Nobody actually enjoys looking at their paystub. It's a universal gut punch to see that big "Gross Pay" number at the top and then watch it get whittled down by federal, state, and local entities until you're left with the "Net" scraps. You’ve likely googled a how much tax would i pay calculator at least once during a job hunt or after a raise.

But here is the thing. Most of those calculators are lying to you by omission.

They do the basic math well enough. They know the IRS tax brackets. They know the difference between a single filer and a head of household. However, they almost always fail to account for the weird, specific nuances of the American tax code that actually determine whether you're getting a $3,000 refund or writing a check to the Treasury next April. Taxes are personal. They are messy. And if you’re just plugging one number into a box, you’re only getting half the story.

The Mirage of the Marginal Tax Bracket

We need to talk about the "tax bracket" myth. I hear people say it all the time: "I don't want a raise because it'll push me into a higher bracket and I'll make less money."

That is not how it works. At all.

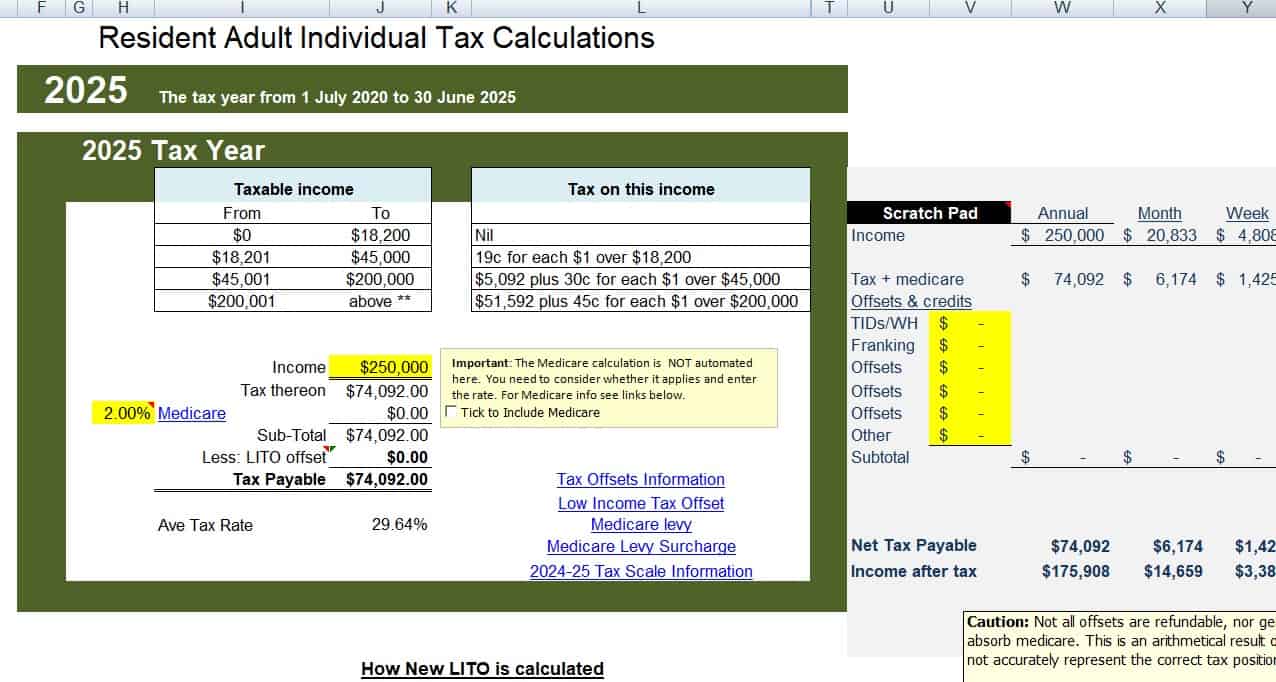

The U.S. uses a progressive tax system. If you use a how much tax would i pay calculator, you'll see your income sliced up like a layer cake. For the 2025-2026 tax years, the first chunk of your income is taxed at 10%. The next slice is at 12%. Then 22%, and so on. Moving into a higher bracket only means the new dollars are taxed at the higher rate. You never, ever take home less total cash because you got a raise.

If a calculator tells you that you owe a flat 24% on your $100,000 salary, close that tab immediately. Your effective tax rate—what you actually pay divided by what you earned—is always lower than your marginal rate.

📖 Related: Why Is AMD Stock Down Today? What Most People Get Wrong

Let's look at a real-world scenario. A single filer making $85,000 in 2025 isn't paying 22% on the whole $85,000. After the standard deduction (which is $15,000 for singles in 2025), their taxable income is actually $70,000. They pay 10% on the first $11,925, 12% on the amount up to $48,475, and 22% only on the remaining sliver. Their effective rate is likely closer to 13% or 14%.

Why the Standard Deduction Changes Everything

The standard deduction is the "free" money the government lets you keep before they even start counting. For the 2025 tax year, the IRS bumped these numbers up to account for inflation.

- Single filers: $15,000

- Married filing jointly: $30,000

- Head of household: $22,500

When you're using a how much tax would i pay calculator, make sure it asks for your filing status first. If it doesn't, it’s basically useless. If you have a mortgage, massive medical bills, or gave a fortune to charity, you might "itemize." But since the Tax Cuts and Jobs Act (TCJA) of 2017, nearly 90% of Americans just take the standard deduction. It’s usually the better deal.

