If you’re checking your phone or laptop right now to see how much is one stock of apple, you’re looking at a number that basically represents the pulse of the global tech economy. Honestly, the price of AAPL (that’s the ticker symbol, for the uninitiated) changes so fast it can feel like watching a high-stakes video game.

As of the close of trading on Friday, January 16, 2026, one share of Apple Inc. was priced at $255.53.

That's the "official" number. But if you’ve spent any time in the markets, you know that price is just a snapshot. It opened that morning at $257.90 and dipped throughout the day, hitting a low of $254.93 before settling. It’s been a bit of a rollercoaster lately. Just a few weeks ago, at the start of January 2026, the stock was trading significantly higher, near $271.

The Current Price of One Apple Share

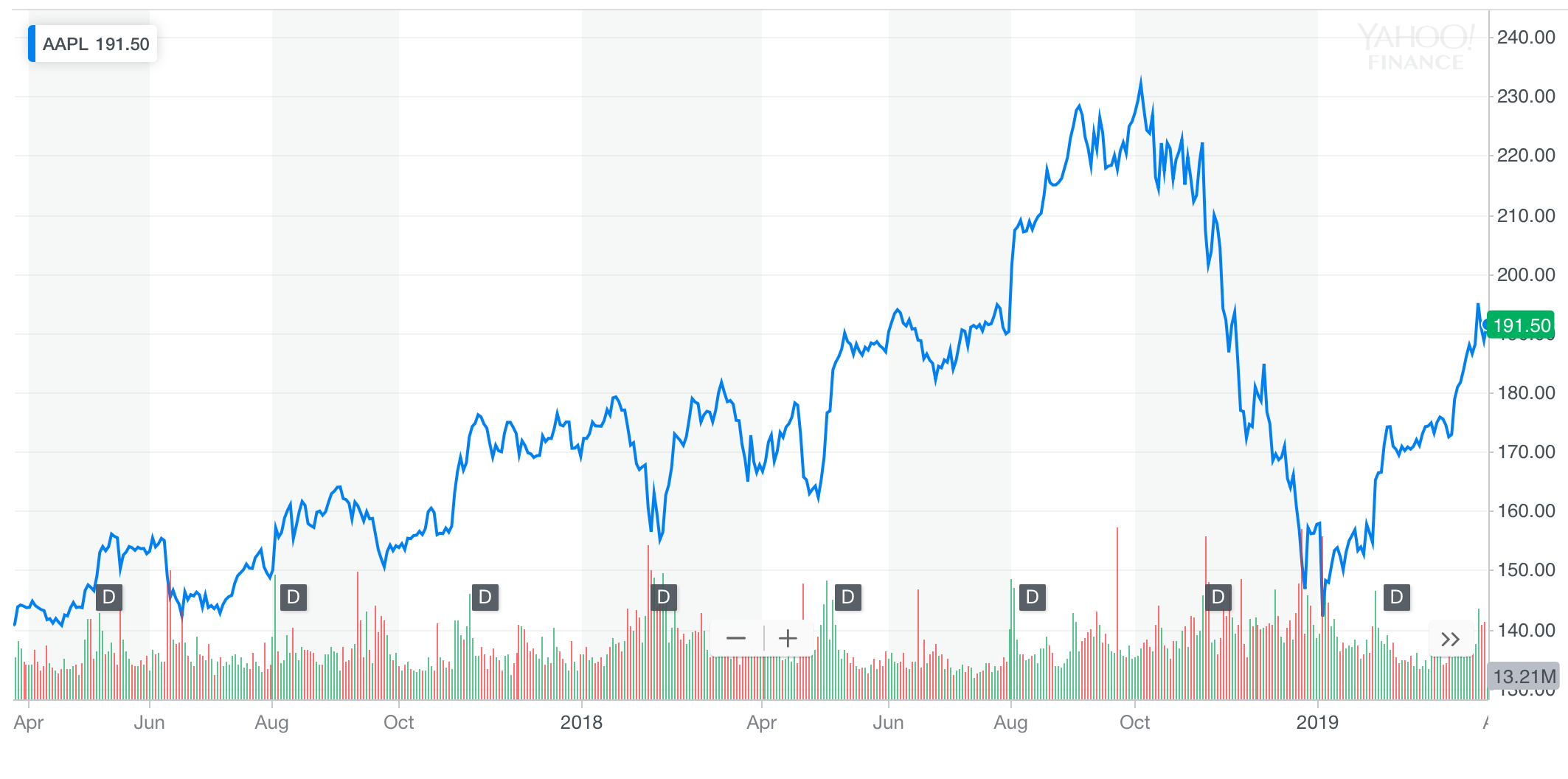

The price of $255.53 doesn't exist in a vacuum. To understand if that's "expensive" or a "bargain," you have to look at where Apple has been recently. Over the last year, the stock has swung between a low of $169.21 and a 52-week high of $288.62.

