Let’s be honest. Most of us haven't thought about math since high school graduation, and yet, here you are, staring at a spreadsheet or a price tag, trying to figure out how much something actually went up. It’s a bit annoying. Whether you're tracking your investment portfolio, checking if your landlord is hiking the rent too much, or analyzing business growth for a quarterly review, knowing how to calculate percentage increase between two numbers is one of those "adulting" skills that actually saves you money and stress. It isn't just about moving decimals around. It’s about understanding the scale of change.

Numbers can lie. Or, at least, they can be misleading. If I tell you a stock went up by $10, you might think that’s great. But if that stock started at $1,000, that ten-buck gain is basically a rounding error. If the stock started at $2? Now we’re talking about a life-changing move. That’s why the percentage matters more than the raw digit.

The Step-by-Step Logic That Actually Sticks

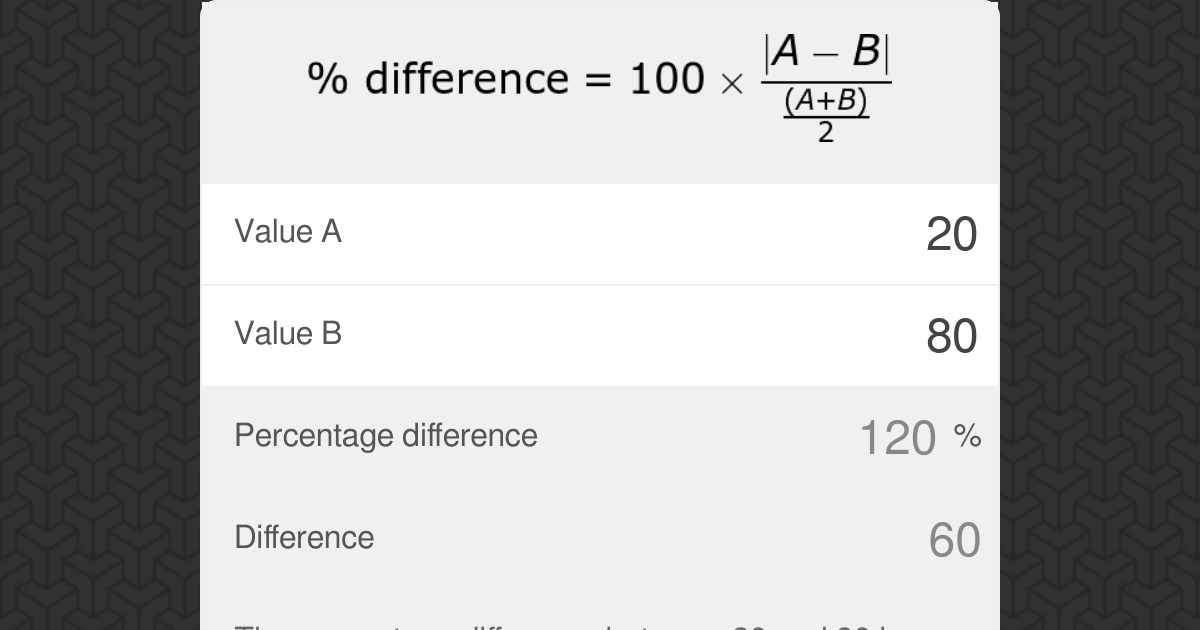

If you search for a formula, you'll see a bunch of $x$ and $y$ variables that look like a mess. Forget that for a second. Let's just use words. To find the percentage increase, you basically need to know how much the "gap" is between your old number and your new number.

First, you subtract the original value from the new value. This gives you the "increase."

✨ Don't miss: $1 How Many Pesos: Why the Math Changes While You're Checking It

Second, you take that increase and divide it by the original number. This is where everyone messes up. People naturally want to divide by the bigger number or the new number because it feels right, but math doesn't care about your feelings. You have to compare the change back to where you started.

Finally, you multiply by 100. Or, if you’re lazy like me, you just move the decimal point two spots to the right.

$$Percentage\ Increase = \frac{New\ Value - Original\ Value}{Original\ Value} \times 100$$

Think of it like this:

You bought a vintage jacket for $50. A year later, it’s worth $75.

The increase is $25.

Now, divide that $25 by the original $50.

You get 0.5.

Multiply by 100, and you’ve got a 50% increase. Easy.

