Honestly, the days of just handing a twenty-dollar bill to your kid for a movie are basically over. Everything is digital now. If you're a parent or a teenager, you've probably wondered about the age limit on payment apps because, let's face it, nobody wants their account frozen with fifty bucks sitting in it.

So, how old do you have to be to use Venmo?

For a long time, the answer was a hard 18. No exceptions. But things shifted. Now, the answer is a bit more nuanced: you have to be at least 18 to have your own independent account, but you can be as young as 13 to use a Venmo Teen Account.

The 18-Year-Old Rule for Standard Accounts

If you want to sign up for Venmo on your own—meaning you link your own bank account, verify your own ID, and have full control without a parent looking over your shoulder—you must be 18 years old. This isn't just a Venmo suggestion; it’s baked into their legal User Agreement.

Why 18? It mostly comes down to legal contracts. In most U.S. states, people under 18 are considered minors and can't legally enter into a binding contract. Since using a financial app involve a lot of legal "I agrees," companies play it safe by sticking to the age of majority.

🔗 Read more: TECL Stock Price Today: Why Leveraged Tech is Still Moving the Needle

If you try to lie about your age, you'll likely hit a wall. Venmo is owned by PayPal, and they are very good at "Know Your Customer" (KYC) checks. They usually ask for the last four digits of your Social Security Number or a photo of your ID. If the math doesn't add up to 18, they’ll lock the account.

