If you’re looking at your bank account and wondering why everything still feels so expensive, you aren’t alone. Honestly, the global currency market is acting a bit like a seesaw that can’t decide which way to tip. As of mid-January 2026, the US Dollar Index (DXY)—that big number everyone tracks to see how the greenback is doing against other major currencies—is hovering right around 99.30.

That’s a far cry from the peaks of 109 we saw in early 2025.

Basically, the dollar is in a "soft" phase, but it’s definitely not "weak" in the way people usually mean when they're panicked about a total collapse. It’s more of a strategic retreat. We’ve seen a roughly 9% drop over the last year, which is a massive swing in the world of foreign exchange.

The Reality of Dollar Strength in Early 2026

So, how strong is the dollar right now compared to, say, your last summer vacation? Well, if you headed to Tokyo today, you’d find the USD/JPY pair sitting near 160. That is still historically quite high. Even though the dollar has cooled off against the Euro (trading near 1.16) and the British Pound, it’s still holding a lot of ground because other economies are also struggling with their own baggage.

Think of it like being the fastest person in a slow race.

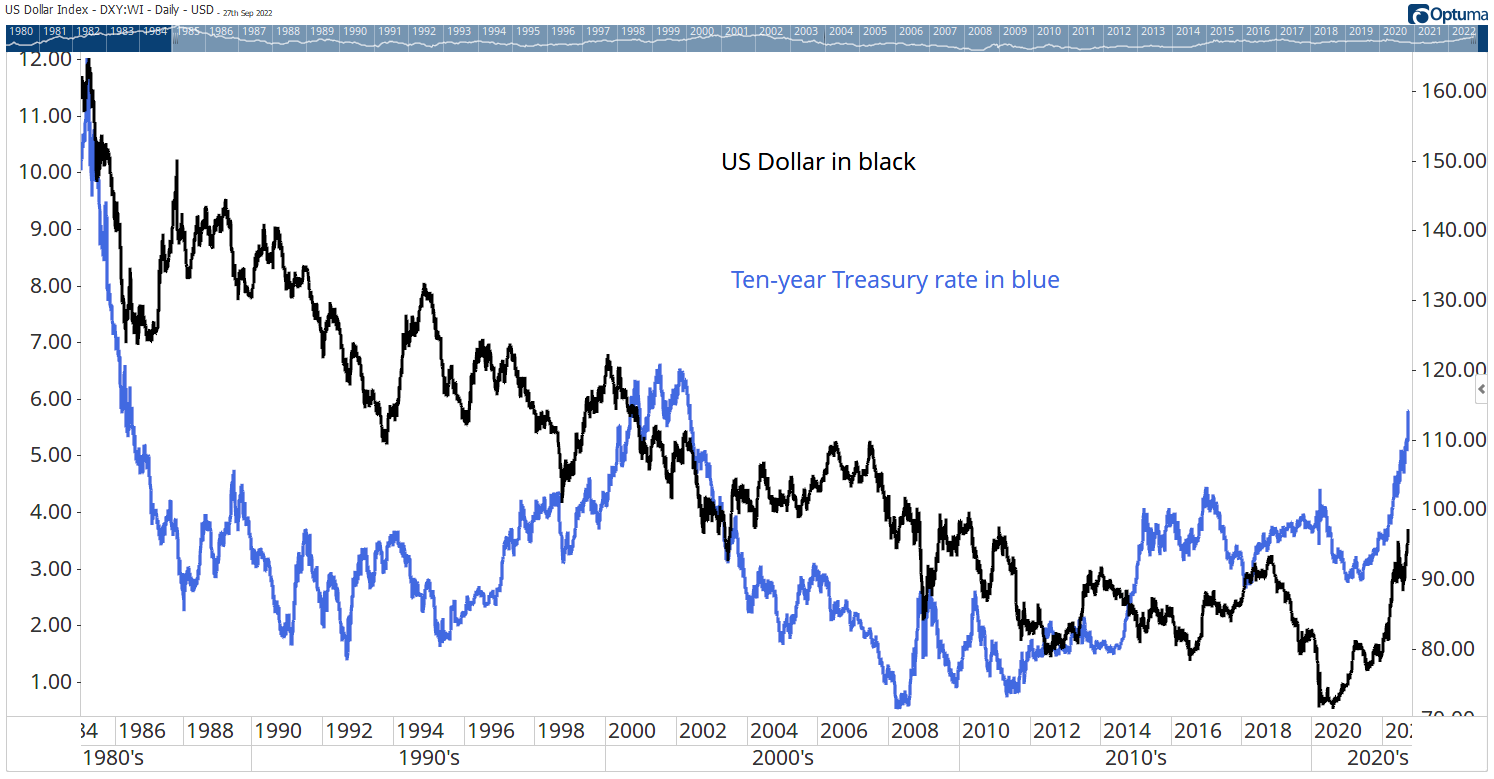

Current sentiment is being driven by a "wait-and-see" vibe from the Federal Reserve. Just this week, Jan Hatzius and the team at Goldman Sachs pointed out that while the Fed paused rate cuts in January, they’re still likely to start trimming again by March. When interest rates stay high, the dollar stays strong because investors want to park their money where it earns the most interest. But as soon as the Fed hints at more cuts, that "yield advantage" starts to evaporate.

Why the "Dollar Smile" Is Smirking

Economists often talk about the "Dollar Smile" theory. It’s the idea that the dollar gets strong when the US economy is booming and when the rest of the world is in a total crisis. It only weakens in the middle, when global growth is just... okay.

Right now, we are in that awkward middle.

- Jobless claims just came in lower than expected at 198K.

- Consumer spending is holding up, but it's not exactly "roaring."

- Inflation (Core PCE) is stuck around 2.7%, which is close enough to the Fed's 2% goal to make them cautious but not enough to make them celebrate.

It's a weird spot. You've got President Trump pushing for lower interest rates to boost manufacturing, while Fed officials like Jeff Schmid are out there giving speeches about how "complacency" on inflation is a huge risk. This tug-of-war is keeping the DXY pinned below that psychological 100 level.

What This Means for Your Wallet

If you’re planning a trip or buying imported goods, the math has changed. A 9% drop in the dollar’s value over twelve months means that $1,000 you spent on a French vineyard tour last year now buys you about $90 less in local services. It’s a slow-motion tax on international lifestyle.

