If you’re checking your ticker app today, January 15, 2026, and wondering why the numbers look different than they did last summer, you’re not alone. Stocks like Amazon move fast. Like, really fast. Right now, the price of Amazon (AMZN) is hovering around $238.21 per share.

It’s been a weirdly busy morning on the NASDAQ. The stock opened at $239.31, shot up to a high of $240.65, and then sort of settled back down as the lunch rush hit Wall Street. Honestly, if you’ve been holding onto these shares since the 2022 split, you're probably feeling okay. But if you're looking to jump in today, the math is a bit more complicated than just staring at a green or red percentage on your phone.

Why the Price Fluctuates So Much Right Now

Prices aren't just random numbers. They're reactions.

This week has been a bit of a rollercoaster for the "Magnificent Seven." While Amazon has been holding its own, the market is currently obsessed with how much money these tech giants are dumping into AI infrastructure. Amazon is on track to spend roughly $125 billion in capital expenditures for the 2025 fiscal year, and word on the street is that number might go even higher as we move through 2026.

Investors get twitchy when they see that much cash going out the door. However, the flip side is the growth in Amazon Web Services (AWS). It recently re-accelerated to about 20.2% year-over-year growth, which is basically the highest it’s been in nearly three years. That’s the engine under the hood. When AWS does well, the stock usually follows, even if the retail side—the part where you buy your toothpaste and dog food—is just steady.

Breaking Down the 52-Week Range

To really understand if $238 is a "good" price, you have to look at where it’s been.

- 52-Week High: $258.60

- 52-Week Low: $161.43

- Current Market Cap: Roughly $2.55 Trillion

Basically, we’re sitting closer to the top than the bottom. Some analysts, like John Blackledge over at TD Cowen, recently set a price target of $315, while others at Wells Fargo are looking at $301. It’s a game of expectations. If you think the "agentic AI" boom—where AI actually does tasks for you instead of just chatting—is the real deal, then $238 might look like a bargain a year from now.

How Much Is the Stock for Amazon Worth Compared to Its History?

