Tax season is a weird mix of anxiety and Christmas-morning energy. Everyone wants to know the magic number. You’re sitting there, staring at your W-2 or your 1099, wondering how much will you get back in taxes this year. Honestly, it’s rarely as straightforward as those online calculators make it seem. You plug in a few numbers, the screen flashes "Estimated Refund: $3,400," and you start mentally spending that money on a new couch or a flight to Mexico.

Stop right there.

The IRS doesn’t just hand out checks because they like you. A tax refund is essentially an interest-free loan you gave the government. If you got a massive refund last year, it means you overpaid your share every single month. If you owed money, you underpaid. The goal for most people—at least according to the "pros"—is to get as close to zero as possible. But let's be real, we all love that lump sum.

🔗 Read more: 29 Euros to USD: Why the Conversion Rate Always Feels Like a Moving Target

The Reality of the Average Refund

Let’s look at the actual data from the IRS. For the 2024 filing season (covering the 2023 tax year), the average refund hovered around $2,852. That’s a decent chunk of change. However, that number is a massive generalization. It includes billionaires and people working part-time at a coffee shop.

Your specific slice of the pie depends on a chaotic cocktail of your filing status, your adjusted gross income (AGI), and whether you’re claiming the standard deduction or itemizing. Most people—about 90% of taxpayers—now take the standard deduction. For the 2025 tax year (the taxes you file in 2026), that standard deduction has climbed to $15,000 for individuals and $30,000 for married couples filing jointly. If your total tax liability is less than what your employer withheld from your paycheck, you get a refund. Simple. But the math gets messy when credits enter the chat.

Credits vs. Deductions: The Real Difference-Makers

People get these two confused constantly. It matters. A deduction lowers the amount of income you’re taxed on. A credit, however, is a dollar-for-dollar reduction in the actual tax you owe.

Take the Child Tax Credit (CTC). It’s a heavy hitter. For many families, this is the primary reason their refund looks so fat. Then there’s the Earned Income Tax Credit (EITC), which is designed for low-to-moderate-income working individuals and couples, particularly those with children. The EITC is "refundable," meaning if the credit reduces your tax bill to below zero, the IRS actually sends you the leftover balance.

Think about a freelancer. Say you’re a graphic designer. You made $70,000, but you had $15,000 in business expenses. Your taxable income drops. But if you also qualify for an energy-efficient home improvement credit because you installed solar panels, that’s where the "getting money back" part really accelerates.

Why Your Refund Might Feel Smaller This Year

Inflation is a thief. The IRS adjusts tax brackets for inflation every year to prevent "bracket creep," which is when you get a raise that just barely keeps up with the cost of living but gets pushed into a higher tax percentage anyway.

For 2025, the brackets shifted up by about 2.8%. If your income stayed exactly the same as last year, you might actually owe slightly less in taxes, which could increase your refund. But if you worked a lot of overtime or landed a better-paying gig, you might have jumped into a higher tier.

The Withholding Trap

If you changed jobs recently, did you update your W-4? Most people don't. They just check "Single" or "Married" and move on. If your employer is withholding based on old data—or if you have two jobs and both are withholding as if they are your only source of income—you’re going to be in for a shock. You might think you're due for a windfall, but you might end up owing the Treasury instead.

Self-Employment and the 1099 Struggle

If you're part of the gig economy, the question of how much will you get back in taxes usually turns into "how much do I have to pay?"

The self-employment tax is 15.3%. That covers Social Security and Medicare. When you’re a W-2 employee, your boss pays half of that. When you’re the boss, you pay the whole thing. To get a refund as a freelancer, you generally have to overpay your quarterly estimated taxes. It’s a psychological game. Some people intentionally overpay their quarterlies just so they don't have to worry about a surprise bill in April. It’s not the most efficient way to manage cash flow, but it helps some people sleep at night.

