So, you’re done with the gecko. Maybe you found a cheaper rate with a local carrier, or perhaps you sold your car and just don’t need the coverage anymore. Whatever the reason, figuring out how to cancel a policy with GEICO isn't always as simple as clicking a giant "quit" button on their homepage. Insurance companies aren't exactly in the business of making it easy for you to stop giving them money.

It’s frustrating. Most people assume they can just log in, hit a button, and walk away. Honestly, GEICO makes you jump through a few hoops—usually involving a phone call—because they want one last chance to keep you as a customer. They'll try to offer you a "loyalty discount" or ask if you’ve considered a higher deductible to lower the price. If your mind is made up, you need to know the specific levers to pull so you don't end up with a "lapsed coverage" mark on your record, which, trust me, makes your next policy way more expensive.

The Reality of Canceling Your GEICO Coverage

You can’t just stop paying your premiums. Seriously, don’t do that. If you just stop the auto-pay or ignore the bill, GEICO will eventually cancel your policy for non-payment. That sounds like what you want, right? Wrong. That goes on your insurance report (LexusNexis or CLUE) as a forced cancellation. When you go to buy insurance again, you'll look like a high-risk client. You’ll pay through the nose for it.

Instead, you have to formally "surrender" the policy. GEICO generally requires you to call them at 1-800-841-1589. While their app is great for seeing your ID cards or filing a quick claim, the "cancel" feature is often buried or directs you to a live agent. They want to put you on the phone with a retention specialist whose entire job is to talk you out of leaving.

Why the Timing Matters More Than the Method

If you're switching to a new company like Progressive or State Farm, make sure your new policy starts before the GEICO one ends. Even a one-day gap in coverage can trigger a massive spike in your future rates. Some states even require the insurance company to notify the DMV immediately when a policy ends. If the DMV sees you have a registered car but no insurance, they might suspend your registration or send you a hefty fine in the mail.

I’ve seen people cancel their policy on a Friday, thinking they'll set up the new one on Monday. Big mistake. Always aim for an overlap. It’s better to pay for two policies for 24 hours than to explain a gap to a future underwriter.

