You’ve probably spent the last few weeks staring at your paystubs or that pile of 1099s, wondering one thing: how much of a tax return will I get this year? It’s the big question. Honestly, it’s the only reason most of us tolerate the headache of filing at all. We want that "government bonus" back in our pockets. But here is the thing—technically, you don’t get a tax return. You file a return to get a refund.

It’s a tiny semantic detail, but it matters because the IRS isn't giving you a gift. They're returning your own interest-free loan.

Predicting the exact dollar amount is kinda like trying to predict the weather in April; we have the tools to get close, but a sudden shift in your income or a missed credit can change everything. Last year, the average refund hovered around $3,000 for many households, but your specific number depends on a chaotic mix of your tax bracket, your filing status, and how many kids or "dependents" are currently eating you out of house and home.

The Math Behind Your Check

The IRS basically runs a giant balancing act. Throughout the year, you pay into the system. If you’re a W-2 employee, your boss takes a chunk out of every paycheck based on what you put on your Form W-4. If you're a freelancer or a "gig" worker, you’re supposed to be sending in estimated payments.

At the end of the year, the IRS looks at your total tax liability—the actual amount you owe based on your income—and compares it to what you already paid. If you paid $10,000 but only owed $8,000, you get $2,000 back. Simple, right? Well, not really. Because credits and deductions enter the chat and mess with the math in a way that usually works in your favor.

Standard vs. Itemized: The Great Divide

Most people—roughly 90% of taxpayers—take the Standard Deduction. For the 2025 tax year (the ones you're likely filing in early 2026), these numbers have adjusted for inflation. For single filers, it's roughly $15,000. For married couples filing jointly, you're looking at double that.