The Impact of State Taxes

We talk a lot about the IRS, but your state wants its cut too. Unless you live in a place like Florida, Texas, or Washington, you’re likely dealing with state income tax. Sometimes you get a federal refund but owe the state. Or vice versa.

In states like California or New York, the brackets are aggressive. If you're wondering about your total "get back" amount, you have to look at the combined total. It’s also worth noting that the SALT (State and Local Tax) deduction is still capped at $10,000. If you live in a high-tax area and own a home, this cap often limits how much you can actually get back through itemizing.

Common Myths That Mess With Your Head

- "I can claim my dog as a dependent." No. You can't. Unless that dog is a certified service animal and you’re deducting medical expenses, and even then, it’s not a "dependent" in the way a human child is.

- "Filing an extension gives me more time to pay." Nope. An extension gives you more time to send in the paperwork. The money is still due by April 15th. If you don't pay by then, the IRS starts tacking on interest and penalties.

- "Getting a big refund is a sign of good financial planning." It's actually the opposite. It means you gave the government a 0% interest loan for 12 months. You could have had that money in a high-yield savings account earning 4% or 5% all year.

How to Estimate Your Number Right Now

You don't need to wait for a tax pro to get a ballpark figure.

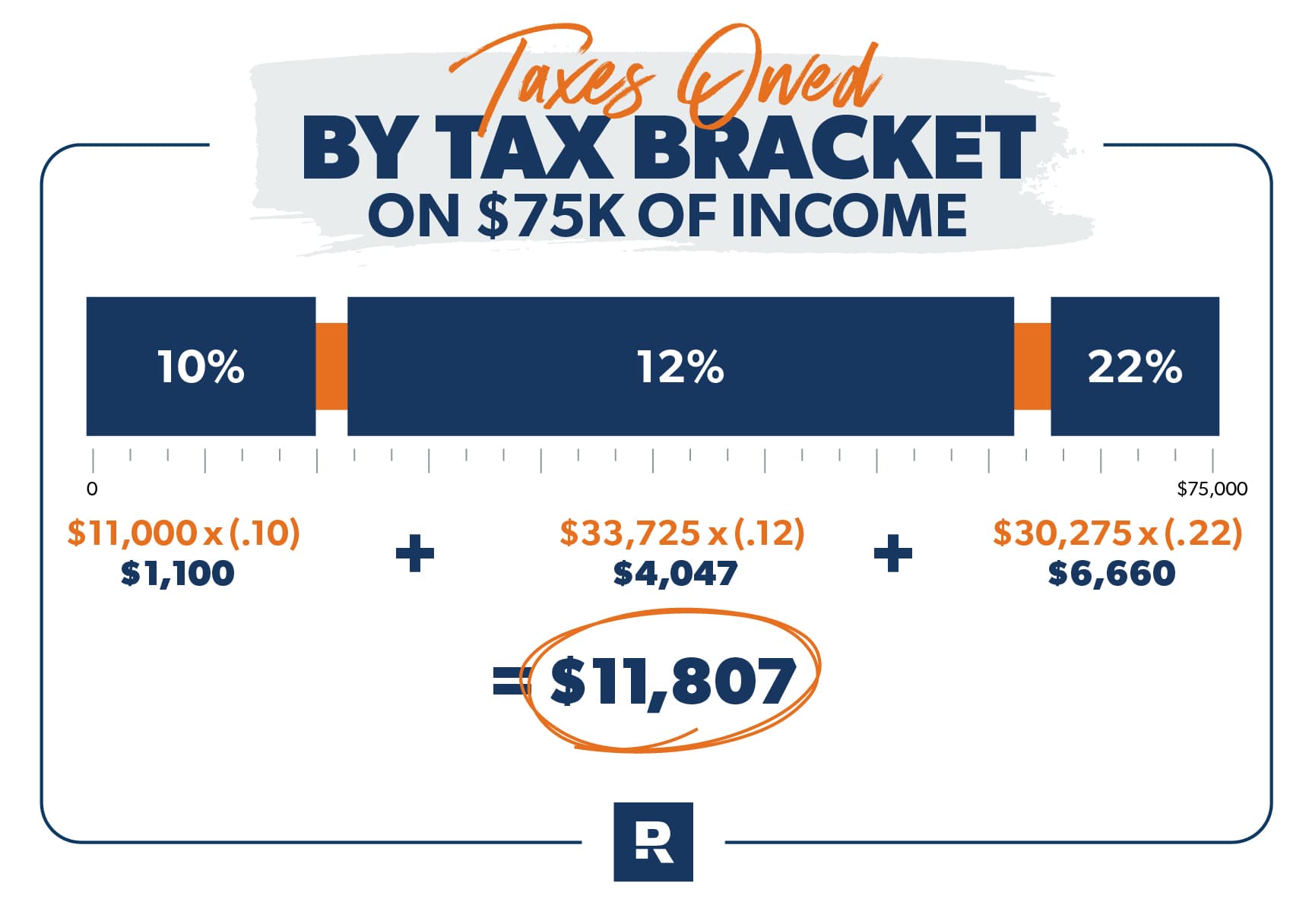

First, find your total income. All of it. Side hustles, bank interest, the $50 you won on a scratcher if you're being "by the book." Subtract your deduction ($15,000 for singles). What's left is your taxable income. Look up the 2025 tax brackets. If you’re single and your taxable income is $45,000, you aren't paying one flat rate. You pay 10% on the first chunk and 12% on the rest.

📖 Related: Make It Exist First: The Brutal Reality of Product Validation

Compare that final tax number to the "Federal Income Tax Withheld" box on your last paycheck stub of the year. If you've already paid more than the calculated tax, that surplus is roughly what you'll get back.

What About the "Surprises"?

