use the IRS Direct Pay portal. It’s free, you get an immediate receipt, and you don’t have to worry about a check getting lost in the mail.

- Evaluate quarterly. At the end of June and September, look at your year-to-date profit. If you are way ahead of last year, you might want to increase your payments slightly just so you aren't hit with a massive bill in April, even if you are technically "safe" from penalties.

Determining your quarterly payments doesn't have to be a source of existential dread. It’s just a business process. Once you automate the savings and understand the safe harbor rules, it becomes as routine as paying your internet bill.

Keep your books updated monthly, stay aware of the deadlines, and always round up. It’s much better to get a refund in April than to realize you owe $5,000 you already spent on a vacation.