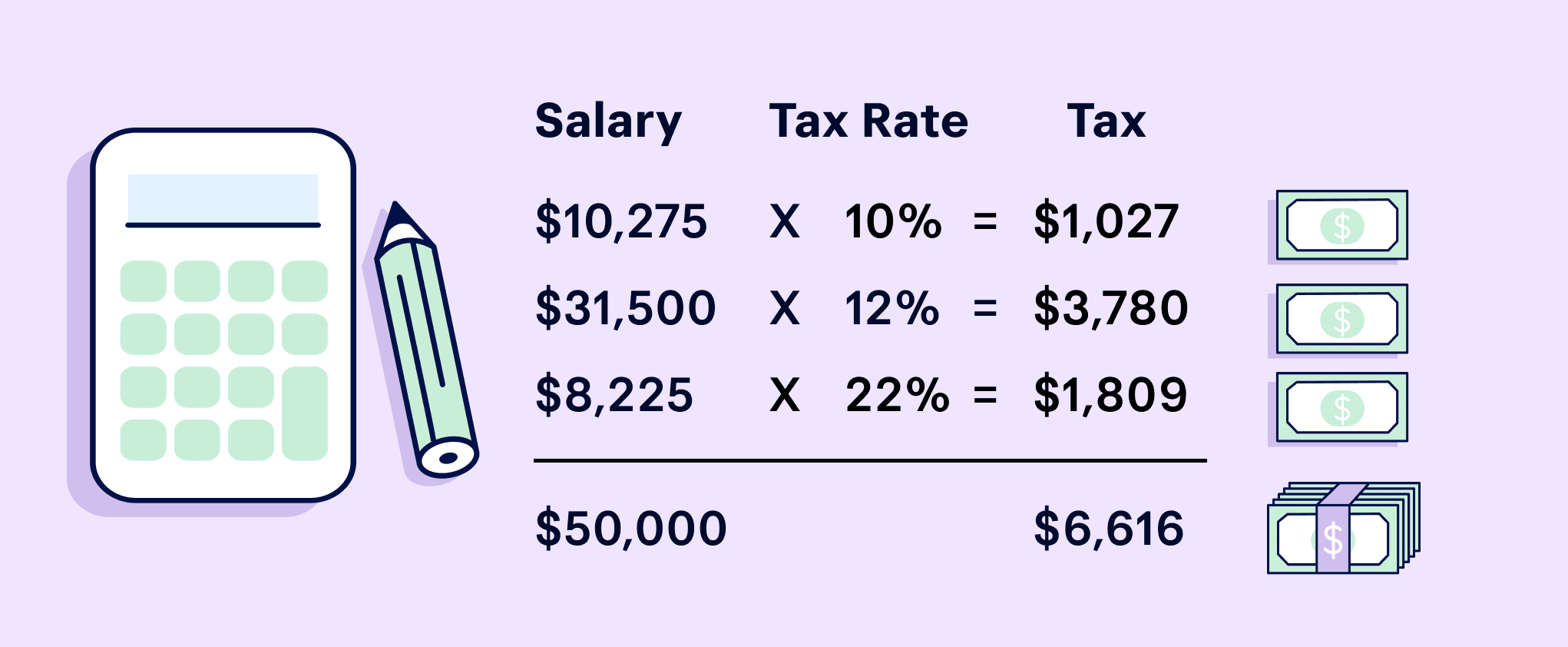

Think of the standard deduction as a "free pass" on a portion of your income. You don't pay taxes on that chunk. If you made $50,000 and the deduction is $15,000, the IRS acts like you only made $35,000. That’s a massive swing in your favor. You only itemize if your specific expenses—like massive medical bills, huge charitable donations, or mortgage interest—add up to more than that standard "free pass" amount.

Most don't. It’s just not worth the paperwork unless you have a very expensive year.

Why Your Friend Got $5,000 and You Got $500

It feels unfair. You and your buddy make the same salary, yet their "how much of a tax return will I get" answer is a tropical vacation, and yours is a dinner at Chipotle.

📖 Related: Bates Nut Farm Woods Valley Road Valley Center CA: Why Everyone Still Goes After 100 Years

Why?

Usually, it comes down to Tax Credits. These are the "Holy Grail" of tax season because they are a dollar-for-dollar reduction in what you owe. If you owe $2,000 and have a $2,000 credit, your bill is zero.

The Child Tax Credit is the heavy hitter here. Even with shifting legislation, it remains one of the biggest reasons people see four-figure refunds. Then there is the Earned Income Tax Credit (EITC), which is designed for lower-to-moderate-income working individuals and families. It’s "refundable," meaning if the credit is more than the tax you owe, the IRS actually sends you the difference. That is where the "big" checks often come from.

The Stealth Tax: Self-Employment and Side Hustles

If you’ve been driving for a ride-share app or selling vintage clothes on the side, your refund might be a total shock—and not the good kind.

When you work for yourself, nobody is withholding taxes for you. You are the employer and the employee. This means you owe the "Self-Employment Tax" (Social Security and Medicare), which sits at 15.3%. If you didn't set aside money throughout the year, your "refund" might actually turn into a "bill."

I’ve seen people expect a $2,000 refund because they had a W-2 job, only to have their $10,000 side hustle wipe that refund out entirely. You have to track your expenses—mileage, home office space, equipment—to lower that taxable income. Otherwise, you're just handing money away.

The Impact of Inflation and Bracket Creep

Every year, the IRS adjusts tax brackets to account for inflation. This is actually good news. It prevents "bracket creep," where you get a cost-of-living raise but end up in a higher tax bracket, effectively making you poorer.

For 2026 filings, the brackets have shifted upward. This means more of your money is taxed at lower rates (10%, 12%, 22%, etc.) than in previous years. If your income stayed exactly the same as last year, you might actually see a slightly higher refund because the "tax chunks" are more favorable now.

👉 See also: Why T. Pepin’s Hospitality Centre Still Dominates the Tampa Event Scene

How to Estimate Your Number Right Now

You don't need to wait for a software program to give you a rough idea.

- Grab your last paystub of the year. Look at the "Federal Tax Withheld" box. That’s how much you’ve already given the IRS.

- Estimate your taxable income. Take your total pay and subtract your standard deduction (around $15,000 for singles, $30,000 for married).

- Check your credits. Do you have kids? Are you a student (American Opportunity Tax Credit)? Did you install solar panels (Energy credits)?

- Compare. If your withheld amount is higher than the tax rate for your income level minus those credits, you're getting money back.

