You've probably seen the ads. They're everywhere. A massive headline promising hundreds of dollars just for moving your paycheck over to a new account. It sounds like free money, right? Well, honestly, it mostly is—if you don't mess up the fine print.

The Capital One direct deposit bonus has become a bit of a legend in the churning community. Why? Because unlike some big banks that make you jump through fifty flaming hoops, Capital One is usually pretty straightforward. But "straightforward" doesn't mean "foolproof." I’ve seen people miss out on $250 or $450 just because they used the wrong transfer method or missed a deadline by twenty-four hours. That hurts.

If you’re looking to snag some extra cash, you need to understand how the 360 Checking system actually works. It isn't just about opening the account. It’s about timing. It’s about the specific type of money entering the account. And frankly, it’s about making sure you aren't already "blacklisted" from the promotion because of an old account you forgot about three years ago.

Why the Capital One Direct Deposit Bonus is Different This Year

Most banks are getting stingier. They want you to keep $10,000 in an account for six months just to give you a hundred bucks. Capital One usually plays a different game. Their most famous recent offer, often tied to the promo code BONUS450 or similar iterations, focuses almost entirely on speed and volume of deposits rather than long-term "parking" of your wealth.

Here is the deal. You open a 360 Checking account. You hit a specific dollar amount in direct deposits within a set window—usually 75 days. Then you wait.

But here is where people get tripped up: the definition of a "Direct Deposit."

In the eyes of Capital One, a direct deposit is an Automated Clearing House (ACH) credit. This usually means a paycheck, pension, or government benefits like Social Security. If you just Venmo yourself $500 from your Chase account? That won't work. If you move money from your PayPal balance? Probably not going to trigger the bonus. The system is looking for a specific "PPD" or "CCD" designation in the transaction code.

The Nitty-Gritty of the 360 Checking Requirements

To qualify for the current Capital One direct deposit bonus, you generally have to be a new customer. If you’ve had a 360 Checking account or a Money Market account in the last few years, you're likely ineligible. They are strict about this. They want fresh blood, not "revolving door" customers who open and close accounts every summer.

- The Promo Code: This is the most common point of failure. You must enter the code at the exact moment of application. If you forget it and try to call customer service later to add it? Good luck. They rarely retroactively apply these.

- The Deposit Window: Usually, you have 75 days from account opening. That sounds like a long time, but if your HR department takes two pay cycles to update your banking info, you’re already halfway through your window.

- The Amount: We’ve seen offers ranging from $250 for $500 in deposits to $450 for $4,000 in deposits. You have to hit the total aggregate amount. It doesn't have to be one giant check; it just has to add up before the clock stops.

I spoke with a guy last month who missed his bonus because he did a "Push" transfer from his brokerage account. He thought since it was an ACH transfer, it counted. It didn't. Capital One’s backend recognized it as a standard bank-to-bank transfer, not a payroll deposit. If you want to be safe, stick to your actual employer’s payroll portal.

Is 360 Checking Actually a Good Account?

Beyond the bribe—let's call the bonus what it is—the account itself is actually solid. I've used it. There are no monthly maintenance fees. That's a huge win. Most "Big Banks" charge you $12 to $15 a month just for the privilege of letting them hold your money unless you keep a high balance. Capital One doesn't do that.

You also get access to their "Cafes." If you haven't been to one, they’re basically Peet’s Coffee shops where you can talk to a banker if you want, or just sit with your laptop and avoid your family. It's a weird hybrid, but it works.

👉 See also: Why How Many Rupees is a Dollar Keeps Changing and What You Can Actually Do About It

The app is also top-tier. It's fast. It doesn't crash when you're trying to check your balance at a grocery store. And the "Early Payday" feature is legit. If your employer sends the payroll file early, Capital One often clears it two days before your coworkers get theirs. It’s a nice psychological boost on a Wednesday.

The "Fine Print" Trap

You need to keep the account open for a certain period. While Capital One doesn't usually claw back the bonus if you close the account immediately after the money hits, it's bad form. More importantly, it can flag you in ChexSystems. If you have a history of "burning and turning" bank accounts, other banks might refuse to open accounts for you in the future.

Keep it open for at least six months. It costs you nothing, and it keeps your banking reputation clean.

Common Mistakes That Kill Your Bonus

- Using the "Transfer Money" button: Doing a standard transfer from your old bank is the fastest way to get $0 in bonus money.

- Missing the 75-day mark: Mark your calendar. Seriously. Set a reminder for day 60 to check if your deposits have cleared the threshold.

- The "Existing Customer" Clause: If you have a Capital One credit card, you're fine. If you have a 360 Performance Savings account, you're usually fine. But if you have had a checking account with them recently, you're likely out of luck.

- Incomplete Applications: If your application goes into "pending" because they need a photo of your ID, the clock might start ticking from the day you started the app, not the day it was approved. Move fast.

Steps to Secure Your Bonus Right Now

First, go to the official Capital One website and find the specific landing page for the Capital One direct deposit bonus. Do not just go to the homepage and open a random account. The "offer" is often tied to a specific URL.

Copy the promo code. Write it on your hand if you have to.