The "Silent" Taxes You Forget to Calculate

Federal income tax gets all the headlines, but it's rarely the only hand in your pocket. FICA is the silent killer of take-home pay.

FICA stands for the Federal Insurance Contributions Act. It covers Social Security and Medicare. It’s a flat 7.65% for most people (6.2% for Social Security and 1.45% for Medicare).

Here’s the kicker: if you are self-employed or a freelancer, you're the employer and the employee. You pay both halves. That’s 15.3%. A lot of "how much tax would I pay" searches come from 1099 contractors who are horrified to find out they owe double the FICA taxes of their W-2 peers.

💡 You might also like: Clark and Howard Towing: What Most People Get Wrong

Then there is the Social Security wage cap. In 2025, you only pay that 6.2% on the first $176,100 you earn. If you make $200,000, those last few dollars are "Social Security tax-free." Most basic calculators miss this. They just keep multiplying by 7.65% forever, which makes high earners look poorer on paper than they actually are.

State and Local Surprises

Living in Florida or Texas? Lucky you. Your state income tax is zero.

Living in New York City or San Francisco? Prepare for a reality check. Not only do you have state tax, but you might have a "city tax" too. In NYC, the local income tax can add another 3% to 4% on top of everything else. If your how much tax would i pay calculator doesn't ask for your zip code, it’s guessing.

Credits vs. Deductions: The Math That Matters

This is where people get confused. A deduction lowers the amount of income you are taxed on. A credit is a dollar-for-dollar reduction in the tax you actually owe.

Credits are king.

Take the Child Tax Credit. If you have a kid, and you owe the IRS $5,000, but you have a $2,000 credit, you now owe $3,000. Simple. A $2,000 deduction, however, might only save you $440 (if you’re in the 22% bracket).

When you're trying to figure out your tax bill, you have to look at:

👉 See also: Is There a Tax on Overtime? What Your Paycheck Actually Shows

- The Child Tax Credit: Still a massive factor for families.

- Earned Income Tax Credit (EITC): Specifically for low-to-moderate-income working individuals.

- Education Credits: Like the American Opportunity Tax Credit (AOTC) for college costs.

If your calculator isn't asking if you have kids or if you're in school, the number it gives you is going to be way too high. You're leaving "fake" money on the table.

The 2026 Cliff: What Nobody is Telling You

We are currently living in a temporary tax world. Most of the individual tax provisions from the 2017 TCJA are set to expire at the end of 2025.

What does that mean for your how much tax would i pay calculator results? It means that starting in 2026, tax rates are likely going back up. The standard deduction will likely be cut nearly in half. The 12% bracket might go back to 15%. The 22% might jump to 25%.

If you are planning a multi-year budget or thinking about a big purchase in 2026, you can't rely on 2025 math. The rules are changing. It’s a political football, sure, but unless Congress acts, you’re going to pay more in 2026 than you did in 2025 for the exact same salary.

How to Get an Accurate Number

If you want to know what you’re actually going to pay, stop using the "one-box" calculators. You need a tool that mimics a 1040 form.

First, determine your Adjusted Gross Income (AGI). This isn't just your salary. It’s your salary minus things like 401(k) contributions and Health Savings Account (HSA) deposits. If you make $100,000 but put $20,000 into a 401(k), the IRS only sees $80,000. That’s a massive difference.

Second, subtract your deduction. Most likely the $15,000 or $30,000 mentioned earlier.

Third, apply the brackets. Do the "layer cake" math.

Fourth, subtract your credits. Fifth, add in your FICA and state taxes. It sounds like a lot. It is. But that’s why "simple" calculators usually fail. They ignore the 401(k) contribution that lowers your taxable income. They ignore the HSA. They ignore the fact that you live in a high-tax municipality.

Actionable Steps for Your Tax Planning

Don't just stare at a calculator and stress out. Use the information to make moves now while the year is still active.

- Check your W-4: If the calculator says you'll owe $15,000 this year, but your paystubs show you’ve only had $10,000 withheld so far, you’re headed for a disaster in April. Adjust your withholding on your employer’s payroll site immediately.

- Max out "Above-the-Line" deductions: Every dollar you put into a traditional 401(k) or a traditional IRA (if you qualify) is a dollar the IRS can't touch. It’s the fastest way to "cheat" the calculator in your favor legally.

- Look at your "Other" income: Did you sell some crypto? Did you flip a house? Did you win a decent parlay on a sports betting app? A how much tax would i pay calculator usually only asks for "annual salary." It forgets about capital gains, which are taxed at different rates (0%, 15%, or 20% depending on income).

- Gather your receipts if you're 1099: If you're a freelancer, your "taxable income" is your revenue minus your business expenses. Don't pay tax on the money you spent on a new laptop or your home office internet.

The bottom line is that tax calculators are a starting point, not a final destination. They are great for "ballpark" figures, but the IRS doesn't deal in ballparks—they deal in exact decimals. Take the time to run your numbers through a more robust tool, like the official IRS Tax Withholding Estimator, which is much more thorough than the average blog sidebar tool.