You’re standing at the checkout line. The person behind you is sighing loudly because you’re fumbling with a physical wallet that honestly feels like a relic from 2005. We've all been there. Trying to add debit card to apple wallet should be a ten-second task, but sometimes the app spins, the verification fails, or your bank acts like you’re trying to launder money just by buying a latte. It’s annoying.

Apple Pay basically changed how we handle money. It uses Near Field Communication (NFC) to send a one-time-use token to the terminal, meaning the merchant never actually sees your real card number. That's a massive security win. But getting the card into the phone is where people usually trip up.

The fast way to get it done

Open the Wallet app. You'll see a little plus (+) icon in the top right corner. Tap that. From here, Apple gives you a few choices, but you want "Debit or Credit Card."

Now, you could type everything in like it's a 1990s data entry job, but why bother? Use the camera. Line up your card in the frame. The software is surprisingly good at reading those embossed numbers, though it sometimes struggles with the new flat, "numberless" cards that banks like Chase or Wells Fargo are pivoting toward. If the camera fails, just hit "Enter Card Details Manually" at the bottom.

Verification is the real gatekeeper

This is where the process usually dies for people. Once you put in the CVV (that three-digit code on the back), Apple talks to your bank. Your bank—whether it’s Bank of America, Navy Federal, or a tiny local credit union—has to give the green light.

Most banks will text you a code. Some make you log into their specific mobile app to "push" the activation. A few, and these are the worst, make you actually call a human being at a 1-800 number. If you’re doing this at 11:00 PM on a Sunday, and your bank requires a phone call, you're probably out of luck until Monday morning.

Why your card might be getting rejected

It’s rarely Apple’s fault. Seriously. If you’re trying to add debit card to apple wallet and you see a "Card Not Added" or "Could Not Connect to Apple Pay" error, it’s almost always a backend issue with the financial institution.

First, check your region. If your Apple ID is set to a country where Apple Pay isn't live yet—think certain parts of the Caribbean or specific African nations—it won't work. Even if you’re physically in New York.

Second, the "Account Not Eligible" error is a classic. This usually happens with business debit cards that have weird restrictions or prepaid cards you bought at a drugstore. Not every prepaid card plays nice with Apple’s security protocols. Vanilla Visa? Hit or miss. Green Dot? Usually okay, but fussy.

The "Expired" Trap

Sometimes the card in your hand is active, but your bank has already issued a replacement in their system because the old one expires in two months. Apple Wallet might reject the old card because the bank is waiting for you to activate the new one. Check your mail.

Using Apple Watch for the double-tap life

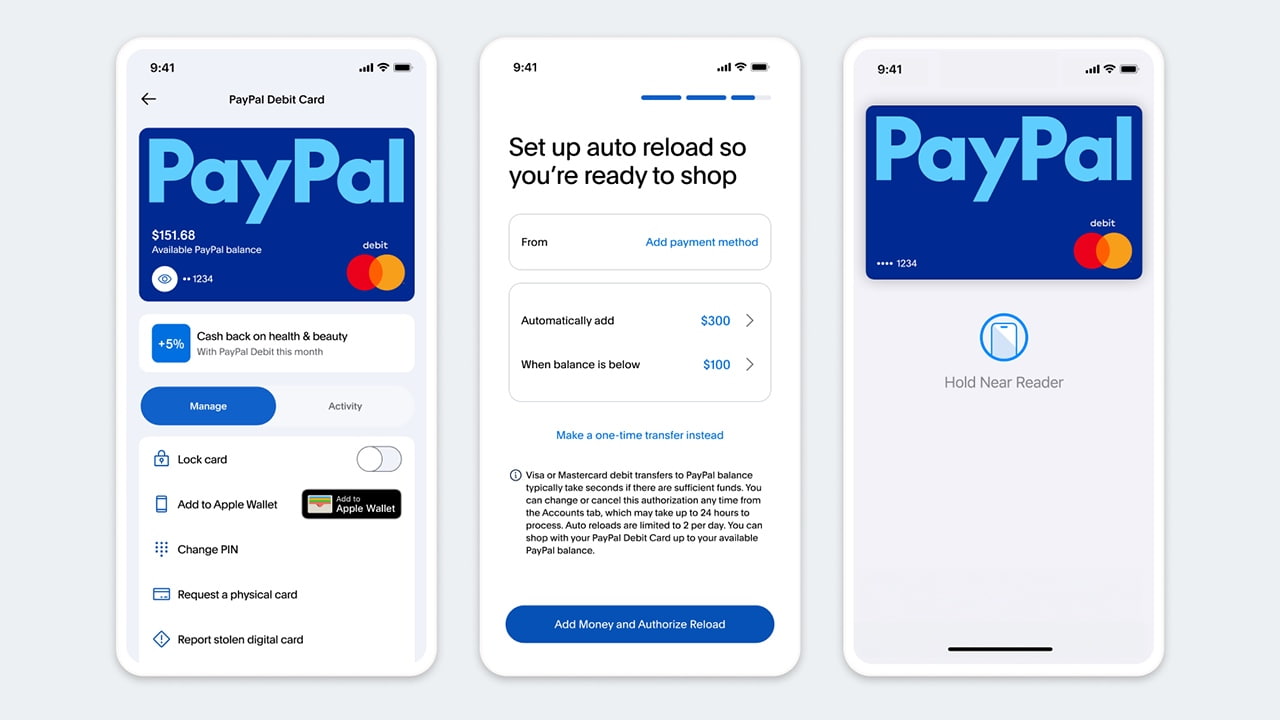

Once the card is on your iPhone, it doesn't just magically appear on your Watch. That’s a common misconception. You have to add it separately.