Common Misconceptions That Kill Your Refund

A lot of people think that getting a massive refund is "winning" at taxes. It's actually the opposite. If you get a $6,000 refund, that means you overpaid the government $500 every single month. That’s money that could have been in a high-yield savings account or used to pay off credit card debt.

The "perfect" tax return is actually $0. It means you kept your money all year and don't owe anything extra. But, let's be real—most of us prefer the forced savings account of a big spring check.

Another myth: "I worked two jobs, so I’ll get two refunds."

Nope. Your income is pooled. Sometimes working two jobs actually results in a smaller refund because each employer thinks you only make a small amount of money and withholds at a lower rate. When the incomes combine, you might suddenly be in a higher bracket than either boss realized.

Surprising Factors for the 2026 Season

State taxes are the wild card. While we focus on the federal "how much of a tax return will I get" question, your state might be a different story. Some states have "surplus" triggers. If the state treasury has too much money, they legally have to send it back to residents. Keep an eye on your local news for "tax rebates" that happen outside of the standard filing process.

Also, remote work is still a mess for some. If you live in one state but your company is in another, you might owe "convenience of the employer" taxes. It’s a tangle. Usually, you get a credit in your home state for taxes paid to the other state, but it requires filing two sets of state returns.

Real-World Example (Illustrative)

Imagine Sarah. Sarah is single and made $60,000 in 2025 as a graphic designer.

- Her W-4 was set to "Single," and her employer withheld about $6,500 over the year.

- She takes the standard deduction of roughly $15,000.

- Now, her taxable income is $45,000.

- Using the current brackets, her total federal tax might be around $5,100.

- Sarah also went back to school part-time, qualifying for a $1,000 credit.

- Her actual tax liability: $4,100.

- Since she already paid $6,500, her refund check will be **$2,400**.

If Sarah had a side gig making an extra $10,000 without withholding, that $2,400 refund would shrink significantly because she'd owe roughly $1,500 in self-employment tax on that extra cash.

✨ Don't miss: Human DNA Found in Hot Dogs: What Really Happened and Why You Shouldn’t Panic

Actionable Steps to Maximize Your Return

Don't just hit "submit" on the first day the IRS opens. That's a rookie mistake.

Wait for all your forms. It is tempting to file the second you get your W-2. But if you have a brokerage account or a high-yield savings account, you need your 1099-B and 1099-INT. If you file and then a form showing $500 in interest shows up in February, you have to file an amended return. That is a nightmare that delays your money for months.

Look into the "Saver’s Credit." If you put money into a 401k or an IRA and your income is below a certain threshold (around $38,000 for singles), the government will literally give you a tax credit just for saving for retirement. It’s one of the most overlooked "free money" moves in the tax code.

Adjust your W-4 for next year. If your refund was massive, go to your HR portal at work. Use the IRS Tax Withholding Estimator tool. Change your settings so you get more money in your monthly paycheck. You'll thank yourself when you aren't struggling to pay bills in November while waiting for a check in April.

Double-check your filing status. "Head of Household" is a specific status that provides a higher standard deduction than "Single," but you have to meet strict criteria (like paying more than half the cost of keeping up a home for a qualifying person). Using the wrong status is a fast track to an audit or a rejected return.

Contribute to a Traditional IRA before the deadline. You usually have until April 15th to contribute to an IRA for the previous year. If you find out you owe money, you can put cash into an IRA, and it may lower your taxable income enough to erase that bill or even trigger a refund. It’s the only way to "time travel" and change your tax outcome after the year has already ended.

Key Takeaways for 2026

- Standard Deduction: It’s higher than ever, meaning you need a lot of expenses to justify itemizing.

- Credits over Deductions: Focus on finding credits (Child, Energy, Education) because they hit your refund harder.

- The IRS Timeline: Expect the "Where's My Refund" tool to update within 24 hours of e-filing, with most direct deposits landing in 21 days.

- Watch the Side Hustles: Always assume 20-30% of your freelance income belongs to the IRS.

The reality of how much of a tax return you will get comes down to how well you documented your life over the last twelve months. Gather your receipts for childcare, your 1098-T for tuition, and your mortgage interest statements. The more "proof" you have of your life's expenses, the less the IRS can claim of your hard-earned income.