Why the "Original Number" is the Only Thing That Matters

If you remember nothing else, remember the starting point. In the world of finance and data analytics, this is called the "base year" or "base value." If you use the wrong base, your data is garbage.

🔗 Read more: AP Macro Graphs Cheat Sheet: Why You Keep Mixing Up Shifting and Movement

Imagine you’re a manager at a coffee shop. Last month, you sold 200 oat milk lattes. This month, you sold 250.

The "increase" is 50.

If you divide 50 by 250 (the new number), you get 20%.

If you divide 50 by 200 (the original number), you get 25%.

That 5% difference might seem small, but in a board meeting or a performance review, that’s a massive discrepancy. It’s the difference between "we're doing okay" and "we're killing it." Always look back to the start.

Real-World Scenarios Where You’ll Actually Use This

Let’s talk about inflation. It’s the topic everyone loves to hate. If a carton of eggs was $2.50 in 2021 and it’s $4.25 today, how much of a hit did your wallet actually take?

- Subtract: $4.25 - 2.50 = 1.75$

- Divide: $1.75 / 2.50 = 0.7$

- Percent: 70% increase.

That is a staggering jump. Seeing it as a percentage helps you realize why your grocery bill feels so heavy even if the individual prices only moved a dollar or two.

Or look at social media. If you had 1,200 followers and now you have 1,800, you’ve grown by 50%. If a celebrity goes from 1 million to 1.1 million, they’ve only grown by 10%. You’re actually growing "faster" than the celebrity in terms of rate, even though their raw numbers are higher. This is a huge ego boost for small business owners, by the way.

🔗 Read more: JNJ Stock Price Today Per Share: Why the Blue Chip Giant is Moving

Common Pitfalls and Why Your Calculator Might Be "Lying"

Sometimes you'll get a negative number. Don't panic. If your new value is smaller than your original value, your subtraction will result in a negative. This just means you have a percentage decrease. The math stays exactly the same.

Also, watch out for "percentage points" vs "percent." This is a classic trap in news reporting, especially during elections or interest rate hikes. If the Fed raises interest rates from 3% to 4%, that is a 1 percentage point increase. However, the percentage increase of the rate itself is actually 33.3%.

Wait, what?

Yeah. 1 divided by 3 is 0.33. So the rate itself increased by a third. It sounds like pedantry, but in the world of high-stakes finance, confusing these two can lead to multi-million dollar mistakes.

When Does This Get Complicated?

It gets messy when you have multiple increases over time. You can't just add percentages together.

If your rent goes up 10% this year and 10% next year, your total increase isn't 20%. It’s actually 21%. Why? Because the second 10% increase is calculated based on the already-increased rent from the first year. This is the "magic" of compounding, and it works for you in savings accounts but against you in debt and price hikes.

To handle this, you need to calculate the value at each step or use a compound growth formula. But for most daily tasks, sticking to the "New minus Old divided by Old" rule will keep you out of trouble.

Putting It Into Practice Today

Don't just read this and forget it. Go look at something in your life that changed recently. Maybe it’s your screen time on your phone or the price of your favorite takeout order.

- Grab the current number (New).

- Find the previous number (Original).

- Run the formula.

If you're using Excel or Google Sheets, you don't even need to do the subtraction yourself. If your original value is in cell A1 and your new value is in B1, just type =(B1-A1)/A1. Then click the little "%" button in the toolbar. The software handles the "multiply by 100" part for you.

Actionable Steps for Mastering Data

- Check your subscriptions: Look at what you paid for Netflix or Spotify three years ago versus today. Calculate the percentage increase. Is the service 30% or 50% better than it was then? It’s a great way to decide if you should cancel.

- Track your raises: When you get a bump in pay, don't just look at the monthly total. Calculate the percentage. If inflation is 4% and your raise is 3%, you actually took a 1% pay cut in terms of purchasing power.

- Verify the "Sales": Stores love to say "50% off!" but sometimes they hike the "original" price right before the sale. Use the formula in reverse to see if the discount is legitimate.

- Audit your business: If you run a side hustle, calculate your month-over-month growth. If the percentage is dropping even while the raw numbers grow, you might be hitting a plateau that requires a change in strategy.

Understanding how to calculate percentage increase between two numbers isn't about being a math genius. It's about having a "BS detector" for the world around you. It allows you to see the true scale of change without being blinded by big numbers or distracted by small ones. Keep the "Original" number as your anchor, and you'll never get lost in the data.