Go to the Watch app on your iPhone. Scroll down to "Wallet & Apple Pay." You’ll see a list of "Cards on your iPhone." There’s an "Add" button next to them. You’ll have to re-enter the CVV because, again, security. It feels redundant, but it ensures that if someone steals your phone, they can't easily sync your life to their own Apple Watch.

Using the Watch is actually faster. Double-click the side button. Hold it near the reader. Done. You don't even need your phone nearby if you have the GPS or Cellular model, as the "token" is stored locally on the Watch's secure element chip.

👉 See also: Social Media Nipple Slips: Why Content Moderation Always Fails the Fairness Test

Security: Is this actually safe?

People worry about their phone getting swiped. "If they have my phone, they have my bank account!" Not really.

Apple Pay uses something called Tokenization. According to researchers at security firms like Norton and Kaspersky, this is significantly safer than swiping a physical card. When you add debit card to apple wallet, Apple creates a Device Account Number. This is a proxy. When you pay, the merchant gets the proxy, not your actual 16-digit card number.

If you lose your phone, you don't have to cancel your physical card. You just go to iCloud.com, find your device, and suspend Apple Pay. Your plastic card in your real wallet still works perfectly.

What about those "skimmers"?

Physical skimmers—the little plastic overlays criminals put on gas pumps—don't work on Apple Pay. They rely on reading the magnetic stripe or the physical chip contact. Since you're not inserting anything, there's nothing for them to grab.

Troubleshooting the "Ghost" card

Sometimes you'll see a card in your wallet that says "Activating" for hours. It’s stuck in limbo.

The fix is annoying but simple: Delete it and start over.

- Open Wallet.

- Tap the stuck card.

- Tap the three dots (More button).

- Go to Card Details.

- Remove Card.

Give it ten minutes. Restart your phone. Try again. This usually clears the cache that was holding up the handshake between Apple's servers and the bank's verification server.

Moving beyond the basics

Adding the card is just the start. If you’re using a debit card, you should look into "Apple Pay Later" or "Apple Cash."

Apple Cash is basically like Venmo but built into iMessage. When you add debit card to apple wallet, you can use that card to fund your Apple Cash balance. This lets you text money to friends instantly. No third-party apps, no extra passwords. It’s incredibly slick once it’s set up.

Public Transit and Express Mode

If you live in a city like New York, London, or Tokyo, your debit card in Apple Wallet can act as your transit pass. You don't even have to wake the phone or use FaceID. In the Wallet settings, look for "Express Transit Card." Select your primary debit card. Now, you can just tap your "dark" phone against the subway turnstile and keep walking.

Common Myths

- "Apple takes a cut of my purchase." No. They charge the banks a tiny fee for the privilege of being in the Wallet, but it doesn't cost the consumer an extra cent.

- "I need internet to pay." You actually don't. The tokenization happens on the device's hardware. You can pay at a vending machine in the middle of a dead zone as long as the terminal has a connection.

- "It stores my photos of the card." Nope. Once the scan is done, the image is discarded. Only the encrypted data remains.

The Reality of Modern Banking

We are moving toward a cashless society, for better or worse. Most major retailers—Target, Costco, even most gas stations—now accept the "tap to pay" method. Walmart is the big holdout in the U.S., clinging to their own Walmart Pay system, which uses QR codes. It's clunky compared to Apple Wallet, but that's the corporate landscape for you.

If you’re traveling abroad, especially in Europe or Australia, Apple Pay is almost mandatory. In London, many places won't even take cash anymore. Having that debit card synced and ready to go before you land saves a massive amount of stress at the airport train station.

Actionable Next Steps

To make sure your setup is bulletproof, do these three things right now:

- Check your bank's app: Ensure "International Transactions" or "Online Purchases" are toggled ON. Sometimes banks block the initial Apple Pay "ping" because they flag it as a suspicious online transaction.

- Set up a Backup: If you have two debit cards, add both. Nothing is more awkward than a "Declined" message when there's a line of twelve people behind you.

- Update your iOS: Apple frequently updates the security certificates for the Wallet app. If you're running an ancient version of iOS, the handshake with the bank will fail every time.

Once the card is in, you're set. You'll probably start forgetting your physical wallet at home, which is its own kind of freedom—until your phone battery hits 1%. Keep a charger handy.