We are currently sitting somewhere in the middle-upper part of that range.

💡 You might also like: AOL CEO Tim Armstrong: What Most People Get Wrong About the Comeback King

Wait, why does the price matter so much? For a lot of people, owning "one stock" is a rite of passage into investing. But Apple isn't just a company; it’s a $3.76 trillion behemoth. When the price moves by even a single dollar, it wipes out or creates billions of dollars in market value.

What determines the daily price?

It’s a mix of big-picture stuff and the nitty-gritty of their business. Right now, investors are obsessing over a few specific things:

- iPhone 17 Sales: The 2025 launch was huge, but now everyone is worried about chip shortages and component costs in early 2026.

- The AI Pivot: You’ve probably heard of "Apple Intelligence." Investors are still waiting to see if Siri’s makeover (reportedly powered by a partnership with Google Gemini) actually makes people buy more phones.

- Services Growth: This is the money Apple makes from iCloud, the App Store, and Apple TV+. It’s the "sticky" part of their business that keeps the stock price from falling too far when hardware sales slow down.

Is Apple Stock a Good Buy in 2026?

This is where things get kinda complicated. Analysts at firms like Wedbush are still banging the drum, setting price targets as high as $350. They see the "service-ification" of the company as a gold mine. On the flip side, you’ve got Barclays and some other skeptical voices who have issued "sell" or "hold" ratings, arguing the stock is too expensive at 34 times its earnings.

Basically, if you buy one share today at $255.53, you’re paying for a lot of future growth that hasn't happened yet.

📖 Related: Wall Street Lays an Egg: The Truth About the Most Famous Headline in History

The Dividend Factor

Most people don't buy Apple for the "income," but it does pay you to own it. The current dividend is $0.26 per share every quarter. That adds up to $1.04 a year.

Is that a lot? Not really. The dividend yield is only about 0.41%. If you put $1,000 into Apple, you’re only getting about $4 back in cash every year. You’re definitely playing for the stock price to go up, not for the quarterly check.

A Quick History of Stock Splits

One reason the price is $255 today and not $25,000 is because Apple loves to split its stock. They’ve done it five times since they went public in 1980. The most recent was a 4-for-1 split back in August 2020.

If they hadn't ever split the stock, a single share would be worth a fortune, making it impossible for regular people to buy in. Splits don't actually change the value of your investment; they just cut the "pizza" into more slices. If you had one share worth $400 and it split 4-for-1, you’d suddenly have four shares worth $100 each.

👉 See also: 121 GBP to USD: Why Your Bank Is Probably Ripping You Off

There is some chatter in the market about whether another split is coming. Usually, when a stock stays consistently above $250 or $300, boards start thinking about it to keep the price "accessible." But for now, $255 is the number you need to know.

Actionable Steps for New Investors

If you're thinking about jumping in and buying your first share, don't just stare at the daily ticker. It'll drive you crazy.

- Look at Fractional Shares: Most modern brokerages (like Robinhood, Fidelity, or Charles Schwab) let you buy $10 or $50 worth of Apple. You don't actually need the full $255.53 to get started.

- Check the Earnings Calendar: Apple usually reports its quarterly results at the end of January, April, July, and October. Expect a lot of price volatility around those dates.

- Think Long Term: Apple is notoriously slow to adopt new tech (like AI), but they usually "win" by making it more user-friendly than the competition. If you’re buying today, you’re betting that their "slow and steady" approach to AI and smart glasses will pay off by 2027 or 2030.

- Monitor the Fed: Since Apple is a "growth" stock, its price is very sensitive to interest rates. If the Federal Reserve cuts rates, tech stocks like Apple usually get a boost.

Understanding how much is one stock of apple is the first step, but the real trick is watching the market capitalization and the P/E ratio to see if the company is actually getting stronger or just getting more expensive.