So, you're done with Chase. Maybe the fees started feeling a bit too aggressive, or perhaps you’re just moving your money to a high-yield savings account that actually pays you more than a few pennies a year. Whatever the reason, deciding to close account Chase Bank isn't always as simple as clicking a single button and walking away. It’s a process. If you don't do it right, you might end up with "zombie" charges or a hit to your credit if an account goes negative from an overlooked subscription.

Chase is the largest bank in the United States. They didn’t get there by making it incredibly easy for people to take their money elsewhere. While they aren't necessarily "trapping" you, there are specific hoops you have to jump through to make sure that account is dead and buried.

The Reality of Closing Your Chase Account

Honestly, most people think they can just empty the balance to zero and the account will eventually close itself. That is a massive mistake. If your balance hits zero and a monthly service fee kicks in—say, that $12 fee for a Total Checking account—your balance goes to negative $12. Now you owe the bank money. If you ignore it, they might report it to ChexSystems, which is basically the "credit score" for bank accounts. This can make it surprisingly hard to open a new account at a different bank later on.

You have to be intentional.

💡 You might also like: What Does Notarized Mean: Why That Little Stamp is Actually a Big Deal

Before you even talk to a teller or hop on a chat, you need to audit your own life. Look at your last three months of statements. Are there any "invisible" ties? Think about your gym membership, your Netflix subscription, or that one utility bill you set to autopay back in 2019. If one of those hits a closed or empty account, you're looking at a world of NSF (non-sufficient funds) fees or service interruptions.

Moving Your Money the Right Way

Don't just withdraw everything in cash at an ATM and walk away. That looks suspicious to fraud algorithms and leaves no paper trail. Instead, use an ACH transfer to move the bulk of your funds to your new bank. Leave a small cushion—maybe $50 or $100—just in case a forgotten transaction clears at the last minute.

Wait.

Wait at least a full week after your last scheduled bill has cleared. Once you are 100% sure the waters are calm, then you make the move to close account Chase Bank.

The Phone Call vs. The Branch Visit

You've got options here. You can call their customer service line at 1-800-935-9935. It’s fine. It works. But be prepared for the "save" script. The representative is literally paid to try and keep you. They might offer to waive fees for a few months or suggest a different account tier. If you’re firm, they’ll process it.

If you prefer looking someone in the eye, go to a branch. This is actually the cleanest way because you can get a printed receipt on the spot that says "Account Closed." It's your "get out of jail free" card if they ever try to claim you owe them money six months from now. Just bring your ID and your debit card. They might ask why you're leaving; you can just say you're consolidating your finances. You don't owe them a detailed life story.