The Step-by-Step Breakdown

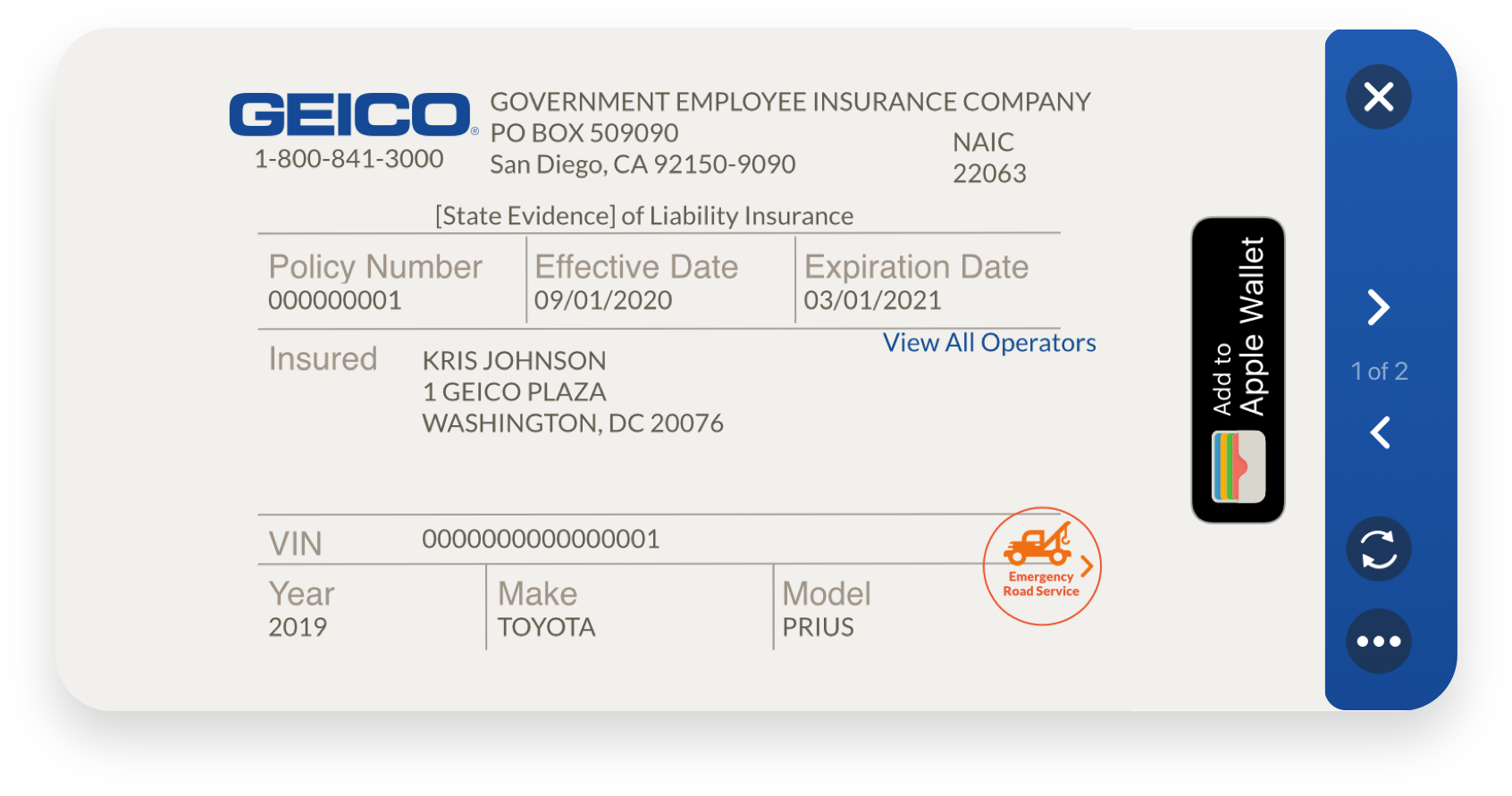

First, grab your policy number. It's on your digital ID card in the app. You'll need it. When you call, the automated system is going to try to route you to every department except cancellations. When the robot asks what you’re calling about, just say "cancel policy."

🔗 Read more: The Park at Broken Sound: Why This Massive Tech Hub is Boca's Best Kept Secret

Expect a wait. Mondays are usually the worst time to call any insurance company. Aim for a Tuesday or Wednesday afternoon if you can. Once you get a human, be firm. You don't have to give a long-winded explanation. "I’ve found coverage elsewhere" is a complete sentence.

Can You Do It via Mail?

Yes, technically. You can send a written notice to their headquarters. But honestly, it’s 2026. Who has stamps? Plus, it takes forever for the mail to be processed, and you won't have an immediate confirmation number. If you choose this route, send it via certified mail so you have proof they received it. It’s the "old school" way, and it’s mostly used by people who want a paper trail for legal reasons.

What About the Refund?

Here is the part most people get wrong. If you paid your six-month premium upfront, GEICO owes you the "unearned premium." This is the portion of the money you paid for days that haven't happened yet. However, check your state laws and your specific policy language. Some states allow insurance companies to "short-rate" your cancellation.

What does that mean? Basically, they keep a small percentage (often around 10% of the remaining balance) as an administrative fee for canceling early. It’s annoying, but it’s legal in many places. If you’re at the very end of your policy term, it might be cheaper to just let it expire rather than canceling three days early and hitting a fee.

Common Pitfalls and the "Hidden" Fees

Let’s talk about the CAIP (Commercial Auto Insurance Procedure) or specific state-funded pools. If you are in a high-risk pool, the rules for how to cancel a policy with GEICO can be even more rigid. Some policies require a 30-day notice.

Another thing: if you have an umbrella policy or a homeowners policy bundled with GEICO, canceling your auto insurance might cause your other rates to skyrocket. You lose the "multi-policy discount." Always ask the agent, "How will this affect my other active policies?" before you hang up.

👉 See also: Bulgaria Currency to Dollar: Why the Lev is Disappearing and What it Means for Your Wallet

- The "Paperless" Trap: If you signed up for paperless discounts, make sure you download your final documents before your login access is restricted. Once the policy is dead, getting back into the portal can be a nightmare.

- Automatic Payments: Sometimes the "stop" command doesn't hit the billing system instantly. If your payment is due tomorrow and you cancel today, there’s a chance the bank pull will still happen.

Dealing with the DMV

In states like New York or North Carolina, the DMV is aggressive. If you cancel your GEICO policy, GEICO is legally obligated to send an electronic notice to the state. If you haven't already registered your new insurance with the state, you'll get a "Notice of Imminent Suspension."

To avoid this, keep your "Proof of Insurance" from your new provider handy. If the state flags you, you'll need to provide the new policy number and the effective date. Honestly, the paperwork is the biggest headache of the whole process.

Getting Your Money Back

When you finally get through the cancellation process, ask the agent for a "cancellation confirmation number." Write it down. Put it in your phone notes. If they tell you a check is in the mail, ask for the exact amount.

If you paid via credit card, the refund usually goes back to that card within 7 to 10 business days. If you paid via EFT (direct pull from your checking account), they might mail you a physical check. Don't throw away any mail from GEICO for the next month, even if it looks like junk. It might be your refund.

Moving Forward Effectively

Once you have successfully navigated how to cancel a policy with GEICO, the work isn't quite done. You need to verify that your bank's "autopay" or "bill pay" settings are truly deleted on your end, just to be safe.

Immediate Next Steps:

💡 You might also like: How to Convert US Dollar to Nigerian Naira Without Getting Scammed by the Spread

- Verify the New Policy: Ensure your new insurance ID cards are in your glovebox or saved to your phone's digital wallet before you drive.

- Monitor Your Bank Statement: Check your account on the date your old GEICO payment used to come out. If you see a charge, call your bank immediately to dispute it using your cancellation confirmation number.

- Check Your State's DMV Portal: Log in to your state's vehicle services website a week after canceling to ensure your registration status is still "active" and no insurance lapses are flagged.

- Save the Final Declaration Page: Keep a copy of your final GEICO "Dec Page" for at least two years. You may need it to prove continuous coverage if you switch insurers again in the future.

This process is mostly about being firm and keeping a paper trail. Don't let the sales pitch slow you down if you've already found a better deal elsewhere.