You're standing at the checkout line. The person behind you is sighing loudly because you're fumbling with a physical wallet that seems to have swallowed your debit card whole. We've all been there. It's annoying. Using your phone is just faster, but for some reason, figuring out how to add card to Apple Pay feels like it should be simpler than it occasionally turns out to be.

Apple makes it look seamless in the commercials. A tap, a beep, and you're walking away with a latte. In reality, you might hit a verification loop or a "Card Not Added" error that makes you want to chuck your iPhone 15 into the nearest fountain.

The Basics of Getting That Card Into Your Digital Wallet

Adding a card isn't just about taking a blurry photo of your plastic. You basically have two main paths. You can go through the Wallet app directly, or you can use your bank's own app. Honestly, the bank app route is often smoother because they’ve already verified who you are.

If you're doing the standard manual way, open the Wallet app. Look for the plus sign (+) in the top right corner. It’s small. Don't miss it. Once you tap that, you'll see a list of options like "Debit or Credit Card" or "Transit Card." You want the first one.

✨ Don't miss: Pi VR QR Codes: Why Your Headset Might Be Scanning More Than You Think

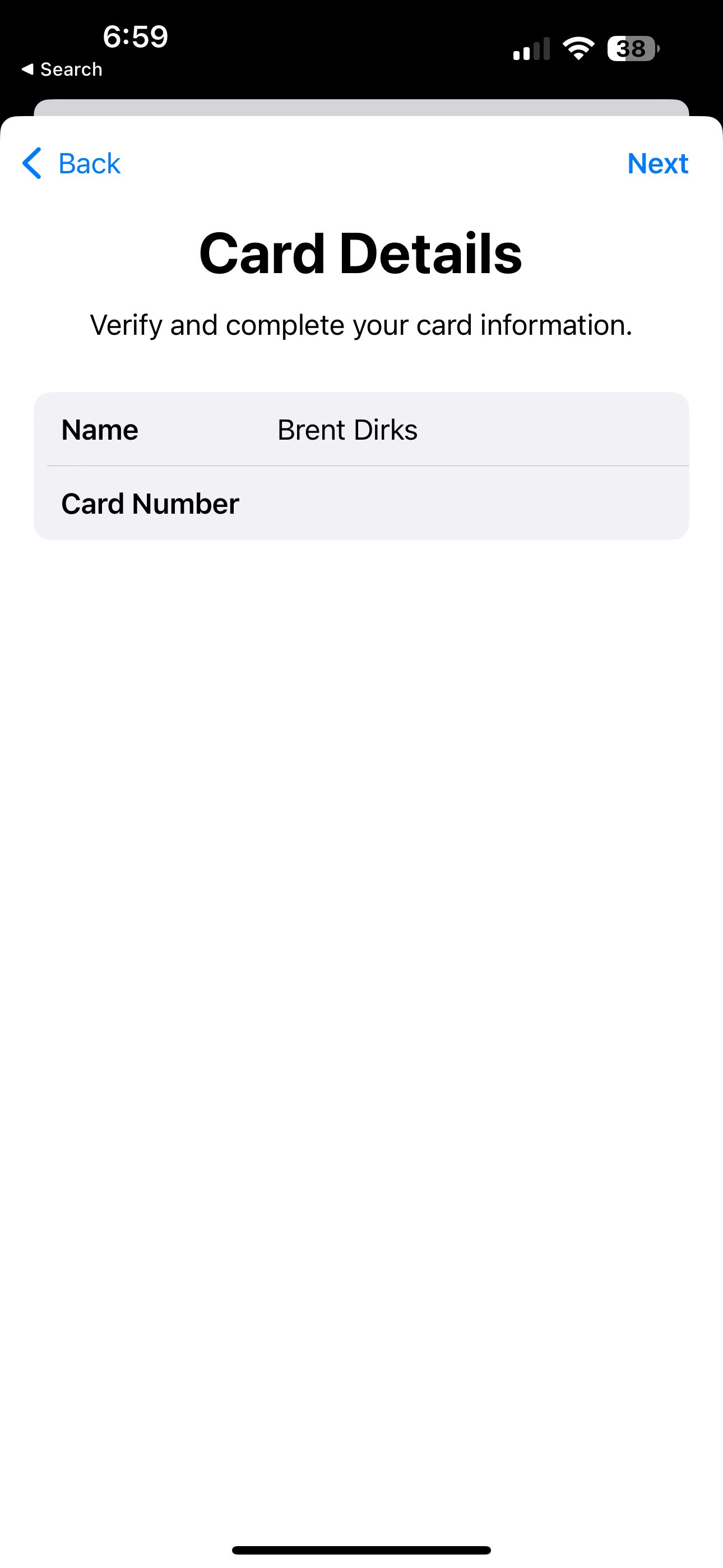

Now, the camera kicks in. Line up your card. If your card is one of those fancy metal ones or has the numbers on the back, the auto-scan might fail. Don't stress. Just tap "Enter Card Details Manually" at the bottom. It takes an extra thirty seconds, but it works every time. You’ll need the card number, the expiration date, and that three-digit CVV code.