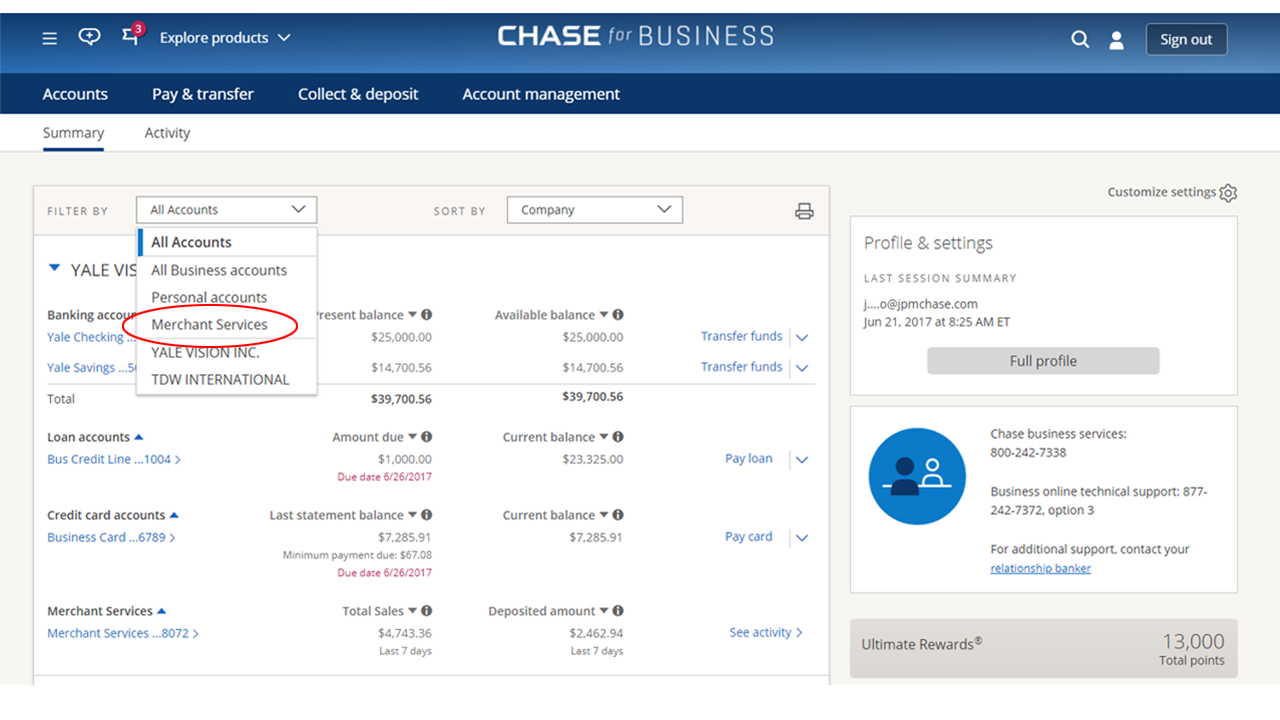

What About the Chase Mobile App?

Can you do it in the app? Sort of. Chase has a "Secure Message Center." You can log in on a desktop or through the app and send a message requesting to close the account. It’s not "instant," but it avoids the awkwardness of a phone call.

However, there’s a catch. If your account has a negative balance, or if there are "pending" transactions, they won't do it over message. You’ll get a reply a day later telling you to call them.

The Paper Trail and Your Credit Score

Closing a checking or savings account won't directly hurt your FICO score. It’s not like a credit card where closing it reduces your available credit and messes with your utilization ratio. But, and this is a big "but," if you have a Chase credit card that is linked to that bank account for autopay, make sure you update that immediately.

If you close the bank account and the credit card tries to pull its monthly payment from a dead account, you'll get hit with a late fee. If that late payment goes past 30 days, that is when your credit score takes a nose dive.

✨ Don't miss: The China Deal With Trump: What Really Happened Behind the Scenes

Dealing with the Overdraft Protection Trap

If you have a Chase overdraft line of credit (not just standard overdraft protection, but an actual line of credit), closing the bank account might trigger a requirement to pay that off in full immediately. Check your fine print. Most people don't have this, but if you do, it's a debt that needs to be settled before they'll let you walk away cleanly.

Specific Steps to Take Right Now

- Open your new account first. Never close your old one until the new one is fully functional, with a debit card in hand and your direct deposit successfully hitting it at least once.

- The 30-day "Cooling" Period. After you think you’ve moved everything, let the Chase account sit for one full billing cycle with just a tiny bit of cash in it. This catches the stragglers—the annual subscriptions you forgot about.

- Download your statements. Once the account is closed, you lose access to the online portal. If you need those statements for taxes or a mortgage application later, you'll have to pay a fee to get the bank to mail them to you. Download the last two years of PDFs now. It takes five minutes and saves a lot of stress later.

- Destroy the plastic. Once you get the confirmation that the account is closed, shred the debit card. Don't just throw it in the trash. Use a cross-cut shredder if you have one.

Is There a Fee to Close?

Chase usually doesn't charge a "closing fee" in the traditional sense. However, if you opened the account very recently—usually within 90 days—and received a sign-up bonus, they might claw back that bonus. They aren't going to give you $300 to open an account and then let you leave three weeks later with the cash. Check the terms of your specific promotion. Usually, you have to keep the account open for six months to keep the "new account" bonus.

If you’re closing it because of the monthly fees, remember that you can often get those waived by having a certain amount of direct deposits or keeping a minimum daily balance. But if you’re done, you’re done.

Handling the Final Balance

If you have money left in the account when you call to close it, Chase will usually mail you a check for the remaining balance. This can take 7 to 10 business days. If you need that money for rent or groceries, don't wait for the check. Transfer the money out electronically until there's maybe $1 left, then close it.

The bank isn't your friend, but they aren't the enemy either. They’re just a business with a lot of automated systems. If you follow the steps and don't leave any loose ends, you can close account Chase Bank without any drama. Just stay organized, keep your receipts, and make sure your new financial home is ready to catch you before you jump.

Once the process is complete, check your mail for a final "Account Closed" notice. Keep that document. It is your proof that the relationship is officially over. If any weird charges pop up later, that piece of paper is your shield.

Take a moment to update your browser's saved passwords and delete the Chase app. It's a small thing, but it prevents you from accidentally clicking into a dead portal and getting confused later. Your financial transition is now complete.