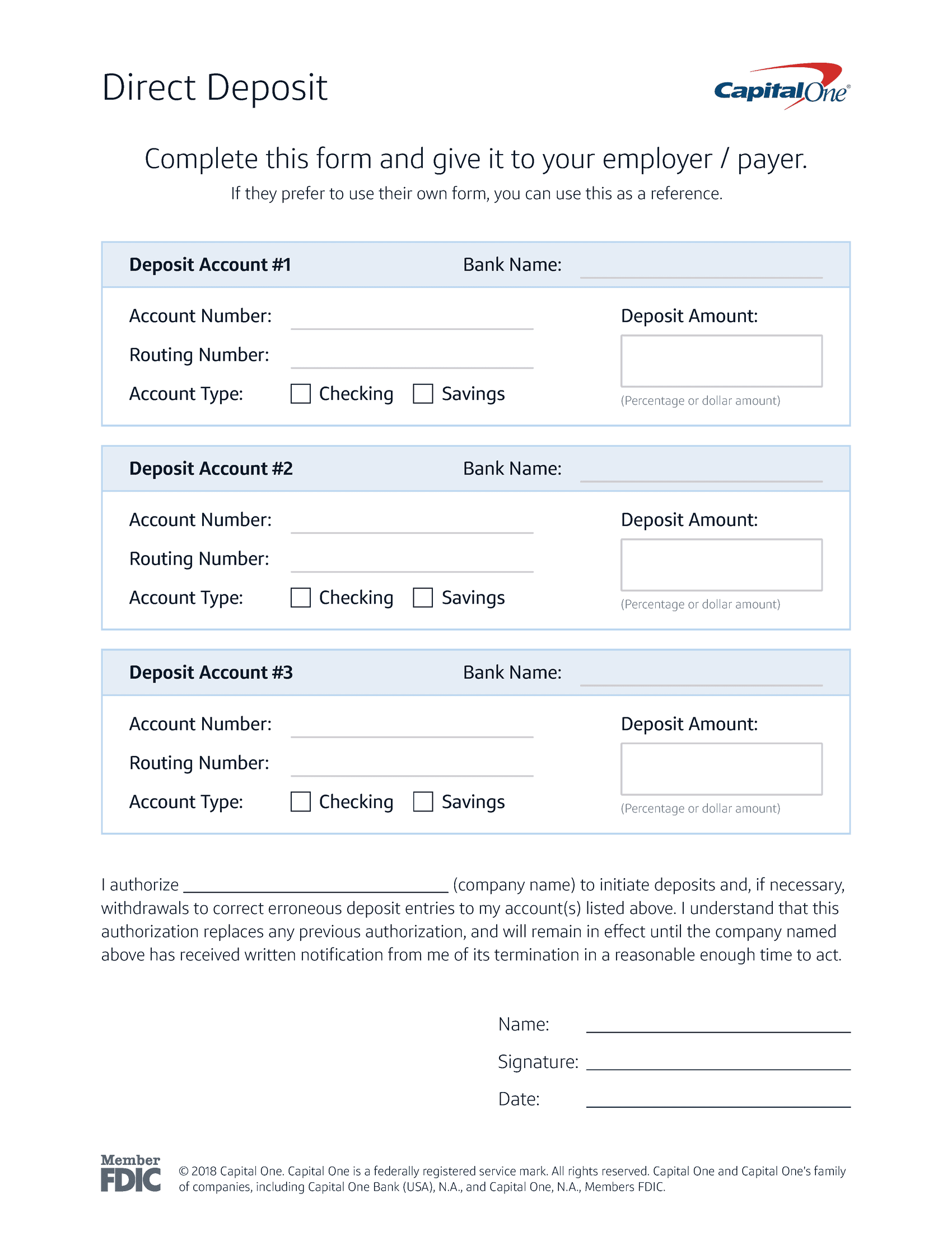

When you fill out the application, ensure your name matches exactly what is on your paycheck. If your payroll says "Jonathan" and you sign up as "Jon," it can sometimes cause a manual review that slows everything down.

Once the account is open, log into your employer's payroll system immediately. Don't wait until Monday. Do it now. If your employer allows for "split" deposits, you can just send a portion of your check to Capital One to hit the goal while keeping your main bills at your old bank. This is the smartest way to do it without disrupting your entire financial life.

✨ Don't miss: Why Did AMZN Stock Drop? What Really Happened With Amazon

Wait Time and Payout

Don't expect the money the day after your last deposit. The terms usually state the bonus will be deposited within 60 days after the 75-day evaluation period ends. This means it could take four or five months from today to actually see that cash. If you need this money to pay rent next week, this isn't the solution for you. This is a long game.

Tactical Summary for Success

- Verify your eligibility: Ensure you haven't had a Capital One checking account in the last two to three years (check the specific terms of the current flyer).

- Use a real payroll deposit: Avoid Zelle, Venmo, or standard ACH transfers from other banks.

- Track your totals: Keep a spreadsheet or a note on your phone. Taxes and 401k deductions can make your "take-home" pay lower than you expect, so make sure the net amount hitting the account adds up to the requirement.

- Keep the account active: Use the debit card once or twice. Show the bank you’re a real human, not a bot hunting for a sign-up bonus.

The window for these high-value offers is usually tight. They pop up for a quarter and then vanish for six months. If you see a $250 or $450 offer live right now, it’s probably time to jump. Just remember: the bank isn't giving you this money because they’re nice. They’re betting that once you set up your direct deposit, you’ll be too lazy to ever switch banks again. If you’re okay with that—or if you’re disciplined enough to move again later—it’s one of the easiest wins in personal finance.

Open the account, enter the code, switch your payroll, and wait. It’s a boring process, but it’s a boring process that pays for a new iPad or a weekend getaway.

Next Steps:

Check your recent bank statements to see your average monthly direct deposit total. Then, visit the Capital One 360 Checking site to see if your current monthly income is enough to hit the highest tier bonus within the 75-day qualifying window. If it is, grab your ID and start the 5-minute application process today.