Why Your Bank Might Be Ghosting You

Sometimes you get all the info in, and then... nothing. A spinning wheel. Or a message saying "Contact your card issuer." This is the part of how to add card to Apple Pay that people hate.

Banks are paranoid. Rightly so. Fraudsters love Apple Pay because once a stolen card is in a digital wallet, it’s hard to stop. Because of this, your bank might require "Extra Verification." This usually means a text message code, an email, or—heaven forbid—a phone call to a customer service rep.

If you have to call, do it. It’s a five-minute conversation where they ask you your mother’s maiden name or your last transaction amount. Once they flip the switch on their end, the card activates instantly.

Adding a Card to Your Apple Watch (Because It's Different)

People often assume that once a card is on their iPhone, it’s automatically on their Watch. Nope. Apple treats the Watch as a separate secure device with its own "Secure Element" chip. This is actually a great security feature, even if it feels like a chore.

- Open the Watch app on your paired iPhone.

- Go to the "My Watch" tab.

- Scroll down until you find "Wallet & Apple Pay."

- You’ll see your existing phone cards listed under "Cards on Your Phone."

- Tap the "Add" button next to the card you want to move over.

You will likely have to enter the CVV again. The Watch doesn't just copy the data; it requests a new, unique "Device Account Number" from the bank specifically for the Watch's hardware.

The Technical Wizardry Under the Hood

When you learn how to add card to Apple Pay, you aren't actually storing your credit card number on your phone. That would be a security nightmare. Instead, Apple uses a process called tokenization.

When you add the card, Apple sends the data to the bank's servers. The bank (or the network like Visa or Mastercard) creates a "token"—a random string of numbers—that represents your card. This token is what lives on your iPhone. When you pay at a store, your phone sends the token, not your real 16-digit number. Even if a hacker intercepted the signal, the number they get is useless outside of that specific transaction context.

Troubleshooting the "Could Not Add Card" Error

It happens to the best of us. You’ve checked the numbers four times. You have a solid Wi-Fi signal. It still fails. Here are a few real-world reasons why:

👉 See also: Apple Store Tokyo Ginza: Why the World's First International Flagship Still Matters

- Region Settings: If your iPhone region is set to a country where Apple Pay isn't supported, the option might not even appear. Check Settings > General > Language & Region.

- iOS Updates: Apple is constantly updating the security protocols for Wallet. If you're running a version of iOS from two years ago, the handshake between your phone and the bank might fail.

- The "Double Device" Limit: Some banks limit how many devices a single card can be added to. If you have it on an iPad, an old iPhone, and two different Apple Watches, the bank might block the fifth attempt.

- The iCloud Requirement: You must be signed into iCloud. If you aren't, the Secure Element can't link the card to your identity.

Common Misconceptions About Apple Pay

One big myth is that Apple Pay charges you a fee. It doesn't. Merchants pay the same processing fees they would for a physical card swipe. Apple actually takes a tiny cut from the bank's side of the transaction, not yours.

Another weird one is that you need an internet connection to pay. You don't. Since the token is stored locally in the Secure Element chip, you can pay for a subway ride or a sandwich in a basement cafe with zero bars of LTE. The merchant's terminal handles the communication with the bank, not your phone.

Real-World Use Case: The Transit Card

Beyond just credit and debit, knowing how to add card to Apple Pay extends to transit. In cities like New York (OMNY), London (TfL), or Tokyo (Suica/Pasmo), you can add a dedicated transit card or just use your "Express Mode" debit card.

Express Mode is a game changer. It allows you to tap your phone against a turnstile without waking the screen or using FaceID. It just works. If your phone dies, some newer iPhones even have a "Power Reserve" feature that keeps the transit card active for a few hours so you aren't stranded at the train station.

Moving Your Cards to a New iPhone

When you upgrade your phone, don't expect your cards to just show up. Because of the security tokens we talked about, cards do not migrate via iCloud backups for security reasons.

When you set up the new phone, you’ll see "Previous Cards" in the Wallet setup. You’ll have to tap each one and re-enter the CVV. It's a bit of a pain, but it’s better than having your financial data floating around in a cloud backup.

Actionable Steps for a Successful Setup

- Verify your Apple ID: Make sure you're signed in and have Two-Factor Authentication turned on. Apple won't let you use Wallet without it these days.

- Check your Bank's App: Before trying to scan the card in Wallet, open your banking app (like Chase, Amex, or Wells Fargo). Look for an "Add to Apple Wallet" button. It bypasses the manual entry and usually skips the extra verification steps.

- Clean your Camera Lens: If the scanner isn't picking up the numbers, it's probably just a fingerprint smudge on your lens.

- Update your Contact Info: Ensure your bank has your current mobile number. If they try to send a verification text to a landline or an old 2012 email address, you're going to be stuck on hold with support for an hour.

- Remove Old Cards: If you have expired cards in there, delete them. Go to the card, tap the three dots (More), then "Card Details," and scroll to the bottom to "Remove Card." This keeps the "Secure Element" memory clean and prevents errors during future setups.