The Venmo Teen Account: For Ages 13 to 17

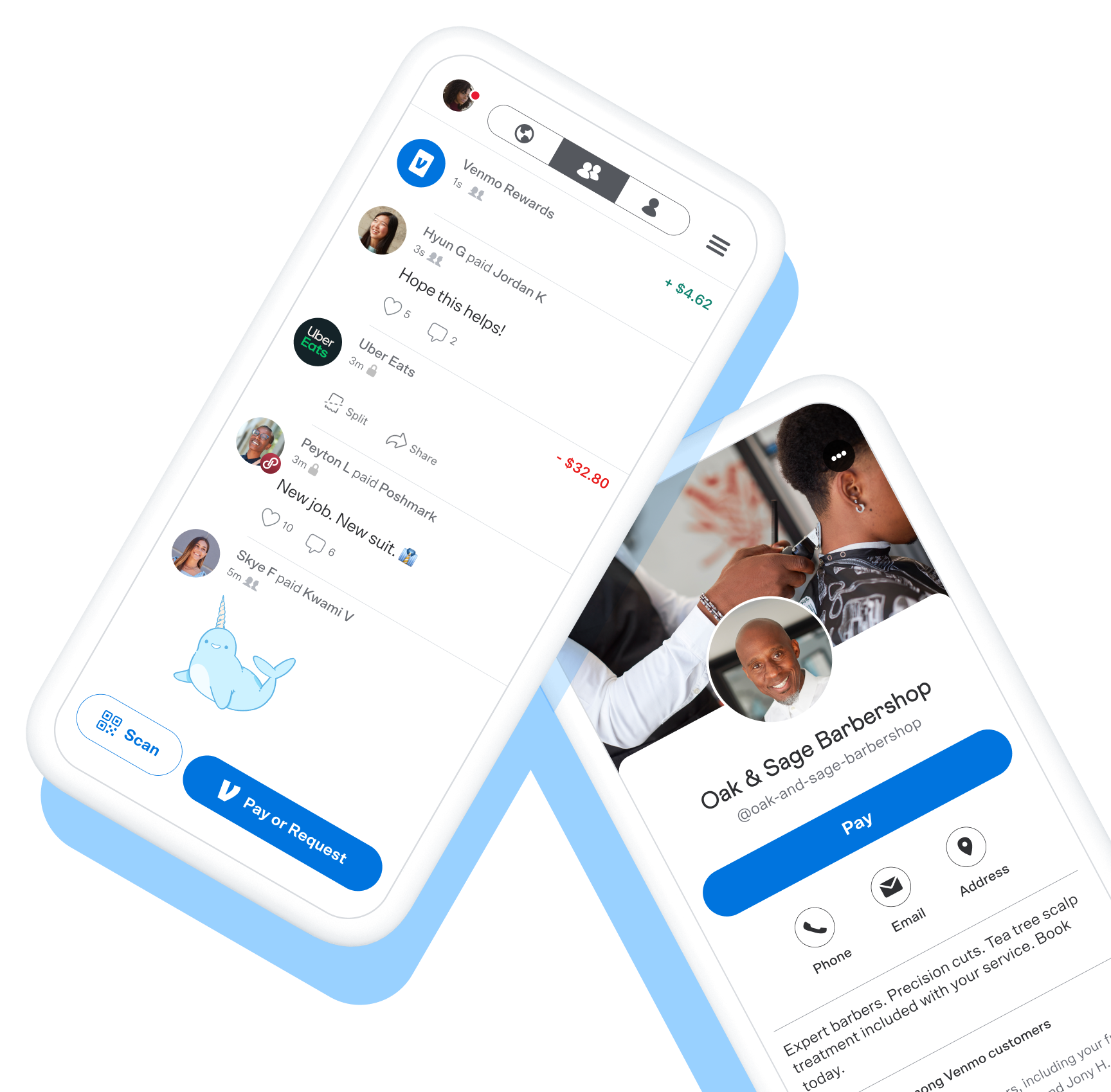

Around 2023, Venmo realized they were missing out on millions of Gen Z users. They launched the Venmo Teen Account, which is specifically designed for 13 to 17-year-olds.

Here is the catch: A teen cannot just download the app and start an account. A parent or legal guardian has to be the one to initiate the process from their own verified Venmo account. It’s basically a sub-account.

What can a 13-year-old actually do on the app?

Quite a bit, actually. Once the parent sets it up, the teen gets:

- Their own Venmo Teen Mastercard Debit Card: This is huge. They can use it at physical stores or for online shopping.

- A separate balance: The teen's money isn't mixed in with the parent's money.

- Direct Deposit: If they have a part-time job at a coffee shop or grocery store, they can have their paycheck sent straight to their Venmo balance.

- App Access: They can see their own transactions and send money to friends who also have Venmo.

Parental Control is Real

If you're a teenager, you should know that this isn't total freedom. Your parents can see everything. They get alerts when you spend money, they can lock your debit card if you lose it (or get grounded), and they can see who you are sending money to.

👉 See also: How a Great Enter to Win Sign Actually Drives Business Growth

Privacy is also different for teens. By default, teen accounts are set to "Private." This means the general public can't see that you just paid your friend for pizza. Only the parent can change these privacy settings.

Parents can manage up to five teen accounts. This is pretty handy for big families who want to ditch the "allowance in an envelope" system.

What Teens Can't Do

Even with a Teen Account, there are some "adult" features that are off-limits until you hit that 18-year-old milestone.

✨ Don't miss: Troy from Shark Tank: What Really Happened to Troy Parker and his Business

- Crypto: Teens cannot buy, sell, or hold Bitcoin or other cryptocurrencies on Venmo.

- Business Profiles: You can't start an official "Business Profile" to sell handmade crafts or services.

- Check Cashing: The "Cash a Check" feature is generally reserved for the primary adult account holder.

- Credit Cards: You can't apply for the Venmo Credit Card; you're stuck with the debit version until you're older.

Why 13 is the Magic Number

You might wonder why it's 13 and not 10 or 11. This is largely due to a federal law called COPPA (Children's Online Privacy Protection Act). It places strict requirements on how companies collect data from kids under 13. To avoid the massive legal headache of complying with those rules, most tech companies—including Venmo, TikTok, and Instagram—just set their minimum age at 13.

Is it Safe?

Safety is a valid concern. Scams are rampant on P2P (peer-to-peer) apps. Expert advice from organizations like Money Management International suggests that parents should use these accounts as a "teaching moment."

One big risk is "accidental" payments. If a teen types in the wrong username and sends $50 to a stranger, that money is usually gone. Venmo treats those payments like cash. Unlike a credit card, you can't just "chargeback" a payment because you made a typo.

Moving from Teen to Adult Account

What happens when you turn 18? You don't just lose everything.

Once a teen reaches the age of majority, they can "graduate" to a full, independent Venmo account. At that point, the link to the parent's account is severed, and the young adult takes full legal responsibility for their transactions. They get access to the full suite of features, like crypto and business profiles.

Actionable Steps for Parents and Teens

If you're ready to get started, here is exactly how to navigate the age requirements:

- Check Eligibility: The parent must have a fully verified Venmo account in good standing.

- Update the App: Open the Venmo app and go to the "Me" tab. Tap your name in the top left. If you see "Create a teen account," you're good to go.

- Order the Card: Let the teen pick their card color. It makes the "financial responsibility" talk feel a little less like a lecture.

- Set the Rules: Before finishing the setup, agree on what the account is for. Is it just for emergencies? Or for their job earnings?

- Verify Identity: Be prepared to provide the teen's legal name, date of birth, and potentially other details to satisfy federal banking regulations.