Real life is messy. Maybe you sold some stock (Capital Gains). Maybe you took a withdrawal from an IRA (Penalty city). Maybe you got married mid-year. All of these things act like a wrench in the gears of a standard tax return.

The IRS is also getting better at spotting discrepancies. Their tech is old, sure, but their data matching is surprisingly sharp. If you "forgot" a 1099-NEC from a side gig, they will find it. And they will send you a letter. It won't be a fun letter.

Actionable Steps to Maximize Your Return

If you want to ensure you're getting every penny back that you're legally entitled to, you need to be proactive. Waiting until April 14th is a recipe for missing things.

💡 You might also like: How Many Gallons in a Barrel: Why the Answer is Never Just One Number

- Review your W-4 today. If you want a bigger refund next year, increase your withholding. If you want more money in your monthly paycheck, decrease it. Use the IRS Tax Withholding Estimator tool—it's actually pretty good.

- Gather receipts for energy-efficient upgrades. The government is still pushing hard on "green" initiatives. Heat pumps, windows, and insulation can trigger credits that directly increase your refund.

- Contribute to a traditional IRA. You have until the filing deadline to contribute for the previous year. This can lower your taxable income at the last minute, potentially pushing you into a lower bracket or increasing your refund.

- Check for "forgotten" credits. The Lifetime Learning Credit (LLC) or the American Opportunity Tax Credit (AOTC) are huge for students or parents paying tuition. Don't leave those on the table.

- Organize your 1099s. If you have multiple income streams, use a simple spreadsheet. Tracking your expenses throughout the year is the difference between a $500 refund and a $2,000 refund for the self-employed.

The question of how much will you get back in taxes isn't just about a one-time check. It's a reflection of your entire financial year. Use the current numbers to plan, adjust your withholdings if you're unhappy with the outcome, and keep an eye on those shifting tax brackets as inflation continues to move the goalposts. For most, the refund is a forced savings account. For the savvy, it’s a number to be minimized in favor of monthly cash flow. Either way, knowing where you stand before the deadline hits is the only way to avoid the April panic.