But for US companies like Apple or Microsoft? They're probably secretly loving this.

When the dollar is a bit weaker, their iPhones and software become cheaper for someone in Berlin or Sydney to buy. It's a boost for exports. Morgan Stanley actually predicts the dollar could dip as low as 94 by the second quarter of 2026. If that happens, you’ll see US-made goods flying off global shelves, but your imported Italian shoes are going to get a lot pricier.

The Elephant in the Room: The "One Big Beautiful Bill"

We can't talk about the dollar without mentioning the fiscal side of things. The "One Big Beautiful Bill" (OBBBA) passed last year has cemented a pretty massive budget deficit. Markets are starting to ask: "How much debt is too much?"

J.P. Morgan analysts have noted that the dollar's "safe haven" status is being tested. People still trust the dollar—it's still involved in 88% of all currency trades—but they aren't as blindly loyal as they were five years ago. There’s a noticeable shift where foreign investors are starting to hedge their bets. They aren't selling their Treasuries yet, but they are buying insurance, just in case.

Is the Dollar's Bull Run Actually Over?

For years, the dollar was the undisputed king. We had a bull cycle that lasted nearly a decade. Now, experts like George Saravelos at Deutsche Bank are suggesting that this era might finally be ending.

It’s not a crash. It’s a rebalancing.

The Euro is becoming a more viable alternative again now that negative interest rates are a distant memory in Europe. Even the Chinese Yuan (CNY) has shown surprising resilience, staying strong even when the dollar tries to rally.

Actionable Insights for Right Now

If you're trying to navigate this, here is how you should actually play it:

👉 See also: Finding the Kickoff Customer Service Number Without Losing Your Mind

- Lock in Travel Costs: If you have a trip planned for late 2026, consider booking your hotels or buying currency now. If the DXY hits 94 like some analysts predict, your dollar will buy significantly less by June.

- Watch the Fed in March: This is the next big "inflection point." If they cut rates, expect the dollar to slide further. If they hold, it might bounce back toward 102.

- Diversify Your Cash: If you're holding large amounts of cash, having some exposure to "harder" assets or international equities might offset the slow erosion of the dollar's purchasing power.

- Exporters vs. Importers: If you’re investing in stocks, look for companies with heavy international sales. They thrive when the dollar softens. Avoid companies that rely solely on cheap imports, as their margins are about to get squeezed.

The bottom line? The dollar is still the heavyweight champion, but it’s definitely nursing a few bruises. It isn't as strong as it was a year ago, but compared to the alternatives, it’s still the cleanest shirt in the dirty laundry basket. Keep an eye on the 99.50 resistance level—if we break above that, the "strong dollar" narrative might just find its second wind.