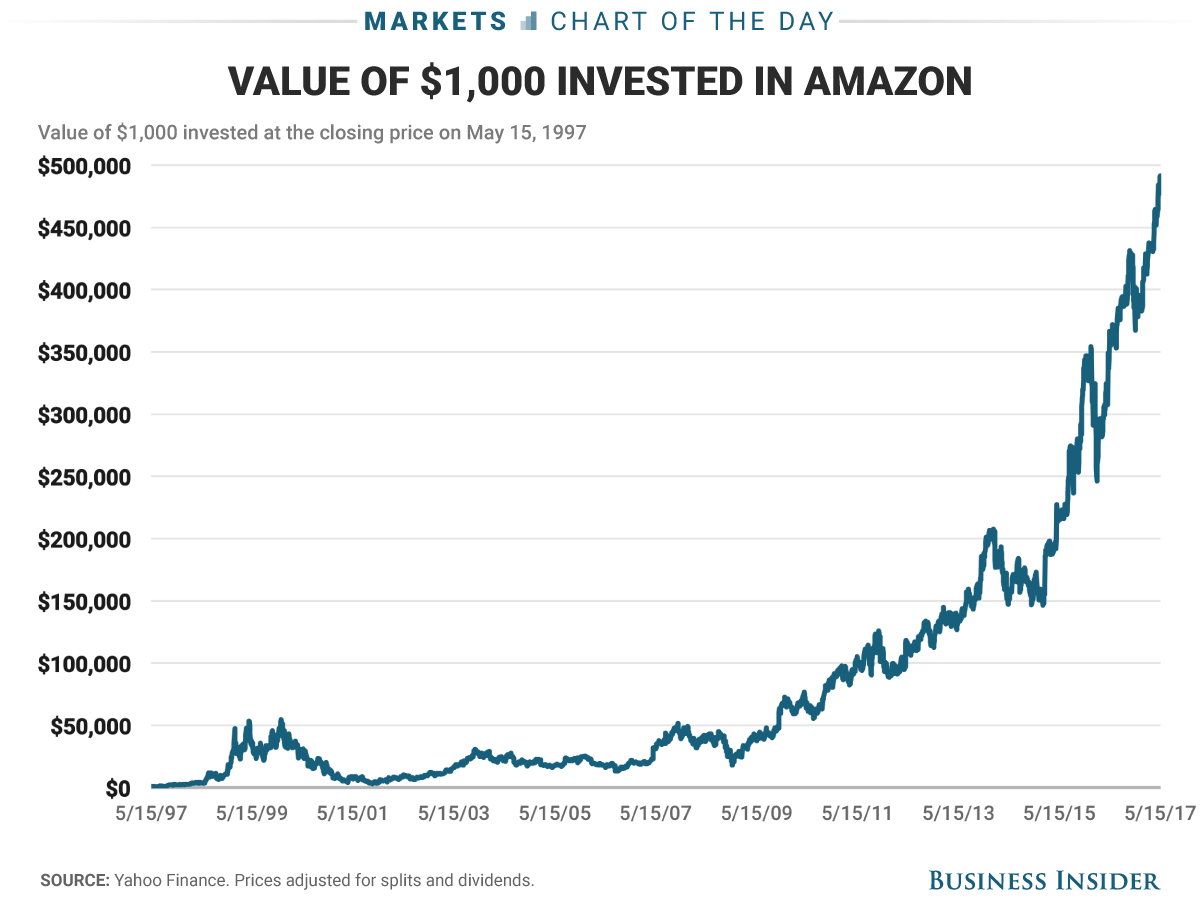

Looking back is kinda wild. If you were one of the lucky ones who bought a single share at the IPO in 1997 and never touched it, you wouldn’t just have one share anymore. Because of the various stock splits—most notably the 20-for-1 split in June 2022—that one original share would have turned into 240 shares today.

📖 Related: 100 Yuan to Dollars: What You Actually Get After Fees and Inflation

The Split History at a Glance

- June 1998: 2-for-1 split

- January 1999: 3-for-1 split

- September 1999: 2-for-1 split

- June 2022: 20-for-1 split

People always ask: "Is there going to be another split in 2026?" Honestly, probably not. Usually, companies wait until the share price gets back up into the high hundreds or thousands before they split again to make it "accessible" for retail traders. At $238, it’s already pretty accessible for most folks using fractional trading apps.

The Hidden Drivers Behind Today’s Price

It isn't just about packages on porches anymore. Most people think of Amazon as a store, but the stock price is increasingly driven by things you can't see.

Take the advertising business. It’s massive. We’re talking about $17.7 billion in revenue in just one quarter last year. Every time you see a "Sponsored" listing while searching for a new toaster, that’s pure profit for Amazon. They’ve also expanded their ad reach into Netflix and Spotify.

Then there’s the Rufus factor. Rufus is their AI shopping assistant. Management reported that shoppers using Rufus are 60% more likely to actually buy something. When you multiply that by 250 million users, you start to see why the stock stays at these high valuations.

Is the P/E Ratio Too High?

Right now, the Price-to-Earnings (P/E) ratio is sitting around 33.6. For a normal company, that’s high. For Amazon? It’s actually somewhat reasonable. Historically, Amazon has traded at much crazier multiples because investors were betting on future growth. Today, they are actually making massive profits—$21.2 billion in net income last quarter—so the valuation is finally being backed up by cold, hard cash.

What to Watch in the Coming Months

If you're holding or buying, mark February 6, 2026, on your calendar. That’s when the next big board meeting and annual report for 2025 results are expected. That day will likely cause some serious volatility.

There’s also the matter of the $475 million investment in Saks, which Amazon recently noted might be worth zero following a bankruptcy filing. It’s a small drop in a $2.5 trillion bucket, but it shows that not every bet they make is a winner.

The real story for 2026 is going to be Trainium3. This is Amazon’s custom AI chip. If they can move away from buying expensive chips from Nvidia and start using their own, their profit margins could absolutely explode. That is what the big institutional investors are watching while the rest of us are just tracking the daily price.

Your Next Moves for Amazon Stock

If you're trying to figure out your own strategy, don't just look at the $238 sticker price. Check the Relative Strength Index (RSI) to see if it’s "overbought" (meaning it might be due for a dip) or "oversold."

Most importantly, look at the AWS backlog. It’s currently at $200 billion. That is guaranteed money coming in over the next few years. If that number keeps growing, the stock price generally has a very solid floor. You should also keep an eye on interest rates; since Amazon is a "growth" stock, they usually perform better when the Fed starts cutting rates, which makes their future earnings more valuable today.

Start by comparing the current price to the 200-day moving average. If the stock is trading significantly above that average, you might want to wait for a "healthy" pullback before going all in. If it's right on the line, it could be a classic entry point.